MNI EUROPEAN OPEN: USD & Yields Weighed By 50Bps Cut Speculation

EXECUTIVE SUMMARY

- THE FED’S RATE-CUT DILEMMA: START BIG OR SMALL? - WSJ

- STRONG CASE FOR 50BP FED CUT, SAY FORMER NY FED CHIEF DUDLEY - RTRS

- ECB CUTS 25BP, DOES NOT COMMIT TO RATE PATH - MNI ECB WATCH

- OVER HALF OF BOJ WATCHERS SEE NEXT RATE HIKE COMING IN DECEMBER - BBG

- SURPRISE GOVERNMENT SPENDING BLOWOUT HITS A$70BN - AFR

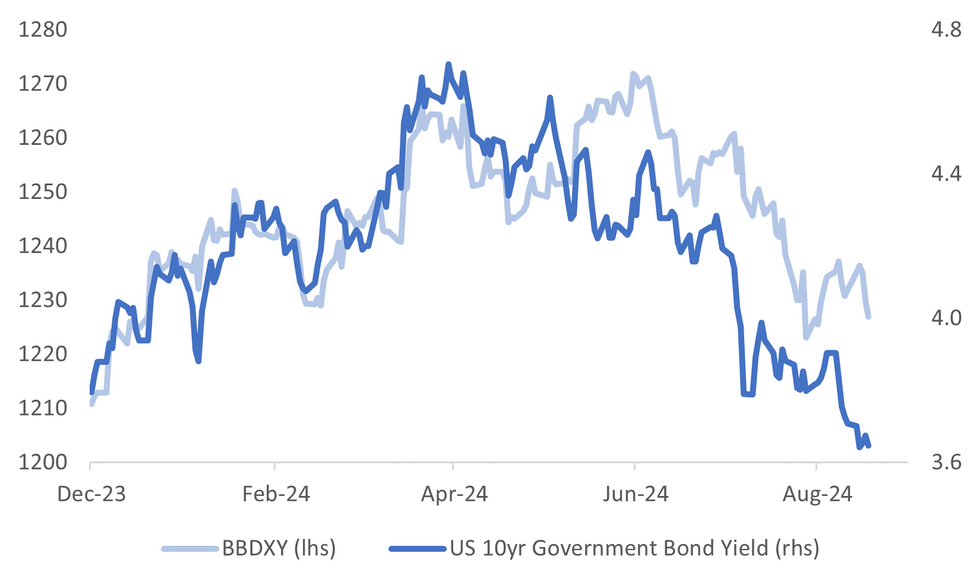

Fig. 1: USD BBDXY Index & Nominal 10yr TSY Yield

Source: MNI - Market News/Bloomberg

UK

UKRAINE (BBG): “The US and UK governments are discussing allowing Ukraine to deploy British cruise missiles backed by US navigational data to conduct long-range strikes inside Russian territory, according to people familiar with the matter.”

EU

ECB (MNI ECB WATCH): The European Central Bank cut its key interest rate by 25 basis points on Thursday but said it was not committing to a predetermined rate path.

EU (MNI): Fight Over Jobs Delays Naming Of EU Commissioners-Sources

RUSSIA (BBG): “Several European Union nations intend to challenge International Monetary Fund chief Kristalina Georgieva about the Washington-based lender’s plan to engage with Russia on economic issues for the first time since the invasion of Ukraine.”

RUSSIA (RTRS): ‘President Vladimir Putin said on Thursday that the West would be directly fighting with Russia if it allowed Ukraine to strike Russian territory with Western-made long-range missiles, a move he said would alter the nature and scope of the conflict.”

CHINA/EU (MOFCOM): “China’s Minister of Commerce Wang Wentao will meet EC Trade Commissioner Dombrovskis on Sept 19 to discuss the EU's anti-subsidy case against China's electric vehicles, He Yongqian, spokesperson for the Ministry of Commerce has said.”

US

FED (WSJ): “Federal Reserve Chair Jerome Powell faces a difficult decision as the central bank prepares to cut interest rates next week: Start small or begin big?”

FED (RTRS): “ Former New York Federal Reserve President Bill Dudley said there was a strong case for a 50 basis point interest rate cut in the United States. "I think there's a strong case for 50, whether they're going to do it or not," he said at the Bretton Woods Committee's annual Future of Finance Forum in Singapore.”

FED (FT): “The Federal Reserve faces a close call over whether to cut US interest rates by a larger-than-expected half-point next week or go with a quarter-point move"

POLITICS (RTRS): “Democratic U.S. Vice President Kamala Harris leads Republican Donald Trump 47% to 42% in the race to win the Nov. 5 presidential election, increasing her advantage after a debate against the former president that voters largely think she won, according to a Reuters/Ipsos poll that closed on Thursday.”

POLITICS (BBG): “ Kamala Harris and Donald Trump traded jabs over their first presidential debate in their return to the campaign trail, with the candidates visiting two crucial swing states in the November election. Republican rules out more presidential debates with Harris.”

CORPORATE (BBG): "Boeing Co. factory workers are poised to walk off the job, crippling manufacturing across the planemaker’s Seattle commercial jet hub after members of its largest union rejected a contract offer and voted to strike."

OTHER

JAPAN (BBG): “Just over half of Bank of Japan watchers see authorities conducting their next rate hike in December, while none expects a policy move when the board meets next week, according to a Bloomberg survey.”

JAPAN (MNI POLICY): BOJ hikes to weather weaker consumption.

AUSTRALIA (AFR): “The Albanese government may have underestimated a state and federal government spending splurge by $70 billion, after a string of stimulatory budgets that have blown Treasury’s official forecasts out of the water.”

PERU (BBG): “Peru cut interest rates to the lowest level among Latin America’s major economies as slower core inflation eased one of the central bank’s top concerns and the economic rebound came to a sudden halt.”

CHINA

FUNDING (SECURITIES TIMES): “Chinese banks have sold more than 22 trillion yuan ($3.1 trillion) of negotiable certificates of deposits as of Thursday this year, up 28% from the year-earlier period, as they sought to ease funding pressure, Securities Times reported, citing Wind data.”

MARKETS (CSJ): “China’s A-share market is likely to attract capital inflows as risk-averse global investors may reduce exposure to pricey US stocks, China Securities Journal reports, citing Wang Guohui, founder of APS Asset Management.”

PPI (21ST CENTURY BUSINESS HERALD): “PPI could improve this year from 2023’s 3% y/y decline, as the economy gradually bottoms out and base effects fade, 21st Century Business Herald reported, citing Su Jian, director at the National Economic Research Center, at Peking University.”

CHINA MARKETS

MNI: PBOC Net Injects CNY94.7 Bln via OMO Friday

MNI (Beijing)

The People's Bank of China (PBOC) conducted CNY236.2 billion via 7-day reverse repos, with the rate unchanged at 1.70%. The operation led to a net injection of CNY94.7 billion after offsetting maturities of CNY141.5 billion, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7500% at 09:28 am local time from the close of 1.8176% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 52 on Thursday, compared with the close of 48 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1030 on Friday, compared with 7.1214 set on Thursday. The fixing was estimated at 7.1097 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND AUGUST REINZ HOUSE SALES Y/Y -0.7%; PRIOR 14.5%

NEW ZEALAND AUGUST BUSINESSNZ MANUFACTURING PMI 45.8; PRIOR 44.4

JAPAN INDUSTRIAL PRODUCTION Y/Y JULY F 2.9%; PRIOR 2.7%

JAPAN JULY CAPACITY UTILIZATION M/M 2.5%; PRIOR -3.1%

SOUTH KOREA AUGUST EXPORT PRICES Y/Y 5.7%; PRIOR 13.0%

SOUTH KOREA AUGUST IMPORT PRICES Y/Y 1.8%; PRIOR 9.9%

SOUTH KOREA JULY MONEY SUPPLY M2 M/M 0.4%; PRIOR 0.6%

MARKETS

US TSYS: Tsys Futures Edge Higher, Ex-Fed Dudley Sees 50bps Cut Chance

- Tsys futures are higher today, although all the moves came in the first half of the session which looked like a follow on from a large block trade made post the NY close which looked like a bet on a 50bps cut next week. Fed fund futures firmed post the trade with the market pricing moving from a 10% chance of a 50bps cut to about a 45bps chance now.

- Ex-NY Fed Pres Dudley sees a strong case for a half-point rate cut at the FOMC meeting, citing a weakening U.S. labor market and risks to jobs outweighing inflation concerns. While most expect a quarter-point cut, Dudley emphasized Powell's reluctance to allow further labor market weakness, and noted that some Wall Street banks, like Citigroup and JPMorgan, are pushing for more aggressive action.

- There was little reaction in tsys futures to the comments from Dudley, with TUZ4 now +03 ⅜ at 104-12⅞, while TYZ4 is +07+ at 115-13.

- The cash tsys curve has steepened with yield 1-6bps lower. The 2yr is now -5.5bps at 3.584%, while the 10yr is -2.8bps at 3.646% the 2s10s is +2.583 at 5.915

- There was just the one Block traded today, a likely seller of TYZ4 at 115-12+, DV01 $135k, contract little changed since.

- Projected rate hikes have firmed throughout the session vs Thursday open levels (*) : Sep'24 cumulative -37.7bp (-29.4bp), Nov'24 cumulative -76.2bp (-65.2bp), Dec'24 -117.6bp (-106.0bp).

- Later today we have Import/Export Prices and U. of Mich. Sentiment.

JGBS: Positive Spill Over From US Tsys, But Don't Break Weekly Highs

JGB futures sit just off session highs in latest dealings. JBZ4 is at 144.71, +.17 versus settlement levels. Pre the lunch time break we got as high as 144.79.

- Positive bias has been evident from the move up in US Tsy futures. Ex NY Fed head Bill Dudley was speaking at a forum in Singapore and stated there is a strong case for the Fed to cut 50bps at the September policy meeting.

- For JGB futures, focus is likely to be on whether we can break above recent highs around 144.80. The technical backdrop is supportive of such a move.

- Cash JGB yields are weaker, led by the backend of the curve. The 10yr is off over 2bps and sub 0.845%, not too from its simple 200-day MA in yield terms. The 20yr has seen the largest drop in yield, off 4bps. Swap rates are off around 2bps for key parts of the curve.

- The 3 month debt sale saw a debt to cover ratio of 3.13x, with an average yield just under 0.06%.

- Looking ahead to next week, the main focus will rest on BoJ's Friday policy announcement (before this we have National CPI). No change is expected from the economic consensus.

- On the supply front we have a 1yr debt sale next Wednesday.

AUSSIE BONDS: ACGBs Richer, Curve Steepens Tracking Move In US Tsys

ACGBs (YM +6.6 & XM +3.3) are richer today, tracking moves made in US tsys.

- Australian household spending rose by 1.8% in August, driven by early Father's Day celebrations, according to a survey by the Commonwealth Bank. Spending in hospitality and household goods saw the biggest gains, increasing by 5.2% and 4.4%, respectively. Utilities and transport spending both fell by 0.3%, partly due to government rebates and lower petrol prices. Despite the rise, the annual spending rate still reflects relatively weak consumer activity.

- US Tsys have rallied, with short-end yields falling as investors speculated about a potential 50bps interest rate cut by the Fed next week. The yield on two-year notes dropped 5.5bps to 3.584%, while the 10-year yield fell 2.8bps to 3.646%. There was a decent sized Block trade in Fed Futures post the NY close which saw the market shift from a 20% to a 45% chance of a 50bps cut next week. While comments from ex-NY Fed Pres Dudley who suggested a 50bps cut could be warranted.

- Cash ACGBs are 1-6bps richer, the 2yr yield is -5bps at 3.558%, while the 10yr is -2.7bps at 3.822%. The AU-US 10-year yield differential is little changed today at 17bps.

- Swap rates are 3-6bps lower, with the curve flatter.

- The bills strip is little changed today

- RBA-dated OIS pricing has 5bps into year-end with 22bps of cuts priced now. Pricing has also firmed 2-10bps for meetings through to August 2025.

- Today, the local calendar was empty, with focus now turning to Retail Sales on Thursday, followed by FOMC later in the day.

NZGBS: Trade Richer As US Rate Cut Pricing Firms

NZGBs are richer today curves have steepened over the week although slightly flattened over the day. Earlier today we saw August House prices fall, while BusinessNZ Mfg PMI rose slightly.

- Ex-NY Fed Pres Dudley sees a strong case for a half-point rate cut at the FOMC meeting, citing a weakening U.S. labor market and risks to jobs outweighing inflation concerns. While most expect a quarter-point cut, Dudley emphasized Powell's reluctance to allow further labor market weakness, and noted that some Wall Street banks, like Citigroup and JPMorgan, are pushing for more aggressive action.

- US tsys futures have edged higher and now trade near session's best. The US 10yr yield is trading at yearly lows of 3.644%, while the US 2s10s curve is +2.833 at 5.894, just off recent highs of 7.405.

- NZGBs yields are 4-5bps lower across the curve, with the 2yr -4.1bps at 3.861%, the lowest since Sept 2022, while the 10yr is trading -4.7bps at 4.088% back at may 2023 levels.

- Swap rates are 3-6bps lower

- RBNZ dated OIS continues to fluctuate with pricing firming 2-3bps into year-end, with 37.5bps of cuts priced in for October. Pricing has firmed 5-10bps through to the July meeting.

- NZ Houses are taking longer to sell, with the median time reaching 50 days in August, the highest since April 2023 with house prices flat in August after five months of declines, annual prices dropped 0.7%. While NZ Mfg PMI rose to 45.8 in August from 44.4 in July, marking the 18th consecutive month of contraction, though improving from a low of 41.4 in June.

- The calendar is empty until Thursday when GDP is due out, with consensus expected to show a 0.5% drop for Q2.

FOREX: USD/JPY Testing Weekly Lows, Safe Havens Rally On Fed Easing Expectation

The USD has remained on the backfoot through the first part of Friday trade. The BBDXY index last near session lows sub 1227 9off 0.25%). Focus remains on whether the Fed will cut by 50bps next week, when it is widely expected to commence its easing cycle.

- Market pricing has given greater likelihood to such a move since media articles (WSJ/FT) from US trade Thursday suggested a 25bps versus 50bps cut was a close call. Speaking in Singapore today, ex Fed NY head Bill Dudley stated there was a strong case for a 50bps cut at the September meeting.

- US yields are weaker across the key benchmarks, led by the front end. The US 2yr yield was last at 3.58%, close to recent lows).

- Such a backdrop has benefited the safe havens, with yen outperforming. USD/JPY got to 140.65 in recent dealings, fresh lows back to last Dec last year. We are around 0.70% stronger in yen terms now (140.80/85). CHF is up around 0.25%, USD/CHF last under 0.8500.

- Equity sentiment has been mixed, despite the positive US/EU lead from Thursday trade. Japan equities weighed by the stronger yen. US equity futures are close to flat.

- This has likely helped keep AUD and NZD relatively steady. AUD/USD last in the 0.6725/30, NZD at 0.6185.

- Looking ahead, we have the BoE inflation survey, ECB speak from Lagarde, while in the US we trade prices and the U. Mich. Sentiment reading.

OIL: Storm Pushing Oil Higher for weekly gain.

- The outlook for demand for oil is ‘slowing sharply’ as the Chinese economy cools, pushing prices to a 3-year low,” according to a report from the International Energy Agency.

- Global consumption rose by 800,000 barrels year to date for 2024, a fraction of the growth rate for the same period in 2023, reflecting not only China’ s slowing economy, but the impact it has on the global economy.

- Overnight oil was up as markets tracked storm Francine’s movement in the Gulf of Mexico as it headed towards major production areas, disrupting activity.

- The storm appears to be not as significant event as first thought but still has interrupted supply.

- West Texas Intermediate was through $69.50 in early morning trade before settling at $69.28 finishing above last week’s closing price of $67.67

- Brent followed a similar pattern trading up at $72.50 before settling at $72.25, a rise from last week’s closing price of $71.06.

GOLD: Gold Higher for the Week on Rate Cut Speculation.

- Gold surged on Thursday and carried over into Friday on the back of USD weakness ahead of next week’s Federal Reserve Decision.

- Gold touched $2,565 in Asia’s morning trading session, up 0.30% on the day.

- Gold has had a strong week and is set to finish up over 2% on last Friday’s close of $2,557.90.

- This year’s surge in gold prices has been supported by Central Bank’s continuing to buy gold and Geo-Political tensions on the rise in the Middle East.

- This week alone saw data from the Reserve Bank of India confirming that they continue to add to their Gold Reserves adding a further 5 tonnes in July, increasing their total reserves to approximately 850 tonnes.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/09/2024 | 0645/0845 | *** |  | FR | HICP (f) |

| 13/09/2024 | 0830/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 13/09/2024 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/09/2024 | - | *** |  | CN | Money Supply |

| 13/09/2024 | - | *** |  | CN | New Loans |

| 13/09/2024 | - | *** |  | CN | Social Financing |

| 13/09/2024 | - |  | EU | ECB's Lagarde in Eurogroup meeting | |

| 13/09/2024 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 13/09/2024 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 13/09/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 13/09/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |