-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Weaker US Tsys Aids USD Sentiment

EXECUTIVE SUMMARY

- IRAN DISPATCHES WARSHIP TO RED SEA AFTER US SINKS HOUTHI BOATS - BBG

- US PUSHED ASML TO BLOCK CHINA SALES BEFORE JANUARY DEADLINE - BBG

- CHINA’S DECEMBER PMI FALLS FURTHER AMID WEAK DEMAND - MNI BRIEF

- CAIXIN DEC MANUFACTURING PMI HITS FOUR-MONTH HIGH - MNI BRIEF

- TWENTY DEAD IN JAPAN AFTER MAJOR QUAKE TOPPLES BUILDINGS - BBG

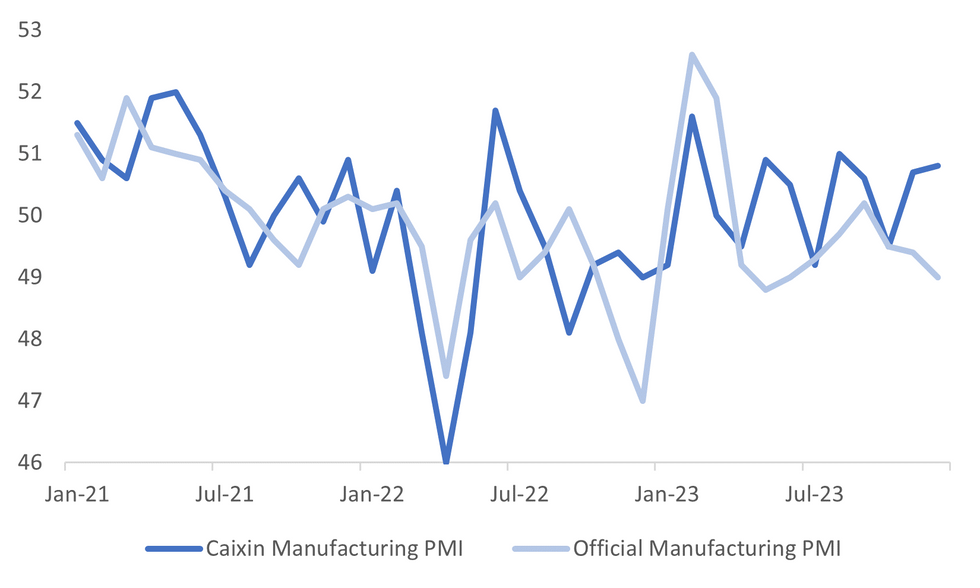

Fig. 1: China Manufacturing PMIs Diverging

Source: MNI - Market News/Bloomberg

U.K.

INFLATION (BBG): Food inflation in UK stores fell sharply in December to its lowest level in more than a year as supermarkets competed on price to attract Christmas shoppers. The British Retail Consortium said Tuesday that food inflation slowed to 6.7% last month, down from 7.7% in November. The figure has fallen for the eighth month in a row to the lowest since June 2022.

EUROPE

TECH (BBG): ASML Holding NV canceled shipments of some of its machines to China at the request of US President Joe Biden’s administration, weeks before export bans on the high-end chipmaking equipment came into effect, people familiar with the matter said.

GERMANY (RTRS): A slim majority of the members of Germany's Free Democrats have voted in a non-binding membership poll to stay in Chancellor Olaf Scholz's fractious three-way governing coalition. The low-tax, business-minded party's membership has chafed at governing with Scholz's socially minded Social Democrats and the Greens, leading to speculation that the coalition might not last the just under two years that remain of its term.

HUNGARY (BBG): Hungary’s government said it will overshoot the budget deficit estimate for 2023 by more than half a percentage point of economic output, raising fresh doubts about the credibility of its fiscal targets.

U.S.

ECONOMY (RTRS): Higher consumer spending over the holiday season, real wage gains over the last nine months and a jump in consumer confidence point to a good start for 2024, said Jared Bernstein, chair of the White House Council of Economic Advisers on Sunday.

OTHER

MIDEAST (BBG): Iran dispatched a warship to the Red Sea after the US Navy destroyed three Houthi boats, a move that risks ratcheting up tensions and complicates Washington’s goal of securing a waterway that’s vital to global trade.

JAPAN (BBG): At least 13 people were killed and scores injured in a powerful earthquake that hit off the Noto Peninsula on Japan’s northwest coast, toppling buildings, buckling roads and triggering a blaze that ripped through a city.

SOUTH KOREA (BBG): South Korea’s main opposition party leader Lee Jae-myung was attacked by an unidentified assailant during a visit to the southern coastal city of Busan and rushed to a hospital after he was bleeding from his neck.

ISRAEL (BBG): Israel’s central bank warned the government’s fiscal response to the war against Hamas risks pushing the country into greater debt and could be an obstacle to further monetary easing, after it cut interest rates for the first time since the height of the global pandemic in 2020.

ISRAEL (BBG): Israel’s Supreme Court overturned a highly contested law aimed at weakening the justices’ own power in a loss to Prime Minister Benjamin Netanyahu’s right-wing coalition.

ISRAEL (RTRS): Israel pulled tanks out of some Gaza City districts on Monday, residents said, as it announced plans to shift tactics and cut back on troop numbers, but fighting raged elsewhere in the Palestinian enclave along with intense bombardment.

IRAN (BBG): Iran said it is open to fresh talks around its nuclear program with world powers that had been overshadowed by the deadly war in Gaza. “The diplomatic environment to hold a new round of talks still exists,” Nasser Kanaani, a spokesman for Iran’s foreign ministry, said in a press conference in Tehran on Monday. “We have no problem with a new round of talks within the framework of our red lines.”

CHINA

ECONOMY (MNI BRIEF): China's Caixin manufacturing PMI rose slightly by 0.1 points to register 50.8 in December from November, staying in the expansionary zone above the breakeven 50 mark for the second month and hitting a four-month high, the financial publisher said Tuesday.

ECONOMY (MNI BRIEF): China's manufacturing Purchasing Managers' Index declined by 0.4 points to 49.0 in December, falling into the contractionary zone below the breakeven 50 mark for the third month, indicating increased economic downward pressure amid weakened demand, data from the National Bureau of Statistics showed Sunday.

ECONOMY (BBG): Chinese President Xi Jinping pledged to strengthen economic momentum and job creation, acknowledging some companies and citizens had endured a difficult 2023 in a rare admission of domestic headwinds facing the country.

TRAVEL (RTRS): Travel in China flourished over the three-day New Year's holiday, with 135 million domestic tourist trips, up 155% from last year, while domestic tourism revenue rose to 79.73 billion yuan ($11.23 billion), data released Monday showed.

POLICY (NDRC): The National Development and Reform Commission will intensify macroeconomic policy, especially counter-cyclical and cross-cyclical adjustments, and strengthen policy coordination between fiscal, monetary, employment, industry, investment, consumption, price, regional, science and technology, and environmental protection, according to an article on the party-run magazine Qiushi.

EXPORTS (SECURITIES DAILY): China’s export growth may grow 3% in 2024 after ending six months of decline in November, as the U.S. inventory cycle bottoms and the purchasing power in the Eurozone and emerging markets restores amid the weaker U.S. dollar should the Federal Reserve cut interest rates, Securities Daily reported citing analysts.

CHINA MARKETS

MNI: PBOC Drains Net CNY869 Bln Via OMO Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY137 billion via 7-day reverse repo on Tuesday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net drain of CNY869 billion reverse repos after offsetting CNY1.006 trillion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8043% at 10:11 am local time from the close of 2.4264% before New Year holiday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 35 on last trading day, compared with the close of 46 the previous day. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.0770 Tuesday vs 7.0827 Friday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0770 on the first trading day in 2024, compared with 7.0827 set on last trading day in 2023. The fixing was estimated at 7.0962 by Bloomberg survey today.

MARKET DATA

AUSTRALIA DEC CORELOGIC HOUSE PRICE M/M 0.4%; PRIOR 0.6%

AUSTRALIA DEC F JUDO BANK PMI MFG 47.6; PRIOR 47.8

UK DEC BRC SHOP PRICE INDEX Y/Y 4.3%; PRIOR 4.3%

SOUTH KOREA DEC S&P PMI MFG 49.9; PRIOR 50.0

CHINA DEC CAIXIN PMI MFG 50.8; MEDIAN 50.3; PRIOR 50.7

MARKETS

US TSYS: Weak To Start The Year

TYH4 is trading at 112-15, -0-13+ from NY closing levels on Friday. There has been little in the way of meaningful news flow today other than a slightly higher-than-expected China Caixin Manufacturing PMI (50.8 vs. 50.3 est.).

- Today's move comes after US tsys exhibited a mixed performance on Friday after recovering from early losses. The market lacked any significant driving force, primarily witnessing position adjustments following a week of volatile activity and a remarkable two-month rally.

- As a reminder, there has been no cash US tsy dealings in today's Asia-Pac session with Japan closed for a public holiday.

AUSSIE BONDS: Weak Start To The Year, US Tsy Futures Weigh

ACGBs (YM -5.0 & XM -6.0) sit weaker, hovering near the lows observed during the Sydney session. In the absence of significant domestic events today, local market participants are relying on US tsy futures as a directional indicator. Notably, US tsy 10-year futures are trading at -0-12+, standing at 112-16, having weakened ahead of the New Year's long weekend.

- Cash ACGBs are 5-6bps cheaper, with the AU-US 10-year yield differential 3bps wider at +14bps. It is important to note however that cash US tsys have not been trading in today's Asia-Pac session due to a public holiday in Japan.

- The swaps curve has bear-steepened, with rates 3-6bps higher. EFPs are 1-2bps tighter.

- The bills strip has bear-steepened, with pricing -3 to -6.

- RBA-dated OIS pricing is 1-5bps firmer across meetings, with November leading.

- Tomorrow, the local calendar sees Judo Bank Composite and Services PMIs.

- Later today, the US calendar sees S&P Global US Manufacturing PMI (Dec F) and November Construction Spending. ISM Manufacturing is due on Wednesday.

OIL: Crude Rallies As Red Sea Situation Deteriorates

Oil prices are higher during APAC trading today following further attacks on shipping in the Red Sea by Iran-backed Houthi rebels over the weekend and now tensions have been increased by Iran sending a warship to the waterway. It is a major route for oil and gas shipments. Brent is up 1.6% to $78.25/bbl, but still below last Thursday’s highs, and WTI is +1.4% to $72.67/bbl. The USD index is 0.2% higher.

- Maersk has again said it will divert ships around southern Africa in response to the latest Houthi attack. The risks in the area have meant that half of the Red Sea’s container traffic is finding alternative routes and as well as some tankers.

- Despite geopolitics, the market remains concerned about demand and supply trends and so OPEC compliance with quotas and China’s economy are likely to be monitored closely.

- Later today the US S&P Global manufacturing PMI for December and November construction data are released. There are also European PMIs.

EQUITIES: Hong Kong, China Markets Unwind Some Late 2023 Gains

Regional equities are mostly lower in the first trading day for 2024. This follows a negative finish for US markets in Friday trade last week (albeit after a strong rally prior). US futures in trade today have tracked tight ranges with a slight downside bias. Eminis were last around 4820 (close to flat), while Nasdaq futures were down 0.10%.

- On the downside, the main focus today has been in weakness in Hong Kong and China markets. At the break, the HSI is off 1.45%, while the CSI 300 is down just over 1%.

- This unwinds some of the strong gains seen towards the end of 2023. It also comes despite a stronger than expected Caixin PMI print today, although on Sunday the official manufacturing PMI slipped further into contractionary territory.

- Japan markets remain closed until Thursday.

- South Korea's Kospi is close to flat, while the Kosdaq has risen by 1%. Earlier comments from President Yoon stated that South Korea's stock market is undervalued, while the authorities will also reportedly seek to abolish financial investment income tax. Taiwan's Taiex is off 0.65% at this stage.

- In SEA, Philippines and Thailand markets are both up around 0.7%. Singapore's Strait Times is down 0.30%, despite a firm Q4 GDP beat.

FOREX: USD Firms, Supported By Weak US Tsys

For the most part of today's session the USD has gained ground against the majors. The BBDXY sits around 0.20% above end 2023 levels, last near 1215.20. Helping sentiment has been a softer US Tsy futures tone, with cash trading closed due to Japan markets remaining out. The other USD support has been a mixed regional equity tone, with Hong Kong and China related equity losses evident.

- USD/JPY drifted lower in early trade, down to 140.82, perhaps amid some caution post yesterday's earthquake/tsunami. However, we climbed back to 141.55 by this afternoon, a yen loss of around 0.50%. CHF has also lost ground down by the same amount against the USD.

- NZD/USD faltered as well, off 0.3%, last near 0.6300. Onshore markets return tomorrow, while Japan markets return on Thursday.

- AUD/USD has outperformed. Higher iron ore prices likely helping at the margin. The pair was last near 0.6815/20, so up slightly versus end 2023 levels. The China Caixin PMI printed better than expected, although this hasn't been reflected in China related equity performance.

- EUR/USD sits down a little over 0.2%, last near 1.1020.

- Looking ahead, the data calendar has the final Dec PMI reads for the UK, EU and the US.

GOLD: Slightly Firmer Today After Achieving First Annual Gain In Three

Gold has seen a 0.3% uptick in the Asia-Pacific session, rebounding from a 0.1% dip on Friday.

- Despite weakness in US Treasury futures during today's Asia-Pacific session, gold is slightly firmer on its inaugural trading day of 2024. Notably, with Japan observing a public holiday, there have been no cash US Treasury transactions in today’s session.

- In a noteworthy shift, bullion secured its first annual gain in three years, concluding 2023 with a 13% increase. This surge can be attributed to growing investor confidence in the likelihood of the Federal Reserve initiating rate cuts in the coming months. Bullion typically has an inverted relationship with interest rates.

- Current market pricing places the probability of a March rate cut at over 80%.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/01/2024 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 02/01/2024 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 02/01/2024 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 02/01/2024 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/01/2024 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 02/01/2024 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/01/2024 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/01/2024 | 0900/1000 | ** |  | EU | M3 |

| 02/01/2024 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 02/01/2024 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 02/01/2024 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 02/01/2024 | 1500/1000 | * |  | US | Construction Spending |

| 02/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 02/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 02/01/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.