-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: What Will The Fed Do?

EXECUTIVE SUMMARY

- COLLAPSE OF SILICON VALLEY BANK, SIGNATURE BANK CALLS FED INTEREST RATE PATH INTO QUESTION (WSJ)

- FED: DETAILS ON WHICH BANKS USE NEW FACILITY RELEASED A YEAR AFTER IT ENDS (RTRS)

- U.S. FEDERAL RESERVE TO REVIEW ITS OVERSIGHT OF SILICON VALLEY BANK (RTRS)

- FDIC PLANNING ANOTHER SILICON VALLEY BANK AUCTION (WSJ)

- MOODY’S PUTS FIRST REPUBLIC, FIVE US BANKS ON DOWNGRADE WATCH

- ECB’S HAWKISH PLANS SET TO FACE BOLDER OPPOSITION ON SVB FALLOUT (BBG)

- BRUSSELS SEEKS NEW CONTROLS TO LIMIT CHINA ACQUIRING HIGH-TECH (FT)

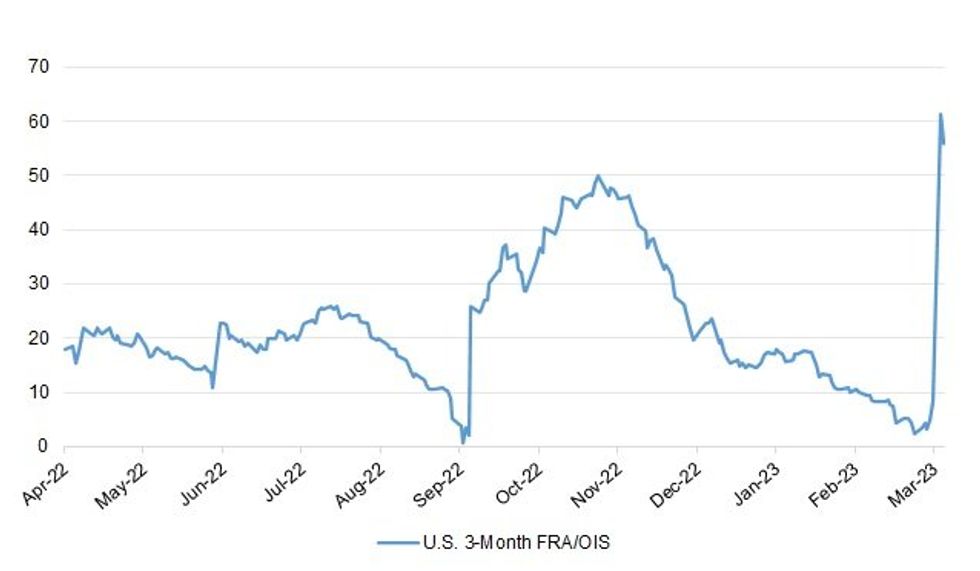

Fig. 1: U.S. 3-Month FRA/OIS

Source: MNI - Market News/Bloomberg

UK

FISCAL: Chancellor of the Exchequer Jeremy Hunt will announce plans for 12 new investment zones in his budget, pledging to “supercharge” growth across the UK through tax incentives and extra funding. (BBG)

FISCAL: Jeremy Hunt will use his budget to raise the lifetime allowance for pension savings to a record level to encourage people to keep working. (The Times)

FISCAL/POLITICS: Rishi Sunak has said Jeremy Hunt will still be chancellor at the next election after criticism his number two did not have enough economic vision (Sky)

BREXIT: U.S. President Joe Biden has accepted a formal invitation from Rishi Sunak to visit Northern Ireland to mark the 25th anniversary of the Good Friday Agreement next month. (POLITICO)

EUROPE

ECB: The European Central Bank’s plans for more big interest-rate hikes are set to meet stronger opposition this week after the collapse of Silicon Valley Bank, according to officials with knowledge of the matter. (BBG)

ECB: A US banking crisis is unlikely to deter the European Central Bank from increasing eurozone borrowing costs this week, but analysts expect rate-setters to be more reluctant to commit to another rise in May. (FT)

ITALY: The Italian government will this week present a draft reform proposing tax cuts for workers and business, government sources told MNI, adding that the changes would not compromise fiscal sustainability. (MNI)

IRELAND: Irish authorities are assessing the potential impact on customers of the collapse of Silicon Valley Bank, the country’s finance minister said, stressing it is still very early days in terms of seeing any consequences. (BBG)

SNB: The Swiss National Bank said on Monday that governing board member Andrea Maechler will leave by the end of June 2023. Maechler, who has been with the Swiss National Bank since 2015, will assume the position of Deputy General Manager at the Bank for International Settlements in Basel later this year. (RTRS)

SWITZERLAND: Swiss financial regulator FINMA on Monday said it was seeking to identify any potential contagion risks for the country's banks and insurers following the collapses of Silicon Valley Bank and Signature Bank. (RTRS)

BANKS: Euro zone banks have no exposure to Silicon Valley Bank (SVB) and euro zone banks are in good shape, the chairman of euro zone finance ministers Paschal Donohoe said on Monday. (RTRS)

BANKS: The cost of insuring exposure to European junk bonds on Monday posted its biggest-one jump in three months as concerns about the banking sector gripped financial markets, hurting risky assets. (RTRS)

POWER: The European Union plans to propose virtual regional electricity hubs as part of an overhaul of its power market to prevent extreme energy price swings that hurt businesses and consumers. (BBG)

U.S.

FED: There is a saying that the Federal Reserve raises interest rates until something breaks. A big surprise over the past year had been that nothing broke. No more. A sharp selloff in regional bank stocks Monday following the collapse of Silicon Valley Bank and Signature Bank risks pushing the Fed uncomfortably close to the one place it wanted to avoid over the past year: resolving a financial-stability trauma at the same time it fights high inflation. (WSJ)

FED/BANKS: Details of which banks tap a new U.S. Federal Reserve liquidity facility will be released only a year after the program ends, tentatively set for March 11, 2024, the Fed said on Monday in an updated information sheet. (RTRS)

FED/BANKS: The U.S. Federal Reserve announced Monday it would be conducting a review of the supervision and regulation of Silicon Valley Bank, which failed on Friday. Fed Chairman Jerome Powell said in a statement the bank's failure demanded a "thorough, transparent, and swift review." Fed Vice Chairman for Supervision Michael Barr is leading the review, and results will be publicly released by May 1. (RTRS)

BANKS: U.S. financial regulators have the tools they need to deal with disruptions and supervise banks, and President Joe Biden is confident in the steps he has taken so far, the White House said on Monday. (RTRS)

BANKS: Regulators are planning to take another crack at auctioning failed Silicon Valley Bank, according to people familiar with the matter, after they were unable to find a buyer for the firm over the weekend. (WSJ)

BANKS: The Federal Deposit Insurance Corp. is considering working with advisers including Piper Sandler Cos. on options for certain US banks, according to people with knowledge of the matter. (BBG)

BANKS: The US system of Federal Home Loan Banks is ramping up the amount of cash it has available to deploy as the failure of several US lenders — including Silicon Valley Bank and Signature Bank — stokes expectations that more regional lenders will need to tap it for funds. (BBG)

BANKS: SVB Financial Group and two top executives were sued on Monday by shareholders, who accused them of concealing how rising interest rates would leave its Silicon Valley Bank unit, which failed last week, "particularly susceptible" to a bank run. (RTRS)

BANKS: Large US banks are being inundated with requests from customers trying to transfer funds from smaller lenders, as the failure of Silicon Valley Bank results in what executives say is the biggest movement of deposits in more than a decade. (FT)

BANKS: Moody’s Investors Service placed First Republic Bank and five other US lenders on review for downgrade, the latest sign of concern over the health of regional financial firms following the collapse of Silicon Valley Bank. (BBG)

EQUITIES: Two Saudi Arabian airlines are nearing a deal to buy a total of about 80 Boeing Co. 787 Dreamliners with options for some 40 more, people familiar with the matter said, another significant order for the American aircraft manufacturer. (WSJ)

OTHER

GLOBAL TRADE: The EU is exploring ways to police how European companies invest in production facilities overseas, following similar US moves to limit the ability of China and other rivals to acquire cutting-edge technologies from the west. (FT)

U.S./CHINA: President Joe Biden plans to hold a phone call with his Chinese counterpart, Xi Jinping, once the legislature concludes its annual gathering and the government in Beijing returns to work, National Security Adviser Jake Sullivan said. (BBG)

UK/CHINA: China "represents a challenge to the world order" which the UK must take seriously, Rishi Sunak has said. (BBC)

GEOPOLITICS: President Biden met with the prime ministers of the United Kingdom and Australia on Monday regarding the vital partnership between the three nations as the growing threat from China looms. (FOX)

BOJ: A public opinion poll conducted by broadcaster NHK showed 24% of Japanese think the Bank of Japan should continue with massive monetary easing, compared with 11% saying it shouldn’t. (BBG)

JAPAN: Silicon Valley Bank and Signature Bank’s collapses are unlikely to have a significant impact on the stability of the Japanese financial system, Finance Minister Shunichi Suzuki tells reporters. (BBG)

JAPAN: The troubles at Silicon Valley Bank and its subsequent collapse have driven investor attention to the heavy investment in US bonds by Japan’s lenders, casting a pall over their shares. (BBG)

AUSTRALIA/CHINA: China will allow all domestic companies to import Australian coal, signaling an end to trade restrictions imposed in late 2020. (BBG)

SOUTH KOREA: South Korean Prime Minister Han Duk-soo said electricity and gas charges may be adjusted gradually in 1H when people use relatively less energy, DongA Ilbo newspaper says, citing an interview. (BBG)

NORTH KOREA: North Korea fired two short-range ballistic missiles Tuesday toward waters off its east coast after threatening the US to turn the Pacific Ocean into a “firing range” if it holds joint military drills with South Korea. (BBG)

CANADA: Canada’s banking regulator is increasing its monitoring of domestic banks’ financial health as the fallout from Silicon Valley Bank’s failure ripples through markets, even after U.S. leaders introduced rare measures designed to avoid repeating the run on deposits that toppled the tech-lending leader. (Globe & Mail)

CHILE/RATINGS: The recent rejection in the Chilean Congress of President Gabriel Boric’s flagship tax legislation adds another setback to reform prospects and increases fiscal uncertainty, Fitch Ratings says. (Fitch)

IMF: The International Monetary Fund said on Monday it welcomed "decisive" U.S. action to stem systemic banking system risks over the weekend and that it was monitoring the situation for global implications. (RTRS)

OIL: U.S. shale crude oil production in the seven biggest shale basins is expected to rise in April to its highest since December 2019, the Energy Information Administration said on Monday. (RTRS)

CHINA

ECONOMY: China’s labour market faces pressure from structural issues such as a shortage in skilled and general workers, as well as a record number of inexperienced college graduates, according to Guan Tao, former Director at State Administration of Foreign Exchange (SAFE). (MNI)

ECONOMY: Following Premier Li Qiang’s strong endorsement of the private sector at his first press conference held on Monday, Beijing needs to enact new reforms to secure the healthy development of the private sector, according to the 21st Century Herald. (MNI)

CORONAVIRUS: China will lift remaining Covid pandemic era restrictions on issuing visas to foreigners to facilitate exchanges between Chinese and foreign personnel, according to a statement on China’s US Embassy webpage. (MNI)

EQUITIES: More foreign capital is flowing into China’s stock market betting on the country’s economic rebound, the official Economic Information Daily reported, citing several overseas funds. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY26 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) conducted CNY29 billion via 7-day reverse repos on Tuesday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY26 billion after offsetting the maturity of CNY3 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0136% at 09:29 am local time from the close of 1.9679% on Monday.

- The CFETS-NEX money-market sentiment index closed at 47 on Monday, compared with the close of 44 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8949 TUES VS 6.9375 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.8949 on Tuesday, compared with 6.9375 set on Monday.

OVERNIGHT DATA

AUSTRALIA FEB NAB BUSINESS CONFIDENCE -4; JAN +6

AUSTRALIA FEB NAB BUSINESS CONDITIONS +17; JAN +18

Business confidence fell back below zero in February, continuing a recent period of volatility. Still, business conditions remained strong with little change in the elevated levels of key subcomponents including trading conditions and employment. Conditions remain elevated across industries and states, with consumer-facing sectors clustered at a high level of around +20 index points and business-facing sectors clustered around +10 index points. (NAB)

AUSTRALIA MAR WESTPAC CONSUMER CONFIDENCE 78.5; FEB 78.5

The Westpac Melbourne Institute Consumer Sentiment Index was unchanged at 78.5 in March, holding near historical lows. This marks the second consecutive month of extremely weak consumer sentiment. Index reads below 80 are rare, back-to-back reads even rarer. Indeed, both the COVID shock and the Global Financial Crisis saw only one month of sentiment at these levels. Runs of sub-80 reads have only been seen during the late 1980s/early 1990s recession and in the ‘banana republic’ period of concern in 1986, when the Australian dollar was in free-fall after the Federal government lost its triple-A rating”, Mr Evans commented. (Westpac)

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 79.9; PREV 80.0

Consumer confidence dropped to its lowest level since April 2020, after the RBA announced a 25bp increase in the cash rate in March. The sharpest decline in consumer confidence was in the current finances subindex, which dropped to its lowest since 2001. Confidence about future finances declined to its sixth-lowest since the COVID outbreak. Inflation expectations also increased post-hike, by 0.4pts. Confidence among those paying off their mortgages increased 1.7pts after a sharp drop last week and are still the least confident of the housing cohorts. Those who own their home outright and renters reported sharp decreases of 4.1pts and 7.9pts respectively. (ANZ)

AUSTRALIA FEB CBA HOUSEHOLD SPENDING -0.1% M/M; JAN -6.8%

AUSTRALIA FEB CBA HOUSEHOLD SPENDING +4.5% Y/Y; JAN +5.3%

The CommBank Household Spending Intentions (HSI) index for February 2023 declined by small 0.1%/mth in original terms, following on from a large 6.8%/mth fall in January. The falls in February were led by declines in Entertainment, Retail and Travel. The shorter calendar month and slowing consumer spending led to the falls. These were partly offset by a seasonal rise in Home buying and Motor vehicles. After seasonally adjusting the data, the HSI index was up marginally in February 2023, with the Travel, Health & fitness and Transport stronger. (CBA)

NEW ZEALAND FEB REINZ HOUSE PRICE -13.9% Y/Y; JAN -13.3%

February traditionally shows a reasonable month of activity but the impact of extreme and devastating weather over the start of 2023 is certainly showing in the data with sales and listings significantly down in affected areas. We may continue to see this for some time in parts of Northland, Auckland, Tairawhiti Gisborne, Hawke’s Bay, Coromandel and Bay of Plenty. (REINZ)

NEW ZEALAND JAN NET MIGRATION +5,170; DEC +8,064

SOUTH KOREA FEB EXPORT PRICE INDEX -2.7% Y/Y; JAN -1.2%

SOUTH KOREA FEB EXPORT PRICE INDEX +0.7% M/M; JAN -2.9%

SOUTH KOREA FEB IMPORT PRICE INDEX -0.5% Y/Y; JAN +1.9%

SOUTH KOREA FEB IMPORT PRICE INDEX +2.1% M/M; JAN -2.1%

MARKETS

US TSYS: 2-Year Yield Rises In Asia, CPI In Focus

TYM3 deals at 114-04+, -0-16+, a touch off the base of the 0-13 range on elevated volume of ~223k.

- Cash tsys sit 16bps cheaper to 2bps richer across the major benchmarks. The curve has twist flattening pivoting on 10s.

- The front end of the curve continued to lead swings in Asia as local participants faded yesterday's historic move in the short end of the curve.

- 2-Year Yields had moved ~115bps from peak to trough from Wednesday to Monday, with Monday’s fall the largest since the early 1980s.

- With an eye on this evening's CPI print, movements in FOMC dated OIS have been seen in Asia today. There is ~25bps of tightening priced into the next two Fed meetings with the terminal rate seen in May at 4.83%, with ~70bps of cuts now priced in for 2023. There was over 90 bps of cuts priced in early in the Asian session

- In Europe today the UK Labour Market survey headlines. Further out February's CPI print headlines the docket, our preview is here. Fed Governor Bowman will also cross today.

JGBS: Curve Flattens, Futures Finish Off Best Levels

JGB futures finished away from best levels of the session, after an early Tokyo rally failed to breach the overnight session high, although the contract was comfortably firmer on the day, +138 at the close.

- JGBs in the intermediate zone of the curve pulled away from best levels after 10-Year swap rates found an intraday base just above the BoJ’s YCC cap (where a low of 0.516% was registered this morning). This probably isn’t a coincidence, as 10-Year swaps are viewed as a fair value play re: JGBs given the relative lack of BoJ control over that market.

- This combination saw 10-Year JGB yields pull away from multi-month lows, after showing below the BoJ’s prior YCC cap (0.25%) for a large chunk of the session. A reduction in short positioning seems to be a clear factor in the recent round of richening in the 7- to 10-Year sector, but does leave the space susceptible to pressure if fresh BoJ YCC speculation is triggered by a hawkish repricing of the path of global central banks.

- Cash JGBs sit 1-16bp richer across the curve, with bull flattening in play after the early outperformance of 7s and 10s gave way. Swaps spreads are tighter out to 5s, but mixed beyond that.

- Local headline flow was limited.

- 5-Year JGB supply saw tepid reception, with outright richness countering relative and carry & roll appeal.

- BoJ Rinban operations headline domestically tomorrow.

JGBS AUCTION: 5-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.0333tn 5-Year JGBs:

- Average Yield: 0.121% (prev. 0.216%)

- Average Price: 100.37 (prev. 99.92)

- High Yield: 0.132% (prev. 0.216%)

- Low Price: 100.32 (prev. 99.92)

- % Allotted At High Yield: 82.2529% (prev. 87.9205%)

- Bid/Cover: 3.261x (prev. 3.977x)

AUSSIE BONDS: Stronger But Well Off Bests Going Into U.S. CPI

In the penultimate session of futures roll ACGBs close at or near Asia-Pac lows (YMM3 +16.6 & XMM3 +7.0) as cash Tsys twist flatten with 2-year yields 18bp higher and the 10-year -1bp. Cash ACGBs strengthen 7-15bp, but well off bets, with 3/10 curve +9bp. The AU-US 10-year yield differential widens 6bp to -12bp. For reference, this differential made a cycle low of -32bp last week.

- Swaps close firmer with rates 2-11bp lower (but 18-20bp off bests) and EFPs 5-6bp wider.

- Bills closed -1 to +39bp with whites leading.

- On the data front, consumer sentiment remained depressed, but business conditions remained robust with broad-based strength (business confidence was soft). In isolation the data would have lent support to a hike in April given it was explicitly cited by RBA Governor Lowe as important for upcoming policy discussions.

- In a significant development however, RBA dated OIS priced, at least temporarily, the end to the tightening cycle. April meeting pricing softened to 2bp of easing with 10bp of easing priced by end-22. At one stage in proceedings more than a full 25bp of easing had been priced.

- Elsewhere, Bloomberg reported today that China will allow all domestic companies to import Australian coal, signaling an end to trade restrictions imposed inn late 2020.

- US CPI for February tonight.

AUSSIE BONDS: Aug-40 I/L Auction Results

The Australian Office of Financial Management (AOFM) sells A$100mn of the 1.25% 21 August 2040 Indexed Bond, issue #CAIN413:

- Average Yield: 1.4269% (prev. 1.9689%)

- High Yield: 1.4500% (prev. 1.9825%)

- Bid/Cover: 2.4300x (prev. 2.9600x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 100.0% (prev. 27.3%)

- Bidders 35 (prev. 52), successful 12 (prev. 27), allocated in full 12 (prev. 25)

NZGBS: Strong Gains Hold Ahead Of U.S. CPI

NZGBs close 10-21bp richer, but well off session bests, as U.S Tsys given back some of yesterday’s Silicon Valley Bank induced gains in Asia-Pac trade (U.S. Tsy 2-year yield +17bp). The 2/10 curve closes +11bp.

- Swaps curve bull steepens with rates 12-27bp lower, implying tighter swap spreads.

- RBNZ dated OIS collapses 16-31bp across meetings. April meeting pricing softens to 20bp of tightening with terminal OCR expectations tumbling to 5.19%, well above RBNZ’s projected OCR peak of 5.50%. For reference, RBA dated OIS went further and priced the end of the tightening cycle.

- Locally, REINZ house sales data notched up another large decline (-31.1% Y/Y), albeit with severe weather distortions. Net migration (Jan) was also released with the result robust. Migration and tourism provide one of the few bright spots for the local economy.

- The local calendar is scheduled to release tomorrow the first of this week’s quarterly data, Q4 Current Account. If a widening deficit is a sign of an overheated economy, then look no further than tomorrow’s data with BBG consensus expecting a -8.6% of GDP print.

- Until then, tracking U.S. Tsys and monitoring SVB developments is likely to remain the main game, at least until the release of US CPI tonight.

EQUITIES: Weakness Across The Board, Led By Financials

All the major indices are down across the board, led by financial stocks. The MSCI Asia Pac financials index was off by 2.7% at one stage. The focus of investors was very much on the sector, following US/EU weakness in the space through Monday's session. US futures are positive at this stage, +0.55% for eminis and Nasdaq futures, but this hasn't provided much of a positive offset for the region.

- Japan's Nikkei 225 is off by 2.25%, with bank names weighing. Bloomberg notes Japan finance companies are prominent in terms of unrealized losses to equity ratios, which could remain a focus point in the wake of the SVB collapse.

- Elsewhere, the HSI is down by around 1.60% at this stage, with banking names also weighing on the headline index. China stocks have fared better, with the CSI 300 down by ~0.70% in the first half of the session.

- The Kospi has sunk over 2%, with offshore investors unloading over $600mn in local shares so far today. The Taiex is down by 1%.

- In SEA, Singapore stocks have outperformed, with REITS drawing safe haven related flows, but all other markets are down. The Philippines index is down around 1%, after yesterday saw the biggest daily equity outflow from offshore investors since 2015.

GOLD: Prices Down As USD And Yields Begin Recovery

Gold prices are down 0.5% to $1903.25/oz as US yields firmed. They are holding above $1900 after reaching an intraday high of $1914.12 earlier, above Monday’s close of $1913.70. Bullion has been boosted by flight to quality flows, the drop in the USD and US Treasury yields following the collapse of Silicon Valley Bank. A less hawkish Fed has also been priced in by markets. The USD index is up around 0.1% today.

- Gold rose through its 50-day simple moving average on Friday and has remained there. Resistance is at $1923.20 and on the downside support is $1871.60.

- Later US CPI for February is released and is likely to be watched closely. It is expected to post similar monthly increases to January but see the annual rates moderate. The Fed’s Bowman speaks at a Community Bankers Event in Hawaii.

OIL: Crude Weakens Further, Waiting For Upcoming US CPI For Clarification On Fed

Oil prices slumped on Monday in the wake of the collapse of Silicon Valley Bank, as the market’s demand fears grew and risk sentiment deteriorated. Today crude is down another percent following yesterday’s -2.5%. WTI is down 1.1% to around $73.98/bbl, close to its intraday low of $73.74, and Brent is 1% lower at around $79.95, also close to the intraday low of $79.67. The USD index is up around 0.2% today.

- Oil has traded during the APAC session above support levels of $72.30 for WTI and $78.41 for Brent. Prices are likely to remain volatile until there is clarification on any economic impact from SVB and on the Fed outlook.

- Later US CPI for February is released and is likely to be watched closely. It is expected to post similar monthly increases to January but see the annual rates moderate. The Fed’s Bowman speaks at a Community Bankers Event in Hawaii. There is also US API inventory data today and OPEC’s monthly report.

FOREX: Yen Pressured, USD Firms As 2-Year Treasury Yield Rises In Asia

The USD is firmer in Asia today, 2-Year US Treasury Yield has risen 18bps as it pares some of the losses it saw yesterday. The fall on Monday in the 2-Year Yield was the largest since 1982.

- Yen is pressured, USD/JPY is ~0.5% firmer. USD/JPY prints at ¥133.75/85, resistance is seen at the 50-Day EMA (¥134.27). Japan's 10-Year Yield has fallen below 0.25% the previous BOJ ceiling.

- AUD/USD is also softer, down ~0.2% today. The pair last prints at $0.6650/55 having found support at $0.6635. A Bloomberg source piece, linked here, noted that China will end trade restrictions on Australian coal which were imposed in late 2020.

- AUD/NZD printed a fresh YTD low at $1.0691, however losses have moderated in recent trade and the cross sits at $1.0700/10.

- NOK is down ~0.4%, last printing at 10.55/60. The next upside target for bulls is the high from 10 March at 10.7512.

- Cross asset wise; BBDXY is up ~0.2%. Regional equities are softer weighing on risk appetite, the Hang Seng is down ~2%. US Equity Futures are firmer, S&P500 eminis are up ~0.6%.

- In Europe today the UK Labour Market survey headlines, however the focus will continue to be on the SVB-inspired volatility. Further out February's CPI print headlines the docket, our preview is here.

FX OPTIONS: Expiries for Mar14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650(E931mln), $1.0695-00(E724mln), $1.0740-50(E1.5bln), $1.0780-00(E1.4bln)

- USD/JPY: Y130.00($720mln), Y131.00($562mln)

- EUR/GBP: Gbp0.8830-50(E752mln)

- AUD/USD: $0.6781-00($694mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/03/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 14/03/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/03/2023 | 0900/1000 | * |  | IT | Industrial Production |

| 14/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 14/03/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 14/03/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 14/03/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/03/2023 | 1230/0830 | *** |  | US | CPI |

| 14/03/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 14/03/2023 | 1400/1000 | * |  | US | Services Revenues |

| 14/03/2023 | 2120/1720 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.