-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Yen Falters Post Ueda Comments

EXECUTIVE SUMMARY

- G20 CENBANKS WORRIED BY OPTIMISTIC RATES MARKETS - MNI POLICY

- FED’S WILLIAMS SEES NO URGENCY TO CUT RATES - MNI BRIEF

- GOOLSBEE ASK HOW LONG TIGHT FED POLICY IS NEEDED - MNI BRIEF

- UEDA SAYS BOJ PRICE GOAL NOT ALREADY IN SIGHT, EYEING WAGE DATA - BBG

- CHINA TO TARGET 3% CPI RISE DEPSITE DEFLATION

- CHINA FEB MFG. PMI CONTRACTS FURTHER ON HOLIDAY - MNI BRIEF

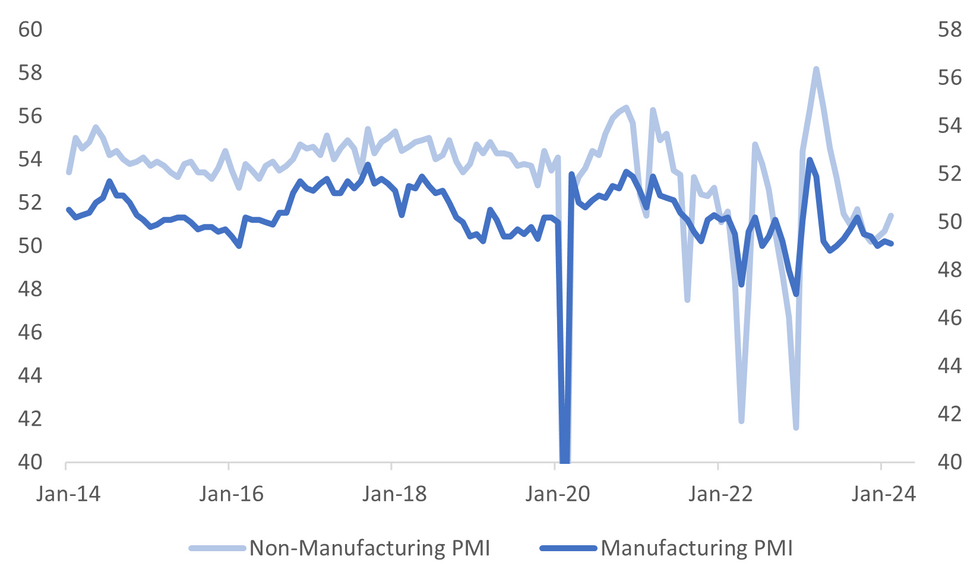

Fig. 1: China Official PMIs

Source: MNI - Market News/Bloomberg

U.K.

RETAIL (BBG): UK retail traffic fell the most since the pandemic due to train strikes, squeezed budgets and one of the wettest Februarys on record, fueling concerns about the strength of the economy.

POLITICS (BBG): Left-wing disrupter George Galloway won a seat in the UK Parliament in a special election that underscored how the Israel-Hamas war has exacerbated community tensions and sowed division across British politics.

EUROPE

ECB (BBG): European Central Bank Governing Council member Fabio Panetta said that consumer-price growth is slowing more rapidly than anticipated. “Inflation is falling faster than expected,” he said in Sao Paulo, where he’s attending meetings of Group of 20 finance ministers and central bank chiefs.

ECB (BBG): Portuguese Finance Minister Fernando Medina urged the European Central Bank to start lowering borrowing costs, saying maintaining them at their current level is a “high risk.”

POLAND (BBG): Polish Prime Minister Donald Tusk said he’ll push for changes to the European Union’s climate agenda to take the burden off the country’s farmers.

U.S.

FED (MNI BRIEF): The Federal Reserve can take its time to see if monetary policy is convincingly bringing inflation back to the central bank's 2% target before lowering interest rates, New York Fed President John Williams said Thursday, adding that he expects cuts are likely at some point later this year.

FED (MNI BRIEF): Cleveland Federal Reserve President Loretta Mester said Thursday there needs to be continued disinflation with prices moving sustainably back to 2%, but she added three 25 basis point cuts in the year "feels right" at the moment if the economy performs as expected.

FED (MNI BRIEF): Chicago Federal Reserve President Austan Goolsbee said Thursday that the need for tight monetary policy may diminish even with strong GDP growth if the U.S. economy continues to see improvements in supply that would help further curb inflation.

FED (MNI BRIEF): Federal Reserve Bank of Atlanta President Raphael Bostic reiterated Thursday the central bank is likely going to be in a position to begin easing interest rates sometime in the summer, but he added that economic data will be the guide and easing can be pulled forward or pushed back.

POLITICS (RTRS): President Joe Biden on Thursday called on Donald Trump to help unblock a plan languishing in Congress to cut migrant crossings as the pair took part in dueling visits to the border over a top issue ahead of November's election. Biden was in the town of Brownsville, Texas, across the Rio Grande river from Mexico, where he criticized Republicans for rejecting a bipartisan effort to toughen immigration rules after Trump told them not to pass it and give the president a win.

FISCAL (RTRS): The Democratic-majority U.S. Senate on Thursday approved a short-term stopgap spending bill to avert a partial government shutdown, after the Republican-controlled House of Representatives backed it with less than 36 hours before funding would have begun to run out.

BANKS (MNI): The largest U.S. banks are still in a position to handle tighter capital standards without compromising their lending capacity, Cleveland Fed President Loretta Mester said Thursday.

CORPORATE (BBG): Commercial real estate lender New York Community Bancorp said it discovered “material weaknesses” in how it tracks loan risks, wrote down the value of companies acquired years ago and replaced its leadership to grapple with the turmoil. The stock plunged.

OTHER

GLOBAL (MNI POLICY): Central bankers gathered at the G20 meeting in Sao Paulo discussed the disconnect between their own expectations for inflation and interest rates and investor expectations, which they fear could loosen monetary conditions prematurely, MNI understands.

GLOBAL (MNI BRIEF): Paulo Picchetti, Brazil's central bank deputy governor for international affairs, said Thursday there's a feeling among policymakers during the G20 meetings in Sao Paulo that disinflation has taken hold around the world but "the last mile" of the inflation fight has yet to be won.

MIDEAST (RTRS): Gaza health authorities said Israeli forces on Thursday shot dead more than 100 Palestinians as they waited for an aid delivery, but Israel blamed the deaths on crowds that surrounded aid trucks, saying victims had been trampled or run over.

JAPAN (BBG): Bank of Japan Governor Kazuo Ueda said the Bank of Japan’s price target is not already in sight, a comment that may temper speculation the bank’s first rate hike since 2007 could come as early as March.

JAPAN (BBG): The Bank of Japan will likely wait until April before terminating the world’s last negative interest rate, rather than moving later this month, according to a former executive director in charge of monetary policy.

AUSTRALIA (BBG): Australian home prices accelerated in February, extending gains at a time of elevated interest rates, reflecting a spike in population growth and a dearth of new housing construction.

NEW ZEALAND (BBG): Reserve Bank of New Zealand Governor Adrian Orr speaks at Business Canterbury event Friday in Christchurch. “Inflation has declined and is declining further. All measures of inflation, tradable, non-tradable, core, are all coming back down, which is wonderful news.” “Inflation is still too high” but “is on a downward trajectory” and “all measures of inflation expectations have come down. That’s really critical for us”

CHINA

PRICES (MNI): China will likely set its inflation target at around 3% y/y for 2024, despite the real level likely printing closer to about 1% due to sluggish demand, which will boost the chance of further central bank policy action, advisors and economists told MNI.

ECONOMY (MNI BRIEF): China's manufacturing Purchasing Managers' Index declined by 0.1 points to 49.1 in February, remaining in the contractionary zone below the breakeven 50 mark for the fifth month, amid the traditional off-season due to Chinese New Year holiday, data from the National Bureau of Statistics showed Friday.

ECONOMY (MNI BRIEF): China's Caixin manufacturing PMI registered 50.9 in February, up 0.1 points from January, staying in the expansionary zone above the breakeven 50 mark for the fourth month, driven by pro-growth policies, the financial publisher said Friday.

HOUSING (MINISTRY OF HOUSING): Up to 276 cities in 31 provinces have launched a real-estate financing mechanism to propose about 6,000 housing projects eligible for funding to commercial banks within their regions by the end of February, China News Service reported citing the Ministry of Housing and Urban-Rural Development. Over CNY200 billion of loans have been granted so far.

CHINA MARKETS

MNI: PBOC Drains Net CNY237 Bln Via OMO Fri; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY10 billion via 7-day reverse repo on Friday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net drain of CNY237 billion reverse repos after offsetting CNY247 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8000% at 09:34 am local time from the close of 1.7667% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 46 on Thursday, compared with the close of 40 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1059 on Friday, compared with 7.1036 set on Thursday. The fixing was estimated at 7.1978 by Bloomberg survey today.

MARKET DATA

AUSTRALIA FEB JUDO BANK F AUSTRALIA PMI MFG 47.8; PRIOR 47.7

NEW ZEALAND FEB ANZ CONSUMER CONFIDENCE M/M 1.0%; PRIOR 0.5%

NEW ZEALAND FEB ANZ CONSUMER CONFIDENCE INDEX 94.5; PRIOR 93.6

NEW ZEALAND JAN BUILDING PERMITS M/M -8.8%; PRIOR 3.6%

JAPAN JAN JOBLESS RATE 2.4%; MEDIAN 2.4%; PRIOR 2.5%

JAPAN JAN JOB-TO-APPLICANT RATIO 1.27; MEDIAN 1.27; PRIOR 1.27

JAPAN FEB F JIBUN BANK PMI MFG 47.2; PRIOR 47.2

JAPAN FEB CONSUMER CONFIDENCE INDEX xx; MEDIAN 38.3; PRIOR 38.0

SOUTH KOREA FEB EXPORTS Y/Y 4.8%; MEDIAN 1.4%; PRIOR 18.0%

SOUTH KOREA FEB IMPORTS Y/Y -13.1%; MEDIAN -11.7%; PRIOR -7.9%

SOUTH KOREA FEB TRADE BALANCE $4.29BN; MEDIAN $2BN; PRIOR $0.328BN

CHINA FEB MANUFACTURING PMI 49.1; MEDIAN 49.0: PRIOR 49.2

CHINA FEB NON-MANUFACTURING PMI 51.4; MEDIAN 50.7: PRIOR 50.7

CHINA FEB COMPOSITE PMI 50.9; PRIOR 50.9

CHINA FEB CAIXIN MANUFACTURING PMI 50.9; MEDIAN 50.7: PRIOR 50.8

MARKETS

US TSYS: Treasuries Unchanged, Fed's Williams See No Urgency To Cut Rates

- Jun'24 10Y futures have traded sideways today making highs of 110-15+ and lows of 110-11, and now trade unchanged at 110-14, ranges remain well within Thursdays. Initial resistance holds at 110-26+ (20-day EMA), a break above here will open 110-08 (50-day EMA), while initial support remains at 109-25+ (Low Feb 23) a break here opens a move to 109-14+ (Nov 28 Low)

- Curves are bull flattening yield are currently +0.05bp to -0.5bps across the curve, the 2Y yield +0.5bp higher at 4.625%, 10Y +0.2bp higher at 4.252% while the 2y10y is -0.425 at -37.527

- The NY Fed President John Williams spoke earlier where he said we don't need to tighten monetary policy any further and expects the Fed to cut interest rates later this year. See MNI's coverage of he speech here.• Earlier the Short-term funding bill passed senate and now sits with Biden.

- Looking ahead: S&P Global US Manufacturing PMI, U. of Mich. Sentiment, Construction Spending, ISMs & Fed Speakers

JGBS: Subdued Session, Local Data Not Market Moving Today, Heavy Calendar On Monday

In the Tokyo afternoon session, JGB futures are slightly higher, +2 compared to the settlement levels, after relatively subdued dealings.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined labour market and Jibun Bank PMI Mfg data, and comments from BoJ Governor Ueda.

- (Bloomberg) -- Bank of Japan Governor Kazuo Ueda said the Bank of Japan’s price target is not yet in sight, tempering market speculation that the bank’s first rate hike since 2007 is just around the corner. (See link ICYMI)

- Cash tsys are dealing flat to 1bp richer in today’s Asia-Pac session after Fed Williams said in a Fireside Chat after the US market close that he doesn’t believe the Fed needs to tighten monetary policy further. He added that he expects to cut interest rates later this year.

- Cash JGBs are cheaper out to the 10-year and slightly richer beyond. The 5-year zone is the underperformer on the curve, with its yield 1.6bps higher. The benchmark 10-year yield is 1.1bp higher at 0.720% versus the Nov-Dec rally low of 0.555% and the February high of 0.772%.

- Swaps are slightly richer, with swap spreads mostly tighter.

- On Monday, the local calendar sees Capital Spending, Company Profits and Monetary Base data, along with BoJ Rinban operations covering 1-3-year and 10-25-year+ JGBs.

AUSSIE BONDS: Little Changed, Light Local Calendar, Heavy Data Calendar On Monday

ACGBs (YM flat & XM +1.0) are slightly richer after dealing in relatively narrow ranges in today’s Sydney session. Today’s data drop (Judo Bank PMI Mfg and CoreLogic House Prices) failed to be market-moving.

- Cash tsys are dealing flat to 1bp richer in today’s Asia-Pac session after Fed Williams said in a Fireside Chat after the US market close that he doesn’t believe the Fed needs to tighten monetary policy further. He added that he expects to cut interest rates later this year.

- Cash ACGBs are flat to 1bp richer, with the AU-US 10-year yield differential 2bps higher at -12bps.

- ACGB May-34 went smoothly with more demand present. The cover ratio moved higher to 3.6437x from 3.1125x at the February auction. The weighted average yield printed 1.28bps through prevailing mids (per Yieldbroker).

- Swap rates are flat to 1-2bps lower.

- The bills strip is little changed.

- RBA-dated OIS pricing is little changed across meetings. A cumulative 37bps of easing is priced by year-end.

- On Monday, the local calendar sees the Melbourne Institute Inflation Gauge, Q4 Inventories, Q4 Company Operating Profits, ANZ-Indeed Job Advertisements and Building Approvals data.

NZGBS: Subdued Session After A Robust Post-RBNZ Rally

NZGBs ended the day flat to 1bp cheaper, reflecting a subdued local session. However, it has been a robust week for NZGBs, as yields closed 10-20bps lower than Tuesday's closing levels following the RBNZ's dovish shift. The 2/10 curve is approximately 10bps steeper than Tuesday's level.

- Moreover, NZGBs have outperformed their $-bloc counterparts, with the NZ-US and NZ-AU 10-year yield differentials around 5bps tighter than Tuesday's closing levels.

- Swap rates closed 1-3bps higher, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed flat to 1bp softer across meetings. A cumulative 53bps of easing is priced by year-end from an expected OCR peak of 5.53%.

- Before Wednesday's decision, the market had attached a 29% chance of a 25bp hike at yesterday’s meeting, with an anticipated terminal OCR of 5.65% (reflecting a 61% probability of a 25bp hike) by the May meeting. A cumulative 40bps of easing by year-end had been factored into the pricing.

- It is also worth noting that in late December, the market had expected over 100bps of easing by year-end, stemming from an anticipated terminal OCR of 5.53%.

- Next week, the local calendar sees Terms of Trade data on Monday.

FOREX: Yen Weakens Post Ueda Comments, Modest Risk On Elsewhere

The USD index has tracked tight ranges in the first part of Friday trade, the BBDXY last near 1244, which is close to end levels from NY on Thursday. This has masked some divergent trends within the G10 space though, with a risk on tone amid JPY and CHF underperformance.

- Early doors we had comments from BoJ Governor Ueda (in Brazil for the G20). These were cautious/less hawkish compared to remarks by Board member Takata that were made yesterday. The governor noted the inflation goal is not yet in sight and that current spring wage negotiations were key to ensuring a sustainable wage/inflation outlook.

- USD/JPY didn't react initially, but rose later to 150.40 (after opening around 150.00), this is a 0.30% yen loss and puts us back close to levels that prevailed before Takata headlines crossed yesterday.

- A turnaround in US equity futures, which now sit +0.10-0.20% higher has likely weighed on the yen as well. US yields are close to flat at this stage. Comments from the Fed's Williams haven't impacted sentiment greatly.

- AUD/USD sits back near 0.6510, close to 0.20% higher. The firmer equity backdrop has helped, while iron ore prices sit back above earlier lows in the week. (last near $117.2/ton). The AUD/NZD cross has been unable to re-take the 1.0700 handle.

- For NZD/USD, we are off the lows from earlier this morning, trading again in very tight ranges of 20pips (last 0.6090/95. Earlier RBNZ Gov Orr gave a speech in Christchurch, largely reiterating what was mentioned earlier this week at the RBNZ OCR meeting.

- CHF was a weaker performer through Thursday trade, and it has lagged softer USD trends elsewhere. EUR/CHF tested above it 200-day MA for the first since June, but has seen little follow through. The pair was last near 0.9565.

- Looking ahead, Eurozone CPI then takes centre stage before US ISM Manufacturing PMI rounds off the week’s tier-one data.

ASIA EQUITIES: Hong Kong Equities Reverse Earlier Losses, China Equities Steady

Hong Kong and China equities are mostly higher today, Hong Kong equities had lagged the move, however, are now out-performing China mainland equities. HK markets pushed higher after an official report showed a slump in manufacturing in China persisted last month, it heightened bets on stronger economic stimulus measures as policymakers gather next week to set economic targets.- Hong Kong equities are mostly higher and out-performing today after initially opening down 0.5-2% lower. Property is the worst performing sector, opening down 1.30% before paring losses however heading into the break sold off again to be down 0.85%. HSTech is the best performer up 1.60%, while the HSI is up 0.75%

- China mainland equities have been less volatile today, with the CSI1000 trading flat, while the CSI300 is up 0.30%.

- China Northbound flows were +16.6b yuan on Wednesday, highest since July 2023, with the 5-day average now 5.75b, while the 20-day is at 3.66b yuan.

- China’s home sales slump dragged on in February, even as regulators stepped up efforts to salvage the beleaguered property market, with the value of new home sales sliding 60% from a year earlier.

- It was reported on Thursday that the US will be investigating security risks associated with Chinese Electric Vehicles and other internet-connected cars. It should be noted that Chinese auto companies have a 27.5% tariff imposed on them, so penetration in the US market is limited; however, this would further dampen hopes of growth in the region.

- Earlier, China's February Non-Manufacturing PMI was 51.4 vs 50.7 est, while February Manufacturing PMI was 49.1 vs 49.0 est.

- Looking ahead, Hong Kong Retail Sales at 4:30 pm local time.

ASIA PAC EQUITIES: Asian Equities Push Higher, As Tech Names Out-Perform

Regional Asian Equities have mostly followed US stocks higher today after strong month-end flows and US inflation data put investors at ease. Japan is the best performer in the region, while South Korea is out for Independence day

- Japan equities are higher today, following wider markets after the US index closed at records highs as Tech names led the move. The BoJ Governor Kazuo Ueda was out earlier saying that price goals are not yet in sight, while he will be closely watching wage data. In local markets Tokyo Electron contributed the most to the index up 1.5%, with the Topix up 1.18%, while the Nikkei 225 trades up 1.95% led by tech names.

- South Korean markets are closed today for Independence Day

- Taiwan Equities are slightly lower today, Taiex Down 0.10%, after initially trading up 0.20%. TSMC is the biggest contributor to the market after the Philadelphia Stock Exchange Semiconductor Index pushed 2.70% higher on Thursday. Foreign equity flows are slowing with just $3.1 flowing into the market on Thursday.

- Australian equities have followed US equities higher and officially enter a bull market after rallying 20% off the June 2022 lows. Strong corporate earnings have helped push the market higher with Life 360 the standout today, up 36% on expansion plans. The ASX200 closed 0.53% higher.

- Indian Equities have surged higher today and the most in almost a month after data showed the economy grew at a faster pace than expected in the last quarter, the Nifty 50 is 1% higher today.

- Elsewhere in SEA, NZ equities have reversed earlier losses to trade unchanged, while Indonesian equities continue to see outflows with another $40.75m, with equities down 0.60%.

OIL: Within Recent Ranges, But Up For The Week

The first part of the Friday session has seen oil benchmarks firm modestly. The active Brent contract (K4) was last near $82.20/bbl, up around 0.35% for the session so far. We are tracking around 1.7% higher for the week at this stage. The active WTI contract is near $78.50/bbl, up around 2.6% for the week so far.

- News flow around oil has been light so far today. BBG noted that major China buyers ramped up derivative related activity, which helps price benchmarks (see this link). Broader risk appetite has been firmer in the equity space, which has likely helped oil at the margin.

- Earlier we had China PMI data, which was slightly better than expected, although the manufacturing index remain comfortably in contraction territory. There are some signs that we may a better next month.

- Elsewhere, US President Biden when asked on the prospect of an Israel-Hamas ceasefire agreement says that 'hope springs eternal,' but that it is unlikely to start by Monday 4 March (previously raised by Biden as a target date).

- Wires also carried comments from the leader of the Houthi forces in Yemen, claiming that the group will introduce military "surprises" in their Red Sea operations, which their "enemies" will not expect.

- For Brent, we remain within recent ranges. Late Jan highs at $83.65/bbl remains the upside focus, while recent lows rest near $80/bbl.

GOLD: Pushes To A Three-Week High After PCE Deflator Data

Gold is slightly higher in the Asia-Pac session, after closing 0.5% higher at $2044.30 on Thursday.

- Bullion rose to a three-week high after inflation figures matched expectations and reinforced bets that the Federal Reserve won’t need to raise interest rates again.

- US Treasuries finished the NY session 1-2bps richer. The US 10-year yield finished 1bp lower at 4.26% after pushing as high as 4.32% ahead of the PCE deflator data.

- The US PCE deflator, which is the Fed’s preferred inflation gauge, printed in line with market expectations, with the core measure up 0.4% m/m and 2.8% y/y. This confirmed the jump in inflation in January, as foreshadowed by prior CPI and PPI data.

- Fed speak remained balanced while leaning toward cut(s) in 2H'24. Fed Bostic reiterated that the central bank is likely going to be in a position to begin easing interest rates sometime in the summer.

- According to MNI’s technical team, Thursday’s high of $2050.72 cleared resistance at $2041.1 (Feb 23 high) and opened the key level of $2065.5 (Feb 1 high).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/03/2024 | 0730/0830 | ** |  | CH | Retail Sales |

| 01/03/2024 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/03/2024 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/03/2024 | 1000/1100 | *** |  | EU | HICP (p) |

| 01/03/2024 | 1000/1100 | ** |  | EU | Unemployment |

| 01/03/2024 | 1000/1100 | *** |  | IT | HICP (p) |

| 01/03/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/03/2024 | 1400/1400 |  | UK | BOE's Pill Speech at Cardiff University | |

| 01/03/2024 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/03/2024 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/03/2024 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 01/03/2024 | 1500/1000 | * |  | US | Construction Spending |

| 01/03/2024 | 1515/1015 |  | US | Fed Governor Chris Waller | |

| 01/03/2024 | 1515/1015 |  | US | Dallas Fed's Lorie Logan | |

| 01/03/2024 | 1715/1215 |  | US | Atlanta Fed's Raphael Bostic | |

| 01/03/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 01/03/2024 | 1830/1330 |  | US | San Francisco Fed's Mary Daly | |

| 01/03/2024 | 2030/1530 |  | US | Fed Governor Adriana Kugler |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.