-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Yen Gains Continue, Up 3.5% This Week

EXECUTIVE SUMMARY

- FED CUTS TIMELINE PUSHED BACK - REINHART - MNI INTERVIEW

- APPLE UNVEILS RECORD $110 BILLION BUYBACK AS RESULTS BEAT LOW EXPECTATIONS - RTRS

- ECB ISN’T PRE-COMMITTING TO PARTICULAR RATE PATH, LANE SAYS - BBG

- THREE ECB CUTS NOW MORE LIKELY IN 2024, STOURNARAS TELLS LIBERAL

- LABOUR WINS BREXIT STRONGHOLDS AS EARLY LOCAL ELECTION RESULTS COME IN - SKYNEWS

- AUSSIE HOME LOANS RISE 3.1% IN MARCH - MNI BRIEF

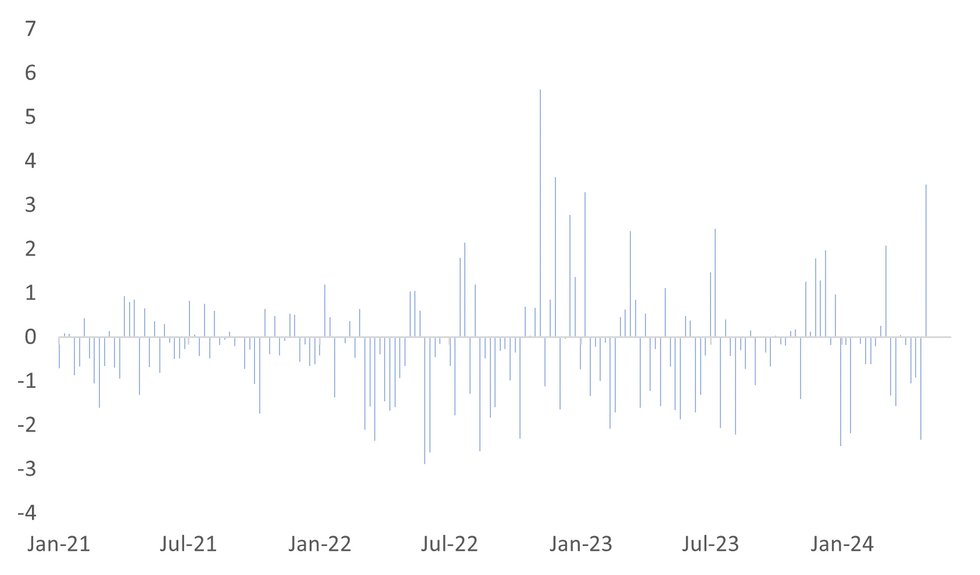

Fig. 1: Yen Weekly Changes Versus The USD (%)

Source: MNI - Market News/Bloomberg

U.K.

POLITICS (SKY NEWS): Labour has won control of a string of Leave-voting councils as results begin to roll in from the local elections across England and Wales. The party seized control of Rushmoor in Hampshire from the Conservatives shortly after 3am - a council the Tories had run for the last 24 years - with a spokesman calling the result "truly historic".

EUROPE

ECB (BBG): The European Central Bank is taking a meeting-by-meeting approach for it’s next steps on monetary policy, according to Chief Economist Philip Lane. “We are not pre-committing to a particular rate path,” Lane said at the Stanford Graduate School of Business on Thursday.

ECB (LIBERAL): The European Central Bank will probably lower borrowing costs three times this year instead of four, according to Governing Council member Yannis Stournaras. The Bank of Greece reviewed Eurostat’s recent inflation and growth data and “we now consider three rate cuts in 2024 as the more likely scenario,” Stournaras said in an interview with Liberal.

TURKEY (BBG): Turkey confirmed it would halt all trade with Israel until the country allows uninterrupted and sufficient flow of humanitarian aid to Gaza, after two officials familiar with the matter said the pause went into effect earlier Thursday.

FRANCE (BBG): Grid limitations in France that constrained its electricity exports are due to end by the end of the week, potentially easing a bottleneck that some blame for higher power prices in neighboring countries.

U.S.

FED (MNI INTERVIEW): The Federal Reserve is likely to cut interest rates once this year in December, and if inflation remains sticky the central bank will delay easing further, Vincent Reinhart, a former director of the Fed's division of monetary affairs, told MNI.

POLITICS (RTRS): Donald Trump will host a bevy of potential vice presidential picks at a Republican event in Florida this weekend, giving him the chance to observe his potential running mates in action while using them as a draw to attract donors.

CORPORATE (RTRS): Apple's quarterly results and forecast beat modest expectations on Thursday, as the iPhone maker unveiled a record share buyback program, sending its stock up almost 7% in extended trade. Apple increased its cash dividend by 4% and authorized an additional program to buy back $110 billion of stock. The buyback is the largest in the company's history, according to Investing.com analyst Thomas Monteiro.

OTHER

NEW ZEALAND (BBG): New Zealand Treasury Department publishes paper titled “The productivity slowdown: implications for the Treasury’s forecasts and projections” Friday in Wellington.

AUSTRALIA (MNI BRIEF): Australian home loan values rose 3.1% m/m in March, higher than the 1% market expectation, and 17.9% y/y to AUD27.6 billion, data from the Australian Bureau of Statistics showed Friday. “The rise in the value of new home loans over the past year reflected increases in the average loan size, in line with rising house prices over the same period,” said Mish Tan, head of finance statistics, at the ABS. “Meanwhile, in original terms, the number of loans reaching the final commitment stage is broadly similar to a year ago.”

CHINA

CHINA/US (BBG): Lawyers spearheading hundreds of lawsuits accusing social media platforms of addicting youths say the protections that TikTok’s platform in China offers for children show that the popular video-sharing app could operate more responsibly in the US.

MARKET DATA

AUSTRALIA APR F JUDO BANK PMI SERVICES 53.6; PRIOR 54.2

AUSTRALIA APR F JUDO BANK PMI COMPOSITE 53.0; PRIOR 53.6

AUSTRALIA MAR HOME LOANS 3.1%; MEDIAN 1.0%; PRIOR 1.9%

MARKETS

US TSYS: Futures In A Holding Pattern Ahead Of Non-Farm Payrolls

TYM4 is trading at 108-10, -0-01+ from NY closing levels, near of the top of today’s relatively narrow Asia-Pac range. Today’s high remains below Thursday’s intra-session high. News flow has been light.

- There has been no cash trading in Asia today with Japan out for observance of the Constitution Memorial Day holiday.

- After shrugging yesterday’s higher-than-expected Unit Labor Costs and slightly lower than expected Initial Jobless Claims, the market’s focus has turned to Non-Farm Payrolls later today.

- Bloomberg consensus sees nonfarm payrolls growth of 241k in April after another strong 303k in March. Markets will be mindful of household survey volatility but with continued focus on immigration-driven supply side strength, the u/e rate should help guide on broader labour market balance. At 3.83% in March, it doesn’t take much to move closer to the FOMC’s 4.0% end-2024 forecast.

- AHE growth is seen settling in at 0.3% M/M pace again although a few analysts caution potential downside risks from calendar effects.

- See MNI US Payrolls Preview: Fed Sensitive To An Unexpected, Meaningful Weakening here.

AUSSIE BONDS: A Typical Pre-Payrolls Friday, RBA Policy Decision On Tuesday

ACGBs (YM +2.0 & XM +4.0) are holding richer after dealing in narrow ranges in today’s Sydney session. Today’s data drop was second-tier and offered little in the way of market-moving potential.

- All eyes were on US tsys after they extended their post-FOMC rally yesterday ahead of US Non-Farm Payrolls data later today. Bloomberg consensus sees nonfarm payrolls growth of 241k in April after another strong 303k in March. There has been no cash trading for US tsys in Asia today due to a holiday in Japan.

- Cash ACGBs are 3-4bps richer with the AU-US 10-year yield differential at -17bps.

- Swap rates are 3-4bps lower.

- The bills strip bull-flattened, with pricing flat to +4.

- The local market’s focus next week will be the RBA Policy Decision on Tuesday. 23 of the 24 economists surveyed by Bloomberg are expecting the cash rate to be left at 4.35%. The more contentious issue is whether the RBA reinstates its explicit tightening bias.

- RBA-dated OIS pricing is little changed across meetings, with the market pricing a 39% chance of a 25bps hike by September.

- (AFR) The RBA might not achieve its inflation target for at least two years without raising rates further unless Treasurer Jim Chalmers uses the coming budget to cool the economy, economists warn. (See link)

NZGBS: Richer But Subdued Trading Ahead Of US Payrolls Later Today

NZGBs closed 4-6bps richer and near the session’s best levels. With the domestic calendar light, today was a typical subdued pre-US payroll session. After the early richening induced by the US tsys’ extension of its post-FOMC rally, ranges were relatively narrow.

- Bloomberg consensus sees nonfarm payrolls growth of 241k in April after another strong 303k in March. Markets will be mindful of household survey volatility but with continued focus on immigration-driven supply-side strength, the u/e rate should help guide on broader labour market balance. At 3.83% in March, it doesn’t take much to move closer to the FOMC’s 4.0% end-2024 forecast.

- Swap rates are 4-6bps lower.

- RBNZ dated OIS pricing is 3-4bps softer for meetings beyond October. A cumulative 42bps of easing is priced by year-end.

- The local calendar is relatively light next week, with ANZ Commodity Prices on Monday, the Government’s 9-Month Financial Statements on Tuesday and BusinessNZ Manufacturing PMI next Friday.

- Across the Tasman, the RBA delivers its Policy Decision on Tuesday, with 23 of the 24 economists surveyed by Bloomberg expecting the cash rate to be left at 4.35%. The more contentious issue is whether the RBA re-states its explicit tightening bias.

FOREX: Dollar Index Drifts Lower Ahead Of US NFP, Yen Up Around 3.5% This Week

The BBDXY USD index sits lower for the first part of Friday trade, last near 1253.00, off around 0.10% versus end Thursday levels in NY.

- All of the G10 bloc is firmer against the USD, albeit away from best levels, as the key US NFP print comes into view.

- USD/JPY got to fresh lows of 153.76, but we now sit back near 153.95, still around 0.45% stronger in yen terms. Japan markets are closed today (and on Monday), but given this week's tendency for intervention to happen during lighter liquidity periods, there is likely to be some degree of caution for the market.

- Key levels to watch on the downside in the near term would be the 50-day EMA near 152.40.

- Yen is up around 3.5% so far this week, its best gain since Nov 2022.

- AUD and NZD are both higher, but gains are less than 0.1% at this stage. AUD/USD was last near 0.570, NZD/USD in the 0.5965/70 region.

- The positive tone to US equity futures and regional equities has likely helped sentiment, but follow through USD selling has been limited against both currencies.

- US Tsy futures have drifted higher, but Thursday late NY session highs remain intact.

- Looking ahead, we have the US non-farm payroll print. Before that focus is likely to rest on the Norges rate decision in Norway.

EQUITIES: Positive Spillover From US Gains, Hong Kong Rally Continues

The tone for regional equities has been positive as we approach the end of the week. China remains closed until Monday, while Japan markets don't return until next Tuesday. Still, the carry over from a positive US session on Thursday, coupled with higher futures today has been a clear positive. Apple's beat (plus large share buyback) has helped push Nasdaq futures up 0.60%. Eminis were last +0.30% firmer.

- Hong Kong equities continue to rally. The HSI up a further 1.13% to the break. We had very strong gains for the Golden Dragon index in US trade (over 6%) and a closely tracked China related ETF. The HSTECH is up a further 2.0% so far today, tracking up +6% for the week.

- Attractive valuations, particularly in the tech space, is aiding sentiment, while hopes of further policy support in the aftermath of the recent Politburo meeting is another contributor.

- Technically though the HSI is now in overbought territory based off the RSI (14)

- Elsewhere, sentiment has been better in Taiwan markets, aided by the positive tech backdrop. The Taiex up around 0.70% at this stage. The Kospi is posting a more modest 0.2% gain at this stage, unable to retake the 2700 level.

- Australia's ASX 200 is +0.50% firmer. In SEA all markets are firmer today, except for the Philippines, gains are under 0.50% at this stage though.

OIL: Stabilizing But Still Down Sharply For The Week

Brent crude sits just under $84/bbl in recent dealings, slightly higher for the session, but still comfortably lower for the week. At this stage we are tracking down 6.2% for the week for the front month Brent contract. WTI was last near $79.25/bbl, off by around 5.5% so far this week.

- Brent is up from recent lows near $83/bbl, but sub all key EMAs. The 200-day juat above $84.10/bbl is the closest, while the 20-day sits back above $87/bbl.

- The softer USD tone amid dovish Fed leanings has helped stabilize sentiment in the latter stages of this week, but reduced conflict risks in the Middle East have seen some geopolitical risk premium come out of prices. Wires reported on Thursday that Hamas have agreed with Qatar to continue talks on a truce in Gaza.

- There are also signs of less gasoline demand as we approach the US summer driving season (per BBG).

GOLD: Sitting 5% Below Its Recent All-Time High Ahead OF US Payrolls

Gold is slightly lower in the Asia-Pac session, after closing 0.7% lower at $2303.83 on Thursday.

- The price of the yellow metal has declined by approximately 5% since reaching its peak in mid-April.

- Thursday's movement partly counteracted the 1.5% surge triggered by comments from Fed Chair Powell and the FOMC statement, which were perceived as less hawkish than anticipated.

- As US Treasuries extended their post-FOMC rally, the reversal in bullion's price suggests that Wednesday's movement might have been an overreaction.

- The market’s focus now turns to US Non-Farm Payrolls later today. Bloomberg consensus sees nonfarm payrolls growth of 241k in April after another strong 303k in March. See MNI US Payrolls Preview: Fed Sensitive To An Unexpected, Meaningful Weakening here.

- According to MNI’s technicals team, gold again breached initial support at $2291.6, the Apr 23 low. A continuation lower would signal scope for an extension towards $2245.2, the 50-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/05/2024 | 0645/0845 | * |  | FR | Industrial Production |

| 03/05/2024 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/05/2024 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 03/05/2024 | 0900/1100 | ** |  | EU | Unemployment |

| 03/05/2024 | 1230/0830 | *** |  | US | Employment Report |

| 03/05/2024 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/05/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.