-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI Global Morning Briefing

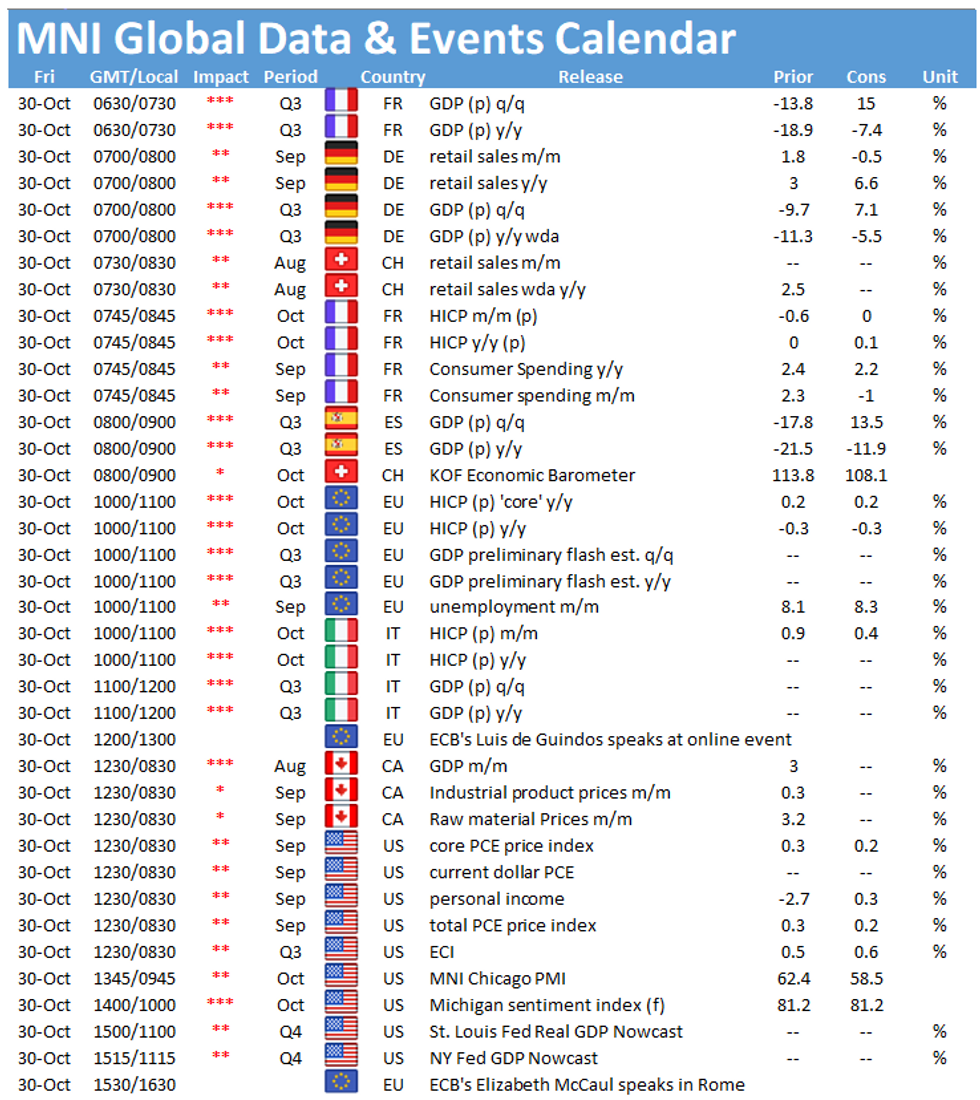

Friday sees a busy schedule in terms of data releases. The main highlights are the publications of Q3 GDP figures for France (0630GMT), Spain (0800GMT), Germany (0900GMT), the EZ (1000GMT) and Italy (1100GMT). Additionally, the release of EZ inflation figures at 1000GMT will be closely watched. The focus in the US will be on the release of the Chicago Business Barometer at 1342GMT.

Q3 GDP set to rebound in Europe

Following the severe contractions in GDP in Q2 due to the national lockdowns, sharp increases of GDP are expected in Q3 on a quarterly basis as the economies were reopened gradually. However, a strong growth rate does not indicate that output is back at pre-covid levels. Annual GDP is still forecast to show a contraction, although at a slower pace than in the previous period. Recent survey data suggests that the recovery lost momentum going into Q4 and the possibility of another quarterly decline in Q4 gets more likely. The recent rise in Covid-19 cases has again forced governments to impose stricter restrictions which weigh especially on the service sector and on consumers. Consumer sentiment in the EZ deteriorated again and the EZ ESI eased in October. Moreover, the flash PMIs signal a renewed downturn of service sector business activity.

The overall EZ GDP is expected to rise by 9.5% following a historic 11.8% contraction in Q2. The German economy is forecast to show the smallest uptick of 7.1% in Q3, however German GDP saw the smallest drop in Q2 where it fell by 9.7%. French GDP is projected to grow by 15.0% after contracting 13.8% in the previous quarter. Spain was hit particularly hard by the pandemic in Q2 with GDP plunging by 17.8%. Markets expect a rebound to 13.5% in Q3. The Italian economy is expected to expand by 11.1% after plummeting by 12.8% in Q2.

EZ inflation expected to remain negative

EZ Inflation is forecast to remain at September's level of -0.3% in October. Energy prices continue to have a negative contribution on consumer prices. Besides energy prices, clothing and footwear as well as accommodation services showed a sharp downward contribution on prices in September as consumers continued to work from home and tourism remained muted due to the pandemic. October's flash PMI suggests a small upside risk with output charges rising for the first time since June 2019. On the other hand, already released national data suggest a downside risk with German inflation coming in at -0.5%, while Spanish flash inflation registered at -1.0% in Oct.

Chicago Business Barometer seen lower

The Chicago Business Barometer surged to 62.4 in September which was the highest level since December 2018 as business activity recovered further. However, markets are looking for a modest downtick to 58.0 in October amid the worsening pandemic. September's sharp increase was broad-based with production and new orders showing the largest upticks. Similar survey evidence suggests a small upside risk. The Dallas Fed manufacturing index improved further to a two-month high in Oct, while the Philadelphia Fed manufacturing index surged 17.3 points. Meanwhile, the Kansas City Fed manufacturing index and the Richmond manufacturing index ticked up in October as well.

The events calendar remains quiet on Friday with only two speeches scheduled for the day including the speakers ECB's Luis de Guindos and Elizabeth McCaul.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.