-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing

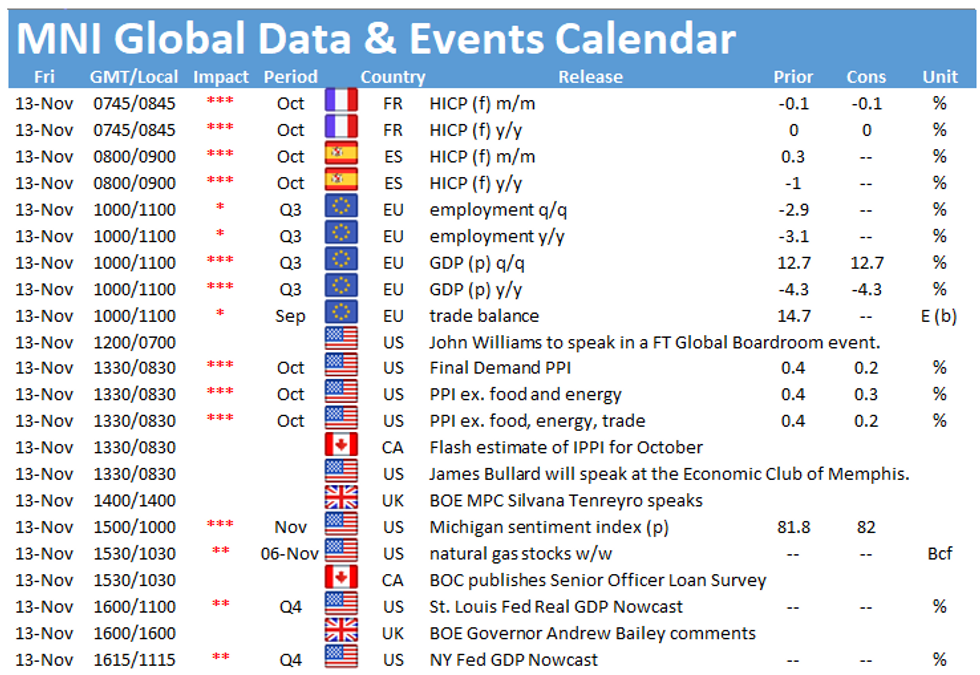

The main data events to look out for at the end of the week include the release of French inflation at 0745GMT, the flash estimate of EZ GDP at 1000GMT and the preliminary Michigan sentiment index at 1500GMT.

French inflation remains muted

According to the flash estimate, the annual HICP was unchanged on September's level of 0.0% in October and markets look for an unchanged reading for the final print. Monthly inflation declined by 0.1% in October after having fallen 0.6% in the previous month. Annual food prices rose 1.5% in October, mainly driven by higher prices for fresh food. Tobacco inflation remained unchanged at 13.7%, while energy and manufactured goods prices fell by 7.7% and 0.1%, respectively. Service inflation slowed to 0.3% according to the flash estimate which is in line with the services PMI where firms noted another drop in prices charged due to weak customer demand.

EZ flash GDP forecast to remain at preliminary flash estimate

The preliminary flash estimate of EZ GDP showed a sharp rebound of economic growth to 12.7% in Q3 after the economy contracted by 11.8% in Q2. This marks the strongest increase on records which began in 1995. Annual growth improved to -4.3% in Q3 following a 14.8% drop in the previous quarter. Markets expect both indicators to register in line with the preliminary results for the second estimate. A detailed breakdown of GDP will only be available with the final result. Looking ahead, another contraction in Q4 looks likely as several European countries re-imposed lockdowns amid the second wave of the virus and activity remains muted. However, the decline is likely to be less severe as the restrictions are focused on the service sector, while the manufacturing sector remains open.

Preliminary Michigan sentiment seen rising

Consumer sentiment edged up to 81.8 in October according to the survey of consumers of the Michigan University. The index ticked up 1.4 points in October and markets expect another small increase in November to 82.0. Last month's survey noted that consumers are concerned about rising infection rates and the extremes of hyper-partisanship ahead of the elections. The impact of these concerns is likely to continue over the coming weeks according to the survey.

The events calendar holds several interesting speakers in the cards on Friday including BOE's Jon Cunliffe, Silvana Tenreyro and Andrew Bailey as well as New York Fed's John Williams and St. Louis Fed's James Bullard.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.