-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI Global Morning Briefing

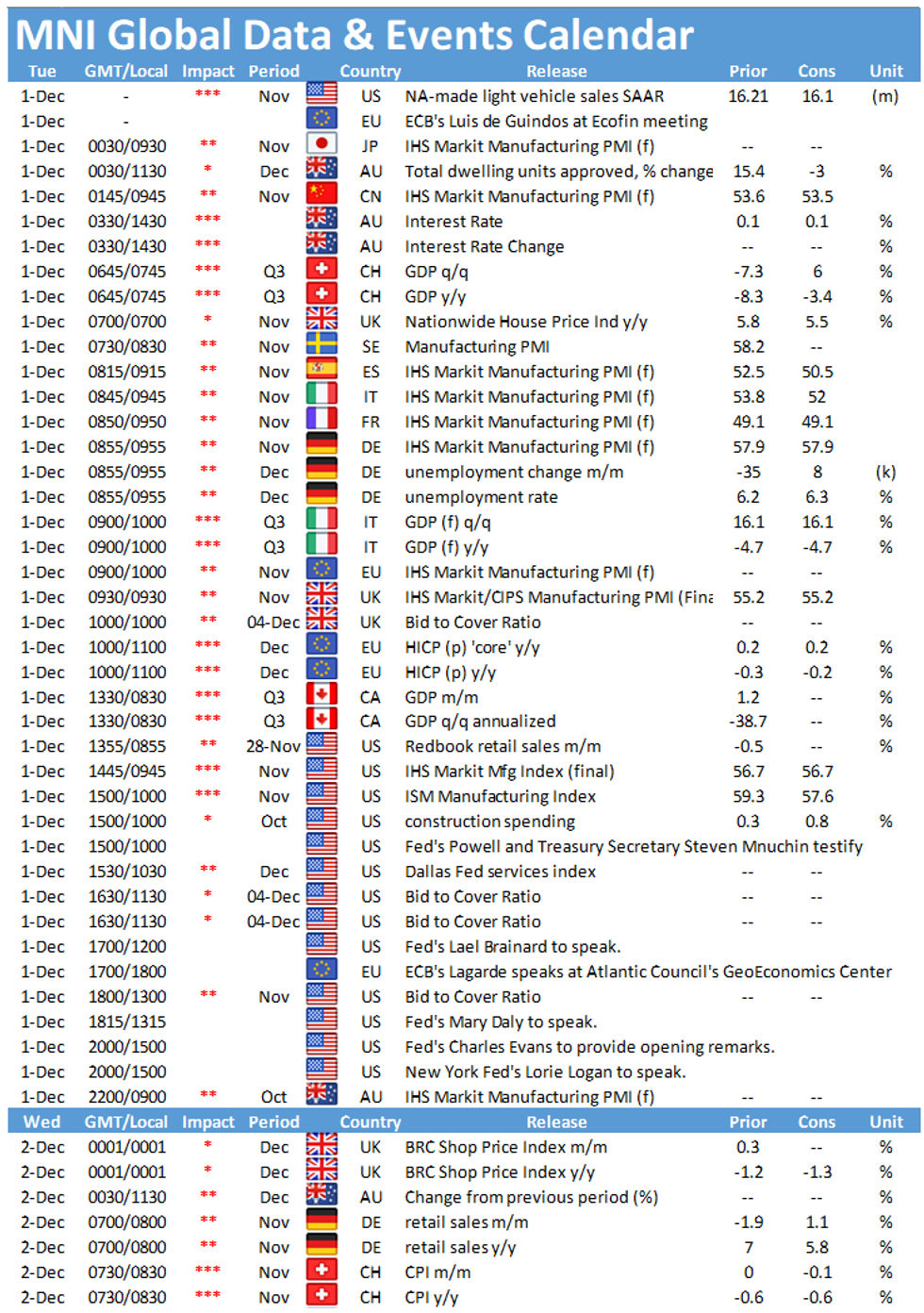

Tuesday throws up a busy schedule of data events with the highlights in Europe being the publications of the final manufacturing PMIs for Spain (0815GMT), Italy (0845GMT), France (0850GMT), Germany (0855GMT), the EZ (0900GMT) and the UK (0930GMT). Additionally, the release of the EZ inflation rate will be eyed at 1000GMT. In the US, the highlight of the day is the publication of the ISM Manufacturing PMI at 1500GMT.

Europe's manufacturing PMIs eased in November

Spain's and Italy's final manufacturing PMIs, for which no flash results are available, are both expected to ease in November amid the second wave of Covid-19. However, both are seen above the 50-mark, signalling expansion. The Spanish index is forecast to drop to 50.5, while the Italian PMI is expected to fall to 52. The French, German and the EZ manufacturing PMIs are expected to register in line with the flash results showing declines for every indicator. However, the French indicator fell even below the 50-threshold to 49.1 due to the tighter covid-restrictions. On the other hand, the German manufacturing PMI signalled solid expansion in November despite a small downtick to 57.9. The EZ PMI decreased to 53.6 and the report noted weaker demand in the industrial sector, mainly driven by France, while Germany remained the bright spot.

While the PMIs in the Eurozone declined, the UK's flash manufacturing PMI ticked up in November and markets expect the final print to remain unchanged from the flash estimate showing an increase to 55.2. However, the flash report noted that supplier delivery times lengthened significantly due to delays at UK ports which pushed the index up. The report further mentioned signs of stock building ahead of Brexit which also contributed to longer delivery times.

EZ flash inflation still seen negative

The headline EZ HICP is forecast to tick up slightly to -0.2% in November, up from -0.3% seen in October. Inflation registered in negative territory since August and it is likely to remain weak in the coming months. However, the main factors behind the weakness are temporary such as the German VAT cut, oil price dynamics and the disruptions of seasonal sales patters.

ISM Manufacturing PMI expected to decline

The ISM Manufacturing PMI is forecast to slip to 57.6 in November, down from 59.3 recorded in the previous month. The index increased 3.9 points in October due to a sharp uptick of New Orders and showed the highest level since September 2018. Similar survey evidence is in line with market forecasts. The Chicago Business Barometer dropped to the lowest level since August, while Kansas City Fed's manufacturing index and Richmond Fed manufacturing index also declined in November.

The highlights of the events calendar are speeches by ECB's Christine Lagarde and Luis de Guindos, BOE's Andrew Bailey and Jon Cunliffe as well as Fed's Jay Powell, Lael Brainard, Mary Daly and Charles Evans.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.