-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Gilt Week Ahead

MNI Global Morning Briefing

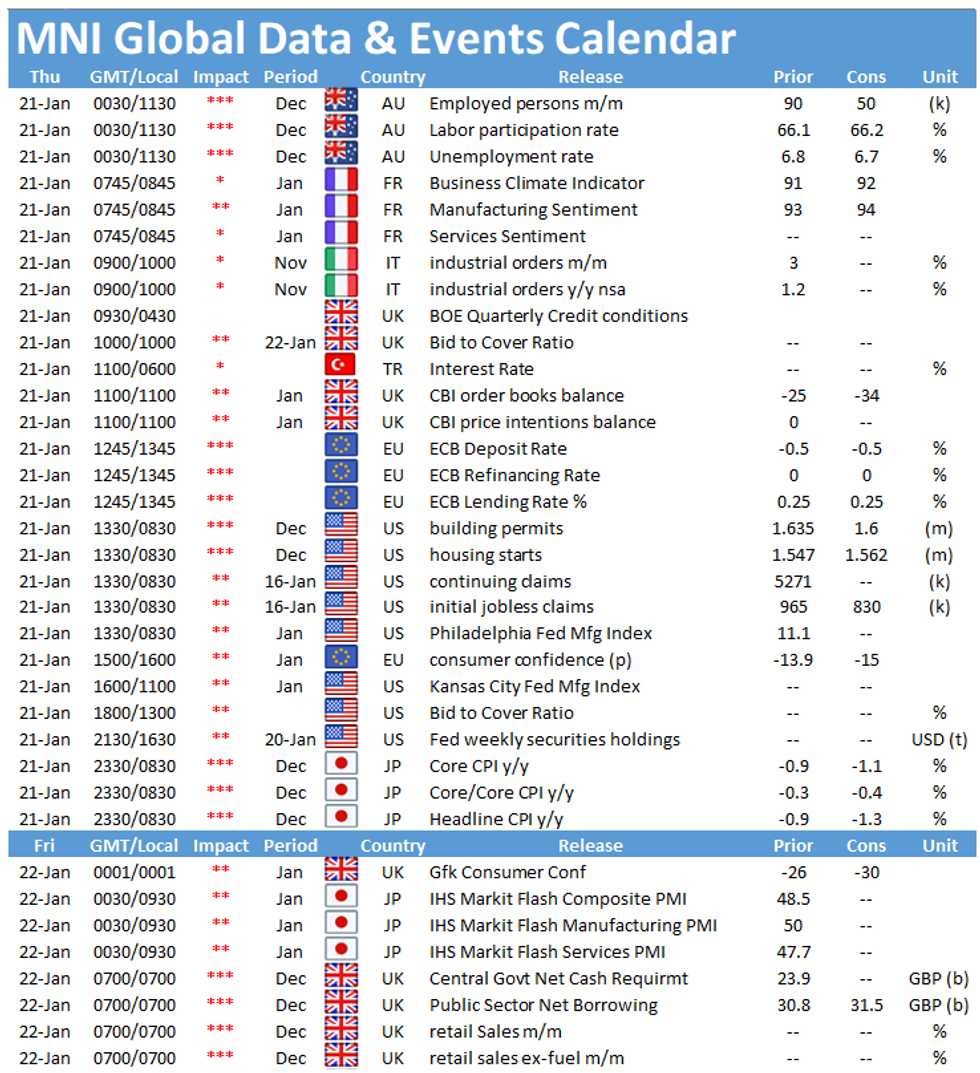

The main European data event to follow on Thursday in Europe is the publication of the French business climate indicator at 0745GMt. At 1245GMT the ECB's interest rate decision will be closely watched before the focus turns to US initial jobless claims at 1330GMT.

French business climate forecast to edge higher

French business climate bounced back strongly in December after November's dip. The indicator rose 12pt to 91 in December and markets look for the second successive uptick in January, although only by 1pt to 92 which would be the highest level since September. Similar to other surveys, firms are less pessimistic about expected activity in the coming months, while their opinion regarding recent activity fell especially in the services and retail trade industry in connection with the lockdown. The situation regarding the pandemic in France remains serious with infection rates still elevated and a tighter curfew introduced last week.

ECB seen on hold

Following the boost for the PEPP in December, along with a host of other measures, it is a near certainty that the Governing Council will be on hold Thursday. President Lagarde's press conference will focus on how she will address the relative strength of the euro, the December/January lockdowns and the sluggish roll-out of the vaccine program across the EU.

ECB Interest rates - source: ECB

US jobless claims seen slowing

U.S. initial jobless claims filed through January 16 are expected to fall to 830,000 from 965,000 through January 6. The latest surge in Covid-19 infections has led to renewed business restrictions and shutdowns, triggering more layoffs. Some UI recipients have had to reapply for regular benefits in recent weeks after state programs were paused while federal programs lapsed, which should push initial claims higher in the coming weeks.

US continuing claims - source: Bloomberg

The events calendar remains quiet on Thursday with the only highlights being the press conference following the ECB's interest rate decision.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.