-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - ECB Set to Deliver Third Consecutive Cut

MNI China Daily Summary: Thursday, December 12

MNI Global Morning Briefing

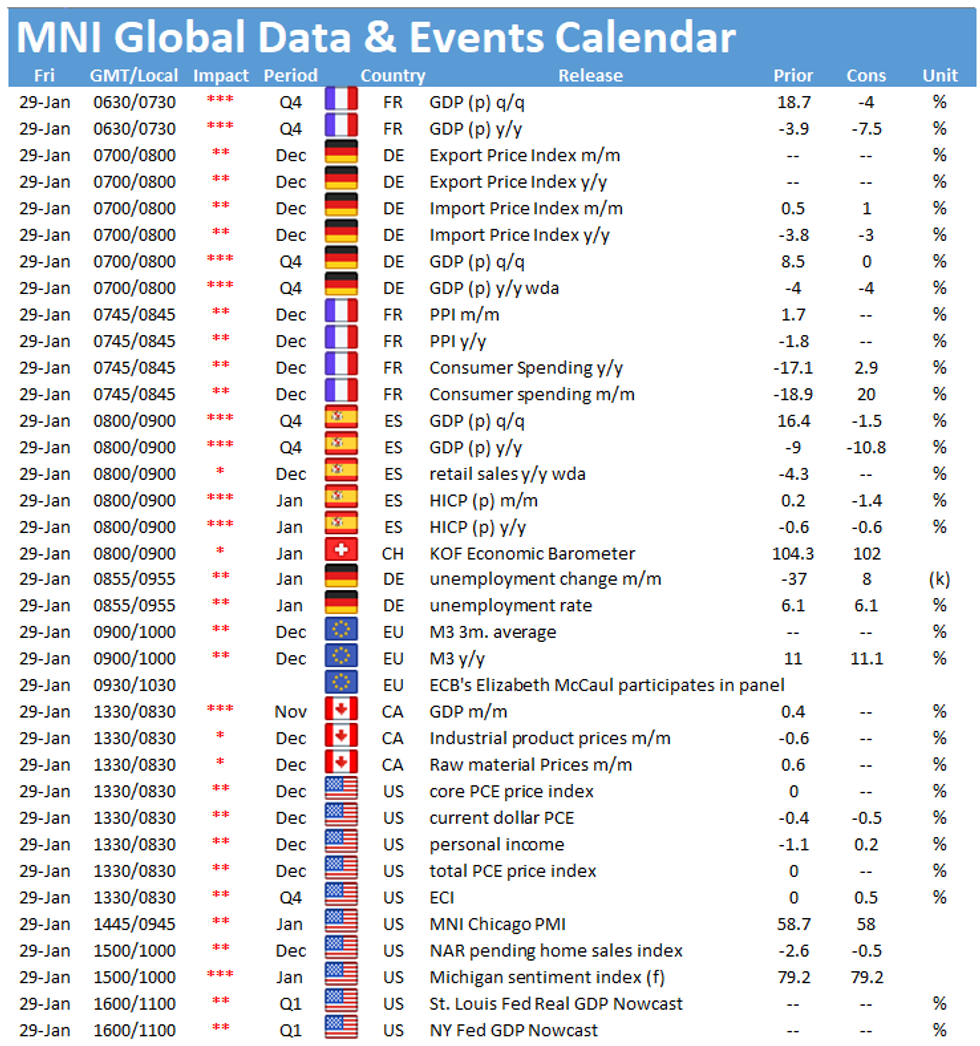

Friday holds several interesting data releases in the cards including the publication of flash GDP figures for France at 0630GMT, Germany at 0700GMT and Spain at 0800GMT. The publication of the Chicago Business Barometer at 1445GMT is the highlight of the day in the US in terms of data releases.

French flash GDP seen falling

The French economy is expected to shrink by 4.0% in Q4 2020 following the strong rebound in the third quarter. Q3's recovery of 18.7% came after a sharp decline of 13.8% in the second quarter. The second wave of Covid-19 led to a renewed lockdown and tighter restrictions which will last well into the new year. As a result, many businesses had to close again at some point in the last three months of 2020, which weighs on economic growth. Looking ahead, January remained challenging with high infection rates and strict curfews in place and February is likely to show a similar picture, resulting in a subdued outlook for Q1 economic growth.

German economy expected to stagnate

German quarterly GDP is expected to come in flat in Q4, while the annual rate is seen at -4.0%. The German economy grew 8.5% in Q3 after contracting by 9.8% in the second quarter. However, Q3 2020 GDP is still 4% smaller than in Q4 2019. Household consumption rebounded sharply in the three months to September, rising by 10.8%, while government consumption rose 0.8%. However, private consumption is likely to be muted in Q4 as the country went into another lockdown and non-essential businesses had to close again. The first quarter of 2021 is likely to be muted as well since infection rates remain elevated and the lockdown has already been prolonged to mid-February.

Spanish GDP forecast to decline

Similar to other European countries, Spain is struggling to bring down infection rates which leads to tight social distancing measures and as a result, the Spanish economy is expected to narrow by 1.5% in Q4. Nevertheless, the decline is smaller than at the beginning of the crisis as more parts of the economy remained open. Looking ahead, the first quarter is likely to show a similar pattern as infection remain stubbornly high. Spanish quarterly GDP increased by 16.4% in the third quarter of 2020 after plummeting by 17.9% in the second quarter when the Covid-19 crisis first hit the country.

Chicago Business Barometer seen lower

The Chicago Business Barometer increased to 58.7 in December after falling to 57.8 in November. Among the main five indicators, Employment saw the largest monthly gain in December, followed by Order Backlogs, while New Orders recorded the biggest decline. In January, markets are looking for a renewed downtick to 58.0. Similar survey evidence is in line with market forecasts. The Dallas Fed business activity index as well the Richmond manufacturing index and the Empire state manufacturing index all declined in the first month of 2021.

Friday's events calendar throws up a busy schedule. Speakers to look out for include ECB's Elizabeth McCaul, Dallas Fed's Rob Kaplan and San Francisco Fed's Mary Daly.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.