-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing

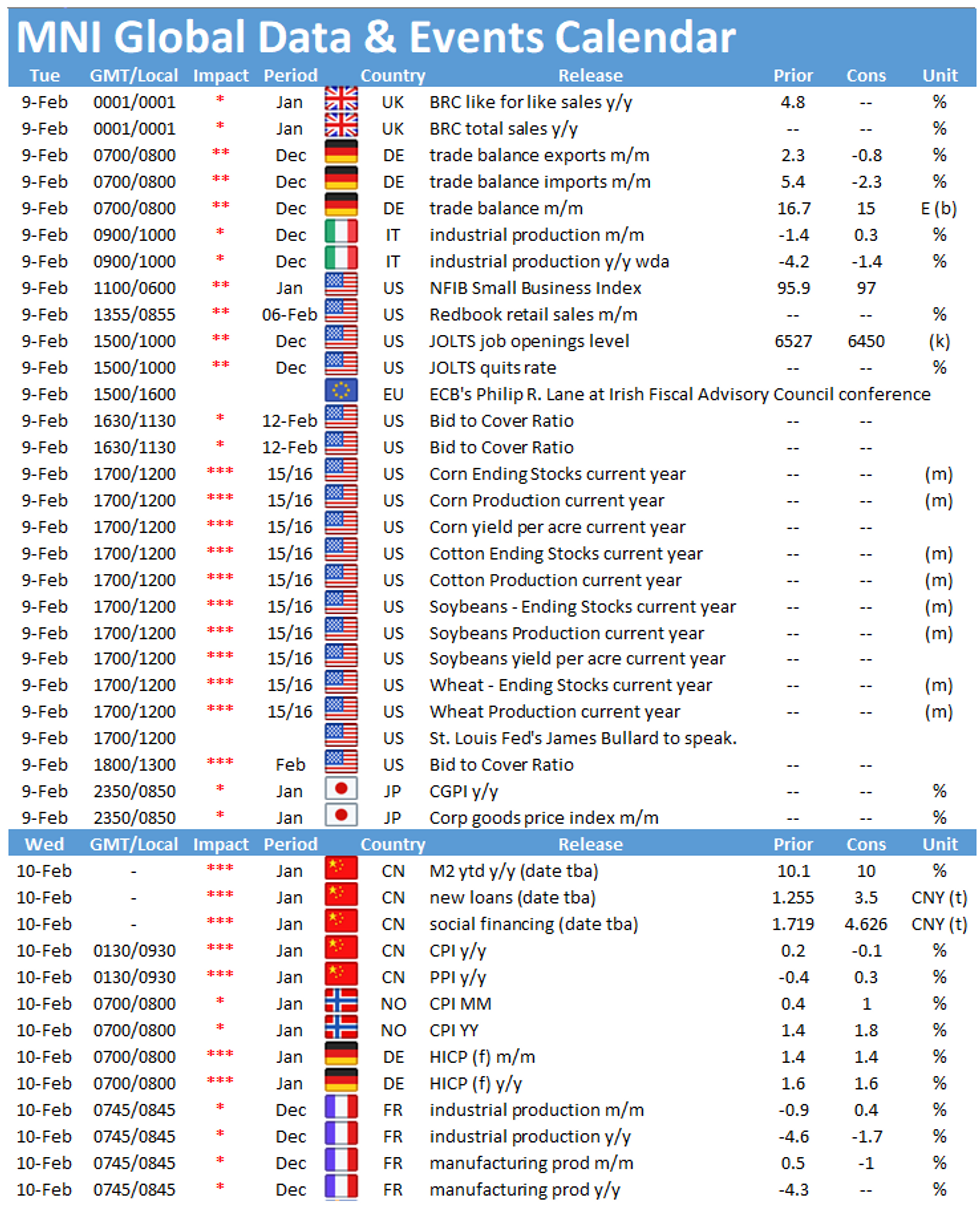

Tuesday kicks off with the release of the German trade balance at 0700GMT, followed by Italian industrial production at 0900GMT. In the US the highlight is the release of the job openings and labour turnover survey at 1500GMT.

German trade surplus forecast to narrow

The unadjusted German trade surplus is expected to narrow to EUR 15.0bn in December, down from EUR 17.2bn recorded in November. The seasonally adjusted trade surplus shrank in November to EUR 16.4bn as imports rose 4.7%, while exports only ticked up 2.2%. In December, seasonally adjusted exports are projected to fall by 0.8%, while markets expect imports to fall by 2.3%, leading to a decline in the adjusted trade surplus. The German composite PMI noted an upturn in new export business in January which bodes well with exports going forward.

Italian industrial output seen edging up

Industrial production in Italy is expected to rise by 0.3% on a monthly basis in December after falling by 1.4% in November. The index rebounded strongly after the initial fall in spring 2020, but the recovery eased since June and the indicator fluctuates from September onwards. Survey evidence is in line with market forecasts, indicated by the manufacturing PMI which rose to a 34-month high in January due to strong orders and output. On the other hand, Istat's manufacturing sentiment eased slightly in January due to a more pessimistic outlook, while order books continued to expand.

US JOLTS job openings expected to ease

The number of job openings is expected to ease to 6,450,000 in December, down from 6,527,000 seen in November. Job openings were little changed in November with openings declining in durable goods manufacturing, information and educational services. Hires were also little changed in November at 6,000,000, while separations rose to 5,400,000 with the layoff and discharges rate rising to 1.4%. Survey evidence suggests an improvement going forward. The ISM services PMI saw employment increase in January with firms noting plans to expand their workforce.

The events calendar throws up a quiet schedule with the highlight in terms of speakers being ECB's Philip Lane and St. Louis Fed's James Bullard.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.