-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

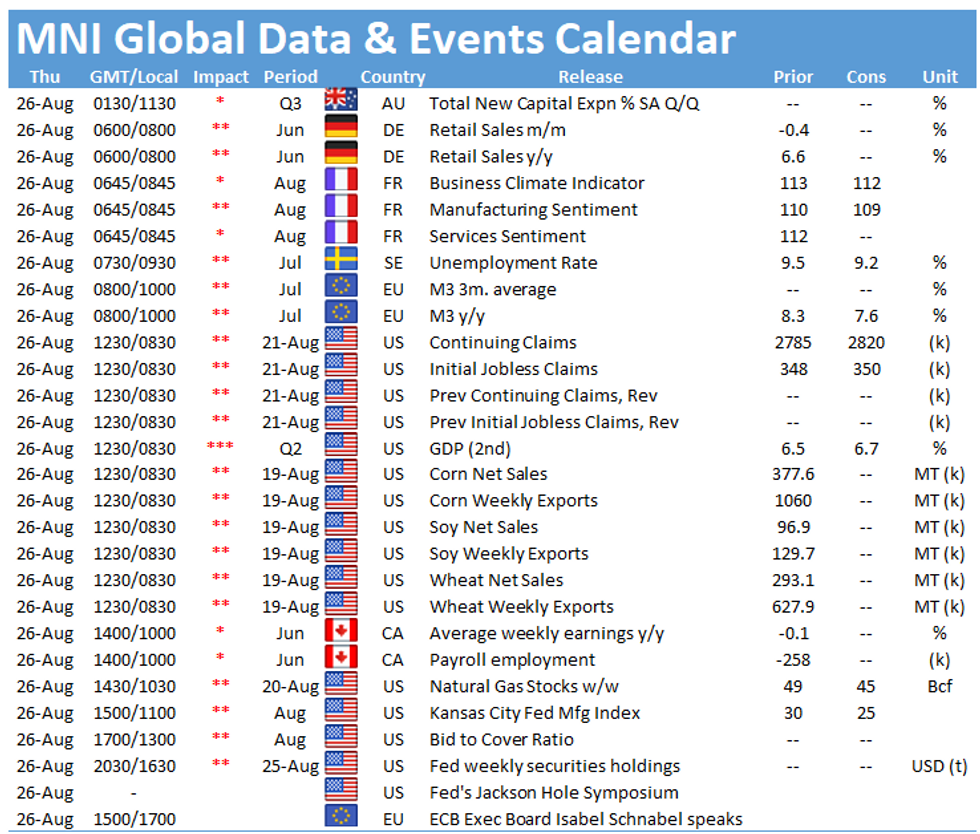

Free AccessMNI Global Morning Briefing: Jackson Hole Schedule Expected

Although there are data points of note Thursday, all focus over the next few days or so will be on Jackson Hole and any update from the Federal Reserve on current policy thinking.

French business sentiment seen lower (0745BST)

French business sentiment is seen modestly lower in August, with the Business Climate Indicator seen edging lower to 112 from July's 113. Both services and manufacturing are expected to slow, with both sentiment indexes expected to drop a point to 111 and 109 respectively.

Eurozone money supply seen narrowing again (0900 BST)

Euro area money supply growth is expected to narrow again in July, dipping to 7.6% from 8.3% in June. Growth peaked at just above 16% around the turn of the year, reflecting the extraordinary measures put in place by the ECB since the start of the pandemic.

However, following the central bank's summer policy strategy review, policymakers have put money supply measures aside as an indicator of inflation, noting "a weakening of the link between monetary aggregates and inflation", with future analysis focusing on "assessing the transmission of monetary policy measures". Although no longer an official ECB metric in deliberations, no doubt the hawks will still have a keen eye on the numbers.

Source: ECB

Jackson Hole may clarify current Fed thinking

Fed Chair Jay Powell is set to deliver a speech via webcast on the economic outlook Friday at 10 ET. His remarks will be closely watched for any hints on QE taper timing and how the surge in delta variant cases is shaping the Fed's forecasts. Minutes of the July FOMC meeting said most officials supported starting the taper this year if the economy performs as expected.

The topic of the annual academic conference is ""Macroeconomic Policy in an Uneven Economy" and a detailed schedule of the now confirmed online event is expected to be released Thursday evening.

ECB Executive Board member Isabel Schnabel is slated to speak at 1600BST.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.