-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: Japan Govt Keeps Economic Assessment, Ups Imports

MNI EUROPEAN OPEN: CAD, MXN Weaken On Tariff Threat, JPY Firms

MNI Global Morning Briefing: ADP Jobs Report Eyed

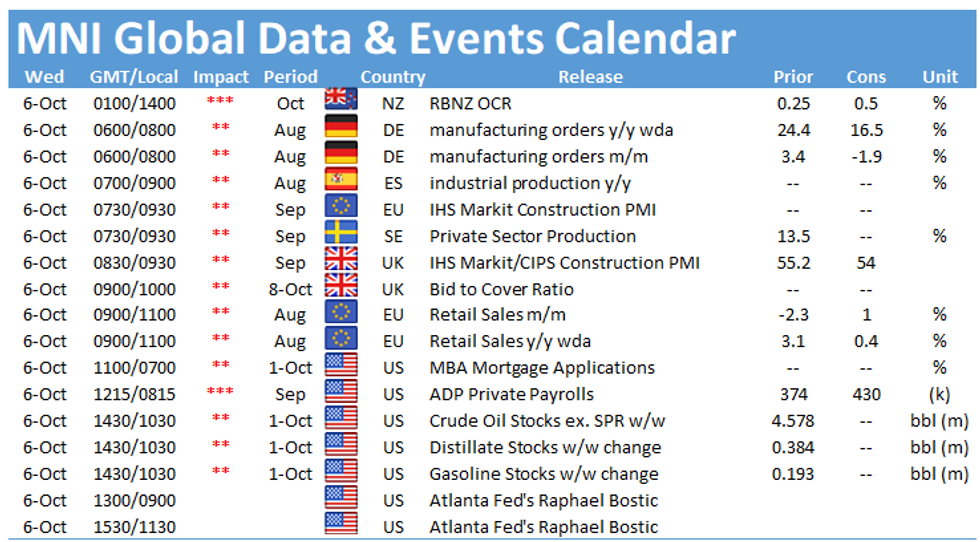

Wednesday sees only a limited data calendar in both Europe and the North Americas, although analysts will get a look at the construction sector across Europe and the UK.

German manufacturing orders seen slowing (0700 BST)

German manufacturing orders are expected to have slowed in August, with analysts looking for a m/m decline of 1.9% against at 3.4% increase in July. Year-on-year, August orders are seen up 16.5% wda, decelerating from a 24.4% rise in the previous month.

The manufacturing PMI fell to a six-month low in August as supply constraints hit production, although still sitting at elevated levels above 60, with prices continuing to rise to historical highs.

EU retail sales recover in August (1000 BST)

Eurozone retail sales are expected to have picked up in August, recovering from the surprise weakness in July. On month, sales are expected to have risen 1% recovering from the 2.3% dip seen in the previous month. Year-on-year sales are expected to rise just 0.4%, slowing from the 3.1% y/y gain in July.

US private sector jobs gains strengthening in September (1315 BST)

The latest ADP report is expected to underline the continued recovery in the U.S. labour market, with analysts looking for an add of 430,000 jobs, up from the 374,000 increase seen in August. An increase along those lines, assuming no sharp decrease in public-sector employment, will likely underline expectations of Federal Reserve tapering getting underway by year end.

There is a limited schedule of policymakers expected Wednesday. Atlanta Fed's Raphael Bostic is due to speak. In the UK, Prime Minister Boris Johnson is expected to lay out the governing party's outlook for the economy post-Covid and post-Brexit.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.