-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI GLOBAL MORNING BRIEFING: UK Jobs, Wages To Feature

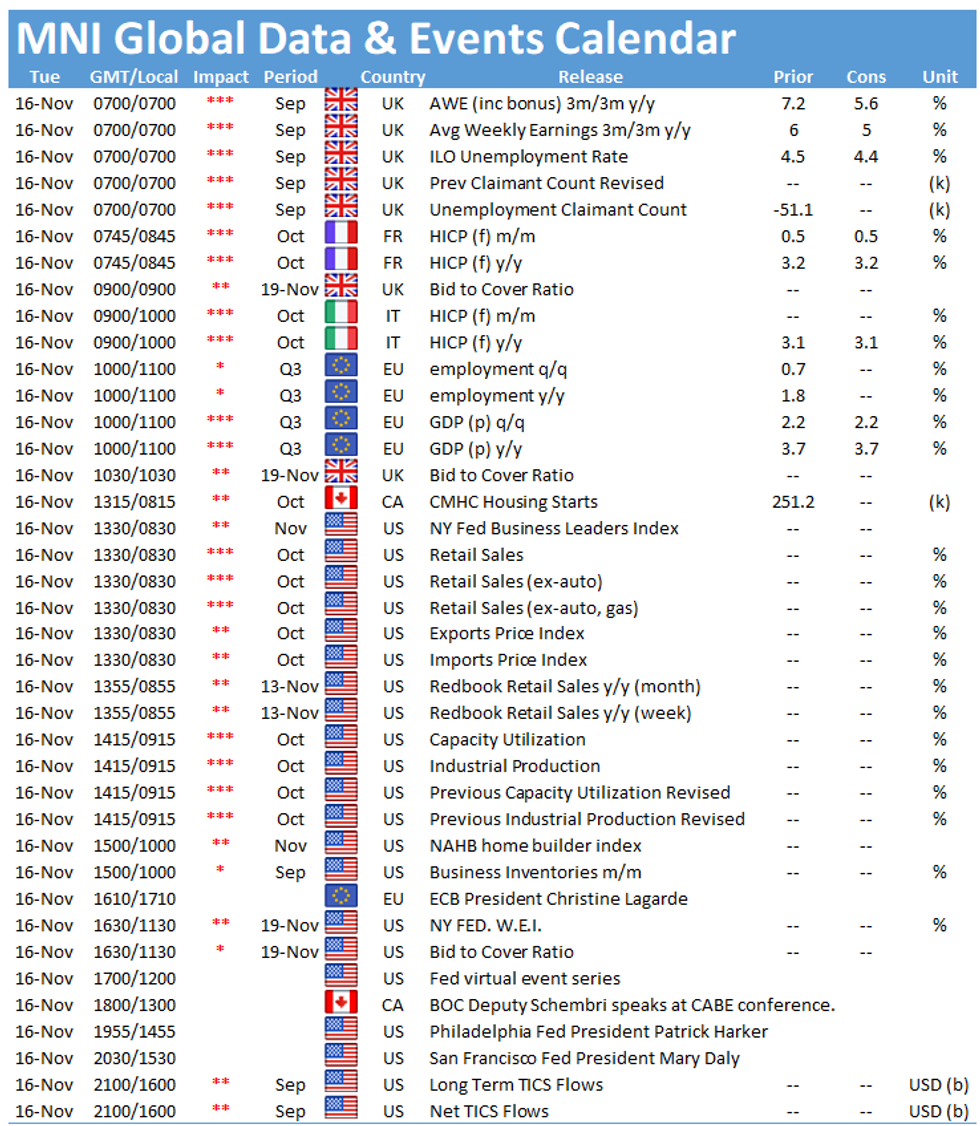

Tuesday throws up a full calendar of data for markets to digest, with the UK labour survey the early highlight.

UK Q3 Wage Growth Seen Slowing Despite Hot Market

Wage growth likely slowed markedly in the third quarter, even as robust employment gains pushed the jobless rate lower, according to economist forecasts. Average weekly earnings decelerated to a 5.6% annual rate in September from 7.2% previously, according to forecasts, continuing the descent from the record-high 8.8% recorded in Q2. Excluding bonuses, regular wage growth is expected to fall to 5.0% from 6.0% in the previous period and a series-high of 7.3% In the three months to August, economists at the Office for National Statistics estimated underlying regular wage growth to sit some 1.2 to 2.7 percentage points below the headline rate, implying, if replicated, underlying third quarter growth at an annual rate of between 2.3% and 3.8%.

The slowdown could bring some relief to Bank of England rate setters, a number of whom have suggested that wage growth and the state of the labour market after the expiry of the government furlough scheme at the end of September could determine the timing of a hike in the Bank Rate, a point restated by Governor Andrew Bailey Monday.

City forecasters predict that employment rose by 188,000 in the third quarter, below the near-six-year high increase of 235,000 posted in the three months to August. Economists will also keep a close eye on the vacancy rate, which rose by 239,000 through Q3 to a record-high of 1.102 million.

Eurozone GDP stable in third quarter (1000GMT)

Consensus forecasts see Eurozone GDP stable in the third quarter of 2021, with q/q readings set to come in at 2.2%, up from 2.1% in Q2. Annual GDP is predicted to come in at 3.7%.

According to Eurostat, Austria recorded the highest Q3 growth of 3.3%, followed by France and Portugal coming in at 3.0% and 2.9% respectively, largely due to solid bouncebacks in household spending as the economy reopened through the summer. Germany continues to lag due to supply shortages persistently impeding domestic manufacturing.

With the ECB set to wind down its pandemic emergency purchase programme (PEPP), growth outlooks for the final quarter of the year are more ambiguous, mainly owing to enduring shortages, high oil prices and the current surge in COVID-19 cases inducing talk of partial lockdown reintroductions across parts of the Eurozone.

US retail sales confirm continued growth (1330GMT)

Fed officials will be closely watching for signs of consumer activity as US monthly retail sales data cross the wires, as they look for any clues that higher prices are either keeping activity subdued or bring spending forward.. Sales are predicted to increase to 1.3% on the headline number in October, accelerating from 0.7% in September. Analysts forecast monthly retail sales ex automobiles to come in at 1.0% in October, displaying slight growth from September's reading of 0.8%.

Overall growth in US retail is largely attributable to heightened inflation expectations and a turnaround in sales of new vehicles, rising for the first time since April. Retail ex automobiles and gas is expected to remain stable at 0.7% for October.

Coming months could see upside surprises with the Christmas shopping rush likely to begin earlier to cushion expected supply shortages.

There are limited central bank policymakers slated to speak Tuesday, but ECB President Christine Lagarde, and regional Fed presidents Mary Daly and Tom Harker are all set to speak.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.