-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: EZ Inflation Seen Lower

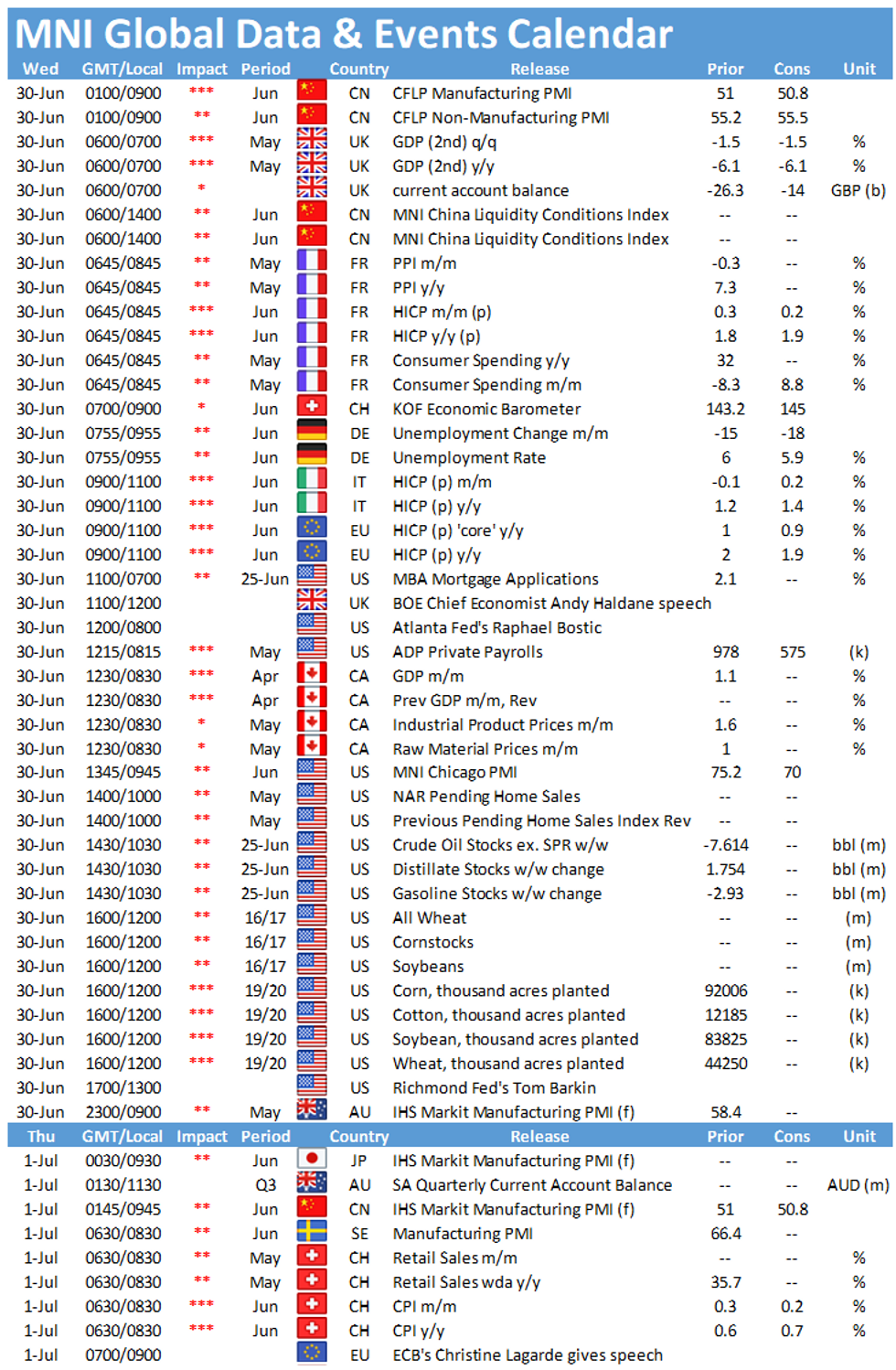

Wednesday kicks off with the publication of the final UK Q1 GDP at 0700BST. At 1000BST the release of EZ flash inflation figures will be closely watched before the focus turns to the publication of the Chicago Business Barometer at 1445BST.

UK final GDP seen at flash estimate

The final print of UK Q1 GDP is expected to register in line with the flash results showing a quarterly decline of 1.5% as the renewed lockdown restricted business activity throughout the quarter. Annual GDP improved to -6.1% in Q1, after falling by 7.3% in Q4 2020 and growth remains 8.7% below the level seen before the pandemic in Q4 2019. While government consumption (+2.6%) and trade contributed positively to GDP, household expenditure (-3.9%) and business investment (-11.9%) fell in Q1. The first quarter saw production and service output decline, while construction output ticked up. School closures and a sharp fall in retail sales were the main driver of the decrease in services output.

Looking ahead, Q2 GDP should rise sharply as the economy was gradually reopening over the second quarter and was outpacing forecasts in many areas. According to their May report, the BOE projects the UK GDP to grow by 4.25% in Q2, which leaves GDP still 5% below the pre-pandemic level.

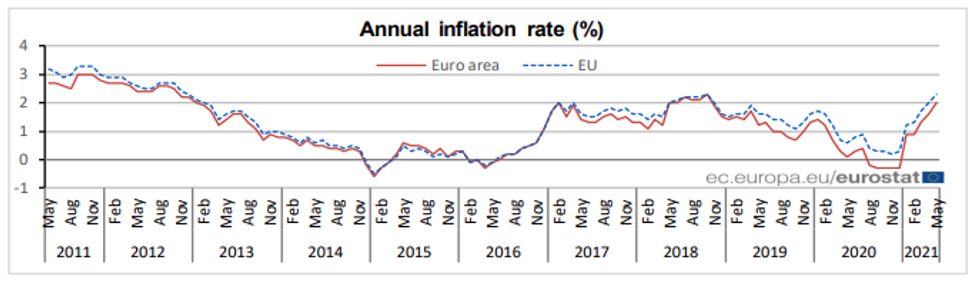

EZ inflation projected to edge lower

The headline EZ HICP is expected to ease slightly in June to 1.9% after rising sharply in the previous months. Energy inflation is likely to decelerate as well, as base effects have a smaller impact on price growth.

While energy price base effects weaken, inflation is likely to be pushed higher in the coming months by base effects resulting from the German VAT cut, which was introduced in July 2020 and was reversed in January 2021. Moreover, higher costs for raw materials and intermediate goods are likely to be passed on to consumers soon, providing an upward pressure to inflation. Survey evidence suggests that output price inflation is rising in addition to input price inflation, as firms pass on the higher costs. Additionally, service inflation is likely to rise on the back of sectors such as tourism and transport, as economies are easing more restrictions and international travel gains momentum.

Source: Eurostat

Chicago Business Barometer expected to tick down

The Chicago Business Barometer rose markedly in May, jumping to the highest level since November 1973 at 75.2. The uptick was broad-based with every main category except for Employment posting a monthly gain. Firms noted another lengthening of lead times in May as supply chain disruptions persisted. In June, markets are looking for a small downtick of the headline index to 70.0. Similar survey evidence is in line with market forecasts. The Dallas Fed manufacturing index dropped 3.8pt in June, while the Empire State manufacturing index eased 6.9pt.

The main events to follow on Wednesday include speeches by BOE's Andy Haldane -- his last as Chief Economist, Atlanta Fed's Raphael Bostic and Richmond Fed's Tom Barkin.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.