-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: Focus on BOE

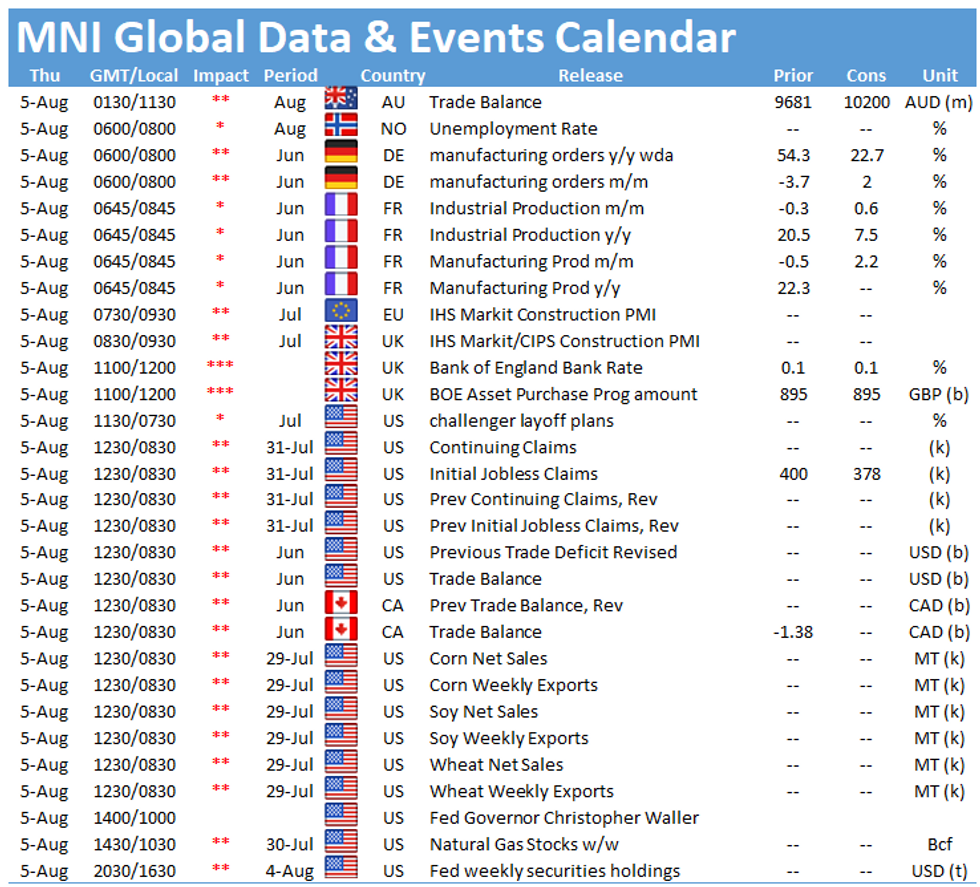

The main events Thursday include French industrial production figures, released at 0745BST. At 1200BST the announcement of the BOE's interest rate decision will be closely watched, while in the US the release of initial jobless claims at 1330BST is the highlight of the day in terms of data publications.

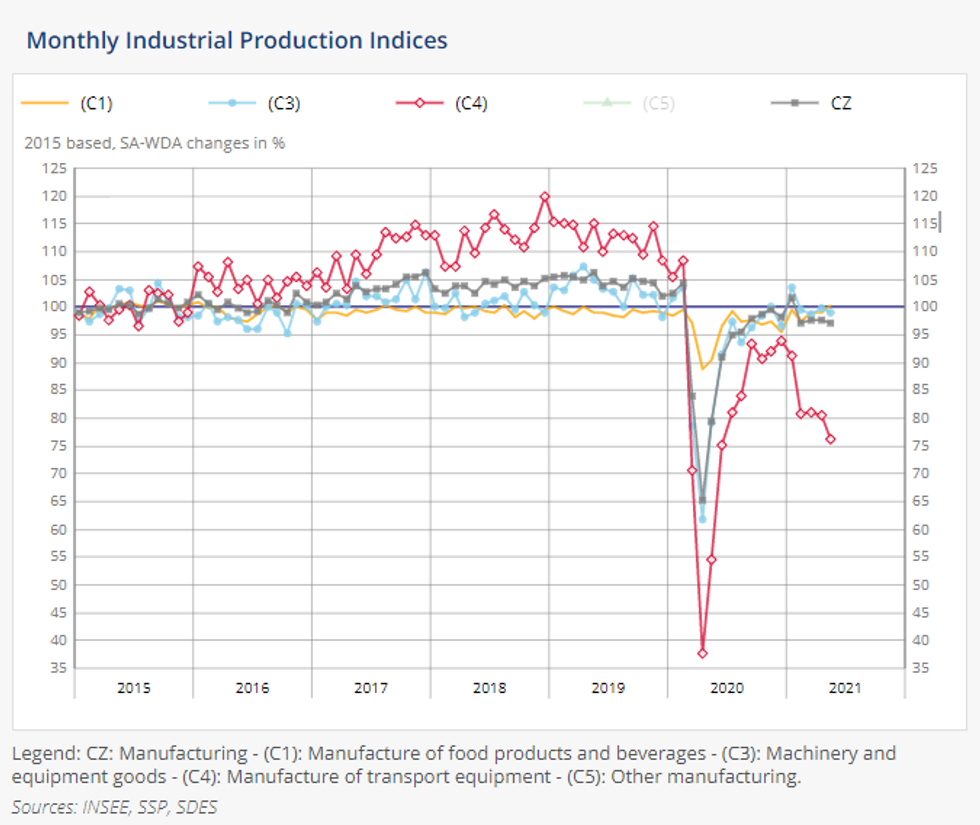

French industrial output forecast to rebound

Industrial production declined by 0.3% in May, following two consecutive months of gains. May's industrial output was still 5.6% lower than in February 2020 before the pandemic. A sharp drop of manufacturing of transport equipment was the main driver for May's decline. In June, markets expect the monthly index to rebound to 0.6%, while the annual rate is seen at 7.5%.

Survey evidence continues to signal expansion in the manufacturing sector in July, although at a slower pace as the manufacturing PMI eased slightly in July. On the other hand, Insee's business climate indicator for the manufacturing sector rose further in July to the highest level since April 2018.

Source: INSEE

BOE policy decision likely unchanged

The Bank of England's August policy decision can certainly be viewed as 'live', although likely to end with policy unchanged. However, despite recent dissenter Andy Haldane now departed, there is a better than even chance that two current MPC members - Deputy Governor Dave Ramsden and external member Michael Saunders - could vote for an early end to the current QE program, presently set to end in November.

However, outgoing MPC member Gertjan Vlieghe and Deputy Governor Ben Broadbent, often seen as the fulcrum for the Bank's internal view, have pushed back against early tightening talk in recent days and it seems likely that the MPC will vote to maintain rates at 0.1% and to continue the current QE program that will take the combined stock to GBP 895 billion by year end.

Many Bank watchers will be eyeing statements from Threadneedle Street for any signs of progress on the future tightening possibilities, particularly the sequencing of rates and bond sales.

US jobless claims forecast to tick down

U.S. jobless claims data filed through July 31 are expected to slow to 378,000, down 22k from a week earlier to a new pandemic low. Continuing claims should also drop to 3.260 million from 3.269 million a week earlier. Many states have already opted out of enhanced federal UI benefits, which is likely to result in slowing numbers for jobless claims going forward.

The only event scheduled on Thursday is Fed's Christopher Waller participating in a virtual event.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.