-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI FOMC Hawk-Dove Spectrum

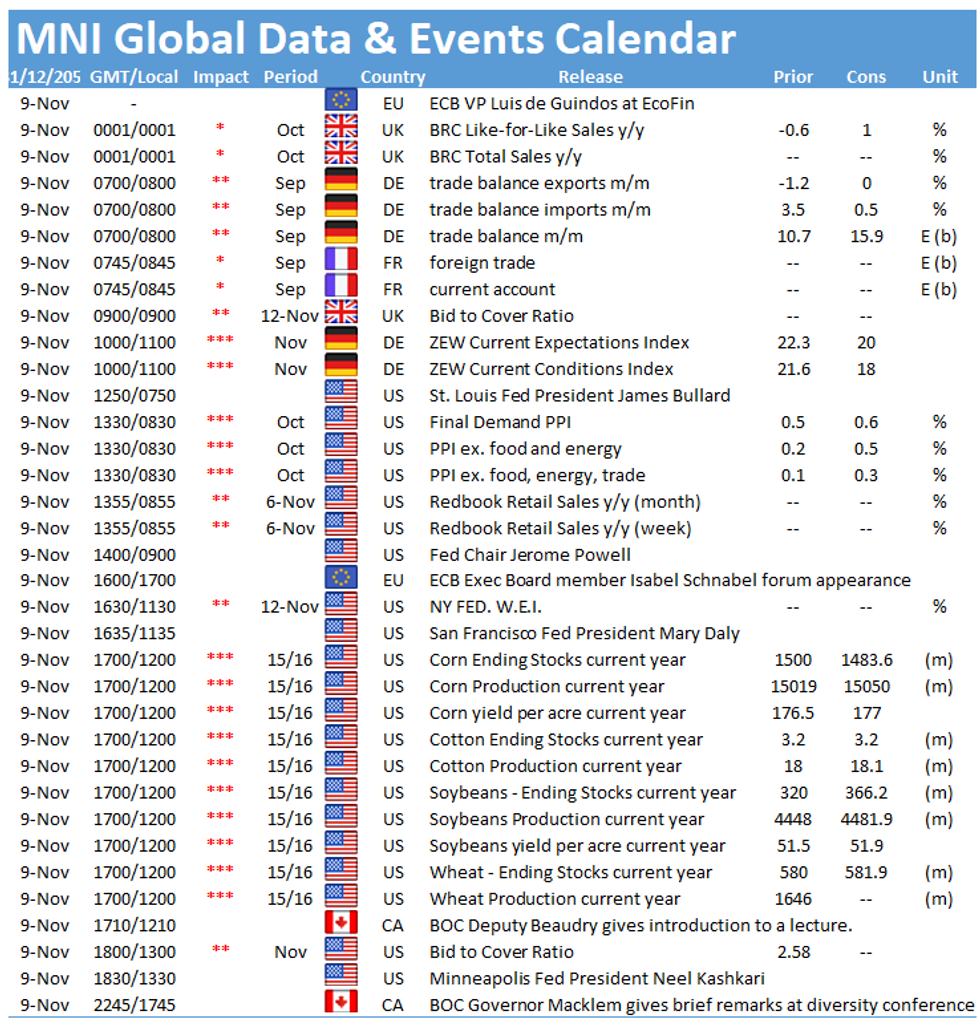

MNI GLOBAL MORNING BRIEFING: November 9

US factory gate inflation and German financial experts outlook for the economy will be the stand out features Tuesday.

German ZEW survey seen slowing (1000GMT)

The ZEW Expectations index is set to slip again in November, likely falling to the lowest level since the start of the global pandemic, as rising infections rates and continued supply chain issues weigh on the outlook. The index fell 4.3 to an 18-month low of 22.3 in October and analysts are looking to a decline to 20.0 this month. To underline how expectations have declined in recent month, the expectation index hit a 21-year high of 84.4 as recently as May.

Current conditions are also expected to decline to 18,0, extending September's decline that saw the index fall 10.3 points to 21.6.

US PPI Inflation to continue rising (1330GMT)

US PPI inflation expectations are again geared towards increases, which will come as no surprise to markets or Fed officials, already tapering additional stimulus, now looking at inflation being 'less transitory' than previously assumed.

The monthly rate of US headline final demand PPI is expected to rise 0.6% in October, accelerating modestly from the 0.5% rise seen in Septembein September. Similarly, the core monthly rate is forecasted to increase, to 0.5% in October from 0.2% in September. The core PPI excluding Trade is expected to follow suit, coming in at 0.3% in October, up from 0.1% in September.

Analysts expect both the annual rate of PPI for final demand and core PPI are expected to remain stable at 8.6% and 6.8% respectively, although there is a chance of upside surprises given the consistently high readings in price components of recent business surveys.

US Final Demand PPI (Annual %)

Source: US Bureau of Labor Statistics

Amongst policymakers expected to speak Tuesday are ECB Executive Board member Isabel Schnabel, St Louis Fed President James Bullard and Bank of Canada Governor Tiff Macklem.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.