-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI Global Morning Briefing: UK GDP, German Inflation in Focus

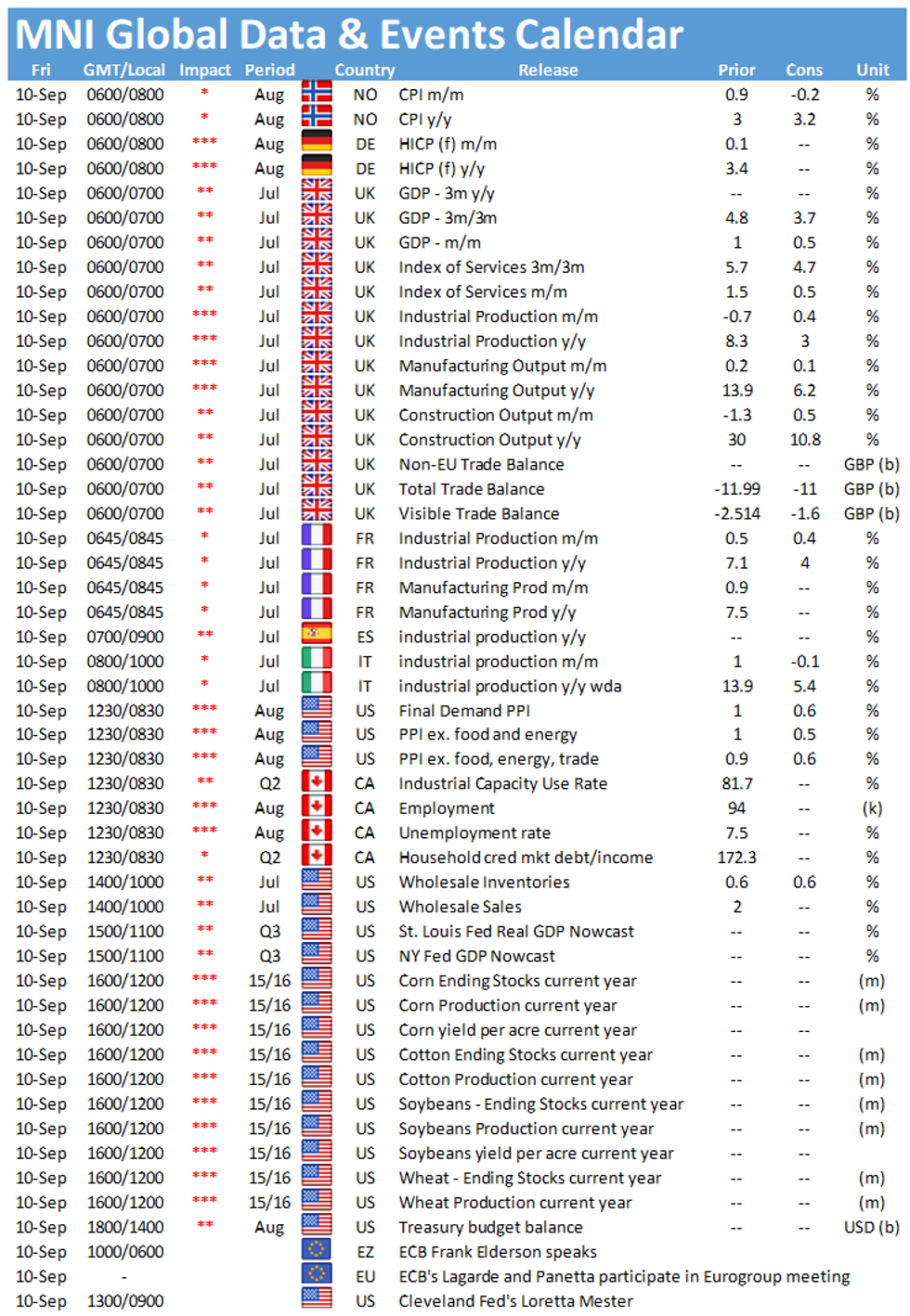

There is plenty of data Friday to keep most ardent number watchers engaged, with the UK monthly short-term indicators the early highlight.

July GDP to Slow Markedly (0700BST)

The economic recovery slowed significantly in July, according to City analysts, with economists predicting a rise of just 0.5% after a 1.0% gain in June. Bank of England Governor Andrew Bailey noted "some flattening out of the rate of recovery" in testimony before the Treasury Select Committee on Wednesday. The so-called ping-demic -- which required some 600,000 people to self-isolate at mid month -- kept workers at home and forced many businesses to reduce opening hours during the month. Supermarket chain Iceland estimated that some 3% of employees were off work during parts of July.

The consensus forecast reflects a 0.6% jump in service sector output, extending a 1.5% gain in June. A big jump in healthcare as GPs resumed to more usual offerings after pandemic-related emergency measures earlier in the year account for approximately half of the gain in June services and could be extended into July. However wholesale and retail trading could exert a drag on the sector, as retail sales slumped by a higher-than-expected 2.5% between June and July. The services Purchasing Management Index declined to 59.6 in July from 62.4 the previous month.

Manufacturing output likely rose by 0.1% in July, stretching a 0.2% gain in the previous month. Automobile production (which accounts for 9% of total manufacturing and just under 1% of GDP) declined by 6% in July, according to the SMMT, after a a 26% jump in June. The manufacturing PMI compiled by IHS Markit decline to 60.4 from 63.9 in June. Analysts' forecast of a 10.9% monthly increase in construction could prove to be optimistic, given widespread reports of a shortage of raw material supplies and a lack of availability of sub-contractors. The Markit PMI slumped to 58.7% in July from a 24-year-high of 55.3 in June.

German Inflation Higher (0700GMT)

With just over a fortnight to the German elections, rising costs are bound to be a doorstep issue for many voters. Friday sees the release of the last inflation report before the polls open and they will likely confirm that the headline domestic CPI rate is at 3.9%, the highest since the post-reunification recovery in 1993. Harmonised CPI will likley be unrevised from the 3.4% y/y flash estimate, the highest reading in 13 years.

Other data in Europe Friday includes both French and Italian industrial production data, due at 0745BST and 0900BST respectively.

US factory gate prices seen higher (1330BST)

In the U.S. PPI data at 1330BST will be closely watched for any signs that factory gate inflation is starting to moderate. Year-on-year, August final demand PPI is seen rising to 8.2% from 7.8% in the previous month. Month-on-month, prices are seen higher by 0.6%, decelerating from the 1.0% gains seen in July.

Among policymaker appearances Friday, ECB President Christine Lagarde and VP Luis de Guindos will brief the Eurogroup meeting, ECB Executive Board member Frank Elderson speaks and Cleveland Fed President Loretta Mester is due to address a conference.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.