-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY248 Bln via OMO Tuesday

MNI Eurozone Inflation Insight – November 2024

MNI Global Morning Briefing: UK Public Finances In Focus

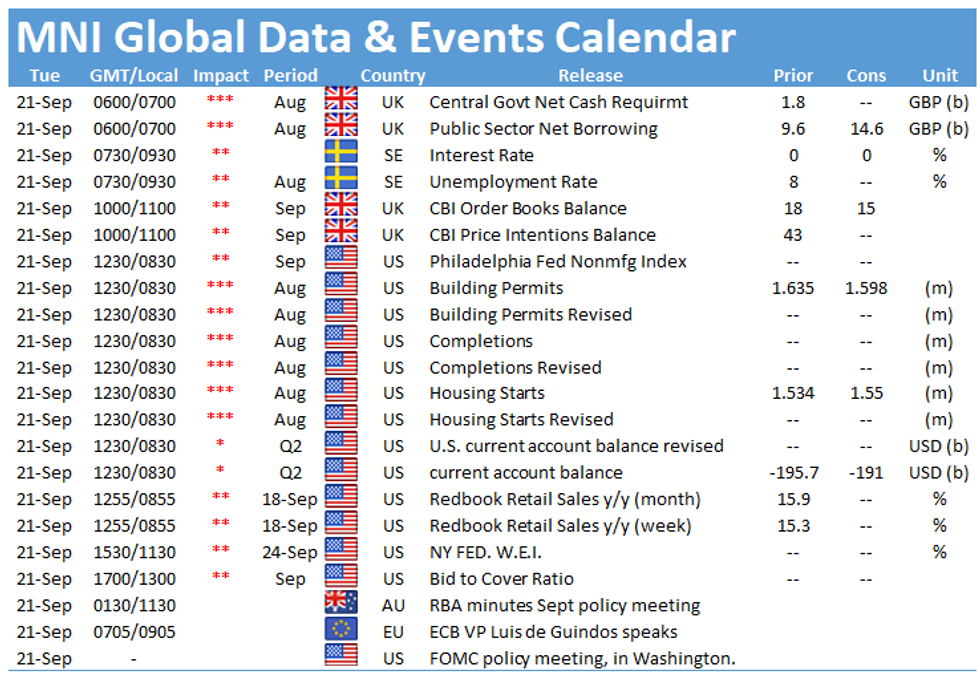

Tuesday throws up a full data calendar, with UK public finance data first up. Also in the UK, the CBI Industrial Trends data will be published. Ahead of that. Sweden's Riksbank will release its latest policy decision.

UK Borrowing Seen Up Markedly in August (0700 BST)

The public sector finances took a turn for the worse last month, with analysts' forecasting an increase in borrowing to GBP15.6 billion.

Borrowing fell to GBP10.353 billion in July, the lowest month since the start of the pandemic save January, when borrowing was dampened by the payment of self-assessment taxes. July is likely to be revised lower, in line with later iterations of borrowing data in every month since the onset of Covid.

Debt interest is likely to rise from the GBP3.4 billion paid out in July, with the increase in RPI between May and June (the reference period for setting August interest payments) rising to 0.6 percentage points, up from 0.4 percentage points between April and May. However payments will remain significantly below the GBP8.7 billion in June (when RPI rose by 1.4 percentage points over the March-to-April reference period).

VAT receipts, which increased by an annual rate of 10.8% in July, were likely dampened by the relaxation on taxes on restaurant meals during the Eat Out to Help Out scheme that ran through August. Even after the July increase, VAT receipts remained 6.5% below pre-Covid levels.

Borrowing will also be lifted by another GBP800 million instalment payment to the European Union, following similar disbursements in June and July. The Exchequer will be issued with a new divorce bill this month.

Riksbank on Hold (0900 BST)

Sweden's Riksbank will likely raise much of its inflation projection through to next summer in its monetary policy report on Tuesday, due to base effects as the pandemic crisis eases, but could wait to get a better fix on whether price rises prove sticky before adjusting a projection for rates to stay unchanged at zero for the full three-year horizon.

The Riksbank could also provide some form of guidance to suggest that a change to the rates projection may soon be forthcoming, and some analysts expect this to occur in the November meeting, with an indication of a move from zero at the end of the three-year period. But some members of the central bank's board have argued that there is no rush to tighten after a prolonged period of inflation undershooting and the economic shock of Covid.

US homebuilding pace quickens (1330 BST)

The pace of homebuilding quickened in August despite severe storms and flooding in major metro areas like New York and Philadelphia. Housing starts reached a seasonally adjusted annual rate of 1.550 million through the month, according to Bloomberg, slightly higher than July's 1.534 million-unit pace.

Building permits are expected to dip, with Bloomberg forecasting a slight slowdown to a SAAR of 1.598 million from 1.635 million in July.

Policymakers speaking include ECB VP Luis de Guindos, while the Fed gather for the first day of the two day policy meeting.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.