-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI Global Morning Briefing: US Jobless Claims Seen Lower

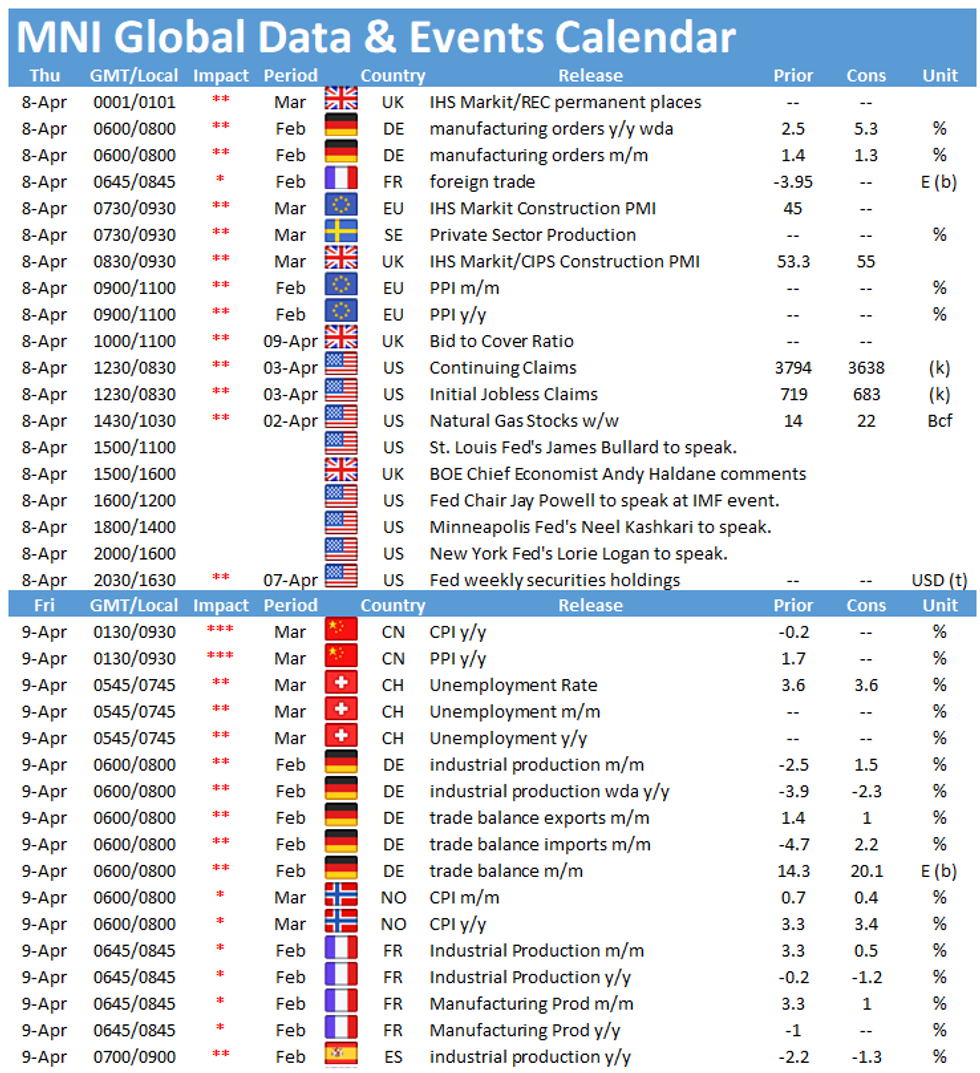

Thursday starts with German factory orders at 0700BST, followed by the EZ producer price inflation data at 1000BST. In the US, the publication of initial jobless claims will again be closely watched at 1330BST.

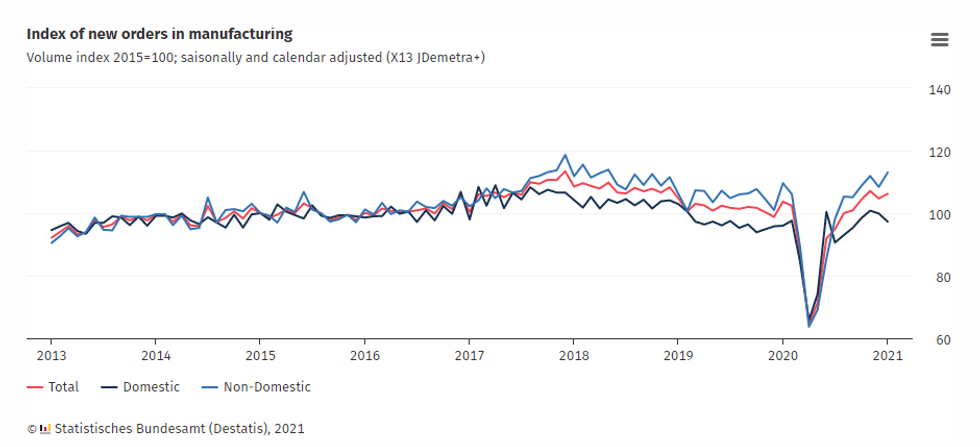

German factory orders seen rising further

German industrial orders are expected to post another increase in February by 1.3% after rising by 1.4% in January. January's uptick was driven by an increase in foreign orders, while domestic orders declined. Overall, factory orders were 3.7% higher than before the start of the pandemic.

The manufacturing sector held up well during the crisis and survey evidence suggests that Germany is especially benefiting from exports to China and the US due to their fast recovery. Germany's manufacturing PMI rose to a record high in March and the report noted the highest increase in new orders since the survey began. Moreover, export orders surged due to new business from Asia, which bodes well with factory orders going forward.

Source: Destatis

EZ PPI expected to increase markedly

Annual EZ producer price inflation was stable in January following seventeen consecutive months of negative rates. In February, markets are looking for an increase of 1.3%, which would mark the highest level of annual PPI since May 2019. Monthly producer prices are projected to decelerate to 0.6% in February, after recording 1.4% in January.

Survey evidence indicates a significant increase of factory gate prices, mainly due to supply chain issues including raw material shortages and delivery delays. The EZ manufacturing PMI also noted increased purchasing activity, which puts further pressure on supply chains. The report also indicated that prices charged by EZ firms rose sharply, putting pressure on inflation.

US initial jobless claims forecast to slow

U.S. initial jobless claims filed through April 3 should fall to 683,000 from 719,000 through March 27, according to Bloomberg. Continuing claims through March 27 are expected to dip to 3.64 million after falling to 3.79 million through March 20.

Recently released payroll data indicates further improvement of the labour market. US jobs growth surged in March when employers added 916,000 jobs. Moreover, the unemployment rate eased further to 6.0%, which is the lowest level in a year.

The main speakers to follow on Thursday include BOE's Andy Haldane, St. Louis Fed's James Bullard, Fed's Jay Powell, Minneapolis Fed's Neel Kashkari and New York Fed's Lorie Logan.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.