-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI GLOBAL WEEK AHEAD: ECB to Hike & US CPI Due

The spotlight in the coming week across developed markets will be on the ECB rate decision and US CPI.

MONDAY

No data of note.

TUESDAY

UK Labour Report: The January/February UK labour report is likely to show some marginal easing of labour market pressures. Wage pressures are projected to cool slightly in January, slowing 0.2pp to +5.7% 3m/yoy for average earning and 0.1pp to +6.6% 3m/yoy ex bonuses.

This follows the December’s strongest wage growth rate on record barring the pandemic period. Wages will be closely watched by the BOE ahead of the March 23 meet, after suggesting that a continuation of domestic price and wage pressures growth would imply an active response in the Bank Rate.

Spain Final HICP: Following final German HICP data on Friday (unrevised), Spanish HICP looks to be confirmed at +1.0% m/m and +6.1% y/y, implying a 0.2pp acceleration on January headline y/y.

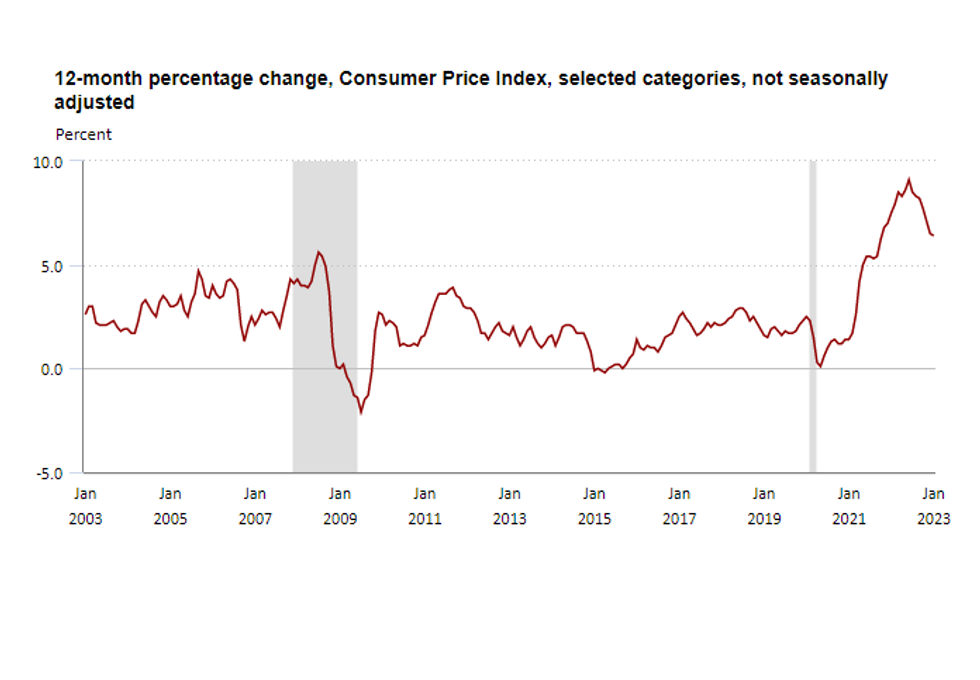

US CPI: Consensus is currently looking for a 0.4pp deceleration in US headline CPI to +6.0% y/y in February. Prices are expected to increase by +0.4% m/m, just 0.1pp below the January rate. Core CPI is projected to inch down 0.1pp to +5.5% y/y, easing for the fifth consecutive month albeit at a slow pace.

February payrolls data was a mixed, as US. employers hired significantly more workers than expected, but wage growth slowed and more workers entered the workforce. As such, a more marked upside surprise to US underlying CPI would likely be needed to increase the chance of a 50bp hike at the Fed’s March 21-22 meeting.

WEDNESDAY

Sweden CPI: Swedish inflation is expected to largely hold pace in February with headline CPI to remain at +11.7% y/y and CPIF only easing by a marginal 0.1pp to +9.2% y/y. With core CPIF expected to hold steady at an over-three decade high of +8.7% y/y, the Riksbank remains on a hawkish foot.

France Final HICP: February French HICP rose +1.0% m/m and +7.2% y/y, up 0.2pp from January.

Eurozone Industrial Production: Euro area IP could note modest January uptick, with consensus pencilling in +0.5% m/m and y/y after a contractionary end to 2023. German industrial production jumped +3.5% m/m in January, with energy-intensive production improving, bolstered by energy price caps. Meanwhile French, Spanish and Dutch data has proved contractionary, whilst Austria saw a moderate +0.5% m/m uptick.

UK Spring Budget: On Wednesday, Chancellor Hunt’ Spring Statement (shortly after 1230 GMT) will provide clarity on UK energy bill support going forward, which could have implications for the inflation path.

US PPI & Retail Sales: February retail sales are seen slowing to +0.2% m/m after +3.0% m/m in January whereby warm weather conditions boosted spending. Underlying demand conditions remain muted, with consensus looking for sales ex. auto to contract by -0.1% m/m.

Factory-gate inflation data should show a continued trend in slowing final demand PPI, with consensus looking for +0.3% m/m after +0.7% m/m in January. Despite m/m PPI remaining expansive, PMI evidence has cited cooling demand and easing supply chains are filtering into lower input costs faced by firms.

THURSDAY

Italy Final HICP: Italian HICP is seen confirmed at +0.2% m/m and a 0.8pp deceleration to +9.9% y/y.

ECB Rate Decision: The ECB has telegraphed a 50bp for the March 16 ECB meeting, and the upside surprises to February HICP and core HICP reaching a fresh high have increased the chances of another 50bp hike in May. Markets will be looking for the ECB to give another indication of the rate path going forward at Thursday’s meeting, after recent central-bank rhetoric underlined division in the Governing Council.

The ECB will also release a fresh round of macroeconomic projections. Keep an eye out for the comprehensive MNI preview next week.

FRIDAY

UK BOE Inflation Attitudes Survey: The quarterly BOE/Ipsos inflation attitudes survey will supply evidence of consumer CPI expectations, after December 12-month expectations edged down, whilst increasing for 24-month outlooks as longer-term expectations became more entrenched.

Eurozone Final HICP: Eurozone HICP surprised to the upside in the flash February data, whereby the 0.3pp acceleration in core HICP to +5.6% y/y will have strongly underlined hawkish sentiment at the ECB. In the flash data, HICP for the bloc had been stickier than expected, slowing a modest 0.1pp to +8.5% y/y. So far, German HICP was confirmed at the flash level. Larger revisions to Spanish, French and Italian final prints this week would be necessary to budge the aggregate print.

US Industrial Production & Prelim Michigan Sentiment Index: Utilities were the culprit for the overall miss in January's US IP which stalled after warm January weather saw heating demand fall. As such, the +0.5% m/m uptick pencilled in for February will likely signal more of a continuation of modest growth rather than a rebound.

The March prelim Michigan Sentiment Index is expected to hold steady at 67.0, the highest since January 2022. Consumer sentiment has been recently boosted by improvements in the short-run economic outlook. Markets will be eyeing any further upticks in inflation expectations ahead of the March Fed meeting.

US CPI - Source US BLS:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/03/2023 | - |  | EU | ECB Panetta at Eurogroup Meeting | |

| 13/03/2023 | 1230/0830 | * |  | CA | Household debt-to-disposable income |

| 13/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 13/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 13/03/2023 | 1805/1805 |  | UK | BOE Dhingra Panellist at International Women’s Day event | |

| 14/03/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 14/03/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/03/2023 | 0900/1000 | * |  | IT | Industrial Production |

| 14/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 14/03/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 14/03/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 14/03/2023 | 1230/0830 | *** |  | US | CPI |

| 14/03/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 14/03/2023 | 1400/1000 | * |  | US | Services Revenues |

| 14/03/2023 | 2120/1720 |  | US | Fed Governor Michelle Bowman | |

| 15/03/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/03/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/03/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/03/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 15/03/2023 | 0700/0800 | *** |  | SE | Inflation report |

| 15/03/2023 | 0745/0845 | *** |  | FR | HICP (f) |

| 15/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 15/03/2023 | 1000/1100 | ** |  | EU | Industrial Production |

| 15/03/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 15/03/2023 | - |  | UK | Chancellor Delivers Spring Budget, OBR Forecasts, Likely DMO Remit | |

| 15/03/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 15/03/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 15/03/2023 | 1230/0830 | *** |  | US | PPI |

| 15/03/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/03/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/03/2023 | 1400/1000 | * |  | US | Business Inventories |

| 15/03/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/03/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 15/03/2023 | 2000/1600 | ** |  | US | TICS |

| 16/03/2023 | 0030/1130 | *** |  | AU | Labor force survey |

| 16/03/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 16/03/2023 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 16/03/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 16/03/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 16/03/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 16/03/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 16/03/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 16/03/2023 | 1245/1345 | *** |  | EU | ECB Deposit Rate |

| 16/03/2023 | 1245/1345 | *** |  | EU | ECB Main Refi Rate |

| 16/03/2023 | 1245/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 16/03/2023 | 1345/1445 |  | EU | ECB Press Conference Following Rate Decision | |

| 16/03/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 17/03/2023 | 0700/0800 | ** |  | SE | Unemployment |

| 17/03/2023 | 0930/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 17/03/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 17/03/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 17/03/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 17/03/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.