-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

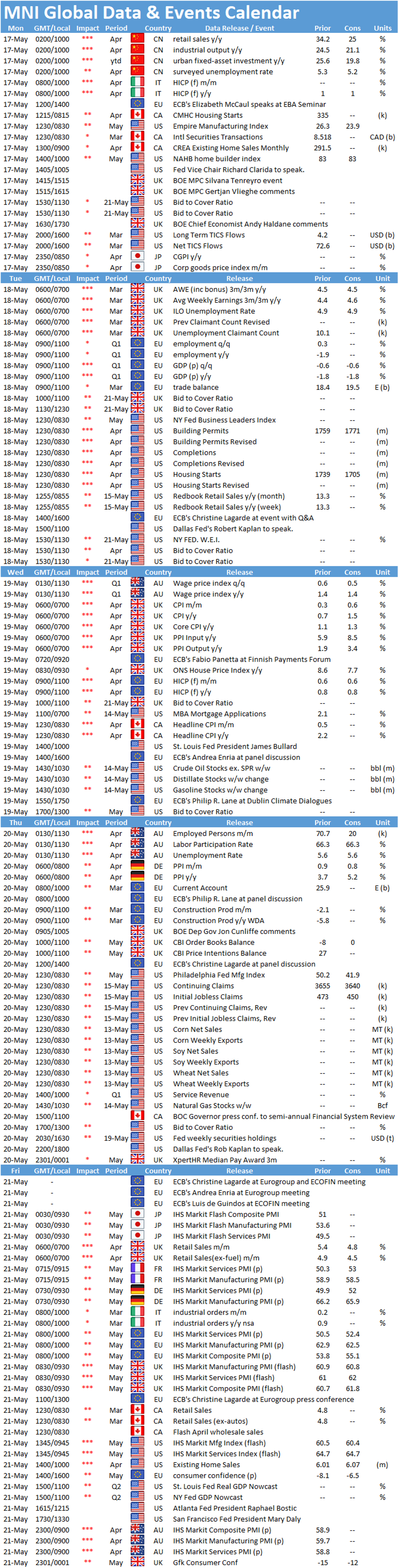

MNI Global Week Ahead May 17 - 21

Key Things to Watch:

- Wednesday, May 19 – UK Inflation

- UK headline inflation likely jumped in April, pushed higher by a rise in domestic energy costs as price caps were raised along with strong upward pressure from base effects as year ago weak numbers drop out. The headline CPI is expected to rise sharply, hitting 1.4% y/y after 0.7% in March.

- Although a doubling in the headline number, CPI is set to remain below the Bank of England's 2% target for a 22nd consecutive month.

- Core inflation is also expected to edge higher, albeit at a slower pace without the energy price increase impact

- Wednesday, May 19 – Canada CPI

- It's Canada's turn to report breakaway inflation on comparisons to last year's plunge in gasoline prices. Companies in April also faced production bottlenecks and households went into a more severe third-wave lockdown than the U.S. or UK.

- The CPI accelerated to a 3.1% pace in April from a year earlier according to Montreal-based National Bank Financial. Inflation hasn't been 3% since July 2018 and hasn't exceeded that mark since 3.2% in September 2011.

- BOC Governor Tiff Macklem told reporters Thursday he's sticking with his forecast inflation will soon reach around 3% and later recede because some parts of the economy remain very weak. Inflation already jumped to 2.2% in March from 1.1% in February.

- Thursday, May 20 – U.S. Weekly Jobless Claims

- Claims filed through May 15 are set to dip to 450,000 from 473,000 through May 8, a pandemic low. Initial claims have been trending downward in recent weeks as the labor market gradually improves.

- Continuing claims through May 8 should fall to 3.64 million, according to Bloomberg, following the previous week's 3.65 million.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.