-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI INTERVIEW: Easing Price Expectations Little Comfort-UMich

Consumer expectations for inflation have shown tentative signs they may turned down but the easing provides little comfort since the moves are from volatile energy prices, the head of the University of Michigan's Survey of Consumers told MNI.

The University of Michigan survey's inflation expectation measures declined in the preliminary September report with the median expected year-ahead inflation rate moving down to 4.6%, the lowest reading since last September, and the median long run inflation expectation rate easing to 2.8%, the first time since July 2021 below the 2.9%-3.1% range.

"If today's state of the world continues this could very well be sustained but if the war in Ukraine causes gas prices to increase then this could change on a dime again," said Joanne Hsu in an interview. "If we had five more months like August then I would expect them to keep going down but we can't know for sure."

Hsu emphasized that the movements "are not large" and added that the downward movement in median five-year-ahead inflation expectations is "typical wiggle." Hsu said she is "pushing back on the idea that they are rolling over," adding "there is so much uncertainty."

It is "too early to tell" whether it has peaked, she said.

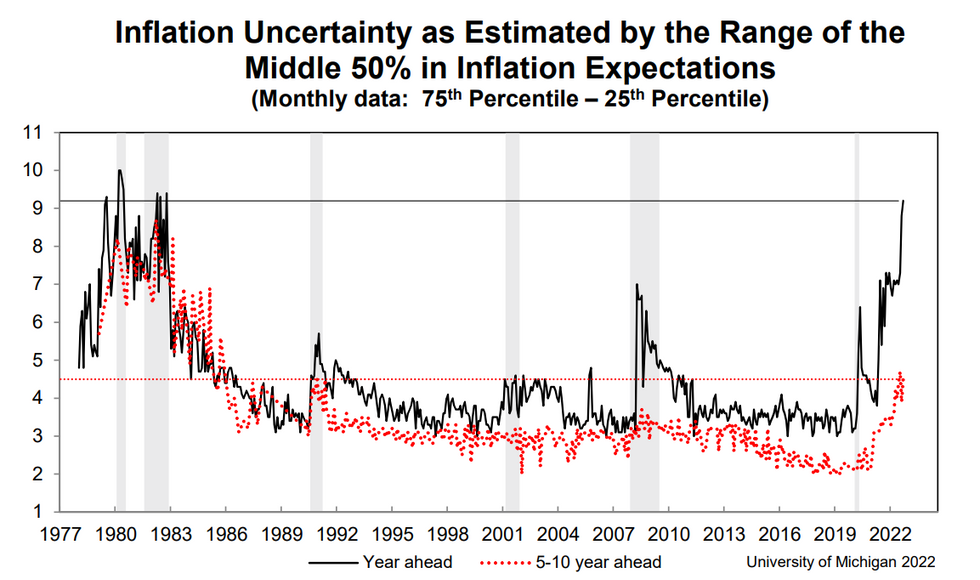

INTERQUARTILE RANGE

But Hsu suggested the downward movement in median long run inflation expectations could be more than just drops in the bottom of the distribution of respondents. "We are seeing reductions in the 25th and 75th percentiles," said Hsu, a former principal economist at the Fed board's division of research and statistics.

"Incorporating that gas prices have come down but core inflation is holding steady, there are conflicting signals," she added. "Consumers remain very uncertain particularly about the trajectory of inflation."

Both headline and core CPI accelerated in August as food prices surged and owners' equivalent rent notched its largest increase since 1986, giving the Federal Reserve no reason to dial back the pace of interest rate hikes. A third straight 75-basis-point rate increase next week is expected take the fed funds rate to a 3%-3.25% target range for the first time since 2008. (See: MNI: Fed Sept Projections To Show Higher Rate, Inflation Peaks)

High inflation remains a major reason Americans feel much worse about the economy than they even did at the start of the pandemic.

"Respondents are not changing how they feel about inflation. They continue to speak spontaneously about how inflation is eroding their living standards," the Michigan survey chief said.

And while consumers continue to have little faith in the government to tackle lingering price pressures, in September respondents showed a little more confidence. "There is a slight increase in those that think that the government is doing a good job, with 17% in August and then 21% now."

Consumer sentiment was essentially unchanged in September, just 1.3 index points above August. The one-year economic outlook continued lifting from the extremely low readings earlier in the summer.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.