-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Trudeau To Keep Working As Opposition Seeks Ouster

MNI INTERVIEW: Fed Caution Warranted As Price Views Soar-UMich

The Federal Reserve should take a cautious stance regarding its progress in tamping down price pressures as one-year-ahead inflation expectations surged to the highest level since May, helping to fuel a significant decline in sentiment, the head of the University of Michigan's Survey of Consumers told MNI.

"Although inflation is slowing, people's concerns about inflation continued to rise," said survey director Joanne Hsu in an interview Friday.

"The fact that long term inflation expectations have been between 2.9 and 3.1 for over two years now should tell the Fed that the inflation battle has not necessarily been wrapped up but nobody needs to panic from this jump in one year expectations." (See MNI INTERVIEW: Disinflation Stall Could Force Fed To 6% Or More)

The University of Michigan survey's reading of one-year inflation expectations surged to 4.2% in October's final reading, up from 3.2% the prior month and the highest since May. The measure of five-year inflation expectations was up two tenths at 3.0%.

"The Fed should move forward with caution," Hsu said. "It's not really clear to me that what we saw this month is related to factors that are necessarily enduring." (See: MNI INTERVIEW: Blinder Sees Fed Rates At Peak For About A Year)

ACROSS THE BOARD

Hsu said the rise in inflation concern was widespread, stretching across across different demographic groups.

"We're seeing increases in the shares of people who expect 5% 8% 10% 15%. All of those went up," she said. "There is definitely a notable increase in the right tail."

Consumers are increasingly both frustrated and worried about inflation, she said. "The sharper pattern I see is an increase in people mentioning food prices and gas prices, like really fundamental economic factors for consumers," said Hsu, a former principal economist at the Fed board's division of research and statistics.

"This is a continuation of a couple months of increases and gas prices are probably what is underlying it." Still, Hsu noted that responses for buying conditions for durables improved in October.

STABLE JOBS

The University of Michigan's final October reading on the overall index of consumer sentiment came in at 63.8, down 6.0% on the month and above expectations for 63.2. The perception of current conditions dipped 0.7% to 70.6 and the expected index plunged 9.9% to 59.3.

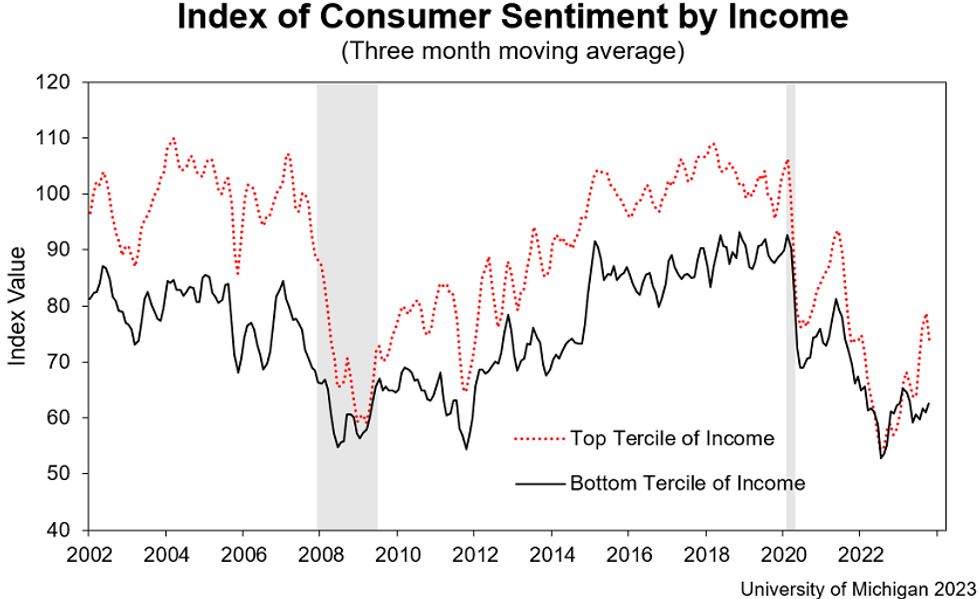

The decline was driven in large part by higher-income consumers and those with sizable stock holdings, consistent with recent weakness in equity markets, she said, and reinforced by negative events in the news such as dysfunction in Congress and conflict in the Middle East.

Hsu has not seen any comments in the survey from those toward the bottom of the income spectrum that their savings are depleted. But a small share of survey respondents who are restarting their student payments this month, "most of them tell us that they're planning on cutting back on spending, and a smaller number are saying that they're going to start borrowing more to keep up their spending."

The good news is that consumers remain optimistic about their income. "Labor market expectations, whether measured in terms of layoff probabilities, income growth, income, growth expectations, or unemployment rate expectations, all of these have been very, very stable."

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.