-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI INTERVIEW: Fed Model Predicts Dec Payrolls As High As +1M

U.S. employers may have added as many as 1 million jobs in December , according to a real time labor market index that has forecast official payrolls reports "reasonably well" over the pandemic, Federal Reserve Bank of St. Louis economist Max Dvorkin told MNI, though he cautioned that another version of the model predicts a much lower jobs gain.

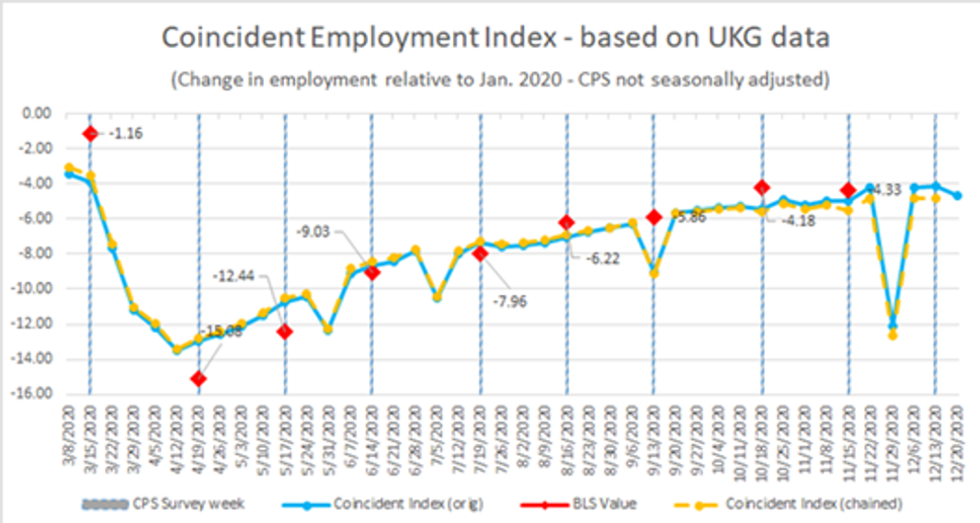

The bank's Coincident Employment Index, using weekly employment data from workplace software maker Ultimate Kronos Group, predicts 1,083,000 jobs were added last month despite restrictions to curb the record winter spike in coronavirus cases, far more than the median market estimate of just 73,000.

"This particular measure is showing very strong employment growth," Dvorkin said.

But another version of the St. Louis Fed model using daily data from time-tracker software provider Homebase is looking for a much lower 80,000 in payrolls growth.

That unusual divergence between the two models may be signaling that "medium and large firms are seeing a bit stronger job creation in the last couple of months than smaller firms," though that has yet to be substantiated by official Bureau of Labor Statistics data, he said.

Homebase users tend to be smaller firms concentrated in retail, food and accommodation services -- sectors most impacted by the pandemic. Ultimate Kronos Group's thousands of clients are more representative in terms of size and industries and its employment index has performed "a bit better" in recent months.

Source: Ultimate Kronos Group and author's calculations. Max Dvorkin - Federal Reserve Bank of St. Louis

Over the past eight months, "these two measures were more or less correct" in anticipating official jobs numbers, with the exception of August and September, when they missed, Dvorkin said. The staff continue to refine the model in an attempt to understand how the labor market is evolving.

The model estimates correspond to the BLS's Household Survey, which includes self-employed workers. The official jobs report payrolls count relies on the Establishment Survey, which does not.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.