-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI INTERVIEW: Fed's Lags To Inflation Have Shortened - KC Fed

The Federal Reserve's expanded toolkit over the years to include forward guidance and balance sheet policy means there's a shorter lag in policy transmitting to inflation, Kansas City Fed senior economist Taeyoung Doh told MNI, adding he expects a continuing deceleration in inflation.

"The peak impact on inflation is actually likely to happen right now in the first half of this year," he said, noting a significant jump in a proxy measure of the fed funds rate in the first half of last year and estimating a one-year time lag.

Still, it is likely less than half of the Fed's overall tightening has flowed into inflation so far, Doh said in an interview.

Recent research from Doh and San Francisco Fed coauthor Andrew T. Foerster suggests there may have been an acceleration in the maximum effect on inflation following the Fed's broader use of balance sheet and forward-guidance tools in 2009, reducing the time between policy moves and their peak impact from three years to as little as 12 months.

"It is not fully reflected yet," he said. "This [inflation] deceleration that we've seen recently has been driven by commodity price fluctuation and a lot of that depends on external conditions and not monetary policy conditions."

UNEMPLOYMENT UNCERTAINTY

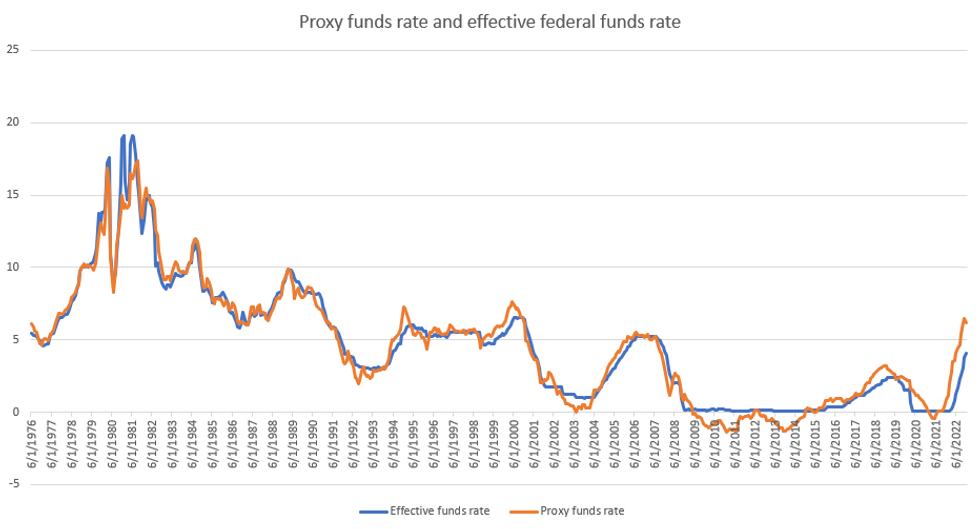

The research from Doh and Foerster uses a proxy federal funds rate that incorporates public and private borrowing rates and spreads to measure the monetary policy stance and shows that monetary policy has been substantially tighter than the federal funds rate indicates.

The proxy rate peaked in the cycle in November at 6.44% before easing to 6.16% in December, declining for the first time since May 2021, due to a slide in mortgage rates and because of a continued fall in longer-dated Treasury yields. It could dip again for the month of January despite expectations for another fed funds rate increase February 1, Doh said.

Fed officials have recently taken to citing the KC Fed research to suggest monetary policy lags could be shorter. Fed Vice Chair Lael Brainard Thursday said "it is likely that the full effect on demand, employment, and inflation of the cumulative tightening that is in the pipeline still lies ahead."

But Doh said there is no statistically significant evidence that the unemployment response to policy tightening has changed in recent years.

"That huge uncertainty is driven by the factor that in the previous tightening we had very gradual tightening but the unemployment rate didn't move up," he said. "This seemed to suggest a very muted response of unemployment today as policymakers continue to raise rates but there is great uncertainty."

So far the KC Fed economist is cautiously optimistic there's a narrow chance for a soft landing in which inflation moderates and real growth remains positive and unemployment stays low. (See: MNI INTERVIEW: Minneapolis Fed's Raffo Upbeat On Prices, Growth)

"So far I don't see any contradiction in the data flow compared to the study."

Source: San Francisco Fed

Source: San Francisco Fed

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.