-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI INTERVIEW: Labor Market Gradually Cooling - Fed's Dvorkin

The U.S. labor market shows signs of a gradual cooling as higher interest rates feed through to the economy, while a substantial moderation in wage growth over the past year also lends optimism on the fight against inflation, Federal Reserve Bank of St. Louis economist Max Dvorkin told MNI.

Ahead of the August jobs report, the St. Louis Fed's real-time labor market conditions tracker suggests employment gains moderated to a 150,000-300,000 range in the month from the 268,000 increase in July, as reported by the Labor Department's household survey, Dvorkin said. Analysts expect sustained signs of slowing in inflation and hiring to keep the central bank on the sidelines at its September meeting or longer.

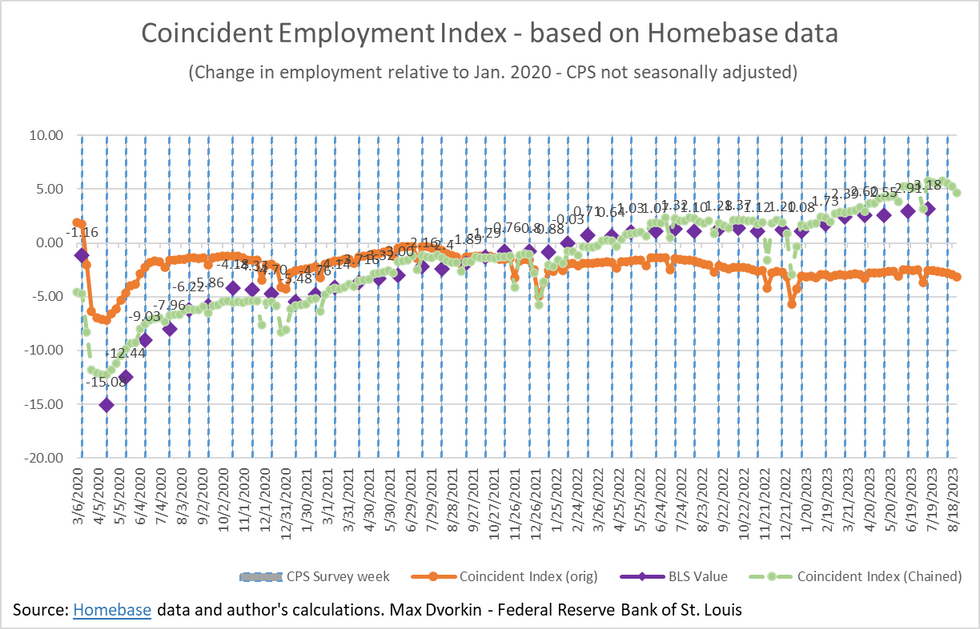

The Coincident Employment Index, which uses high frequency data from payroll and time-tracker software maker Homebase to glean information on the state of the labor market in real time, signaled continued labor market strength last month, Dvorkin said. The August average points to a seasonally adjusted gain of 300,000 employed people, but taking into account a "continued mild decline" in employment since mid-August, when the Bureau of Labor Statistics gathers its data, employment may have increased more modestly by 150,000.

"The labor market seems to be gradually cooling, likely as a result of the policies adopted by the FOMC," Dvorkin said.

70K BREAKS EVEN

The U.S. economy needs an increase in employment of around 70,000 a month to the employment-to-population ratio constant at the levels seen in recent months, Dvorkin noted. Anything above that would require increased participation in the labor force or lower unemployment, "both of which would signal a still booming labor market."

The Philadelphia Fed's quarterly Survey of Professional Forecasters, updated this month, showed private economists expected payrolls growth to slow to just above 100,000 a month by the fourth quarter from roughly 170,000 in the third quarter.

Dvorkin is uncertain we'll see those figures by year-end, though he notes the recent expansion in employment was attained on the supply side with lower unemployment and increased labor forced participation and a "rather modest impact on wages," which is good news for the inflation picture.

WAGE INFLATION

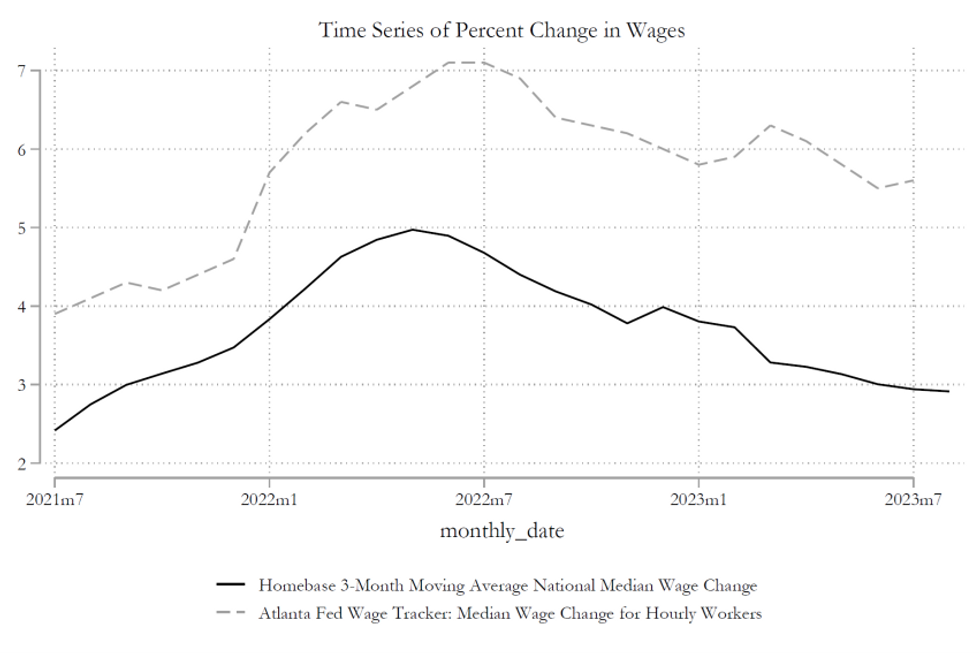

An analysis of Homebase pay data in August also shows more moderate upward pressures on wage inflation. The Coincident Wage Inflation Index for August indicates a continuation of a mild downward trend for hourly workers continuously employed in the same firm for 12 months, a trend similar to that of the Atlanta Fed's Wage Growth Tracker.

At higher frequencies, wage inflation over 4 weeks annualized also shows trimmed-mean growth of 4%, Dvorkin said.

"While the rate of increase is higher than that of the pre-pandemic years, wage inflation has moderated substantially since mid-2022, which offers a different picture of the gradual cooling of the labor market and provides a favorable sign about the future evolution of inflation," he said.

"Clearly, there are limits on how much employment can increase without extra pressure on wages, and that is why a cooling of the labor market is important."

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.