-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

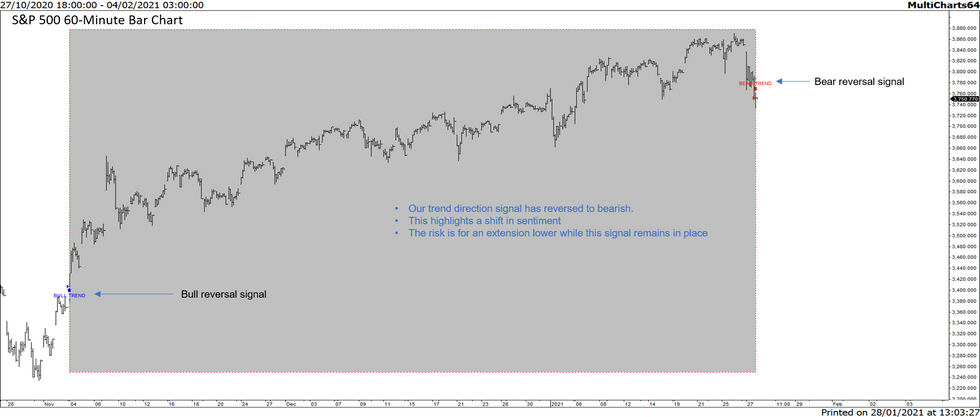

MNI MARKETS ANALYSIS: E-Mini S&P Reversal Threat?

A sharp sell-off in the E-mini S&P yesterday highlights the first significant threat to the bullish cycle that has been in place since early November. The key technical developments that warn of a top are:

- A clear breach of the 20-day EMA yesterday at 3706.50. The close below this average reinforces the short-term significance of the break.

- Support at 3740.50, Jan 19 low has also been breached.

- This leaves the 50-day EMA exposed. The average intersects at 3696.02 and represents an important support area today. A break would strengthen a bearish case.

- It could be argued that yesterday's candle pattern is a bearish engulfing reversal.

Note, both the 20- and 50-day EMAs continue to highlight a broader bullish theme. This is important as levels below the 50-day EMA would represent a potential "buy-zone" - a strong area of support. Buy-zones in this instance do not refer to specific price levels. Instead they highlight a price region where demand may begin to increase. We will be on the lookout for any basing signals near-term.

An additional bearish technical feature to note is our trend direction model in the index. This tracks underlying sentiment on the 60-minute frequency and it shifted to bearish yesterday. This reverses the previous bull signal that had been in place since Nov 4 2020. The signal is important in that it highlights a new bearish risk in this market.

Support levels to watch are:

- SUP 1: 3696.02 - 50-day EAM

- SUP 2: 3562.50 - Jan 4 low

- SUP 3 3568.50 - High Sep 3, 2020 and a former breakout level.

Key resistance has been defined at 3862.25, the Jan 26 high. A break would resume the uptrend and negate any bearish risk.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.