-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: PBoC Liquidity Jitters Seen, U.S. Tsy Option Activity Noted

- Jitters surrounding a net liquidity drain from the PBoC and some questions surrounding the ultimate size of the impending U.S. fiscal support dented broader risk sentiment in Asia-Pac hours.

- This also lead to questions re: the sustainability of the recent run higher in the Hang Seng, given it's trajectory & proximity to technical resistance.

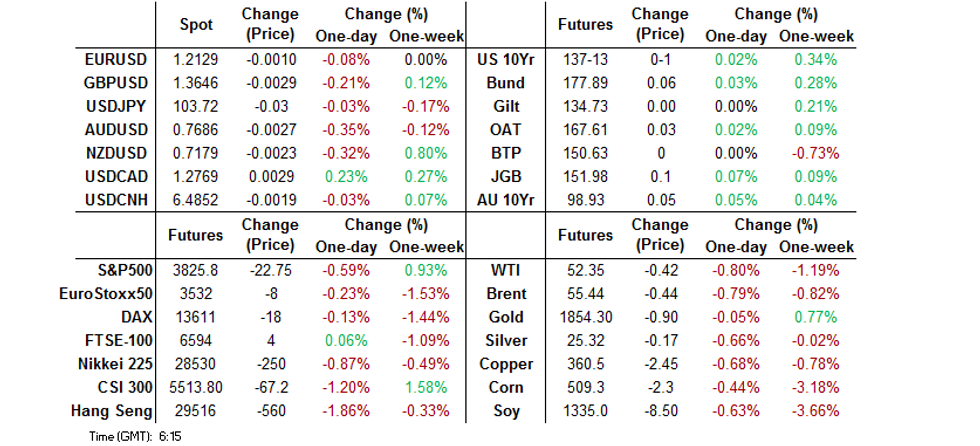

- U.S. Tsys stuck to narrow ranges, although their were several notable rounds of flow witnessed.

BOND SUMMARY: TY Options Flow Headlines A Limited Asia Session

T-Notes held to a 0-02+ range in Asia, last +0-00+ at 137-12+, with volume hampered by an Australian market holiday. Cash Tsys across the curve trade unchanged to a touch cheaper on the day, but currently sit within 0.5bp of Monday's closing levels. Still, there was plenty of interesting rounds of flow to note within the space: A 10K block of the TYJ1 138.00/133.50 risk reversals, buying the puts to sell the calls in the 4th round of 10K Asia-Pac TYJ1 risk reversal block trade in that direction over the last week or so. A 5K block of the TYH1 138.25/136.50 risk reversals (once again buying the puts to sell the calls). A 10.0K block buyer of the TYH1 138.00 calls at 0-13, which was followed up by screen lifts 5.0K of 3.0K, which paid 0-12 and 0-14 respectively, before another 10.0K block buyer paid 0-15. There was also a 5,585 block seller of TYH1 futures, as well as a 1,425 block seller of USH1 futures. 5-Year Tsy supply and consumer confidence headline the local docket on Tuesday.

- JGB futures stuck to a narrow range on Tuesday, with futures closing +10, although bulls failed to force their way through the 152.00 marker. The cash curve saw some light bull steepening, aided by the setup ahead, and realisation of, a sub-par round of 40-Year JGB issuance. The minutes from the BoJ's December meeting revealed some dialogue surrounding the future of the Bank's YCC and ETF purchase schemes, although they provided nothing in the way outright surprises, resulting in no tangible market impact (these matters will be central pillars of discussion in the Bank's monetary policy review, which is set to be released in March).

FOREX: Caution Creeps In

Light risk aversion crept in amid concerns over potential delay to the U.S. Covid-19 relief package, spread of new variants of the virus and questions surrounding the pace of vaccine rollouts. Participants shied away from the Antipodeans with regional liquidity thinned by a market holiday in Australia. New Zealand confirmed that its latest Covid-19 patient was infected with the South African strain, but stopped short of changing national alert levels. AUD/NZD was poised to extend its four-day losing streak, but struggled to move through support from the NZ$1.0700 figure/100-DMA.

- JPY & USD firmed up a tad on the back of safe haven demand. The DXY edged higher but failed to test yesterday's peak.

- The PBOC fixed USD/CNY mid-point at CNY6.4847, around 19 pips higher than sell side estimates, as demonstrating its asymmetric response to yuan strength. It also withdrew CNY 278bn of liquidity from the system, even as LNY and tax payments loom, with a PBoC advisor signalling the need to curb asset bubbles.

- EUR/USD was stable and continued to rest upon its 50-DMA. Italian PM Conte is expected to hand in resignation today, hoping to return at the helm of a new Cabinet.

- Cable slipped past yesterday's trough with markets awaiting UK gov't's decision on tighter border controls. Ministers are expected to sign off on plans to force some inbound travellers to quarantine in hotels upon arrival.

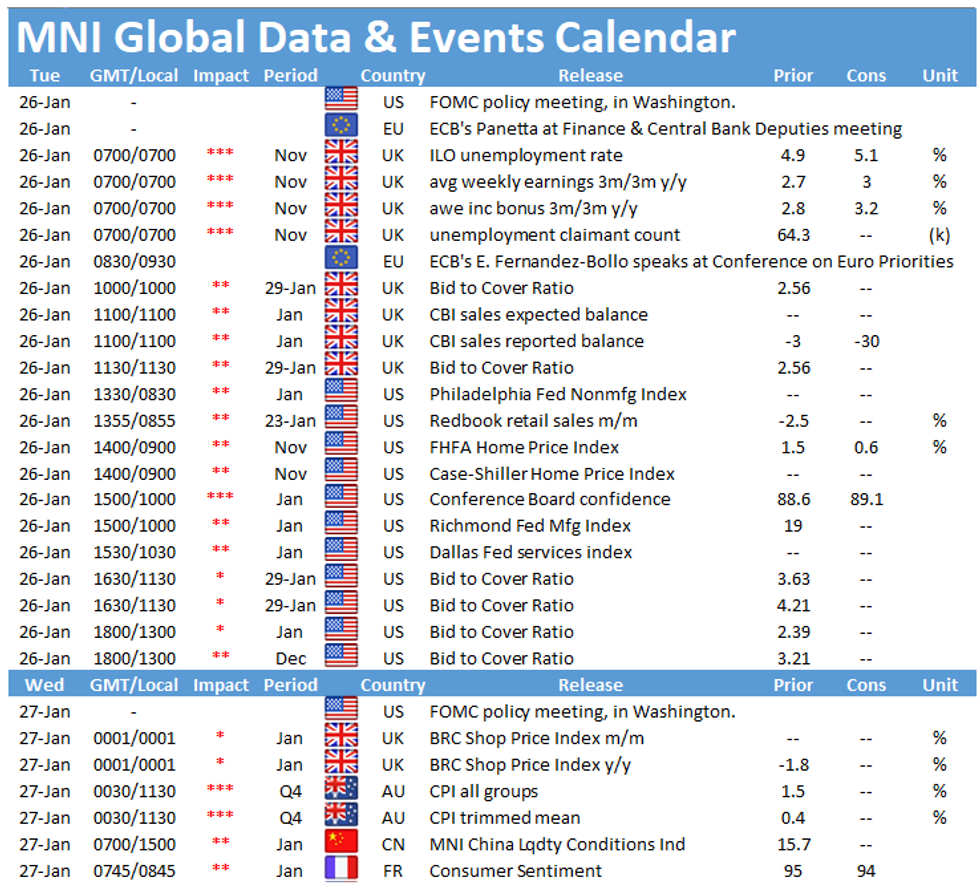

- UK labour market report, U.S. Conf. Board Consumer Confidence and comments from ECB's Centeno & de Cos will grab attention today.

FOREX OPTIONS: Expiries for Jan26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E727mln), $1.2230-50(E625mln), $1.2300(E514mln)

- USD/JPY: Y105.00($510mln)

- AUD/USD: $0.7700-15(A$873mln-AUD puts)

- USD/CNY: Cny6.4600($500mln)

ASIA FX: Mixed Session For Asia EM Amid Risk Off Flows

Asian EM FX was mixed on Tuesday but within narrow ranges, equities declined in the region as risk off sentiment took hold after indications that the US stimulus package could take several months to pass.

- CNH: Yuan gained despite a weaker fix, PBOC withdrew CNY 278bn of liquidity from the system, even as LNY and tax payments loom. Markets look for clues as to Biden's stance on China.

- SGD: Modestly higher, has been in a tight range awaiting industrial production data. USD/SGD last at 1.3273.

- TWD: USD/TWD is off session lows and back above 28.00 at 28.05, the pair closed on the level yesterday. Industrial production rose above expectations.

- HKD: USD/HKD down 5 pips at 7.7511, the Hang Seng took a beating today as Tencent saw profit taking after brushing against a $1tn valuation.

- KRW: Won is the weakest of Asia EM FX, impacted by outflows from local equities. USD/KRW last up 3.50 at 1104.10.

- IDR: Bank Indonesia stepped into spot & domestic NDF markets to shore up the rupiah as USD/IDR caught a light bid in early trade. USD/IDR last up 40 pips at 14050.

- MYR: Ringgitt slightly stronger, USD/MYR at 4.0425, Int'l Trade & Industries Min Azmin Ali downplayed calls for a nationwide "total lockdown," noting that it should be weighed against alternative scenarios.

- THB: USD/THB down 20 pips at 29.970, ANZ suggested that Thailand could be added to the U.S. Treasury's list of currency manipulators, as its FX purchases are expected to top the 2% threshold upon the release of Q4 GDP data.

EQUITIES: Red On The Screens

Asia-Pac equities pressured lower on Tuesday as risk off sentiment takes hold in the region. Investors are considering delays to the proposed stimulus package in the US which has impacted risk tone. The Hang Seng led the way lower in the region, losing around 2.4% after rallying last week. Tencent added some downward pressure on profit taking after the firm's market value rose to the cusp of $1tn for the first time yesterday. The PBOC unexpectedly withdrew CNY 278bn of liquidity from the system and a PBOC adviser said he saw a stock bubble which exacerbated downward pressure.

- US futures are lower on the prevarication over the stimulus package and as US health official expressed concern about vaccination delays. Nasdaq 100 contracts also pointed lower, several key earnings are due after-market including Microsoft, AMD and Starbucks. European futures are slightly higher, key earnings today include LVMH, Novartis and UBS.

GOLD: Within Familiar Lines

Lower U.S. real yields have competed with the uptick in the DXY over the last 24 hours, although the respective moves have edged away from extremes, with spot gold a touch higher over that timeframe, but ultimately little changed after dealing either side of where we sit now, $1,860/oz in spot trade. The technical parameters flagged in recent days remain in play.

OIL: Risk Off Pressures Oil In Asia

Oil is lower in Asia-Pac trade on Tuesday, with WTI & Brent siting $0.40 below their respective settlement levels.

- Markets adopted a broadly risk off tone in Asia as a resurgence in Covid-19 and tighter lockdowns dent the demand outlook.

- The downside is tempered as markets weigh lower supply; Iraq is reducing production to compensate for exceeding its quota in 2020, it will pump 3.6m BPD in January and February, some 250k BPD lower than December and the lowest since 2015. Supply from Libya could also be disrupted as strikes over pay disputes go ahead.

- Attention will turn to how strict travel restrictions are in China over the LNY period, and API inventory data late on Tuesday.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.