-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Thune Defends Two-Step 2025 Agenda

MNI US MARKETS ANALYSIS - EUR Steadies Ahead of ECB

MNI POLITICAL RISK ANALYSIS - Netherlands’ Rutte On The Ropes

Just two weeks after seemingly securing a record fourth term in office, Dutch Prime Minister Mark Rutte narrowly avoided losing a vote of no confidence on Thursday 1 April. However, the scandal that has embroiled the PM is likely to result in a significantly dragged-out period of coalition building, the potential for Rutte to be forced from office, or even snap elections to be called.

Main Takeaways

- The prospect of a swift re-formation of the previous Dutch government has been scuppered by the scandal. Should a coalition be possible, it will likely take some months to be put together given the large number of parties in parliament and the damage done to Rutte's reputation.

- Prime Minister Mark Rutte could be forced from his position as head of the VVD, the largest party in parliament. This could allow the previous government to re-form, but without Rutte at its head (in office since 2010) the nature and governing style of this administration would be unclear for some time.

- While a snap election is not the preferred option for most of the major parties amidst the COVID-19 pandemic, there is the prospect they may be required before year-end should no coalition government (or minority government) be possible.

The scandal surrounding PM Rutte that erupted late last week is complex and goes as follows:

- Following the 15-17 March general election, Interior Minister Kasja Ollongren from the liberal pro-EU Democrats 66 (D66) and head of Rutte's People's Party for Freedom and Democracy (VVD) in the Senate Annemarie Jorritsma, were appointed as scouts to test out party leaders as to what sort of coalition could be formed.

- Ollengren was forced to swiftly leave meetings and the parliamentary estate in mid-March following an (incorrect) positive COVID-19 test. As she was leaving, she was photographed with a pile of papers, including a note suggesting that Pieter Omtzigt from the centre-right Christian Democratic Appeal (CDA) might be found a 'position elsewhere'.

- Omtzigt is a senior backbencher in the CDA and is known for his outspoken nature. He was instrumental in revealing the child benefits scandal earlier in the year that saw the last Rutte government resign ahead of the March election. The note did not make clear whether a 'position elsewhere' meant coaxing Omtzigt to leave frontline politics, or to offer him a ministerial position with the aim of silencing his views.

- Rutte initially stated that he had not talked about Omtzigt with Jorritsma or Ollongren, who both resigned their scout positions. A parliamentary debate was called which required the publication of the notes from civil servants regarding the exploratory talks. In these notes it was found that Rutte and the scouts had indeed discussed Omtzigt.

- After this Rutte claimed that he had "remembered that [the talks] wrong" and stated that he only remembered talking about Omtzigt on the morning of 1 April following a phone call with an unnamed person. This about-face resulted in a deluge of criticism with opponents from across the political spectrum calling for his resignation.

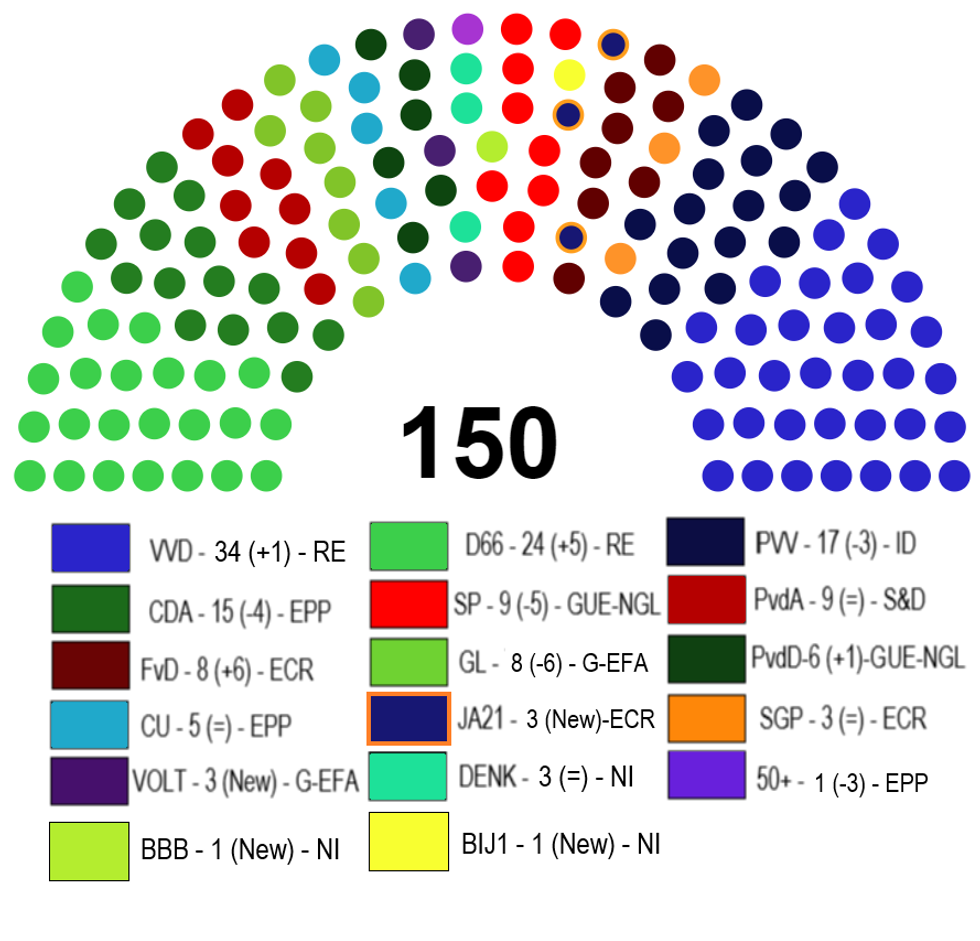

- This led to a vote of no confidence in the Rutte government taking place in the House of Representatives (Tweede Kamer) on the evening of Thursday 1 April. The Rutte government narrowly survived, with 78 votes to the opposition's 72. Of the 17 parties in the chamber, 13 voted against the government. As such, Rutte survives as PM for now, but he is badly tainted by the scandal and may not be able to form a majority government.

Source: Tweede Kamer, MNI

Source: Tweede Kamer, MNI

Lots Of Options, None Of Them Stable

In the aftermath of the confidence vote, one party – the socially conservative but economically centre-left Christian Union – has stated that it will not work in a government under a Rutte premiership. Party head Gert Jan Segers stated at the weekend that, "We don't want to return to 'business as usual'. We cannot be part of a fourth Rutte government". This comes as Rutte faces a motion of censure from the CDA and D66, the two other coalition allies of Rutte's VVD. This would not force Rutte from office and is being seen by some as allowing a narrow path for the PM to remain in office.

There are four scenarios that would avoid the prospect of new elections:

- Rutte remains as VVD head as a chastened PM who might not serve out his full term. If the Christian Union do not reverse their decision not to work with Rutte, a party or parties with at least three deputies would need to go into coalition to provide the government with a majority.

- Rutte resigns or is ousted as head of the VVD, allowing the previous government to be re-formed with a new prime minister, with Rutte potentially remaining in a caretaker capacity until a new VVD leader is chosen. The VVD does not have a politician with the stature of Rutte, who has led the party since 2006 and the Netherlands since 2010, making this a potentially difficult internal process.

- Rutte remains as VVD head and seeks to form a more left-leaning coalition without the CDA, potentially including Labour and the GreenLeft. An unlikely prospect given the condemnation of Rutte from these parties, but they may be tempted by the strong centre-left bias this prospective coalition would have.

- Other parties attempt to form a broad 'rainbow' coalition without the VVD. It would be an extremely difficult task to achieve this without the VVD, given it holds 34 seats in the House of Representatives. Combining all parties in the chamber excluding the VVD, the far-right (Party for Freedom, and Forum for Democracy) and the far-left (Socialist Party and BIJ1) would give the prospective government 78 seats, but it would be almost impossibly unwieldy.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.