-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI REALITY CHECK: US Dec Retail Sales Growth Seen Stalling

U.S. retail sales growth was likely stagnant in December, figures due Friday should show, as increasing virus cases and still-dampened consumer confidence muted holiday spending and mobility, industry experts told MNI.

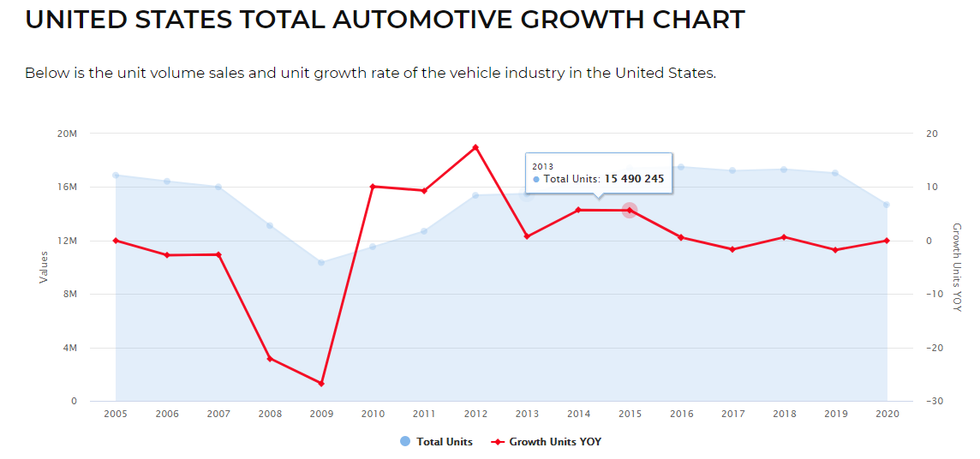

There are some bight spots though with car sales in December higher than anticipated, Michelle Krebs, an analyst at online vehicle retailer Autotrader, told MNI, though year-end sales were still down roughly 3 million from 2019.

New vehicle sales hit a seasonally adjusted annual rate of 16.3 million, up 6% from November's 15.6 million pace, according to data from Autotrader's parent company Cox Automotive. Sales of new vehicles in December were up 6.4% on the same month a year ago, thanks in part to three more selling days.

Inventory constraints that have impacted vehicle sales and prices for most of the year remained an issue in December, Krebs said, and could continue to hamper sales into 2021 as a global shortage in computer chips has already forced several automakers to cut back on production this month.

Source: U.S. Bureau of Economic Analysis

New vehicle inventory hit 3 million in December, Krebs said, the highest since May, although still down nearly 1 million on last year.

Used vehicle sales hit a seasonally adjusted annual rate of 38 million in December, up slightly from 37 million in November.

STIMULUS BOOST MIXED

Krebs said there were clear signs that many recipients of the USD1,200 stimulus checks distributed under the CARES Act used that money to buy vehicles, but it's unlikely that consumers will use the USD600 checks sent out late last month to purchase a car because it's an inadequate amount to stimulate such large discretionary purchases.

Some of the additional stimulus could prop up sales of footwear and apparel in the coming months, said Gary Raines, chief economist at the Footwear Distributors and Retailers of America, which represents more than 90% of the U.S. footwear industry.

"We may see a bit more footwear demand from the stimulus this time around compared to the first time around, but it's not going to be Earth-shattering," he said. "A lot of that spending will go toward needs rather than consumer discretionary purchases like footwear and apparel. You're more interested in covering the rent and buying groceries than buying a new pair of shoes."

Shoe store sales in December were still down from a year ago, Raines said, though year-over-year declines are beginning to "moderate." Holiday spending could have provided a temporary boost to sales.

GASOLINE SALES FALL

Gasoline demand was down about 1.3% from November after adjusting for an extra day in December, said Patrick De Haan, head of petroleum at Gasbuddy, which tracks real-time gasoline prices from stations across the U.S. That'll likely translate into a drop in December gas station sales at the pump, he said, as lower demand equates to lower traffic.

That isn't too surprising, De Haan said, and a drop in demand toward the end of December is typical as many Americans travel to their holiday destinations before staying put for several days.

"I don't believe the drop in December was due to Covid, I think more of it is likely kind of typical declines in demand," he said.

Fuel demand is down roughly 10% from a year earlier, he noted.

Excluding motor vehicle and gas station sales, December retail sales should fall 0.3% following a 0.8% decline in November. Retail sales were likely unchanged in December, according to Bloomberg, after a 1.1% drop in November.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.