-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net injects CNY90 Bln via OMO Thursday

MNI: PBOC Sets Yuan Parity Higher At 7.1740 Thurs; -0.77% Y/Y

SK Telecom (SKM, A3/A-/A-) in quantum computing partnership

MNI SARB Preview - May 2023: No Choice But To Tighten

Executive Summary

- The market is well priced for a 50bp rate hike after participants have been adding hawkish bets.

- Inflationary pressures remain heightened on the back of a number of idiosyncratic factors.

- Weakening exchange rate raises the risk of exacerbating imported inflation.

MNI SARB Preview - May 2023.pdf

Heading into the SARB’s monetary policy meeting this week, the market’s bias is for the SARB to deliver a back-to-back 50bp rate hike, sticking to a firm hawkish posture which took most observers off guard at the previous meeting. We align with consensus in expecting South African policymakers to keep their foot firmly on the brake pedal, as a combination of idiosyncratic factors and a weakening rand exchange rate prevent a sustainable decline in price pressures. Although the SARB can do little to alleviate the impact of logistical bottlenecks, load-shedding or diplomatic tensions, it is under growing pressure to preserve the rand’s appeal, as a weakening exchange rate amplifies imported inflation.

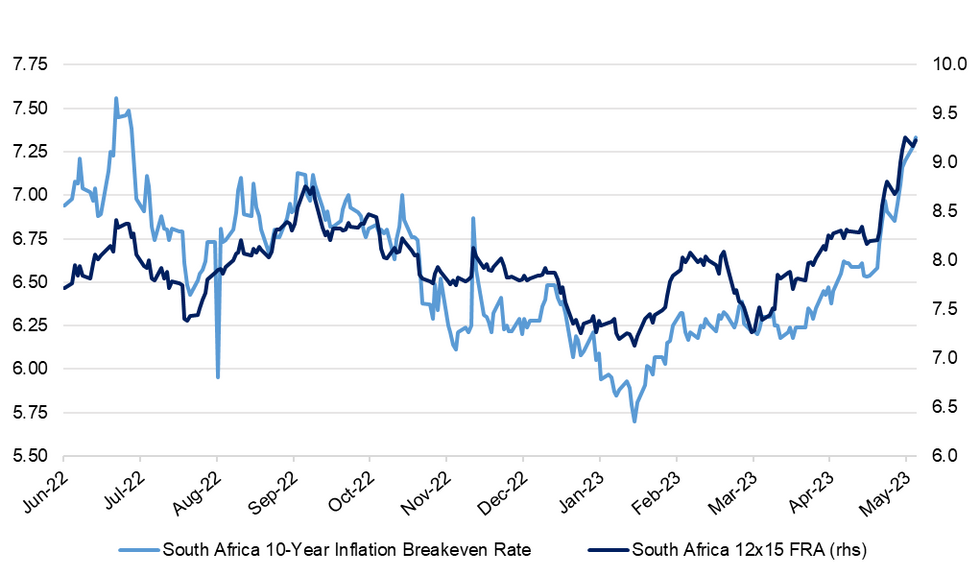

Fig. 1: South Africa 10-Year Breakeven Inflation Rate vs. South Africa 12x15 FRA

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

We think that exchange-rate depreciation is set to come to the fore, with USD/ZAR hitting new all-time highs in the recent days. Heavy foreign outflows from South African bond markets this year suggest that traditionally high-yielding local assets have lost some of their appeal among offshore investors. This comes as rising global interest rates squeeze the risk premium offered by South African assets, with the SARB under pressure to stay in the race, having raised its policy rate by “just” 425bp this cycle versus the Fed’s 500bp.

Firmly entrenched expectations of bold interest-rate action from the SARB may help force its hand this week. Participants have been adding hawkish rate-hike bets, pushing the local FRA curve sharply higher in the course of this month. The market now expects the SARB to maintain an unambiguously hawkish posture and keep rates higher for longer. Against this backdrop, should policymakers under-deliver and announce a pause or a token 25bp rate hike, they would risk sending the rand into a tailspin again at a time when it trades at near-record lows.

Of course, the SARB cannot be entirely oblivious to broader economic headwinds. Deputy Governor Kuben Naidoo recently said in a speech that the central bank is “close to the end of the hiking cycle,” albeit it stands ready to act if inflation refuses to head towards the target. Any signs of setting the stage for a future pause will be closely eyed in the presser.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.