-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

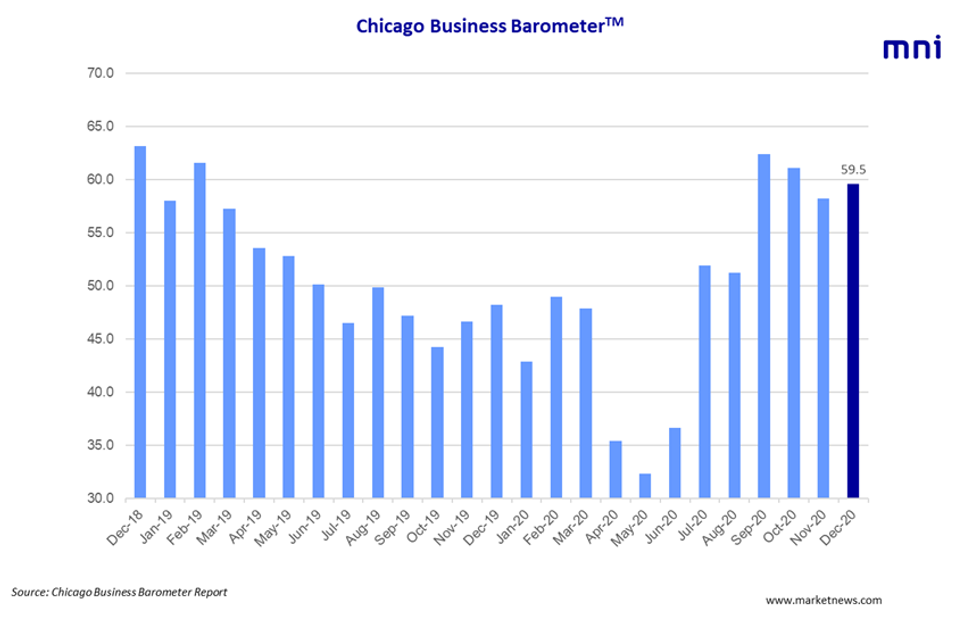

MNI DATA IMPACT: Dec Chicago Biz Barometer Edges Higher

Chicago Business Barometer 59.5 December Vs 58.2 November

The Chicago Business Barometer edged up in December, outpacing market expectations for a decline to 56.0. The headline index rose to 59.5 on a monthly basis, while quarterly business sentiment increased to 59.6, the highest level since Q4 2018.

Among the main five indicators, Employment saw the largest monthly gain, followed by Order Backlogs. New Orders recorded the biggest decline.

Demand eased in December as New Orders slipped 2 points to 58.0. Against that, Production ticked up by 1.1 points to 61.9 as business activity picked up. On a quarterly basis, both New Orders and Production jumped to a 2-year high, pushing the indices up to 61.0 and 61.6, respectively.

Order Backlogs grew 3.6 points to 55.0 in December, second consecutive advancement. In Q4 the index rose to 52.3, lifting the indicator above the 50-mark for the first time since Q1 2019. Meanwhile, Inventories jumped to a seven-month high of 49.4 in December, leaving the quarterly index at 47.6 in Q4.

EMPLOYMENT

Employment saw the largest climb in December, rising to a one-year high of 48.8. Nevertheless, the indicator has now been in contraction territory since July 2019. Quarterly demand for labor progressed to 45.3 in Q4.

Supplier Deliveries showed little change at 69.7 in December with companies continuously noting delivery delays due to issues with shipping and trucking. Prices paid at the factory gate expanded to 76.6, hitting the highest level since September 2018, with firms reporting higher prices for metals. In Q4, the index rose to 71.8, the highest level since Q3 2018.

This month's special question asked, "What is your planned business activity forecast for 2021, by percent?". The majority (44.9%) sees growth below 5%, while 42.9% expect growth to be between 5% and 10%. The second question asked, "As vaccine(s) roll out over the next few months, have you made plans to adjust your 2021 budget, in which period?". The majority does not know yet if they will adjust their 2021 budget.

This month's survey ran from December 1 to 14.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.