-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI FOMC Hawk-Dove Spectrum

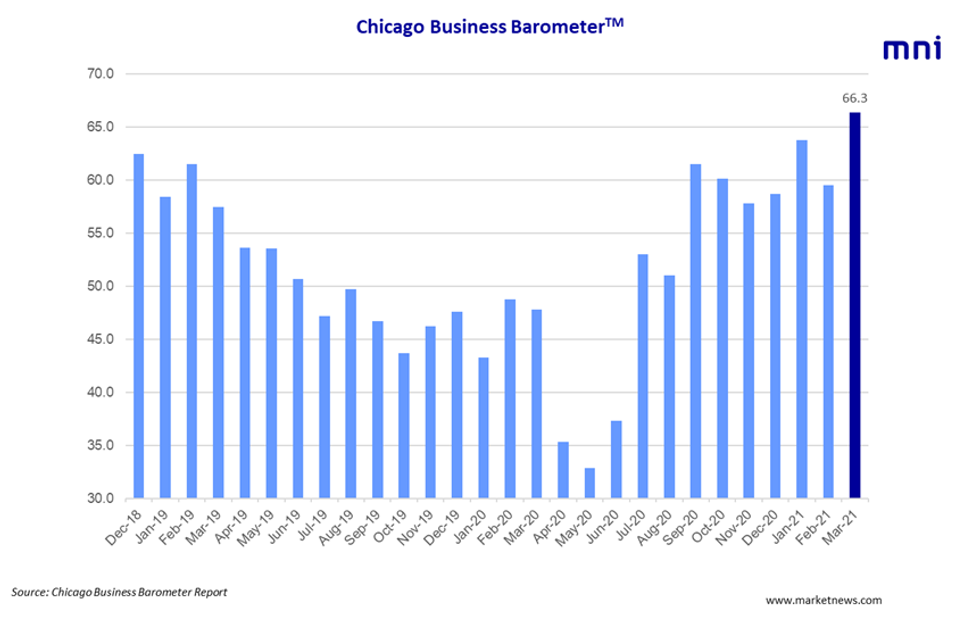

MNI DATA IMPACT: Chicago Biz Barometer At 32-Month High

Chicago Business Barometer 66.3 March Vs 59.5 February

The Chicago Business Barometer rose in March, with the headline index expanding 6.8 points to 66.3, driven by a sharp increase in output and marking the highest level since July 2018. The uptick was stronger than financial market expectations. Through Q1 the index gained 4.4 points to 63.2, the strongest reading since Q3 2018

Among the main five indicators, Production saw the largest gain, while Order Backlogs saw the biggest drop.

Production jumped to 72.0 in March, up from February's 62.0. The monthly index now stands at a 3year high, while production increased to 68.4 in Q1, its highest level since Q4 2017. New Orders increased to 62.3 in March, while the quarterly index improved to 61.3 in Q1. Companies were optimistic in March and noted that business is picking up.

Order Backlogs was the only major category to fall, down 6 points to 57.0. However, over Q1 the index rose to 60, its highest level since Q3 2018. Meanwhile, Inventories ticked up to 55.6 in March, leaving the indicator above the 50-mark for a third consecutive month, mainly driven by supply chain issues. Quarterly inventories rose to 53.7 in Q1.

EMPLOYMENT

Employment shifted into expansion territory in March, up 5.5 points to 54.6, the first reading above 50 since June 2019. Employment rose to 49.0 in Q1.

Supplier Deliveries lengthened to a 47-year high of 79.9 in March, surpassing April's recent peak when supply chain issues pushed the index up to 77.5. In Q1 the index rose to 73.8, its highest level since Q2 1974. Prices paid at the factory gate escalated for the seventh month in a row and the index now stands at 80.4, its highest reading since August 2018. Quarterly prices rose to 76.9 in Q1. Anecdotal evidence suggests that prices for steel continue to rise in March.

This month's special question asked, "As the first quarter of 2021 comes to an end, are you planning to amend your inventory position due to any of the following conditions?" The majority, at 67.6%, plan to change their inventory levels due to supplier lead-times, while 43.2% noted logistical issues as a reason.

This month's survey ran from March 1 to 15.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.