-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CLOSING FI ANALYSIS: Virus Spd Underscores Risk-off Bid For Rates

US TSY SUMMARY:

Tsys held near early session highs post data but continued to extend, finishing near the top end of session range, Yld curves adding to Mon's bull flattening.

- Sources reported early two-way flow in intermediates with carry-over bank portfolio selling in 10s, derivative selling out the curve vs. real$ buying 30s. Better buying in intermediates to the long end reported in the second half, albeit on lighter volume (TYZ around 825k by the closing bell) as the spread of COVID-19 spurred lockdown concerns.

- Underscoring, if not adding to the risk-off tone, French PM Macron is said to be "considering a national lockdown" as curfews set last wk have failed to stop the spd of the virus. Macron to address nation Wednesday evening.

- Other salient headlines: WH Press Sec MCenany: CHANCES ARE SLIM FOR STIMULUS BILL BEFORE ELECTION, bg; EU official warned there won't BE ENOUGH COVID-19 VACCINES FOR WHOLE EU POPULATION" until late 2021.

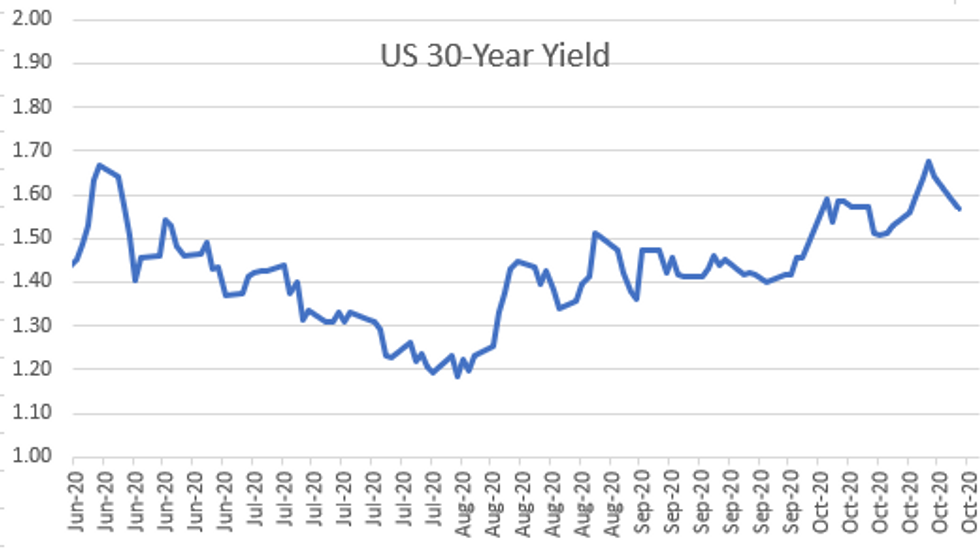

- Second half trade included decent deal-tied hedging, light steepener unwinds in 2s and 5s vs. 10s. So-so auction, US Tsy $54B 2Y Note (91282CAR2) drew 0.151% (0.136% last month) vs. 0.149% WI, bid/cover 2.41 vs. 2.42 previous. The 2-Yr yield is down 0.2bps at 0.1474%, 5-Yr is down 1.9bps at 0.3317%, 10-Yr is down 2.5bps at 0.776%, and 30-Yr is down 2.6bps at 1.5652%.

TECHNICALS

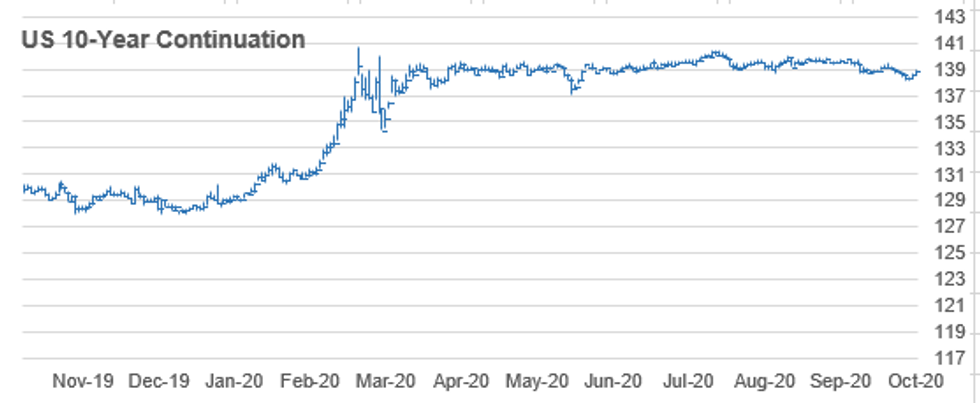

US 10YR FUTURE TECHS: (Z0) Off Recent Lows

- RES 4: 139-14 High Oct 15

- RES 3: 139-04 50-day EMA

- RES 2: 138-29+ 20-day EMA

- RES 1: 138-23 High Oct 26

- PRICE: 138-26+ @16:08 GMT Oct 27

- SUP 1: 138-05 Low Oct 23

- SUP 2: 138-04+ 1.00 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 3: 138-00+ Bear channel base drawn off the Aug 4 high

- SUP 4: 137-29 76.4% retracement of the Jun - Aug rally (cont)

Treasuries bounced further Tuesday as a correction unfolds off last week's 138-05 low. A bearish theme was reinforced recently on Oct 21 following the break of 138-20+, Oct 7 low. This confirmed a resumption of the broader reversal that occurred on Aug 4 and clears the way for an extension lower. towards 138-04+ next, a Fibonacci projection ahead of 138-00+, a bear channel base drawn off the Aug 4 high. Firm resistance is seen at 138-29+.

AUSSIE 3-YR TECHS: (Z0) Looking To Clear Resistance

AUSSIE 3-YR TECHS: (Z0) Looking To Clear Resistance

- RES 3: 100.00 - Psychological round number

- RES 2: 99.886 - 3.0% Upper Bollinger Band

- RES 1: 99.845 - All time High Oct 20, 15 and the bull trigger

- PRICE: 99.840 @ 16:10 BST Oct 27

- SUP 1: 99.760 - Low Oct 1 and 2

- SUP 2: 99.705 - Low Sep 18, 21 and 22

- SUP 3: 99.675 - Low Sep 7 and key support

Aussie 3yr futures are largely unchanged and remain bullish. The price surge at the tail-end of September and early October confirmed bullish trend conditions. Recent activity is viewed as a pause in the uptrend and in pattern terms has taken on the appearance of a bull flag. This is a continuation pattern and reinforces current trend conditions. A break of 99.845, Oct 20 high and last week's high would open 99.889. Support is at 99.760.

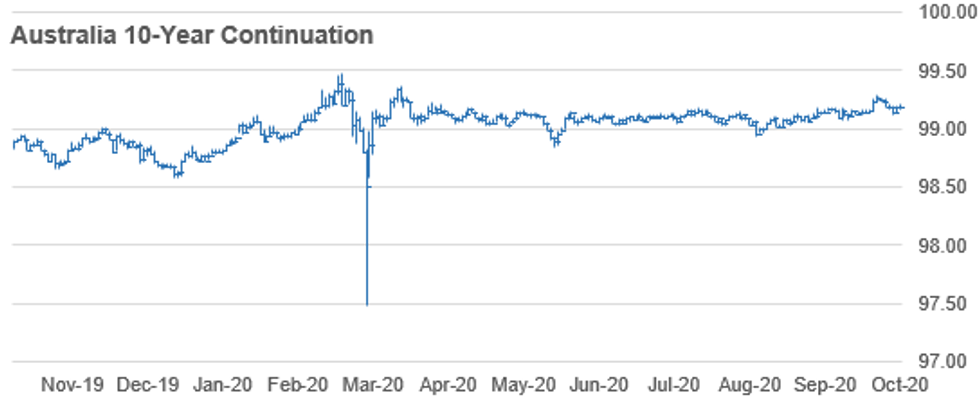

AUSSIE 10-YR TECHS: (Z0) Uptrend Remains Intact

AUSSIE 10-YR TECHS: (Z0) Uptrend Remains Intact

- RES 3: 99.480 - High Mar 10 and the all-time high

- RES 2: 99.360 - High Apr 2 (cont)

- RES 1: 99.290 - High Oct 16

- PRICE: 99.210 @ 16:11 BST Oct 27

- SUP 1: 99.112 - 50-dma

- SUP 2: 99.055 - Low Sep 18 and 21

- SUP 3: 98.970 - Low Sep 8

Aussie 10y futures remain bullish despite last week's pullback. The break above 99.180, an area of congestion reflecting highs in Sep and early October confirmed a resumption of the uptrend that started on Aug 28. Attention turns to 99.300 and 99.360. The latter is the Apr 2 high (cont). The near-term bull trigger is 99.290, Oct 16 high. On the downside, firm trend support is at 99.075, Oct 5 low.

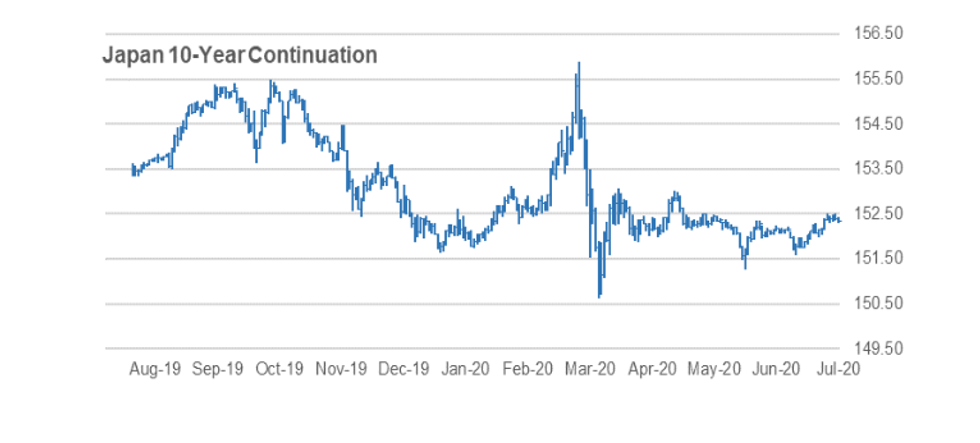

JGB TECHS: (Z0) Looking More Comfortable Above 152

JGB TECHS: (Z0) Looking More Comfortable Above 152

- RES 3: 152.55 - High Aug 5 (cont)

- RES 2: 152.36- 3.0% Upper Bollinger Band

- RES 1: 152.29 - High Sep 24 and the bull trigger

- PRICE: 152.15 @ 16:13 BST Oct 27

- SUP 1: 151.75 - Low Oct 08 and trend support

- SUP 2: 151.54 - Low Sep 7

- SUP 3: 151.43 - Low Sep 1

JGBs have convincingly topped 152.00, reestablishing the recent positive outlook. Attention remains on 152.29, Sep 4 high, a key resistance and the bull trigger. A break of this level would confirm a resumption of the uptrend and open 152.36, a Bollinger band objective and 152.55, Aug 5 high (cont). On the downside, key trend support has been defined at 151.75, Oct 8 low.

US TSY FUTURES CLOSE

Broadly higher on modest volumes (TYZ<825k), futures near top end relative narrow session range since the open, yld curves bull flatten, update:

- 3M10Y -3.12, 67.855 (L: 67.1 / H: 70.949)

- 2Y10Y -2.64, 62.32 (L: 61.818 / H: 65.464)

- 2Y30Y -2.579, 141.372 (L: 140.697 / H: 144.905)

- 5Y30Y -0.697, 123.148 (L: 122.473 / H: 124.868)

- Current futures levels:

- Dec 2Y up 0.12/32 at 110-13.5 (L: 110-13.12 / H: 110-13.75)

- Dec 5Y up 2.75/32 at 125-24.5 (L: 125-20.75 / H: 125-24.75)

- Dec 10Y up 7.5/32 at 138-28 (L: 138-18.5 / H: 138-28.5)

- Dec 30Y up 19/32 at 174-6 (L: 173-12 / H: 174-09.00)

- Dec Ultra 30Y up 44/32 at 217-28 (L: 216-02 / H: 218-04)

US EURODOLLAR FUTURES CLOSE

Steady to mildly higher out the strip, at/near session highs; lead quarterly EDZ0 back to steady after trading firmer since 3M LIBOR set' +0.00575 to 0.22225% (-0.00188 last wk).

- Dec 20 steady at 99.755

- Mar 21 steady at 99.785

- Jun 21 +0.005 at 99.80

- Sep 21 +0.005 at 99.805

- Red Pack (Dec 21-Sep 22) steady to +0.005

- Green Pack (Dec 22-Sep 23) +0.010 to +0.015

- Blue Pack (Dec 23-Sep 24) +0.020 to +0.025

- Gold Pack (Dec 24-Sep 25) +0.030 to +0.035

US DOLLAR LIBOR: Latest settles

- O/N -0.00075 at 0.08063% (-0.00075/wk)

- 1 Month -0.00475 to 0.15150% (-0.00475/wk)

- 3 Month -0.00900 to 0.21325% (-0.00325/wk)

- 6 Month -0.00313 to 0.24625% (-0.00313/wk)

- 1 Year -0.00463 to 0.33200% (-0.00463/wk)

US TSY SHORT TERM RATES

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $58B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $179B

- Secured Overnight Financing Rate (SOFR): 0.09%, $921B

- Broad General Collateral Rate (BGCR): 0.06%, $338B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $315B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.735B accepted vs. $4.064B submission

- --

- 28-Oct Next forward schedule release at 1500ET

OUTLOOK: Look Ahead To Wednesday

- OUTLOOK: US Data/Speaker Calendar (prior, estimate)

- 28-Oct 0700 23-Oct MBA Mortgage Applications (-0.6%, --)

- 28-Oct 0830 Sep advance goods trade gap (-$82.9B, -$84.5B)

- 28-Oct 0830 Sep advance retail inventories (0.8%, 0.5%)

- 28-Oct 0830 Sep advance wholesale inventories (0.4%, 0.4%)

- 28-Oct 1030 23-Oct Distillate/gas/crude stocks w/w change

- 28-Oct 1130 US Tsy 105D Bill CMB auction

- 28-Oct 1130 US Tsy 154D Bill CMB auction

- 28-Oct 1300 $26B US Tsy 2Y-Note/FRN auction (91282CAS0)

- 28-Oct 1300 $55B US Tsy 5Y-Note auction (91282CAT8)

- 28-Oct 1800 Dallas Fed Kaplan panel discussion w/ Mark Carney

PIPELINE: P&G, Berkshire Hathaway Energy Lead Day's Supply

- $7.15B to price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 10/27 $2.25B #P&G $1B 5Y +25, $1.25B 10Y +47 (issued $5B on March 23: 5pt: $750M 5Y +210, $500M 7Y +220, $1.5B 10Y +225, $1B 20Y +220, $1.25B 30Y +225)

- 10/27 $2B #Berkshire Hathaway Energy $500M 10Y +90, $1.5B 30Y +128 (issued $1.25B 5Y on March 20)

- 10/27 $1.25B #Kommuninvest 2Y +2

- 10/27 $500M #Genuine Parts Co 10Y +120

- 10/27 $650M #Tractor Supply 10Y +110

- 10/27 $500M #Acuity Brands Lighting 10Y +140

- Expected Wednesday

- 10/28 $500M Kommunalbanken 2Y +4a

- 10/28 $500M World Bank (IADB) +4Y SOFR+27a

EURODOLLAR/TREASURY OPTIONS

Eurodollar Options:

- -2,000 Dec 97 straddles, 4.5

- -1,000 Blue Mar 92/96 strangles, 11.5

- Overnight trade

- +20,000 Blue Nov 91/92/93 put flys, 1.0

- 9,500 Dec 97 puts, 2.0

Tsy Options:

- +9,000 TYZ 138 puts, 22-21

- -6,000 TYZ 135/137 2x1 put spds, 5/64

- 1,100 TYZ 137.75/139.25 strangles, 41/64

- over +5,500 USF 176/179 1x2 call spds, 1/64 credit/1-leg over buyer USF 175 straddles, 531 after USF 172/178 strangle traded 119 1,500 FVZ 125.75 calls, 14.5/64

- Overnight trade

- +3,000 TYZ 135.5/136.5/137.5 put flys, 6/64

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.