-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CLOSING FI ANALYSIS: Risk-Parity Unwind vs FR Lockdown

US TSY SUMMARY: Risk-Parity Unwinds?

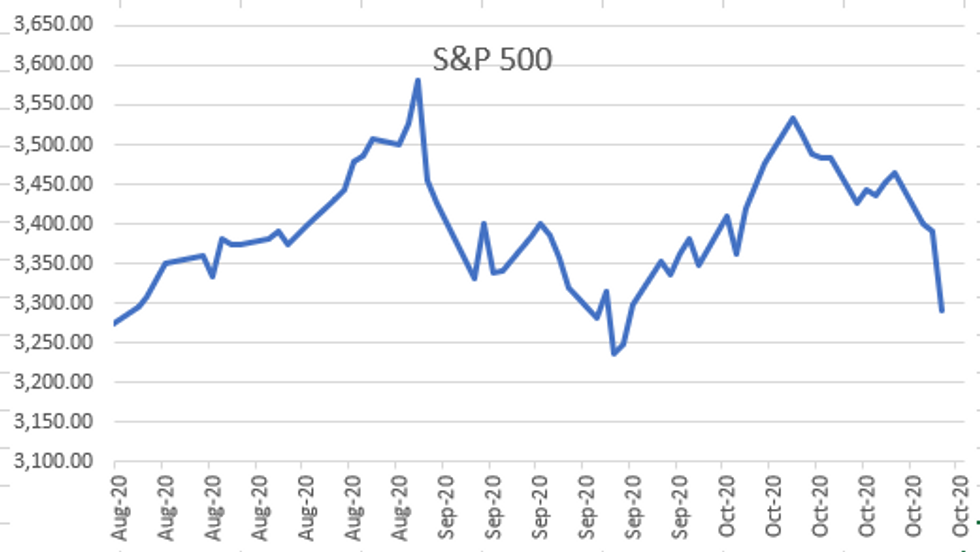

Tsy futures opened well bid in reaction to steep losses in equities through London into New York trade (ESZ0 -105.0 in late trade). Tsy support was not consistent, however.

- The reluctance of Tsys to hold onto strong bids across the curve in the face of sharp sell-off in equities spurred a lot of questions. It was evident early on that German DAX lead S&P futures rout, selling ebbed briefly after details of German shutdown aired).

- Varied desks pointed to likely position unwinds by Risk-Parity funds from midmorning on as Tsys continued to scale back deep support into the close.

- Delayed react to late headlines that France PM Macron calling for a nationwide lockdown to contain the spread of COVID-19 (will reevaluate in 15 days), helped Tsys bounce off lows while equities continued to fall (ESZ0 -120.0)

- The 2-Yr yield is up 0.1bps at 0.1466%, 5-Yr is unchanged at 0.3301%, 10-Yr is up 0.5bps at 0.7727%, and 30-Yr is up 0.4bps at 1.5571%.

TECHNICALS

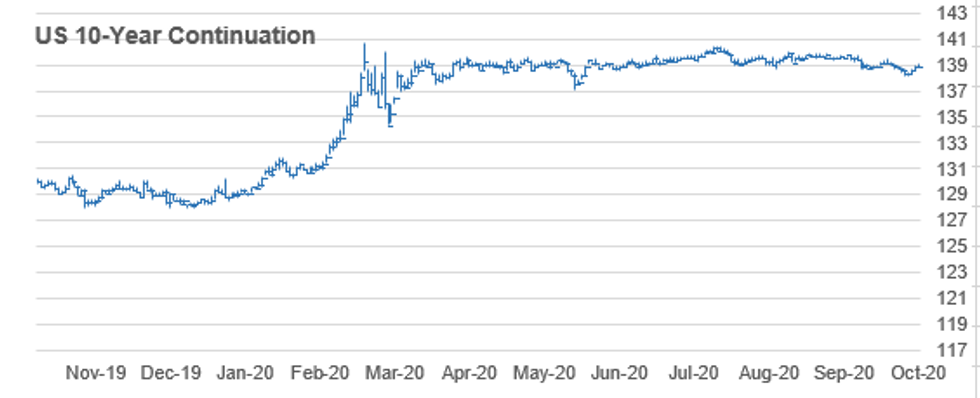

US 10YR FUTURE TECHS: (Z0) Intraday Strength Fades

- RES 4: 139-17 Bear channel resistance drawn off Aug 4 high

- RES 3: 139-14 High Oct 15 and a key resistance

- RES 2: 139-07+ High Oct 16

- RES 1: 139-03+ 50-day EMA

- PRICE: 138-29 @16:23 GMT Oct 28

- SUP 1: 138-18+ Low Oct 27

- SUP 2: 138-05 Low Oct 23

- SUP 3: 138-04+ 1.00 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 4: 138-00+ Bear channel base drawn off the Aug 4 high

After the strong close Tuesday, Treasuries gained further Wednesday but faded off the highs into the close. Nonetheless, the underlying momentum behind the current rally suggests scope for further upside and attention turns to the top of a bear channel resistance at 139-17. The channel is drawn off the Aug 4 high. Immediate resistance is at the 50-day EMA at 139-03+ and 139-14, the Oct 15 high. On the downside, initial firm support lies at 138-18+, Oct 27 low.

AUSSIE 3-YR TECHS: (Z0) Looking To Clear Resistance

AUSSIE 3-YR TECHS: (Z0) Looking To Clear Resistance

- RES 3: 100.00 - Psychological round number

- RES 2: 99.886 - 3.0% Upper Bollinger Band

- RES 1: 99.845 - All time High Oct 20, 15 and the bull trigger

- PRICE: 99.835 @ 16:27 BST Oct 28

- SUP 1: 99.760 - Low Oct 1 and 2

- SUP 2: 99.705 - Low Sep 18, 21 and 22

- SUP 3: 99.675 - Low Sep 7 and key support

Aussie 3yr futures are largely unchanged and remain bullish. The price surge at the tail-end of September and early October confirmed bullish trend conditions. Recent activity is viewed as a pause in the uptrend and in pattern terms has taken on the appearance of a bull flag. This is a continuation pattern and reinforces current trend conditions. A break of 99.845, Oct 20 high and last week's high would open 99.889. Support is at 99.760.

AUSSIE 10-YR TECHS: (Z0) Uptrend Remains Intact

AUSSIE 10-YR TECHS: (Z0) Uptrend Remains Intact

- RES 3: 99.480 - High Mar 10 and the all-time high

- RES 2: 99.360 - High Apr 2 (cont)

- RES 1: 99.290 - High Oct 16

- PRICE: 99.225 @ 16:29 BST Oct 28

- SUP 1: 99.116 - 50-dma

- SUP 2: 99.055 - Low Sep 18 and 21

- SUP 3: 98.970 - Low Sep 8

Aussie 10y futures remain bullish despite last week's pullback. The break above 99.180, an area of congestion reflecting highs in Sep and early October confirmed a resumption of the uptrend that started on Aug 28. Attention turns to 99.300 and 99.360. The latter is the Apr 2 high (cont). The near-term bull trigger is 99.290, Oct 16 high. On the downside, firm trend support is at 99.075, Oct 5 low.

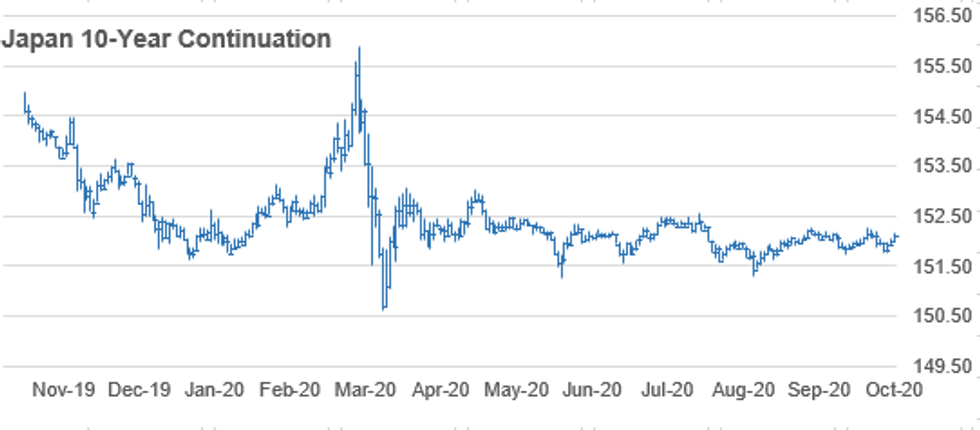

JGB TECHS: (Z0) Looking More Comfortable Above 152

JGB TECHS: (Z0) Looking More Comfortable Above 152

- RES 3: 152.55 - High Aug 5 (cont)

- RES 2: 152.36- 3.0% Upper Bollinger Band

- RES 1: 152.29 - High Sep 24 and the bull trigger

- PRICE: 152.12 @ 16:31 BST Oct 28

- SUP 1: 151.75 - Low Oct 08 and trend support

- SUP 2: 151.54 - Low Sep 7

- SUP 3: 151.43 - Low Sep 1

JGBs have convincingly topped 152.00, reestablishing the recent positive outlook. Attention remains on 152.29, Sep 4 high, a key resistance and the bull trigger. A break of this level would confirm a resumption of the uptrend and open 152.36, a Bollinger band objective and 152.55, Aug 5 high (cont). On the downside, key trend support has been defined at 151.75, Oct 8 low.

TSY FUTURES CLOSE: Well Off Early Session Highs Even After Equity Rout

Well off early session highs, Tsy futures trading mixed after the bell, 10s-30s weaker, even as equities retain steep losses (ESZ0 -86.0). Decent volumes (TYZ0 over 1.38M); yield curves mildly steeper after flattening last four sessions. Update:

- 3M10Y +1.006, 68.106 (L: 64.075 / H: 68.441)

- 2Y10Y +0.694, 62.716 (L: 59.936 / H: 63.08)

- 2Y30Y +0.903, 141.467 (L: 138.223 / H: 142.347)

- 5Y30Y +1.051, 123.187 (L: 121.134 / H: 124.067)

- Current futures levels:

- Dec 2Y up 0.12/32 at 110-13.62 (L: 110-13.3 / H: 110-13.8)

- Dec 5Y up 0.25/32 at 125-24.5 (L: 125-24 / H: 125-27.25)

- Dec 10Y down 1/32 at 138-26 (L: 138-24.5 / H: 139-03)

- Dec 30Y steady at at 174-3 (L: 173-30 / H: 174-29)

- Dec Ultra 30Y up 7/32 at 217-25 (L: 217-13 / H: 219-14)

US EURODLR FUTURES CLOSE: Follow Tsy Futures Lead

Steady to mixed in the short end, mildly weaker out the strip; lead quarterly EDZ0 back to steady since 3M LIBOR set' +0.00113 to 0.21438% (-0.00212/wk).

- Dec 20 steady at 99.755

- Mar 21 +0.005 at 99.790

- Jun 21 +0.005 at 99.800

- Sep 21 steady at 99.800

- Red Pack (Dec 21-Sep 22) -0.005 to steady

- Green Pack (Dec 22-Sep 23) -0.01 to -0.005

- Blue Pack (Dec 23-Sep 24) -0.01 to -0.005

- Gold Pack (Dec 24-Sep 25) -0.015 to -0.010

US DOLLAR LIBOR: Latest settles

- O/N -0.00138 at 0.08025% (-0.00113/wk)

- 1 Month +0.00312 to 0.14775% (-0.00850/wk)

- 3 Month +0.00113 to 0.21438% (-0.00212/wk)

- 6 Month -0.00237 to 0.24413% (-0.00525/wk)

- 1 Year -0.00412 to 0.32763% (-0.00900/wk)

US TSY Short Term Rates

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $60B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $177B

- Secured Overnight Financing Rate (SOFR): 0.09%, $931B

- Broad General Collateral Rate (BGCR): 0.06%, $331B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $309B

- (rate, volume levels reflect prior session)

- Thu 10/29 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 10/30 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B

- Mon 11/02 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Tue 11/03 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 11/06 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

- Mon 11/09 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 11/10 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Thu 11/12 1010-1030ET: Tsys 7Y-20Y, appr $3.625B

- Fri 11/13 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Fri 11/13 Next forward schedule release at 1500ET

OUTLOOK: Look Ahead To Thursday

- US Data/Speaker Calendar (prior, estimate)

- 29-Oct 0830 24-Oct initial jobless claims (787k, 770K)

- 29-Oct 0830 24-Oct continuing claims (8.373M, 7.700M)

- 29-Oct 0830 Q3 GDP (adv) (-31.4%, 32.0%)

- 29-Oct 0830 Q3 GDP Price Index (-1.8%, 2.9%)

- 29-Oct 1000 Sep NAR pending home sales index (132.8, --)

- 29-Oct 1030 23-Oct natural gas stocks w/w

- 29-Oct 1130 US Tsy 4W-Bill auction

- 29-Oct 1130 US Tsy 8W-Bill auction

- 29-Oct 1300 $53B US Tsy 7Y-Note auction (91282CAU5)

- 29-Oct 1630 28-Oct Fed weekly securities holdings

PIPELINE

Waiting On Lenovo

- Date $MM Issuer (Priced *, Launch #)

- 10/28 $1B #Lenovo 10Y +265

- 10/28 $750M #Kommunalbanken 2Y +3

- 10/28 $500M *World Bank (IADB) +4Y SOFR+25

- 10/28 $500M *Kookmin 10NCL covid bond, +175

- 10/?? $500M Swedish Export Credit Corporation (SEK) 2Y +6a

EURODOLLAR/TREASURY OPTIONS

Eurodollar Options:

- +2,500 Green Dec 93 puts, 0.5

- +10,000 Red Dec'21 100 calls, 3.0

- +5,000 Red Mar22 97/98 1x2 call spds, 1.5

- +5,000 Blue Dec 90/92/95 put flys, 4.0

- +5,000 Blue Mar 90/91/93 broken put trees, 4.0

- +5,000 Blue Mar 93/95/96 put flys, 2.0

- +1,000 Blue Jan 90/92 put spds, 2.25

- +5,000 short Dec 98/100 call spds vs. -Blue Dec 97/98 call spds, .25cr

- +5,000 Blue Mar 90/91/93 broken put trees, 4.0

- Overnight trade

- -3,400 Green Jan 96 puts vs. Gold Nov 91/92 put spds, 0.0

- Block, +7,500 TYZ 138.75 puts, 38 vs. 138-27/0.47%

- +2,000 FVG 124.75/125/125.25 put trees vs. FVG 127 call, 0.0

- -4,500 FVZ 124.75/125/125.25/125.5 put condors, 2.5

- +2,500 TYZ 137.5/140.5 put over risk reversals, 4

- +4,500 TYZ 137 puts, 7/64

- +4,000 TYF 137/137.5/138 put flys, 2

- +1,500 TYZ 139.5/140.5 2x3 call spds, 28/64

- 2,300 USZ 167/171.5 put spds, 47/64

- +1,200 USF 177/180 1x2 call spds, 2-1 cr

- Overnight trade

- Block, +10,000 TYZ 137.5 puts, 14

- Block, +3,750 TYZ 137 puts, 9

- -4,200 TYZ 139.5 calls 3 over TYZ 137.5/138.5 put spds

- +3,500 TYF 140 calls, 17-19

- 2,000 TYZ 136/137/138 put trees, 8

- -2,900 FVZ 125.5 puts 3 over FVZ 126/126.25 call spds

- +3,000 USZ 182 calls, 8-10

- +2,300 USZ 176.5 calls, 115-117

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.