-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - French Politics Undermines EUR

MNI US OPEN - Trump Warns BRICS Over Moving Away From USD

MNI US CLOSING FI ANALYSIS: Big Stim Deal Line In Sand For GOP

EXECUTIVE SUMMARY

- TRUMP: SEES CHANCE FOR STIMULUS BILL WITH PRESSURE ON PELOSI, Bbg

- MCCONNELL REJECTS `HIGHER AMOUNT' FOR STIMULUS: REUTERS

- MNI EXCLUSIVE: China Import Surge To Ease In Q4, Advisors Say

- MNI REALITY CHECK: US Sep Retail Sales Seen Moderating Again

- MNI EXCLUSIVE: Fed May Extend Facilities as Fiscal Talks Stall

- Senate Judiciary Committee will vote to approve Amy Coney Barrett's nomination to Supreme Court on October 22

US TSY 30Y YIELD

US

FED: The Federal Reserve will likely prolong emergency programs past their set end date of late December, current and former officials told MNI, citing concerns over coronavirus, the small cost of keeping facilities open, and a lack of more fiscal relief. For more see 10/15 main wire at 1400ET.

US: Stimulus Comments Causing Some Confusion; Wires and social media making some confusing comments with regards to a potential COVID-19 stimulus package.- Reports that the White House said there is a chance a 'serious' stimulus bill may emerge are incorrect, with the comments in fact coming from Senator Sheldon Whitehouse (D-RI).

- The latest comments from the administration remain largely negative on the prospect of a deal being reached before the election, with Treasury Secretary Steve Mnuchin saying that the prospect of a pre-November 3 deal was unlikely.

- The floor vote will then follow on the week of October 26.* The Committee vote, like the following Senate floor vote, is seen as a foregone conclusion, with the Republicans holding a 12-10 majority on the Judiciary Committee

ASIA

CHINA: China's surprisingly robust September import data was driven partly by panic buying of chips containing U.S. technology and increased purchases under the two countries' trade deal, so may not be sustainable in months ahead, particularly given uncertainties about the Covid-19 pandemic and the U.S. presidential election, policy advisors told MNI. For more see 10/15 main wire at0900ET.

OVERNIGHT DATA

- US JOBLESS CLAIMS +53K TO 898K IN OCT 10 WK

- US PREV JOBLESS CLAIMS REVISED TO 845K IN OCT 03 WK

- US CONTINUING CLAIMS -1.165M to 10.018M IN OCT 03 WK

- US weekly jobless claims rose by 53,000 to 898,000 in the week ending Oct. 10, the Labor Department said. Continuing claims fell by 1,165,000 to 10,018,000 in the week ending Oct. 3. Claims have eased recently after spending months above 1 million per week, but are still at very high levels generally associated with a worsening employment outlook.

- US SEP IMPORT PRICES +0.3%; Fuel Import Prices -2.9%, 1st Drop Since April

- US SEP EXPORT PRICES +0.6%; NON-AG +0.3%; AGRICULTURE +2.7%

- Import prices rose 0.3% mom after gaining 1.0% in August, lifting the yoy rate to -1.1%. Fuel import prices fell -2.9% in the first drop since April as petroleum import prices fell.

- Nonfuel import prices +0.6% mom on industrial supplies and materials; they are 1.5% yoy, biggest rise since June 2018.

- Export prices rose 0.3% m/m, after rising 0.5% in August. They're down -1.8% yoy.

- Prices for imports from China were flat in September after rising 0.1% in August and 0.2% in July. They're flat yoy.

- US OCT PHILADELPHIA FED MFG INDEX 32.3

- CANADIAN SEPT HOME SALES +0.9% MOM, +45.6% YOY - CREA

- CANADIAN SEPT AVERAGE HOME SALES PRICE +17.5% YOY

MARKETS SNAPSHOT

- DJIA up 14.12 points (0.05%) at 28514.62

- S&P E-Mini Future down 3.25 points (-0.09%) at 3475.75

- Nasdaq down 39.2 points (-0.3%) at 11724.13

- US 10-Yr yield is up 1 bps at 0.7356%

- US Dec 10Y are down 4/32 at 139-3

- EURUSD down 0.0041 (-0.35%) at 1.1704

- USDJPY up 0.3 (0.29%) at 105.47

- WTI Crude Oil (front-month) down $0.1 (-0.24%) at $40.93

- Gold is up $5.46 (0.29%) at $1906.56

- European bourses closing levels:

- EuroStoxx 50 down 80.59 points (-2.46%) at 3192.69

- FTSE 100 down 102.54 points (-1.73%) at 5832.52

- German DAX down 324.31 points (-2.49%) at 12703.75

- French CAC 40 down 104.24 points (-2.11%) at 4837.42

US TSY SUMMARY: Big Stim Deal Line In Sand For GOP

Dueling headlines over a stimulus deal continued to drive market speculation, but still no closer to a deal after the bell. Rates opened with a strong risk-off tone Thursday, but followed a steady pace as gains given back through the close.

Salient headlines:

- MNUCHIN: WE'RE GOING TO KEEP TRYING TO GET STIMULUS DEAL

- WHITEHOUSE: THERE'S A CHANCE `SERIOUS' STIMULUS BILL MAY EMERGE

- MCCONNELL REJECTS `HIGHER AMOUNT' FOR STIMULUS: REUTERS

- TRUMP: WILLING TO RAISE STIMULUS OFFER ABOVE $1.8 TRILLION, Bbg

- HSE DEMS: WILL ADDRESS NEEDS IF NO DEAL SOON, Bbg

- STIMULUS RELIEF WON'T WAIT UNTIL JANUARY, Bbg

- The 2-Yr yield is unchanged at 0.139%, 5-Yr is up 0.8bps at 0.312%, 10-Yr is up 0.8bps at 0.7339%, and 30-Yr is up 0.8bps at 1.5134%.

US TSY FUTURES CLOSE: Risk-Off Unwound, Extend Lows Late

After a stronger open, Tsy futures ground steadily lower through the day, apparently over hopes of a stimulus deal in the near term despite the lack of progress over the last few weeks. Yld curves mixed, well off early flatter levels, update:

- 3M10Y +1.34, 63.249 (L: 58.513 / H: 63.581)

- 2Y10Y +1.03, 59.29 (L: 55.42 / H: 59.622)

- 2Y30Y +1.063, 137.304 (L: 132.158 / H: 137.637)

- 5Y30Y +0.067, 120.045 (L: 116.752 / H: 120.429)

- Current futures levels:

- Dec 2Y down 0.12/32 at 110-13.8 (L: 110-13.87 / H: 110-14.5)

- Dec 5Y down 1.75/32 at 125-26.75 (L: 125-26.5 / H: 125-31)

- Dec 10Y down 3.5/32 at 139-3.5 (L: 139-02 / H: 139-14)

- Dec 30Y down 8/32 at 175-4 (L: 175-01 / H: 176-10)

- Dec Ultra 30Y down 21/32 at 219-16 (L: 219-11 / H: 222-02)

US TSYS/SUPPLY: Preview Next Wk's Auctions

| DATE | TIME | AMT | SECURITY | CUSIP |

| 19-Oct | 1130ET | $54B | 13W-Bill | (9127963V9) |

| 19-Oct | 1130ET | $51B | 26W-Bill | (9127962Q1) |

| 20-Oct | 1130ET | $30B | 42D-Bill CMB | (912796TU3) |

| 20-Oct | 1130ET | $30B | 119D-Bill CMB | (9127964D8) |

| 21-Oct | 1130ET | TBA | 105D-Bill CMB | 20-Oct |

| 21-Oct | 1130ET | TBA | 154D-Bill CMB | 20-Oct |

| 21-Oct | 1300ET | $22B | 20Y-bond/R/O | (912810SQ2) |

| 22-Oct | 1130ET | TBA | 4W-Bill | 20-Oct |

| 22-Oct | 1130ET | TBA | 8W-Bill | 20-Oct |

| 22-Oct | 1300ET | $17B | 5Y-TIPS | (91282CAQ4) |

US EURODLR FUTURES CLOSE: Lead Qtrly EDZ0 Bid After 3M LIBOR All-Time Low Set'

Mostly steady in the short end to moderately weaker out the strip. Lead quarterly holds bid since 3M LIBOR fell to new all-time low: set' -0.01238 to 0.21775%** (-0.00638/wk). Latest lvls:

- Dec 20 +0.005 at 99.760

- Mar 21 steady at 99.795

- Jun 21 steady at 99.805

- Sep 21 steady at 99.805

- Red Pack (Dec 21-Sep 22) -0.015 to steady

- Green Pack (Dec 22-Sep 23) -0.02 to -0.01

- Blue Pack (Dec 23-Sep 24) -0.025 to -0.02

- Gold Pack (Dec 24-Sep 25) -0.035 to -0.03

USD LIBOR FIX

- O/N 0.08125 (0.00037)

- 1W 0.10150 (0.00162)

- 1M 0.14725 (0.0015)

- 2M 0.18550 (-0.00113)

- 3M 0.21775** (-0.01238)

- 6M 0.25325 (0)

- 12M 0.34775 (0.00375)

US TSY/STIR:

FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $54B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $163B

- Secured Overnight Financing Rate (SOFR): 0.09%, $885B

- Broad General Collateral Rate (BGCR): 0.06%, $34B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $326B

- (rate, volume levels reflect prior session)

FED: NY Operational Purchase

- TIPS 1Y-7.5Y, $2.401B accepted of $4.728B submission

- Next scheduled purchase:

- Fri 10/16 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

PIPELINE: Supra-Sovereigns Focus

Waiting for Ag Bank of China to price, otherwise it appears issuance is done for the day. Denmark short duration issue likely next week.

- Date $MM Issuer (Priced *, Launch #)

- 10/15 $900M *Bank of China Group Inv $400M 5Y +125, $500M 10Y +160

- 10/15 $850M #Ag Bank of China, $500M 3Y +90, $350M 5Y +100

- 10/15 $300M *Union Bank of Philippines 5Y +195

- 10/15 $500M *COFCO (HK) 10Y +150

- 10/?? $Benchmark Denmark short duration bond

FOREX: Dollar Buoyed as Stimulus Hopes Dashed

The dollar was the best performing currency in G10 Thursday, with a sharp pullback in equities (particularly European bourses) adding further pressure to risk assets and adding weight to the likes of AUD, NZD and NOK.

- While Trump said on Fox Business he'd go over $1.8trn on stimulus, he added that Pelosi has 'mental problems', leading markets further to believe there is little hope of a near-term stimulus deal.

- This led the USD to gain sharply, prompting the USD index to touch levels not seen since Wednesday last week - a move that further pressured equities and led European indices to shed as much as 2.5%. Poorer than forecast weekly initial jobless claims added weight to the move.

- Focus Friday turns to US retail sales and the prelim October Uni. of Michigan confidence data. Fed's Bullard and Williams are both due to speak.

EGB: Peripheries Fade As Safe Haven Buying Dominates

A relentless safe-haven bid saw Bunds and Gilts rally all session Thursday, while periphery EGBs weakened with spreads widening by the most in months. Concerns about the economic impact of regional lockdowns underpinned UK and German bull flattening, while the uncertainty over Brexit going into the European Council summit offered another risk-off driver.

- With little remaining in the data/speaker/supply calendar this week, most attention Friday will be on the Summit (which has already resulted in the EuCo adopting the expected language on UK-EU relations and talks not yet seeing "sufficient progress".

- Closing levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 2.3bps at -0.768%, 5-Yr is down 2.7bps at -0.791%, 10-Yr is down 2.9bps at -0.61%, and 30-Yr is down 4.1bps at -0.202%.

- UK: The 2-Yr yield is down 0.4bps at -0.052%, 5-Yr is down 1.6bps at -0.074%, 10-Yr is down 4bps at 0.18%, and 30-Yr is down 4.3bps at 0.724%.

- Italian BTP spread up 6.9bps at 130.7bps

- Spanish bond spread up 4.3bps at 75.9bps

- Portuguese PGB spread up 4.4bps at 75.6bps

- Greek bond spread up 8.4bps at 143.7bps

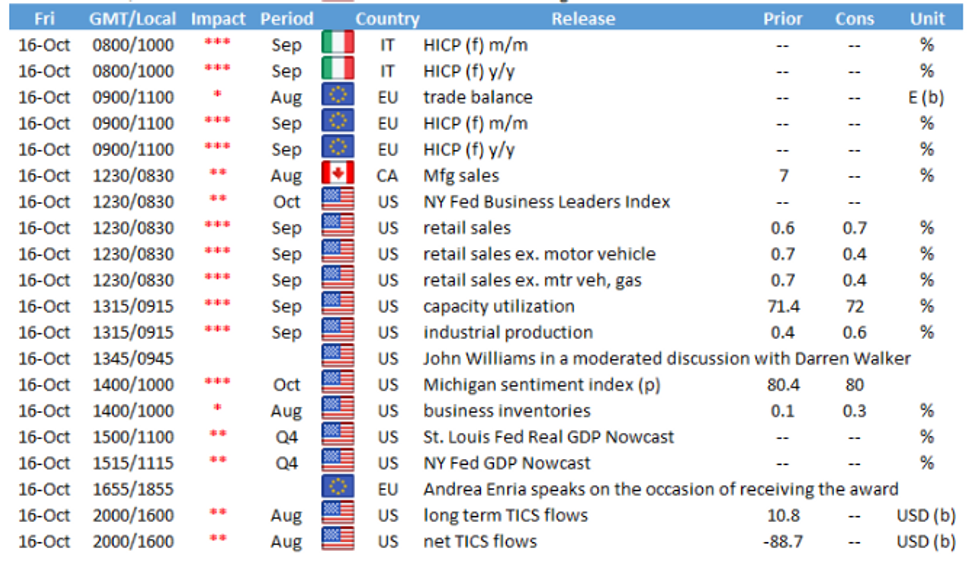

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.