-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: US Consumer Price Expectations Drop - New York Fed Survey

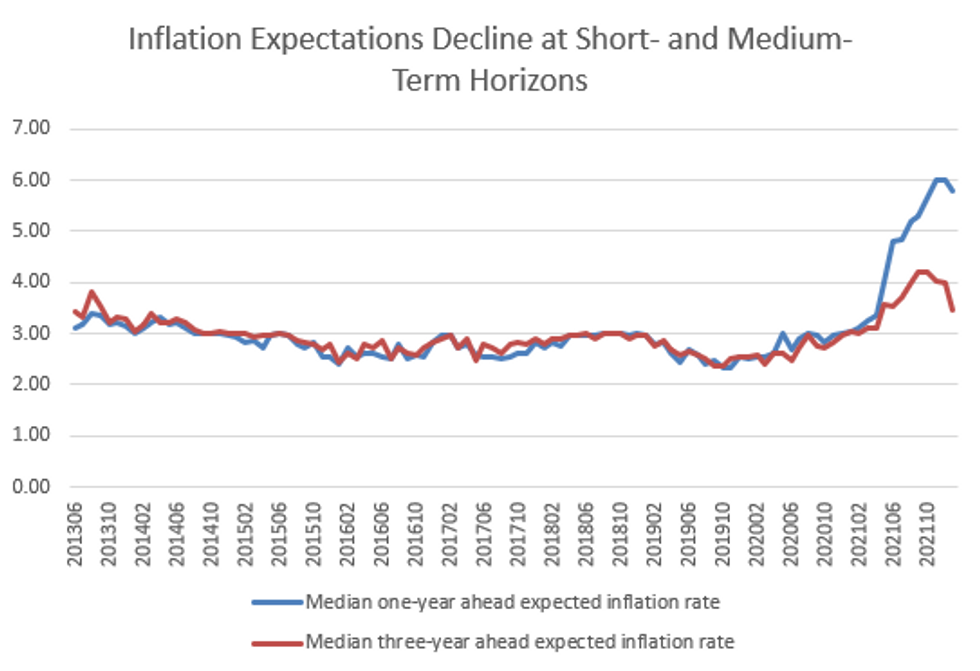

U.S. consumers’ inflation expectations dropped in January, with household estimates for short-term and medium -term price gains breaking momentum of a streak of gains since 2020, a survey showed, as the New York Fed said long-term price expectations remain stable.

The median inflation outlook for the next year dropped by 0.2 percentage point to 5.8%, the first decline in short-term inflation expectations since October 2020. The median three-year outlook for inflation showed a broad-based drop, decreasing 0.5 percentage points to 3.5%, the largest monthly decline in the measure since the inception of the survey in 2013.

In a separate blog released alongside the updated figures, authors, including New York Fed President John Williams, wrote that long-run inflation expectations remain stable. In figures not usually released monthly, they show that 5-year ahead price expectations fell to 3.0% in January from 3.2% in November 2021.

"While one-year-ahead and three-year-ahead expectations rose significantly during the pandemic, five year-ahead inflation expectations have remained remarkably stable. Taken together, these findings indicate that consumers are taking less signal than before the pandemic from inflation news in updating their longer-term expectations, and that they do not view the current elevated inflation as very long-lasting," Williams and his New York Fed co-authors wrote.

Fed officials have signaled they will likely lift interest rates from its near-zero setting in March, and ex-officials have tole MNI they expect front-loaded hikes at the next few FOMC meetings.

The New York Fed's January survey, which is based on a rotating panel of approximately 1,300 households, showed consumers are also slightly less optimistic about the labor market.

The perceived odds the U.S. unemployment rate will be higher one year from now increased by 0.7 percentage point to 35.9% and the perceived probability of finding a job declined to 55.6% from 57.5% in December, still above its 12-month trailing average of 53.5%.

Note: New York Fed Survey of Consumer ExpectationsSource: New York Federal Reserve

Note: New York Fed Survey of Consumer ExpectationsSource: New York Federal Reserve

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.