-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Morning FI Analysis: Focus Shifts To US CPI

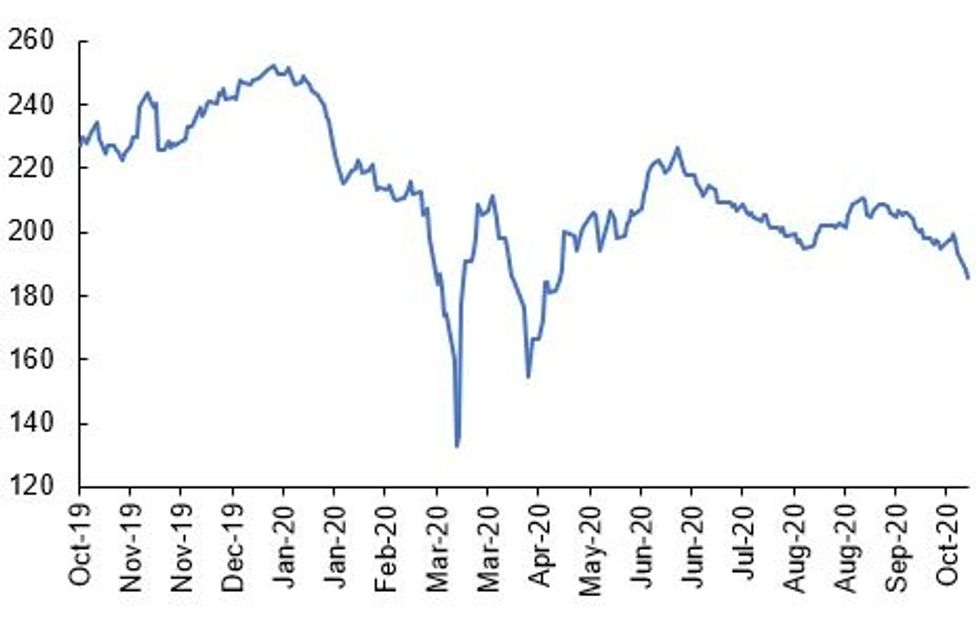

Fig 1. Italy 2s10s Spread, bp

Source: MNI/Bloomberg

US TSYS SUMMARY: Attention turns to US CPI

US Treasuries have traded in a tight 3 ticks range during our European session and within the overnight Asia price action.

- Contract have remained somewhat underpinned following J&J pausing vaccine study.

- Upside in TYZ0 has been limited, on option related delta hedged futures seller, on a large diagonal Risk reversal.

- US Equity earning season for Q3 is kicking off today, with Citi still to report next.

- US curve is leaning bull flatter, but the tight range in the long end has keep curve moves to a minimum.

- Looking ahead, US CPI is the highlight, while Fed's Barkin takes Part in a Virtual Discussion later today.

- 2y yields down -0.8bp today at 0.148%

- 5y yields down -1.6bp today at 0.322%

- 10y yields down -2.1bp today at 0.755%

- 30y yields down -2.7bp today at 1.547%-

- 2s10s down -1.3bp today at 60.7bp

- 10s30s down -0.5bp today at 79.3bp

BOND SUMMARY: EGB/GILT

It has been a relatively quiet session so far with price action contained in EGBs.

- The gilt curve has marginally bull flattened with cash yields 1-2bp lower. The Dec-20 gilt future trades at 135.59, 9 ticks off the day's low.

- Bunds are little change on the day. Last yields: 2-year -0.7351%, 5-year -0.7440%, 10-year -0.5455%, 30-year -0.1153%.

- OATs are similarly unch on the day and the curve trades flat.

- The BTP curve has flattened slightly on the back of the short end trading weaker and the longer end rallying. The 2s30s spread is 3bp narrower.

- Supply this morning came from the UK (Gilts, GBP4.25bn), Italy (BTPs, EUR7.5bn), Spain (Letras, EUR0.935bn), Netherlands (DSL, EUR2bn), Belgium (TCs, EUR1.845bn), Finland (bills, EUR1.981bn) and the ESM (bills, EUR1.5bn).

- UK labour market data showed larger than expected job losses in August (-153k vs -30k on a 3m/3m basis) with the unemployment rate inching up to 4.5% from 4.1% the previous month.

- The latest German ZEW print for October disappointed with the expectations component reading 56.1 vs 72.0 survey.

DEBT SUPPLY

GILT AUCTION RESULTS: DMO sells GBP1.25bln nominal of the 1.75% Jan-57 gilt

- Avg yld 0.796% (0.674%), bid-to-cover 2.41x (2.16x), tail 0.2bp (0.6bp) price 130.349 (135.138).

- Pre-auction mid-price 130.211

- An additional GBP312.5mln will be available through the PAOF to successful bidders until 14:30BST.

GILT AUCTION RESULTS: DMO sells GBP3.00bln nominal of the 0.125% Jan-26 gilt

- Avg yld 0.013% (-0.009%), bid-to-cover 2.45x (2.60x), tail 0.2bp (0.1bp) price 100.595 (100.718).

- An additional GBP750mln will be available through the PAOF to successful bidders until 13:00BST.

ITALY AUCTION RESULTS: Italy Sells E7.5bn of BTPs VS E6.0-7.5bn Target

- E3.75bn of 0.0% Jan-24 BTP: Average yield -0.14%, bid-to-cover 1.40x

- E2.25bn of 0.95% Sep-27 BTP: Average yield 0.34% (0.75%), bid-to-cover 1.76x (1.47x)

- E1.0bn of 2.45% Sep-50 BTP: Average yield 1.48% (1.91%), bid-to-cover 1.42x (1.39x)

DUTCH AUCTION RESULTS: The Netherlands Sells E2.0bn of the 0% Jan-27 DSL

- Average yield -0.624%

SPAIN AUCTION RESULTS: Spain sells E935mln of letras vs E500-1500mln target

- E435mln of the 3-month Jan 15, 2021: Ave yld -0.676%, bid-to-cover 5.98x

- E500mln of the 9-month Sep 7, 2021: Ave yld -0.589Y%, bid-to-cover 8.15x

BELGIUM AUCTION RESULTS: Belgium Sells E1.845bn of Bills Vs E1.6-2.0bn Target

- E0.605bn of Jan 14, 2021 TCs: Average yield -0.693%, bid-to-cover 3.6x

- E1.24bn of Sep 9, 2021 TCs: Average yield -0.647%, bid-to-cover 2.2x

FINLAND AUCTION RESULTS: Finland Sells E1.981bn of Treasury Bills

- E0.980bn of May 11, 2021 bills: Average yield -0.640%, bid-to-cover 1.83x

- E1.001bn of Aug 10, 2021 bills: Average yield -0.630%, bid-to-cover 1.63x

ESM AUCTION RESULTS: The ESM Sells E1.5bn of 12-Month Bills

- Average yield -0.61%, bid-to-cover 5.43x

OPTIONS

EGB OPTIONS: Bund upside buyer

RXX0 176c, bought for 5 in 5k

SHORT STERLING OPTIONS: interest in Blue structure

3LG1 99.62/99.37ps, bought for 2.75 in 15 (ref 99.85, 16 del)

EGB OPTIONS: Bobl/Schatz Bear Steepener

Bobl/Schatz conditional Bear steepener via option:

- OEZ0 135.25/135.00ps, bought for 8 in 5k

- OEZ0 135.50c, sold at 20 in 2k

- DUZ0 112.30/40 RR, sold the put at half in 5k

TECHS

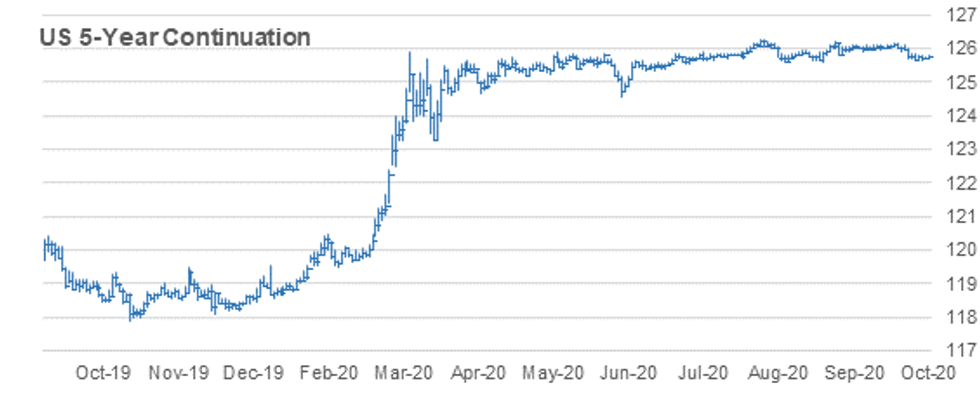

US 5YR FUTURE TECHS: (Z0) Bear Flag

- RES 4: 126-06+ High Sep 3 and the bull trigger

- RES 3: 126-046 High Sep 30

- RES 2: 125-292 50-day EMA

- RES 1: 125-272 High Oct 6

- PRICE: 125-24 @ 11:19 BST Oct 13

- SUP 1: 125-202 Low Oct 7 and the bear trigger

- SUP 2: 125-16+ 1.00 proj of Aug 4 - 13 sell-off from Sep 3 high

- SUP 3: 125-112 1.236 proj of Aug 4 - 13 sell-off from Sep 3 high

- SUP 4: 125-08 1.382 proj of Aug 4 - 13 sell-off from Sep 3 high

5yr futures traded sharply lower recently but have found room to consolidate. The recent pause has taken on the appearance of a bear flag formation. This is a continuation pattern and suggests that further bearish pressure is likely to dominate near-term. On Oct 7, futures probed key support at 125-216, Aug 28 low. This also reinforces bearish conditions and a clear break would open 125-16+, a Fibonacci projection. Resistance is at 125-272, Oct 6 high.

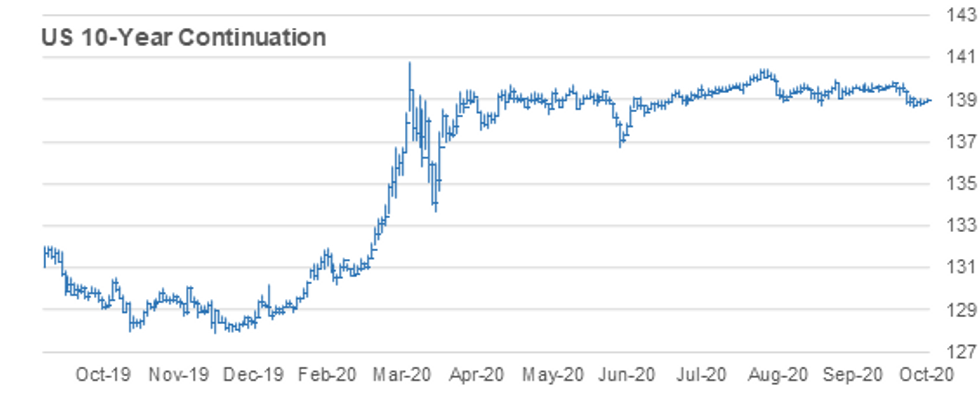

US 10YR FUTURE TECHS: (Z0) Eyeing Key Support

- RES 4: 139-29 High Sep 3 and the bull trigger

- RES 3: 139-26 High Sep 17

- RES 2: 139-09 50-day EMA

- RES 1: 139-06 High Oct 6

- PRICE: 138-30 @ 11:30 BST Oct 13

- SUP 1: 138-20+ Low Oct 7

- SUP 2: 138-18+ Low Aug 28 and the bear trigger

- SUP 3: 138-04+ 1.000 proj of Aug 4 - 28 sell-off from Sep 3 high

- SUP 4: 138-00 Round number support

Treasuries maintain a bearish stance. Futures have traded lower since Sep 29 but more recently, a consolidative tone has set in. This pause has taken on the appearance of a bear flag. This is a continuation pattern and suggests that bearish pressure is likely to dominate near-term. Attention is on the next major support at 138-18+, Aug 28 low and the bear trigger. A break would open 138-04+, a Fibonacci projection. 139-06, Oct 6 high is resistance.

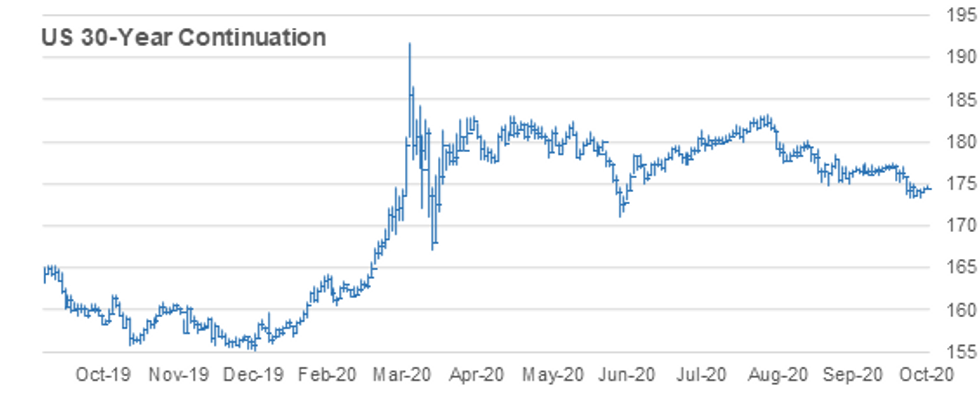

US 30YR FUTURE TECHS: (Z0) Bearish Focus

- RES 4: 177-14 High Sep 17

- RES 3: 177-00 High Oct 2

- RES 2: 176-11 50-day EMA

- RES 1: 175-03 High Oct 6

- PRICE: 174-17 @ 11:53 BST Oct 13

- SUP 1: 173-10 Low Oct 7 and the bear trigger

- SUP 2: 172-13 0.764 projection of Aug 6 - 28 decline from Sep 3 high

- SUP 3: 172-00 Round number support

- SUP 4: 170-16 1.00 projection of Aug 6 - 28 decline from Sep 3 high

30yr futures remain bearish. Price has recently traded sharply lower clearing a key support at 175-00, Sep 10 low. Last week futures probed major support at 173-16, Aug 28 low and the bear trigger. A clear break would confirm a resumption of the downleg that started on Aug 6 and open 172-13, a Fibonacci retracement. 175-03 is initial resistance with 177-00, Oct 2 high also providing a hurdle for bulls.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.