-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS -

MNI US MARKETS ANALYSIS - LOCKDOWN RETURNS

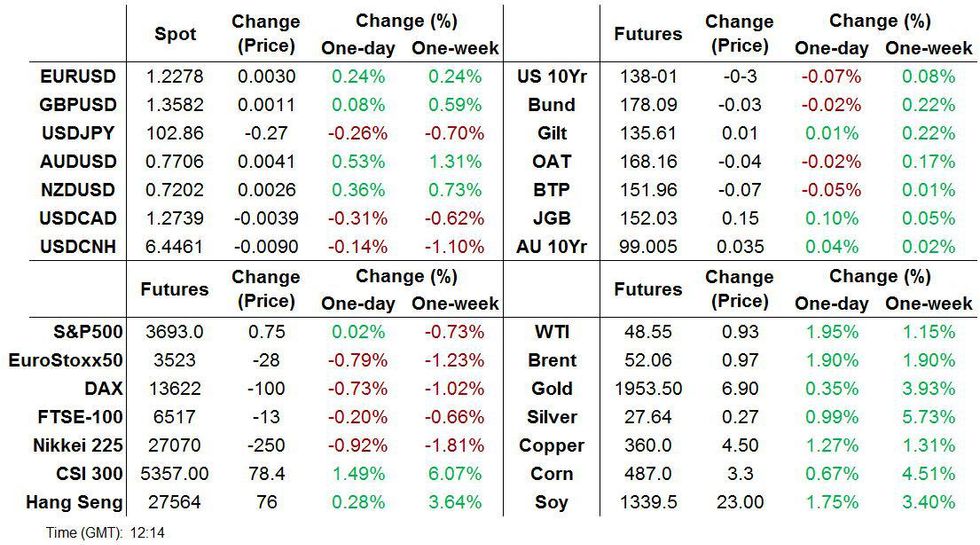

- Markets are mixed this morning with equities trading weaker, G10 FX gaining against the dollar, commodities pushing up and core European govies trading weaker.

- UK Chancellor of the Exchequer Rishi Sunak has announced a new support package for businesses after England was forced back into a national lockdown.

- Focus in the US remains on the Georgia election.

US TSYS SUMMARY: Edging Lower, With Georgia Elections Eyed

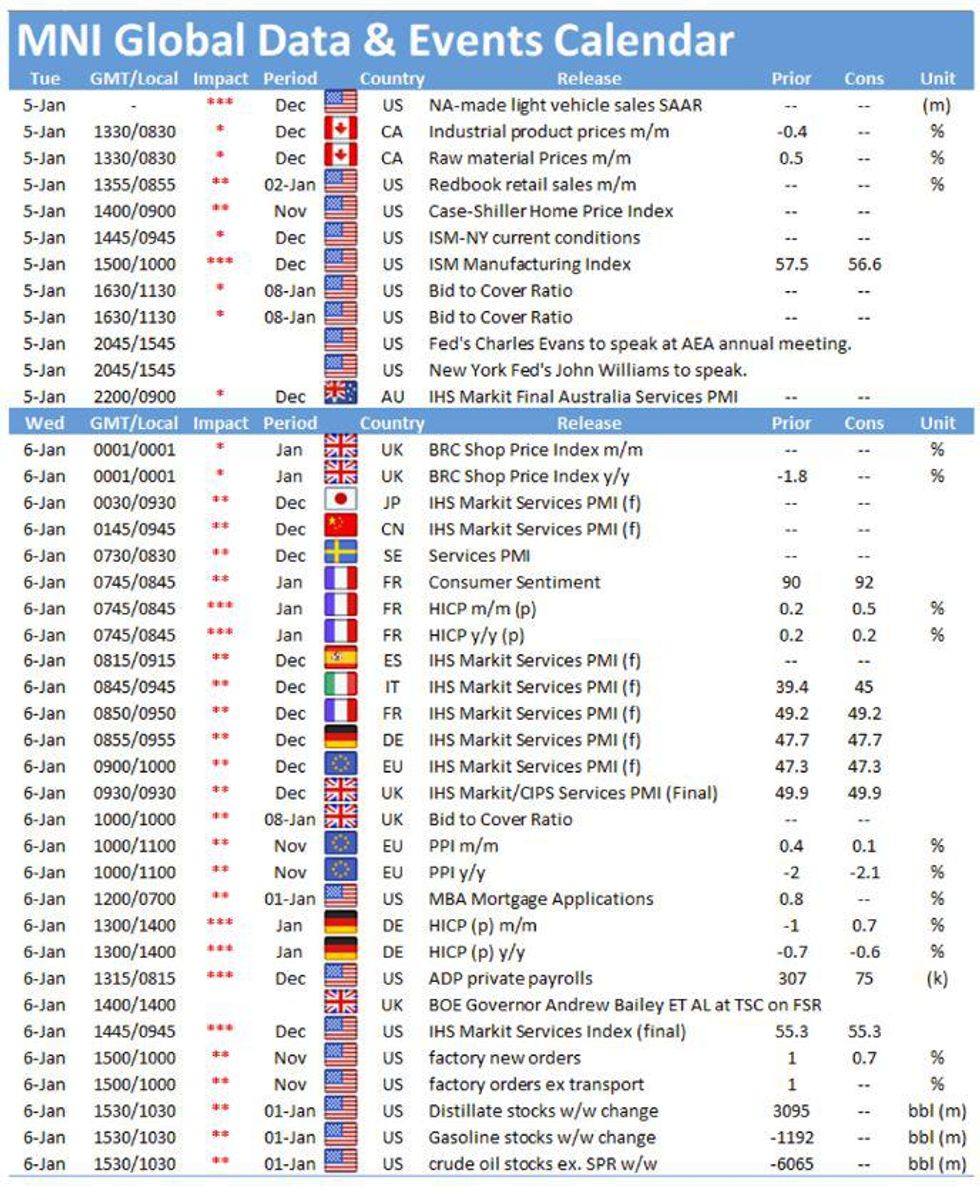

Treasuries have edged lower with bear steepening overnight on modest volumes, with election risk looming large and a fairly limited slate otherwise Tuesday.

- The 2-Yr yield is up 0.2bps at 0.1151%, 5-Yr is up 1.1bps at 0.3607%, 10-Yr is up 1.8bps at 0.9315%, and 30-Yr is up 2.3bps at 1.6784%.

- Mar 10-Yr futures (TY) down 4/32 at 138-00 (L: 137-31.5 / H: 138-05), ~175k traded.

- While we may not have a definitive result for a couple of days at least, focus is pretty clearly on tonight's Georgia Senate runoffs (polls open at 0700ET, close at 1900ET).

- UK betting odds imply 65% chance of Dems winning the Special runoff, 50/50 on the Regular runoff. In both cases we are at/near highest implied probabilities for Dem wins.

- Dec ISM Manufacturing is the only data point, at 1000ET.

- At 1545ET we hear from two Fed speakers: Chicago's Evans, and NY's Williams chairing an American Economic Association on the Monetary-Fiscal nexus (with text release).

- Supply consists of $60B of 42-/119-day bills, auction at 1130ET. NY Fed buys ~$1.750B of 20-30Y Tsys.

BOND SUMMARY: EGB/Gilt

European govies have traded weaker this morning with price action relatively contained thus far.

- Gilt yields are up to 1bp higher on the day with the curve marginally bear steepening.

- Bunds are similarly trading marginally below yesterday's close.

- OATs trade broadly in line with bunds. Last yields: 2-year -06755%, 5-year -0.6724%, 10-year -0.3588%, 30-year 0.3458%.

- BTP yields are 1bp higher on the day with the curve trading flat overall.

- UK Chancellor of the Exchequer Rishi Sunak today announced a new GBP4.6bn support package for UK businesses. This follows yesterday's announcement from PM Boris Johnson that England will re-enter a national lockdown in a bid to contain the coronavirus.

- Supply this morning came from Germany (Bubills, EUR4.84bn allotted), Belgium (TCs, EUR2.20bn), Greece (Bills, EUR812.5mn) and the ESM (Bills, EUR1.5bn).

- The economic data calendar was relatively light this morning. German retail sales were better than expected in November (5.6% Y/Y vs 4.0% survey).

GERMAN T-BILL AUCTION RESULTS: Germany allots E4.84bln of the 0% Dec-22 Schatz

- Average yield -0.73% (-0.78%)

- Buba cover 1.52x (2.29x)

- Bid-to-cover 1.22x (1.84x)

- Pre-auction mid-price 101.418

BELGIUM T-BILL AUCTION RESULTS: BELGIUM SELLS E2.20BN OF TCs VS E2.0-2.4BN TARGET

- E0.766bnbn of the Nov 12, 2020 TC: Average yield -0.574%, bid-to-cover 2.28x

- E1.435bn of the Jul 15, 2021 TC: Average yield -0.568%, bid-to-cover 1.64x

GREECE T-BILL AUCTION RESULTS: PDMA sold E812.5mln of 13-week bills

- Amount on offer E625mln (upsized by 30% due to non-competitive bids)

- Average yield -0.32% (-0.20%)

- Coverage ratio: 1.95x (2.10x)

- Maturity: Apr 9, 2021

ESM T-BILL AUCTION RESULTS: The ESM sells E1.5bln of 3-month bills

- Average yield -0.642% (-0.664%)

- Bid-to-cover 6.1x (6.68x)

- Maturity Apr 8, 2021

Slovenia dual-tranche update

- New 10-year

- Revised guidance: MS+20bp area (previous MS+25bp area).

- Books: E7.3bln ex JLM interest

- 0.4875% Oct-50

- Revised guidance: MS+45bp area (previous MS+ high 40bp area).

- Books: E2.1bln ex JLM interest

- Books subject at 10.45 GMT / 11:45 CET

- Today's business

KFW 10YR EUR Benchmark - Terms & Update #1

- Books over EUR 16bn excl. JLM interest

- Size set at EUR 5bn

- Spread set at MS-9 bps

- Books to close 10am LDN/ 11am CET

FOREX SUMMARY

A mix early start for FX today, with USD taking its cue from Equity price movements.

- USD remains in negative territory against all majors, ahead of the two Georgia Senate run-off.

- GBP trades within ranges, despite the UK new lockdown measures, more of a USD function.

- Cable is flat on the day at 1.3570.

- EURUSD tested session high at 1.2284, but still short of the big 1.2310 High Dec 30 and the bull trigger.

- We have a small triple top here, with the pair also printing 1.2309 on the 31st Dec and yesterday.

- Yuan has given back some of its overnight gains, which were driven by the NYSE scrapping plans to delist China's 3 biggest state owned communication firms.

- Overnight desk, noted USD local demand for the initial reversal.

- AUD is the best performer in G10 against the Greenback, up 0.69% at the time of typing.

- Looking ahead, US ISM Manufacturing is the data of note, and Fed Williams, Evans are the scheduled speakers.

- Short term focus (this week), is on the US election run-offs results.

Expiries for Jan05 NY cut 1000ET (Source DTCC)

- AUD/JPY: Y79.10-20(A$569mln-AUD puts)

- AUD/NZD: N$1.0485(A$960mln-AUD puts), N$1.0665(A$480mln-AUD puts)

- USD/CAD: C$1.2965-75($519mln)

TECHS: Price Signal Summary - Oil Stalls At Yesterday's High

- A strong start to 2021 for the E-Mini S&P contract yesterday found resistance at 3773.25. This level is the short-term bull trigger. Support to watch today is at 3651.00, Dec 23 low

- The trend remains bullish. On the cards, is $3819.10, 1.764 proj of the Sep 24 - Oct 12 - Oct 30 swing

- On the commodity front, Gold remains firm above $1900.0. The focus is on $1965.6, Nov 9 high and a key resistance. Both Brent and WTI stalled at their trading to fresh trend highs. In Japanese candle terms, yesterday's price pattern is a shooting star reversal.

- If correct, Brent (H1) support at $49.29, Dec 21/23 low is exposed. Key resistance is $53.33, Jan 4 high.

- In WTI (G1), risk is for weakness to $46.16, Dec 23 low and key support. Resistance is $49.83, Jan 4 high.

- In FX , the USD remains weak. The EURUSD bull trigger for today is at 1.2310, Dec 30 high. Potential is for 1.2380, 2.00 projection of the Nov 4 - 9 rally from the Nov 11 low. USDJPY targets 102.02, Mar 10 low following yesterday's fresh low print. In the EU FI space, Bund (H1) rallied yesterday and targets 178.44 next, Dec 21 high and a key near-term resistance. 135.99, Dec 14 is the next bull trigger in Gilts.

EQUITIES: Mixed Start To Tuesday Trade

- Asian stocks closed mixed, with Japan's NIKKEI down 99.75 pts or -0.37% at 27158.63 and the TOPIX down 3.37 pts or -0.19% at 1791.22. China's SHANGHAI closed up 25.719 pts or +0.73% at 3528.677 and the HANG SENG ended 177.05 pts higher or +0.64% at 27649.86

- European equities are likewise trading mixed, with the German Dax down 5.22 pts or -0.04% at 13726.74, FTSE 100 up 31.14 pts or +0.47% at 6571.88, CAC 40 down 1 pts or -0.02% at 5588.96 and Euro Stoxx 50 up 1.08 pts or +0.03% at 3564.39.

- U.S. futures are slightly higher, with the Dow Jones mini up 69 pts or +0.23% at 30172, S&P 500 mini up 8.75 pts or +0.24% at 3701, NASDAQ mini up 26.5 pts or +0.21% at 12711.75.

OPTION FLOW SUMMARY

- RXH1 177.5/176.5/176.0p ladder, bought for -1 in 1k vs 176.50/175ps 1x2, sold at 8 in 1k

- LM1 100.12c vs LU1 100.12/100.25cs, sold the June at 1 in 14k

- LU1 100.25/100.50cs, bought for 2.75 in 3k

- LH1 100.00/100.12cs 1x2, bought for 1 in 6k

- L M1 100.00/100.125/100.25cl fly, bought for 2.25 in 1k

- LM1 100.12/100.25/100.37c fly, bought for 1.5 in circa 10k

- LM1 100/100.12^^, sold at 8.5 in 1k

- SX7E June 75c, bought for 5.70 in 40k

- FVH1 126.25c, sold at '14 in 10k

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.