-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - A Weak Start

MNI US MARKETS ANALYSIS - A Weak Start

HIGHLIGHTS:

- A weak start for European government bonds and stocks

- Asia Covid Concerns & Israel-Palestine Conflict Add To Background Risk

- UK proceeds with lockdown easing plan

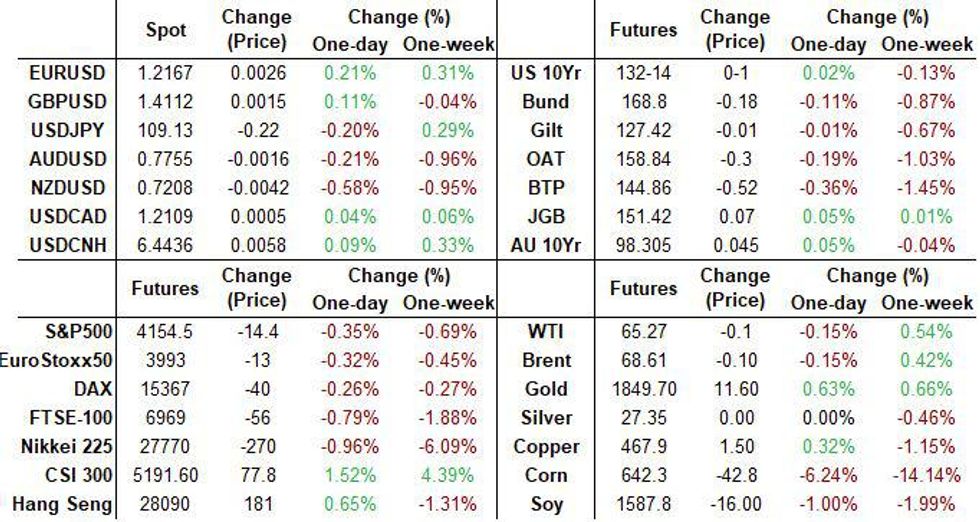

US TSYS SUMMARY: Bounce From Last Week's Lows Continues

Tsys are trading off the overnight session's best levels but continue to bounce from Thursday's low.

- Jun 10-Yr futures (TY) up 4.5/32 at 132-17.5 (L: 132-12 / H: 132-21.5) The 2-Yr yield is down 0.4bps at 0.143%, 5-Yr is down 1.1bps at 0.8016%, 10-Yr is down 1.2bps at 1.6165%, and 30-Yr is down 0.4bps at 2.3357%.

- Some focus overnight on Asia COVID concerns and Israeli-Palestinian tensions; muted reaction to soft Chinese econ data. Equity futures and the dollar trading weaker early.

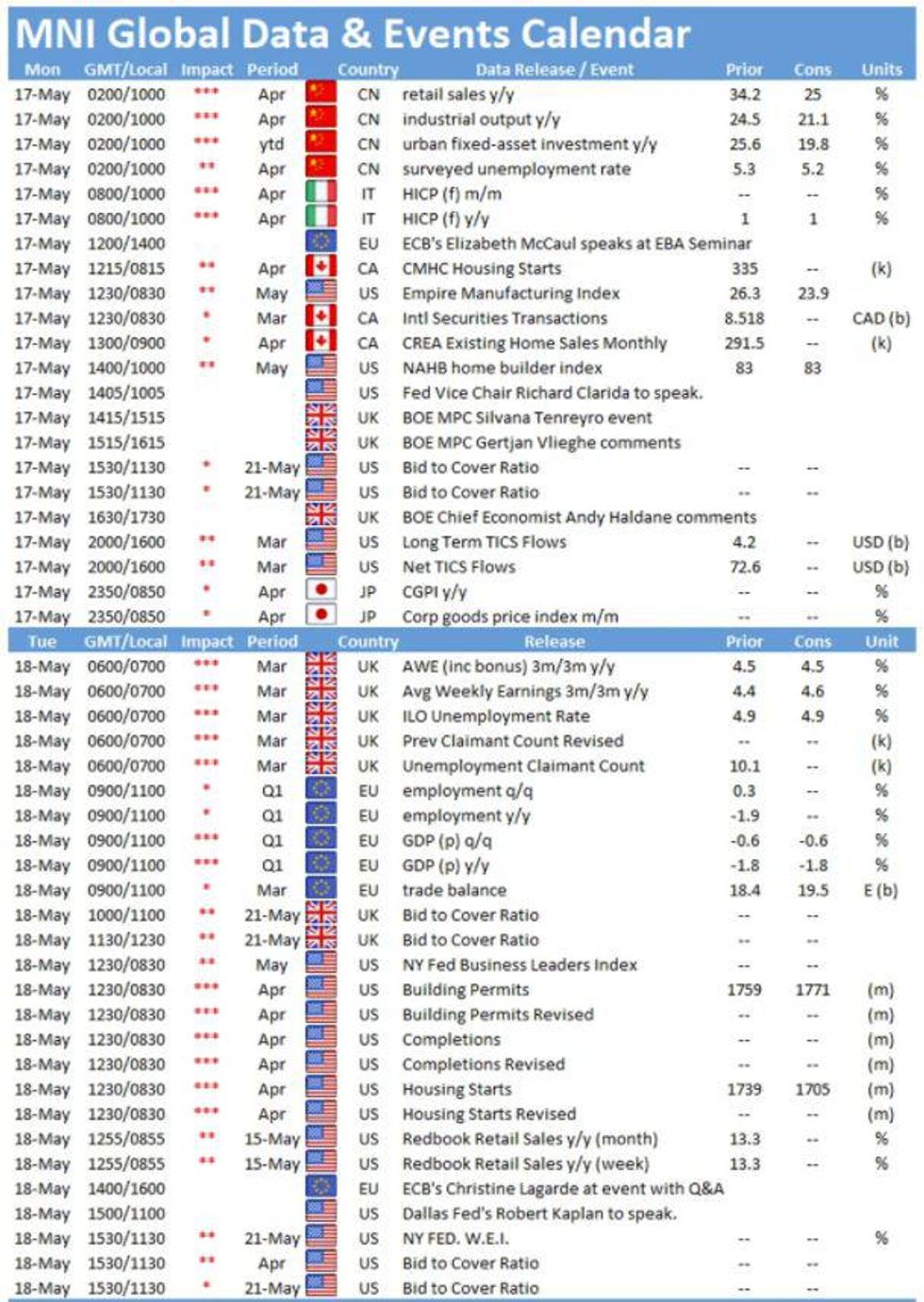

- Fed speakers today include VC Clarida (1005ET and again at 1025ET w Atlanta's Bostic), perhaps another opportunity to reflect on recent data. Dallas' Kaplan appears at 1800ET.

- A slow data calendar (esp compared to the excesses of last week), with May Empire Manuf. index at 0830ET, May NAHB Housing at 1000ET, and TIC flows at 1600ET.

- Pres Biden delivers remarks on the pandemic/vaccines at 1300ET.

- In supply, $111B combined of 13-/26-week bill auctions at 1130ET. NY Fed buys ~$1.425B of 10-22.5Y Tsys.

EGB/GILT SUMMary: Trading Weaker

Following an initially strong start to the week, European sovereign bonds have traded weaker through the morning alongside fresh downside for stocks.

- Gilts opened higher but have progressively sold off with yields now 1-2bp higher on the day and the curve close to flat overall.

- The bund curve has bear steepened with the 2s30s spread 2bp wider.

- OATs have slightly underperformed bunds with yields 1-3bp higher on the day.

- BTPs have underperformed core EGBs with cash yields 2-5bp higher and the curve 3bp steeper.

- Supply this morning came from Germany (Bubills, EUR5.89bn allotted), the Netherlands (DTCs, EUR2.34bn) and Slovakia (SlovGBs, EUR528.7mn).

EUROPE ISSUANCE UPDATE

GERMAN T-BILL AUCTION RESULTS: 5/11-month bubills

| Type | 5-month bubill | 11-month bubill |

| Maturity | Oct 27, 2021 | Apr 21, 2022 |

| Allotted | E2.951bln | E2.94105bln |

| Previous | E2.556bln | E2.367bln |

| Avg yield | -0.6313% | -0.6361% |

| Previous | -0.6328% | -0.6422% |

| Bid-to-cover | 1.85x | 1.71x |

| Previous | 1.16x | 1.84x |

| Buba cover | 1.88x | 1.74x |

| Previous | 1.36x | 2.34x |

| Previous date | Apr 19, 2021 | Apr 19, 2021 |

| Total sold | E3bln | E3bln |

DUTCH T-BILL AUCTION RESULTS: 3.5/5.5-month DTCs

| Maturity | Aug 30, 2021 | Oct 28, 2021 |

| Amount | E1.04bln | E1.3bln |

| Target | E1-2bln | E1-2bln |

| Previous | E1.28bln | E1.62bln |

| Avg yield | -0.631% | -0.625% |

| Previous | -0.625% | -0.610% |

| Bid-to-cover | 2.28x | 1.58x |

| Previous | 1.76x | 1.03x |

| Previous date | May 03, 2021 | May 03, 2021 |

SLOVAKIA AUCTION RESULTS: E528.7mln SlovGBs sold

| Coupon | 0.25% | 1.00% | 1.00% | 2.00% |

| Maturity | May-25 | Oct-30 | May-32 | Oct-47 |

| Instrument | SlovGB | SlovGB | SlovGB | SlovGB |

| Amount | E118.5mln | E114.0mln | E167.0mln | E129.2mln |

| Previous | E145.0mln | E142.0mln | E110.0mln | E110.0mln |

| Avg yield | -0.3964% | 0.1299% | 0.2521% | 1.0024% |

| Previous | -0.5722% | -0.0435% | 0.1040% | 0.7812% |

| Bid-to-cover | 2.08x | 1.25x | 1.66x | 1.35x |

| Previous | 2.55x | 1.86x | 4.68x | 1.50x |

| Price | 102.603 | 108.117 | 108.093 | 123.047 |

| Previous | 109.903 | 109.935 | 129.062 | |

| Pre-auction mid | 102.566 | 108.107 | 107.844 | 122.780 |

| Previous date | 19-Apr-21 | 19-Apr-21 | 15-Mar-21 | 19-Apr-21 |

*Previous results for 5-year are from auction of 0% Jun-24 SlovGB

FOREX: A Mixed Start For The USD

A mix start for the USD, after being better bid overnight, led by small risk off during the Asian session after Chinese data missed expectation.

- The dollar is up against most G10, besides the JPY, EUR and GBP.

- The British Pound has been supported, as the UK enters the next steps of re-opening when the rule of 6 ends.

- Groups of up to 6 people or people from two households can meet up indoors.

- Outdoors, groups of up to 30 are also allowed., a green light for pubs and restaurants to serve indoors, and hotels, museums, theaters, cinemas and stadiums are reopening.

- Kiwi is under pressure this morning, a continuation from the Asian session, with desk reporting leverage fund selling interest, unwinding some of last Friday's rally.

- NZD has since pared some of its overnight losses against the Dollar.

- But the Kiwi is till down 0.51% on the session, but off the lows.

- Further pullback would eye Friday's high at 0.7256 (0.7251 is today's high), now at 0.7212.

- Looking ahead, very little in terms of data, speakers include US Fed Clarida and Kaplan

FX Options: Expiries

- EURUSD: 1.2150 (1.94bn)

- AUDUSD 0.7755 (779mln), 0.7760 (621mln)

Price Signal Summary - Stocks Remain In An Uptrend

- In the equity space, the trend outlook remains bullish. S&P E-minis are holding onto recent gains. A key support has been defined at 4029.25, May 13 low. A break of this level would risk a deeper pullback. While it holds, the trend remains up.

- In the FX space, EURUSD recovered from last week's lows and remains above 1.1986, May 5 low. Key short-term support is 1.2052, May 13 low. The outlook is bullish while price remains above this support. GBPUSD is bullish following last week's gains. Attention is on 1.4237, Feb 24 high and this year's high. USDJPY support has been defined at 108.34, May 7 low. A bullish theme remains intact while it holds and attention is on 109.79, May 13 high. A break of support would highlight a trendline break drawn off the Jan 6 low and risk a deeper pullback.

- On the commodity front, Gold is climbing and remains bullish. The focus is on $1875.7, Jan 29 high. Oil is well off recent highs but the uptrend remains intact. The Brent (N1) focus is on the psychological $70.00 level and $71.75, Jan 8 2020 high (cont). Watch key support at $63.09, May 3 low. WTI bulls are eyeing the key resistance at $67.29, Mar 8 high. Key near-term support is at $63.09, May 3 low

- In the FI space, Bunds (M1) remain vulnerable and the risk is for a revisit of the 2020 lows at 167.52. A break of 168.59, May 13 low would trigger a resumption of the downtrend. Near-term risk in Gilts (M1) is still skewed to the downside. The key support and bear trigger is 126.79, Mar 18 low. BTPs (M1) remain in a clear downtrend and have extended lower. The focus is on 144.96, Sep 9, 2020 low (cont).

EQUITIES: US Futures Off Slightly

Asia COVID headlines overnight and weaker-than-expected Chinese economic data have kept a lid on equities so far to begin the week.

- Asia closes: Japan's NIKKEI down 259.64 pts or -0.92% at 27824.83 and the TOPIX down 4.56 pts or -0.24% at 1878.86. China's SHANGHAI closed up 27.24 pts or +0.78% at 3517.616 and the HANG SENG ended 166.52 pts higher or +0.59% at 28194.09

- Europe cash: with the German Dax down 44.84 pts or -0.29% at 15406.81, FTSE 100 down 50.2 pts or -0.71% at 7036.36, CAC 40 down 26.98 pts or -0.42% at 6380.21 and Euro Stoxx 50 down 15.33 pts or -0.38% at 4006.38.

- U.S. futures: Dow Jones mini down 119 pts or -0.35% at 34199, S&P 500 mini down 13.75 pts or -0.33% at 4155.25, NASDAQ mini down 52.5 pts or -0.39% at 13334.5.

COMMODITIES: Precious Metals In Focus

Precious metals have gained with the USD on the back foot Monday. Our tech analyst sees Silver bulls remaining in control, while Gold has retraced 3-month highs set this morning.

- WTI Crude down $0.09 or -0.14% at $65.52

- Natural Gas up $0.08 or +2.84% at $3.034

- Gold spot up $6.41 or +0.35% at $1853.69

- Copper up $2 or +0.43% at $466.2

- Silver up $0.21 or +0.77% at $27.7074

- Platinum up $3.54 or +0.29% at $1234.6

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.