-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Data Dependent

MNI US MARKETS ANALYSIS - Data Dependent

HIGHLIGHTS

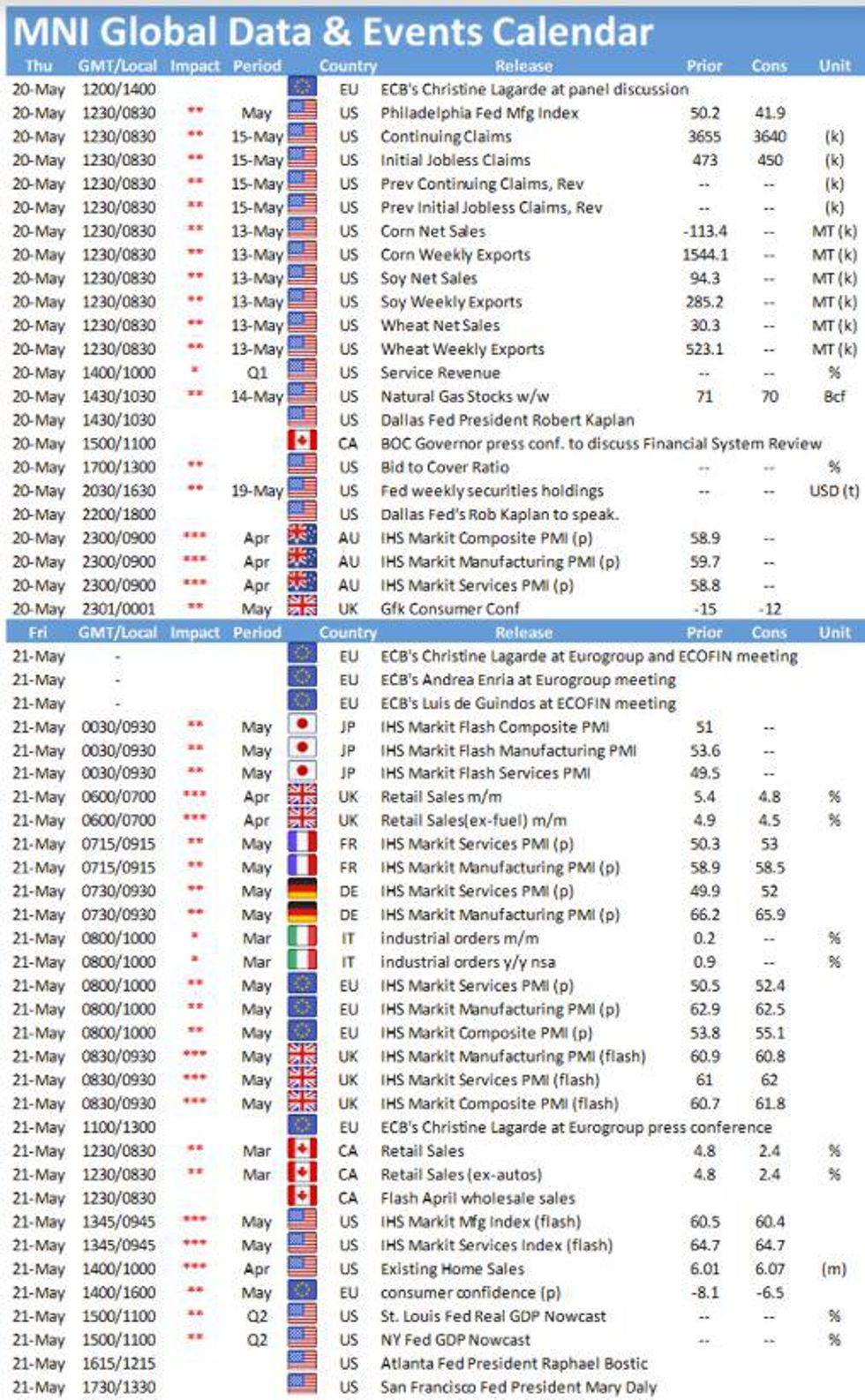

- The Philly Fed Survey & US Initial Jobless Claims Come Into Focus Today

- FI Price action has moderated somewhat following yesterday's volatility

- Tomorrow's preliminary PMI data for May will be eagerly awaited

US TSYS SUMMARY: Steady Gains For TYs Overnight Ahead Of Jobless Claims

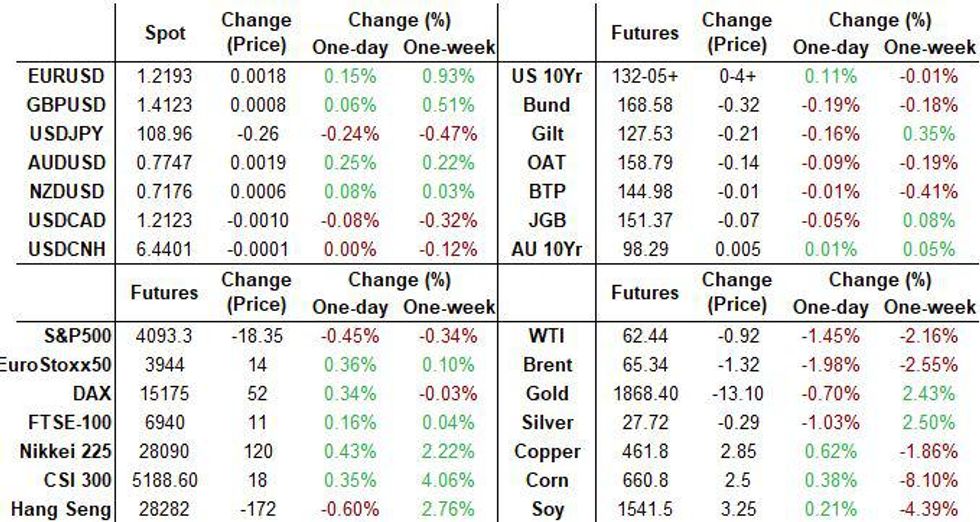

After a steady rise from Wednesday's lows through Thursday's overnight trade, TY's are pretty much where they were 24 hours ago despite a fair bit of price action in the interim.

- That said, the curve remains a little flatter vs 24 hours ago despite belly outperformance today (2s30s and 5s30s ~2bps lower vs 0630ET Weds). The 2-Yr yield is down 0.2bps at 0.1532%, 5-Yr is down 1.6bps at 0.8405%, 10-Yr is down 1bps at 1.6608%, and 30-Yr is down 0.7bps at 2.3626%.

- Jun 10-Yr futures (TY) up 5/32 at 132-6 (L: 132-01 / H: 132-09), normal volumes (~260k).

- Equities have retraced some of their overnight gains but holding above Wednesday's lows so far; dollar trading a little weaker.

- Data today centres around 0830ET's releases: jobless claims and May Philly Fed.

- As yesterday's FOMC minutes release continues to be digested, Dallas Fed's Kaplan (undoubtedly one of the "number of participants" that said it "might be appropriate at some point in upcoming meetings" to begin talking about a taper) takes part in a moderated discussion at 1030ET.

- Of possible interest on the fiscal front: Transport Sec Buttigieg testifies about infrastructure @ Senate Banking Committee at 1000ET.

- In supply, 1130ET sees $80B in 4-/8-week bills auctioned; $13B in 10Y TIPS at 1300ET. NY Fed buys ~$2.025B of 22.5-30Y Tsys.

EGB/GILT SUMMARY: Broadly Weaker

European government bonds have broadly traded weaker this morning with equities mixed.

- Gilt yields are 1-2bp higher with the curve similarly 1-2bp steeper.

- German bond yields are also 1-2bp lower with the belly of the curve slightly underperforming on the day.

- OATs sold off early in the session before recovering losses and trading back near yesterday's closing levels.

- The short-end/belly of the BTP curve is flat on the day, while the longer end is a touch firmer with yields 1bp lower.

- Supply this morning came from France (OATs, EUR10.491bn, Linkers, EUR2.979bn), Spain (Bonos/Oblis, EUR5.386bn) and Ireland (IRTBs, EUR0.75bn).

EUROPEAN ISSUANCE UPDATE

FRANCE AUCTION RESULTS: MT OATs

| 0% Feb-24 OAT | 0% Feb-27 OAT | 0.75% Nov-28 OAT | |

| Amount | E4.789bln | E3.297bln | E2.405bln |

| Previous | E3.04bln | E4.30bln | E2.25bln |

| Avg yield | -0.53% | -0.19% | -0.03% |

| Previous | -0.61% | -0.36% | -0.46% |

| Bid-to-cover | 2.49x | 2.32x | 2.28x |

| Previous | 2.70x | 2.21x | 2.08x |

| Price | 101.470 | 101.080 | 105.860 |

| Previous | 101.740 | 102.150 | 109.670 |

| Pre-auction mid | 101.447 | 101.023 | 105.792 |

| Previous date | 22-Apr-21 | 22-Apr-21 | 21-Jan-21 |

New 10y OATi / 15y OATei tap

| 0.10% Mar-32 OATi | 0.10% Jul-36 OATei | |

| Amount | E2.029bln | E0.950bln |

| Previous | E0.42bln | |

| Avg yield | -1.010% | -0.960% |

| Previous | -1.140% | |

| Bid-to-cover | 1.89x | 2.32x |

| Previous | 3.18x | |

| Price | 112.680 | 117.340 |

| Previous | 121.410 | |

| Pre-auction mid | 117.133 | |

| Previous date | 19-Nov-20 |

SPAIN AUCTION RESULTS: 3/7y Bonos / 10y Obli

| 0% May-24 Bono | 0% Jan-28 Bono | 0.10% Apr-31 Obli | |

| Amount | E1.723bln | E1.677bln | E1.986bln |

| Previous | E1.79bln | E2.13bln | E2.23bln |

| Avg yield | -0.356% | 0.171% | 0.598% |

| Previous | -0.411% | -0.035% | 0.368% |

| Bid-to-cover | 1.78x | 1.78x | 1.77x |

| Previous | 2.50x | 1.75x | 1.92x |

| Price | 101.083 | 98.860 | 95.205 |

| Previous | 101.283 | 100.242 | 97.363 |

| Pre-auction mid | 101.045 | 98.777 | 95.060 |

| Previous date | 22-Apr-21 | 08-Apr-21 | 22-Apr-21 |

IRELAND AUCTION RESULTS: E750mln 5-month IRTB

| Type | 5-month ITB |

| Maturity | Oct 25, 2021 |

| Amount | E750mln |

| Target | E750mln |

| Previous | E750mln |

| Avg yield | -0.605% |

| Previous | -0.602% |

| Bid-to-cover | 2.1x |

| Previous date | Apr 15, 2021 |

FOREX - Dollar Mixed

A mixed session for the Dollar in early trade.

- Early flow, price action saw some rounds of USD selling as we started the European session.

- USD was already underperforming against G10s overnight, but some small continuation early on.

- USD broke out of the tight ranges to fades yesterday's price action, but nonetheless still within ranges.

- The USD tested session low against EUR, GBP, AUD, CAD, and JPY.

- The small resistance in EURUSD which moved down To 1.2202 held for now, printing a 1.2205 high.

- Above the latter would open to double top at 1.2245 (April and May's high)

- GBP came under pressure, but no clear driver on the latest leg lower, besides some dip lower in yields, as well as some reversal in USD.

- Safe haven FX are in the green with risk better offered and lower yields. CHF and JPY are up 0.25% and 0.22% respectively.

- Looking ahead, US IJC is the notable release.

- Speakers include ECB Lane, Lagarde, Holzmann,,Fed Kaplan.

- BUT all attention is turning to Global prelim PMI releases tomorrow

FX OPTION EXPIRY

FX OPTION EXPIRY (updated). Some chunky ones.

Of note:

EURUSD: 2.58bn between 1.2160-1.2195

AUDUSD: 3.21bn between 0.7730-0.7785.- EURUSD: 1.2160 (916mln), 1.2175 (1.28bn), 1.2195 (390mln), 1.2220 (336mln)

- USDJPY: 108.50 (385mln), 108.65 (532mln), 108.75 (268mln), 109 (372mln), 109.10 (264mln)

- AUSUSD: 0.7700 (391mln), 0.7730 (502mln), 0.7735 (445mln), 0.7760 (834mln), 0.7765 (265mln), 0.7775 (792mln), 0.7785 (374mln), 0.7800 (354mln)

- USCAD: 1.2130 (338mln)

Price Signal Summary - Equities And Oil Test The 50-Day EMA

- In the space, S&P E-minis have moved away from Tuesday's high print of 4179.50. Futures have also tested the 50-day EMA at 4074.26 which represents an important support area. Last week's low of 4029.25 however marks the key short-term support.

- In the FX space, EURUSD traded higher yesterday and probed key resistance at 1.2243, Feb 25 high. An extension higher would open 1.2285, Jan 8 high. GBPUSD remains bullish following last week's gains. Attention is on 1.4237, Feb 24 high and this year's high. USDJPY support has been defined at 108.34, May 7 low. A bullish theme remains intact while it holds and attention is on 109.79, May 13 high. A break of 108.34 would highlight a trendline break drawn off the Jan 6 low and risk a deeper pullback.

- On the commodity front, Gold remains bullish. The focus is on$1892.7, 76.4% retracement of the Jan 6 - Mar 8 sell-off. Oil is off recent highs. Brent (N1) has tested its 50-day EMA. Yesterday's low of $65.30 marks the key short-term support. WTI has entered a corrective phase. Key near-term support is $61.95, yesterday's low.

- In the FI space, Bunds (M1) traded lower yesterday and cleared support at 168.59, May 13 low. This confirms a resumption of the underlying downtrend and opens 168.09, 0.764 projection of the Jan 27 - Feb 25 - Mar 25 price swing. Near-term risk in Gilts (M1) is still skewed to the downside. The key support and bear trigger is 126.79, Mar 18 low. BTPs (M1) remain in a clear downtrend. The focus is on 144.16, 1.236 projection of the Feb 12 - 26 - Mar 11 price swing.

EQUITIES: Markets mixed in European trading

| Japan's NIKKEI up 53.8 pts or +0.19% at 28098.25 and the TOPIX up 0.68 pts or +0.04% at 1895.92 |

| China's SHANGHAI closed down 4.021 pts or -0.11% at 3506.944 and the HANG SENG ended 143.52 pts lower or -0.5% at 28450.29 |

| German Dax up 24.98 pts or +0.17% at 15139.14, FTSE 100 down 12.48 pts or -0.18% at 6937.66, CAC 40 up 18.73 pts or +0.3% at 6281.28 and Euro Stoxx 50 up 10.36 pts or +0.26% at 3947.1. |

| Dow Jones mini down 182 pts or -0.54% at 33649, S&P 500 mini down 22.25 pts or -0.54% at 4089.5, NASDAQ mini down 68.25 pts or -0.52% at 13167.25. |

COMMODITIES: Divergence: Platinum up but oil, copper, gold lower

- WTI Crude down $1.07 or -1.69% at $62.29

- Natural Gas up $0.01 or +0.2% at $2.973

- Gold spot down $1.83 or -0.1% at $1867.16

- Copper down $1.05 or -0.23% at $456.75

- Silver down $0.12 or -0.42% at $27.6007

- Platinum up $4.88 or +0.41% at $1199.5

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.