-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - BoE Critisised On QE And Inflation

MNI US MARKETS ANALYSIS - BoE Critisised On QE And Inflation

HIGHLIGHTS:

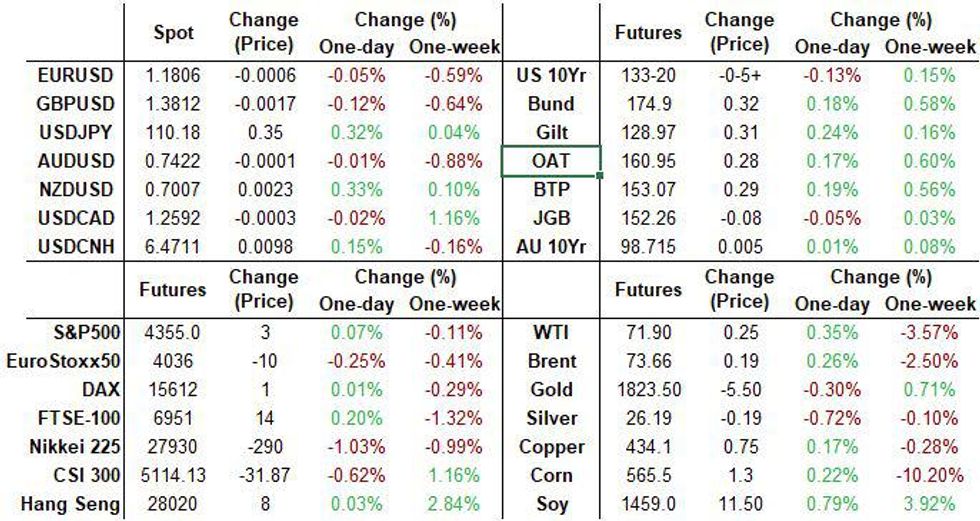

- European government bonds have broadly firmed while USTs have traded weaker overnight

- The Lords Economic Affairs Committee argued that the BoE has not sufficiently justified why inflation will be temporary

- Focus later today will be on US retail sales and the Uni. Michigan consumer confidence data.

US TSYS SUMMARY: Bear Steepening Overnight, With Retail Sales Ahead

Treasuries have weakened with the curve steepening in overnight trade, underperforming European core FI but in line with modest JGB declines. Retail sales data coming up.

- Sep 10-Yr futures (TY) down 5.5/32 at 133-20 (L: 133-17.0 / H: 133-25.5) No particular macro drivers, and low-ish volumes (~220k front TYs traded). Equities bouncing a little.

- The 2-Yr yield is up 1.1bps at 0.2336%, 5-Yr is up 2.1bps at 0.7959%, 10-Yr is up 2.3bps at 1.3221%, and 30-Yr is up 3.2bps at 1.9525%.

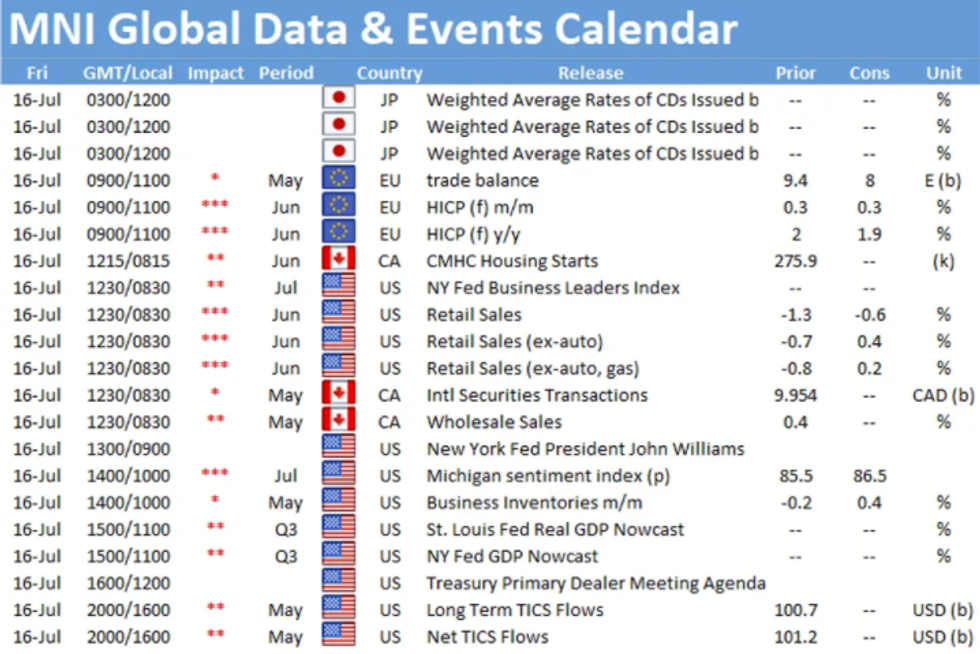

- June retail sales data at 0830ET is expected to see another monthly decline (-0.3% M/M vs -1.3% prior) as stimulus effects fade and auto sales abate. Ex-auto seen +0.4% M/M (-0.7% prior), ex-auto and gas +0.5% (-0.8% prior).

- UMich sentiment and business inventories out at 1000ET, TIC flows out later at 1600ET.

- NY Fed's Williams speaks at 0900ET, but as a "culture in the workplace" event that may have little current monetary policy content.

- No supply. NY Fed buys ~$3.225B of 7-10Y Tsys.

EGB/GILT SUMMARY: BOE Faces Criticism On Inflation

Gilts and EGBs have broadly traded higher this morning alongside uneven trading in equities.

- Gilts have firmed with cash yields 2bp lower across the curve.

- Bunds have slightly lagged on the day with yields broadly 1bp lower.

- It is a similar story for OATs where the curve is 1bp flatter on the day.

- The Lords Economic Affairs Committee has argued that the Bank of England has failed to justify its QE policy and needs to provide more justification for believing that the recent surge in inflation is temporary. This follows on the heels of comments yesterday from the BoE's Saunders who suggested that the central bank could soon have to curtail the pandemic stimulus.

- The UK's Chief Medical Officer, Chris Whitty, has warned that the UK is "not out of the woods yet" at a time when the government is moving forward with reopening the economy alongside rising infections.

- Supply this morning came from the UK (T-Bills, GBP3.0bn).

European Issuance Update

UK AUCTION RESULTS: DMO sells GBP3.0bln of 1/3/6-month UKTBs

| Tenor | 1-month | 3-month | 6-month |

| Maturity | Aug 16, 2021 | Oct 18, 2021 | Jan 17, 2022 |

| Amount | GBP0.5bln | GBP1bln | GBP1.5bln |

| Previous | GBP0.5bln | GBP1.0bln | GBP1.5bln |

| Avg yield | 0.0066% | 0.0240% | 0.0212% |

| Previous | 0.0186% | 0.0237% | 0.0259% |

| Bid-to-cover | 4.27x | 2.67x | 3.83x |

| Previous | 4.27x | 2.86x | 4.08x |

| Next week | GBP0.5bln | GBP1.0bln | GBP1.5bln |

FOREX - Busy GBP

- USD stays mixed since the cash Govie open.

- The standout overnight has been the Kiwi, up now 0.50%, but just off its best levels, after the New Zealand second quarter inflation broke through the CB's range.

- This saw Westpac changing their calls, to a punchy three 25bps hikes this year (August, October, November).

- Initial upside resistance in NZDUSD is seen at 0.7045.

- Most of the morning action was in the Pound, with another round of selling hitting the Pound, and Cable traded below 1.3800, Tuesday's low.

- Delta variant spike and a mess with the NHS Covid app, is weighted on the British Pound, with the country set to fully re-open on the 19th.

- Desk reported some demand below 1.3800, and Cable faded all the early losses to trade at session high 1.3862.

- There was no clear catalyst, but market participants still favour fading the bid, and we now trade at 1.3831.

- Looking ahead, US Retail sales in the notable data. US Fed Williams (Voter, leaning Dove) is the scheduled speaker.

- At 12.30BST/07.30ET: The President participates in the Asia-Pacific Economic Cooperation Leaders' Virtual Retreat,

FX OPTION EXPIRY

FX OPTION EXPIRY:

Of note: Would have been the 3.73bn at 1.2500 in USDCAD, but looks a little too far.- EURUSD; 1.1800 (848mln)

- USDJPY: 110 (488mln)

- GBPUSD: 1.3835 (369mln)

- USDCAD: 1.2500 (3.73bn)

- NZDUSD: 0.7000 (407mln)

Price Signal Summary - S&P E-Minis Pullback Likely A Correction

- In the equity space, bullish conditions remain intact in the S&P E-minis and pullback this week is considered corrective. Attention is on 4400.00 next. Key support is at 4279.25, Jul 8 low. EUROSTOXX 50 futures remain above last week's low of 3951.50. The contract has so far failed to challenge initial resistance at 4101.50, Jul 1 high where a break would neutralise recent bearish price signals and signal scope for a stronger recovery.3951.50, Jul 8 low is key support.

- In FX, the USD outlook remains bullish. The EURUSD needle still points south. The focus is on 1.1704, Mar 31 low. Gains are considered corrective with resistance at 1.1881, Jul 9 high. GBPUSD remains vulnerable. The focus is on support and a bear trigger at 1.3733, Jul 2 low. The 50-day EMA offers resistance and intersects at 1.3933. USDJPY failed to hold onto Wednesday's high and challenge resistance at 110.82, Jul 7 high. The reversal lower Wednesday suggests the recent 3-day recovery has been a correction and is over. Support at 109.53, Jul 8 low appears exposed.

- On the commodity front, Gold has this week cleared the 50-day EMA. The break higher strengthens bullish conditions with attention on $1833.7 (tested yesterday) and $1853.3, 50.0% and 61.8% retracement levels of the Jun 1 - 29 decline. Brent (U1) futures attention is on support at $72.11, Jul 8 low. A break would be bearish. WTI (Q1) key support to watch is at 70.76, Jul 8 low.

- Within FI, Bund futures recovered off Wednesday's low. Conditions remain bullish and 174.77, Jul 8 high and the bull trigger has been probed. A clear break would open 174.97 next, Mar 3 high (cont). Gilt futures traded lower yesterday. Broader conditions are bullish and the recent pullback is considered corrective. Attention is on 129.92, Jul 8 high and the bull trigger. Support to watch is 128.54/39, Jul 14 low and the Jun 11 high and recent breakout level.

EQUITIES: Mixed to lower moves for indices

- Japan's NIKKEI down 276.01 pts or -0.98% at 28003.08 and the TOPIX down 7.42 pts or -0.38% at 1932.19.

- China's SHANGHAI closed down 25.286 pts or -0.71% at 3539.304 and the HANG SENG ended 8.41 pts higher or +0.03% at 28004.68.

- German Dax down 8.63 pts or -0.06% at 15622.99, FTSE 100 up 13.55 pts or +0.19% at 7025.06, CAC 40 down 31.42 pts or -0.48% at 6459.95 and Euro Stoxx 50 down 11.93 pts or -0.29% at 4046.01.

- Dow Jones mini up 4 pts or +0.01% at 34867, S&P 500 mini up 2.5 pts or +0.06% at 4354.75, NASDAQ mini up 12 pts or +0.08% at 14800.25.

COMMODITIES: Oil up but metals down

- WTI Crude up $0.27 or +0.38% at $71.91

- Natural Gas down $0.02 or -0.42% at $3.599

- Gold spot down $6.51 or -0.36% at $1823.25

- Copper down $1 or -0.23% at $431.5

- Silver down $0.22 or -0.85% at $26.1282

- Platinum down $6.74 or -0.59% at $1136.06

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.