-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Advance GDP, Tech Earnings at Forefront

Highlights:

- Treasuries sit modestly weaker ahead of advance Q1 GDP and earnings deluge

- Risk events back-loaded this week, with BoJ decision, various Eurozone growth and inflation metrics due Friday

- Amazon and Intel reports on tap

US TSYS: Modestly Cheaper Awaiting GDP Q1 Advance, Further Earnings

- Cash Tsys sit near the middle of the overnight range as they hold modestly cheaper levels from Wednesday’s close. Today sees particularly heavy earnings (latest Caterpillar beating adj EPS estimates with $4.91 vs $3.82) with Amazon the largest by market cap coming after the close.

- The regular session is headlined by the GDP Q1 advance (cons 1.9%, latest GDPNow 1.1%) after recent retail sales downward revisions plus its clues for tomorrow’s March core PCE deflator, but also sees 7Y supply.

- 2YY +1.2bp at 3.963%, 5YY +0.9bp at 3.493%, 10YY +0.9bp at 3.458% and 30YY +1.9bp at 3.722%

- TYM3 trades 6 ticks lower at 115-11+ on average volumes. An earlier low of 115-06+ inched closer to support at the 20-day EMA of 115-00+.

- Data: GDP/PCE Q1 advance (0830ET), weekly jobless claims (0830ET), Pending home sales Mar (1000ET), Kansas City Fed mfg index Apr (1100ET).

- Note/bond issuance: US Tsy $35B 7Y note auction (91282CGZ8) – 1300ET

- Bill issuance: US Tsy $50B 4W, $45B 8W bill auctions – 1130ET

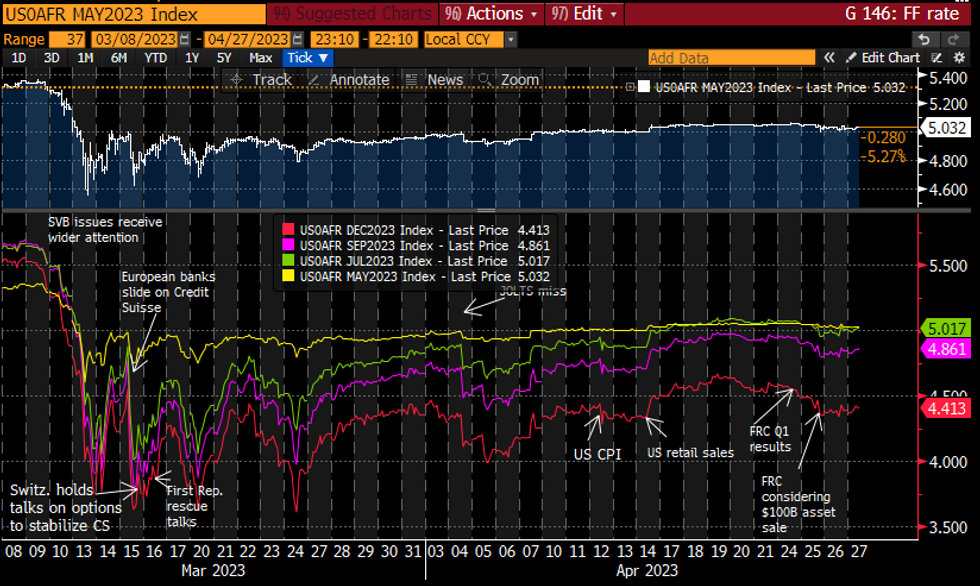

STIR FUTURES: Fed Rate Path Slowly Unwinding Prior FRC-Boosted Decline

- Fed Funds implied rates have pushed higher in European hours to continue yesterday’s recovery after sliding Tue with a helping hand from First Republic Bank considering an asset sale.

- 20bp hike for next week’s FOMC (+0.5bp) and cumulative 25bp hike for Jun (+1bp) which is then almost fully reversed by Sep before 19bp of cuts from current levels to 4.64% in Nov (+2bp) and a total 42bp of cuts to 4.41% Dec (+2bp).

- GDP Q1 advance in focus today (cons 1.9%, latest Atlanta Fed GDPNow 1.1%) after recent retail sales revisions plus its clues for tomorrow’s March core PCE deflator.

Source: Bloomberg

Source: Bloomberg

EUROPE ISSUANCE UPDATE:

Italy auction results

- E2.5bln of the 3.40% Apr-28 BTP. Avg yield 3.77% (bid-to-cover 1.6x).

- E5bln of the 4.35% Nov-33 BTP. Avg yield 4.42% (bid-to-cover 1.32x).

- E1.5bln of the 0.80% Oct-28 CCTeu. Avg yield 4.45% (bid-to-cover 1.75x).

- E160mln of the 0.875% Sep-25 RFGB. Avg yield 2.78% (bid-to-cover 1.47x).

- E209mln of the 0.50% Sep-29 RFGB. Avg yield 2.87% (bid-to-cover 4.23x).

FOREX: USD Index Sits at Midpoint of Week's Range Ahead of Key Data

- The USD Index is sticking to the midpoint of the week's range headed through to the NY crossover, as markets tread water ahead of a busy Friday session: both the BoJ decision and a large number of CPI and GDP releases from across the Eurozone are scheduled to round off the week.

- The JPY is the poorest performer on the day, helped by the recovery off yesterday's lows in USD/JPY at 133.01. The move has been aided by a pause in the pullback for equities, as the e-mini S&P bounces off yesterday's bearish close. The BoJ decision on Friday could be key for short-term sentiment. Consensus looks for no change due to the relatively short period of time that has elapsed since Ueda took up his new post as well as existing BoJ forward guidance, the underlying BoJ view on inflation and continued jitters surrounding the U.S. banking sector. There may be a tweak to the forward guidance, removing the reference to COVID-19, but that shouldn’t be viewed as substantial, if it is indeed forthcoming.

- NZD takes up the top spot on an intraday basis, putting NZD/USD through yesterday's high and within range of the 200-dma to the upside at 0.6161.

- Later today, US data takes focus, with advanced US GDP for Q1 the highlight, ahead of pending home sales and the Kansas City Manufacturing Index. ECB's Panetta is the sole speaker today, commenting on the future of the digital Euro just after the European close.

FX OPTIONS: Expiries for Apr27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0750(E1.1bln), $1.0830(E635mln), $1.0900(E723mln), $1.0975(E585mln), $1.1000(E779mln), $1.1040(E1.1bln), $1.1125-26(E650mln)

- USD/JPY: Y135.00($1.2bln)

- GBP/USD: $1.2390-10(Gbp743mln), $1.2425-39(Gbp633mln)

- USD/CAD: C$1.3565-80($1.0bln)

- USD/CNY: Cny6.9500-20($770mln)

EQUITIES: E-Mini S&P Breaches 50-Day EMA, Signaling Scope for Extension Lower

MNI US EARNINGS SCHEDULE - Amazon, Intel headline busy tech earnings day

- The Eurostoxx 50 futures contract has pulled back from recent highs. A key short-term support at 4282.10 remains intact - for now. This is the 20-day EMA where a break is required to signal a short-term top and highlight potential for a deeper pullback - towards 4206.30, the 50-day EMA. Trend conditions remain bullish and attention is on the bull trigger at 4363.00, Apr 21 high. A break would open 4381.50, Jan 5 2022 high (cont).

- A strong sell-off in S&P E-minis this week has resulted in a break below both the 20- and 50-day EMAs. The break of the 50-day EMA strengthens short-term bearish conditions and signals scope for an extension lower, towards 4061.11 next and 4018.75, Fibonacci retracement points. On the upside, the 20-day EMA at 4120.83 marks initial resistance, a clear break above this EMA would ease bearish pressure.

COMMODITIES: Strong Sell Off in WTI Futures Exposes Support at $73.98

- The outlook in WTI futures remains bearish and Wednesday's strong sell-off reinforces the current theme. The move lower has exposed $73.98, a Fibonacci retracement point. A break would open $72.76, the Mar 30 low. On the upside, a key short-term resistance has been defined at $79.18, the Apr 24 high where a breach is required to ease bearish pressure. This would also highlight a potential reversal.

- Gold remains in consolidation mode. The broader trend condition remains bullish, however, the yellow metal has recently entered a short-term corrective cycle. Price has pierced support at $1988.2, the 20-day EMA, highlighting potential for a deeper retracement. This has opened $1949.7, Apr 3 low. Key short-term resistance has been defined at $2048.7, the Apr 5 high. A break would confirm a resumption of the uptrend.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/04/2023 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 27/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 27/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/04/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 27/04/2023 | 1230/0830 | *** |  | US | GDP |

| 27/04/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 27/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 27/04/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 27/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 27/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 27/04/2023 | 1615/1815 |  | EU | ECB Panetta at EACB Board Meeting | |

| 27/04/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 27/04/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 28/04/2023 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 28/04/2023 | 2350/0850 | * |  | JP | Retail sales (p) |

| 28/04/2023 | 2350/0850 | ** |  | JP | Industrial production |

| 28/04/2023 | 2350/0850 | * |  | JP | labor forcer survey |

| 28/04/2023 | 0300/1200 | *** |  | JP | BOJ policy announcement |

| 28/04/2023 | 0530/0730 | *** |  | FR | GDP (p) |

| 28/04/2023 | 0530/0730 | ** |  | FR | Consumer Spending |

| 28/04/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 28/04/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/04/2023 | 0630/0830 | ** |  | CH | retail sales |

| 28/04/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 28/04/2023 | 0645/0845 | ** |  | FR | PPI |

| 28/04/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 28/04/2023 | 0700/0900 | *** |  | ES | GDP (p) |

| 28/04/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 28/04/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 28/04/2023 | 0800/1000 | *** |  | IT | GDP (p) |

| 28/04/2023 | 0800/1000 | *** |  | DE | GDP (p) |

| 28/04/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/04/2023 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 28/04/2023 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 28/04/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/04/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/04/2023 | - |  | EU | ECB Lagarde at Post-Eurogroup Meeting Press Conference | |

| 28/04/2023 | - |  | EU | ECB Lagarde, Panetta, de Guindos at Eurogroup / ECOFIN Meeting | |

| 28/04/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 28/04/2023 | 1230/0830 | ** |  | US | Employment Cost Index |

| 28/04/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 28/04/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 28/04/2023 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 28/04/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.