-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - AUD Narrows Gap With Resistance on RBA Action

Highlights:

- AUD on top as RBA surprises with 25bps hike

- Treasuries modestly firmer, in belly-led richness

- ECB's Visco, Centeno and Vujcic make up the speaker slate

US TSYS: Lightly Richer, Not Yet Building On TYU3 Resistance Clearance

- Cash Tsys trade lightly richer, led by the belly, as they lean on EGBs for support in a move that started before but has since been further helped by a sharp decline in ECB consumer inflation expectations. The front-end trades just within yesterday’s post-ISM service miss highs but 5s and 10s have pushed through.

- 2YY -1.6bp at 4.449%, 5YY -2.3bp at 3.795%, 10YY -2.1bp at 3.662%, 30YY -1.2bp at 3.871%. 2s10s are within recent ranges at -78.5bps.

- TYU3 trades 7+ ticks higher at 114-04 off a high of 114-06+ after clearance of yesterday’s 114-03+ has failed to generate meaningful momentum. Nevertheless, that break next opens resistance at 114-22 (20-day EMA) after which lies 115-00 (Jun 1 high).

- Cumulative volumes are in line with recent averages at 260k.

- No data releases or Treasury supply scheduled today for a very light docket.

STIR FUTURES: Fed Rate Path Little Changed After Two-Way External Drivers

- Fed Funds implied rates are little changed from yesterday's close after any impulse from the RBA’s surprise 25bp hike was offset by ECB consumer inflation expectations declining “significantly”.

- It leaves the June skip narrative intact, whilst earlier UBS added a 25bp hike to July after originally seeing their final hike in May.

- Cumulative changes from 5.08% effective: +6.5bp Jun (+0.5bp on the day), +19bp Jul (+0.5bp), +15.5bp Sep (unch), +4bp Nov (-0.5bp), -12.5bp Dec (-1bp) and -32bp Jan (-1bp).

- Yesterday’s ISM services miss with weak prices paid still weighs but rates remain above pre-payrolls levels – see table for comparison.

RBA Watchers Sound Hawkish Alarms After June Hike

The well-known RBA watchers at the major press outlets have come out flagging hawkish policy risks after the Bank lifted rates by 25bp on Tuesday, while it maintained pre-existing guidance re: the potential need for further tightening in the process.

- Terry McCrann of the Herald Sun notes “The Reserve Bank really should have hiked by 0.5 per cent and linked it directly to last Friday’s national wage decision… We might get a pause in July. But the inflation data for the June quarter, released at the end of July, ahead of the August RBA meeting, will be utterly determinative.”

- The AFR’s Kehoe notes “The Reserve Bank of Australia’s 12th interest rate rise may not be the last, as governor Philip Lowe loses patience in response to the emerging “upside risks” to inflation and frets that it will embed higher wage claims.”

- The WSJ’s Glynn notes “A fundamental breakdown between the aims of wage policy and monetary policy in Australia is now threatening to drive interest rates up more than most economists are forecasting, and there seems to be little government will to correct the situation.”

- RBA-dated OIS price in another ~21bp of tightening when it comes to terminal rate levels (seen at the end of the Bank’s November meeting), a touch shy of the post meeting peak.

- Our full post-meeting review, including a summary of sell-side thoughts, will be published on Wednesday.

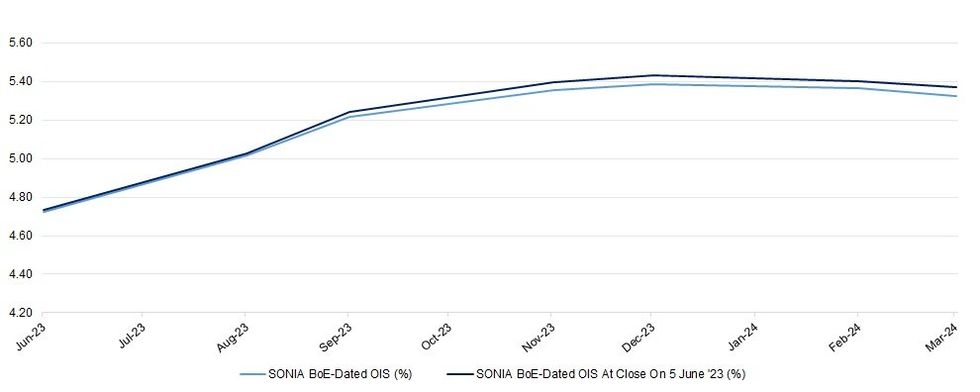

BoE Pricing a Little Softer Today, Recent Ranges Intact

Softer crude oil prices and broader global core FI dynamics have allowed BoE-dated OIS to ease a touch this morning, building on yesterday’s general tick lower, leaving terminal rate pricing just above 5.45% (operating above yesterday’s session lows). Residual pricing of odds of a larger than 25bp hike remains evident over the next few MPC gatherings. A reminder that we do not have anything in the way of tier 1 data/BoE speakers scheduled until next week.

| BoE Meeting | SONIA BoE-Dated OIS (%) | SONIA BoE-Dated OIS At Close On 6 June '23 (%) |

| Jun-23 | 4.724 | 4.732 |

| Aug-23 | 5.015 | 5.027 |

| Sep-23 | 5.218 | 5.241 |

| Nov-23 | 5.354 | 5.395 |

| Dec-23 | 5.384 | 5.434 |

| Feb-24 | 5.363 | 5.401 |

| Mar-24 | 5.322 | 5.371 |

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EUROPE ISSUANCE UPDATE

EUROZONE ISSUANCE: EU-bond syndication: 7/20-year dual-tranche- 1.625% Dec-29 EU-bond, spread set at MS-3bps (guidance was MS -1bps area)

- Size: E3bln WNG

- Books in excess of E25bln (inc E2.2bln JLM interest)

- 3.375% Nov-42 EU-bond, spread set at MS+52bps (guidance was MS +54bps area)

- Size: E4bln WNG

- Books in excess of E35bln (inc E2.35bln JLM interest)

- EUR Benchmark 12Y Fixed (June 14, 2035) MS+115 Area

- IPT: MS+135 Area

- Books above E5.75bln (incl JLM interest)

Estonia syndication: 10-year tap, 4.00% Oct-32 - FINAL TERMS

- E500mln WNG Tap of 4.00% Oct-32 at MS+65

- Revised guidance MS+65-70bp, will price in range

- Books above E4bln (ex JLM interest)

- E275mln 0.10% Apr-33 ILB, Avg yield 0.00% (Prev. -0.04%), Bid-to-cover 1.28x (Prev 1.31x)

- E185mln 0.10% Apr-46 ILB, Avg yield -0.05% (Prev. -0.18%), Bid-to-cover 1.45x (Prev 2.06x)

Gilt auction results:

- GBP2.50bln 3.75% Oct-53 Gilt, Avg yield 4.478% (Prev. 4.083%), Bid-to-cover 2.58x (Prev. 2.50x), Tail 0.5bps (Prev. 0.2bps)

- E700mln 2.90% Feb-2033 RAGB, Avg yield 2.955% (Prev. 2.961%), Bid-to-cover 2.36x (Prev. 1.72x)

- E600mln 0.25% Oct-36 RAGB, Avg yield 3.114% (Prev 0.364%), Bid-to-cover 2.08x (Prev. 2.89x)

FOREX: AUD on Top as RBA Warn More to Come

- The RBA pushed against consensus with a 25bps hike to the cash rate target, boosting rates to 4.10% and signaling that further policy tightening could follow. In response, AUD rallied and sits firmer against all others in G10 - helping to extend the streak of higher intraday lows into a fifth session against the USD. AUD/USD is now within range of the 200-dma resistance at 0.6692 and a break above would open the mid-May highs of 0.6710.

- Chinese assets traded briefly firmer through the local close, with markets receiving a small boost on the back of reports out of China, as authorities ask the largest Chinese banks to cut their interest rates levied on deposit products - with steps to become effective as soon as this week. The release has raised some market concern about the aggregate financing data due later this week - with the policy step today potentially looking to get ahead of a weaker-than-expected release.

- GBP is among the poorest performers so far Tuesday, chewing through Monday's modest gains to narrow the gap with the pullback lows at 1.2369 - the next downside support.

- Data releases are few and far between Tuesday, keeping focus on the Canada Ivey PMI later today. ECB's Centeno and Vujcic make up the speaker slate, with Fedspeak off the agenda as markets sit inside the pre-meeting media blackout period.

FX OPTIONS: Expiries for Jun06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0685-00(E1.1bln), $1.0750(E2.3bln)

- USD/JPY: Y140.00($1.5bln)

- AUD/USD: $0.6640-45(A$515mln)

- USD/CAD: C$1.3365($500mln)

EQUITIES: E-Mini S&Ps Remain Close to Recent Highs

- Eurostoxx 50 futures traded higher Friday as the contract recovered from last Wednesday’s low of 4216.00. For now, the move higher appears to be a correction. Price action earlier last week reinforced a bearish theme - support at 4252.00, the May 25 low has been breached. Price has also pierced support at 4233.00, the May 4 low and a key short-term level. Resistance to watch is 4362.00, May 29 high, a break would be bullish.

- S&P E-minis trend conditions remain bullish following recent gains. Resistance at 4244.00, the Feb 2 high and a medium-term bull trigger, has been cleared. The break reinforces bullish conditions and confirms a resumption of the uptrend that started in October 2022. The focus is on 4327.50 next, the Aug 16 2022 high. The 50-day EMA, at 4149.71 remains a key support. A break is required to signal a reversal.

COMMODITIES: WTI Futures Fade Off OPEC+ Induced Highs

- WTI futures traded higher yesterday, piercing resistance at $74.73, the May 24 high. However, the contract has failed to hold on to its latest gains. A clear break of $74.73 would strengthen a bullish condition and signal scope for an extension higher. This would open $76.74, the Apr 28 high. For bears, a stronger reversal would instead signal a top and this would once again expose key support at $63.90, the May 4 low.

- The bear cycle in Gold remains intact and. The yellow metal is once again testing trendline support drawn from Nov 3 2022. The trendline intersects at $1949.1. A clear breach of this trendline would reinforce bearish conditions and open $1903.5, a Fibonacci retracement. Initial firm resistance is $1985.3, the May 24 high. A break of this level is required to signal a short-term reversal.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/06/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 06/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 06/06/2023 | 1230/0830 | * |  | CA | Building Permits |

| 06/06/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/06/2023 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/06/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 07/06/2023 | 0130/1130 | *** |  | AU | Quarterly GDP |

| 07/06/2023 | 0545/0745 | ** |  | CH | Unemployment |

| 07/06/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/06/2023 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/06/2023 | 0750/0950 |  | EU | ECB de Guindos Speech at EC/ECB Conference | |

| 07/06/2023 | 0800/1000 | * |  | IT | Retail Sales |

| 07/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/06/2023 | 0910/1110 |  | EU | ECB Panetta Moderates EC/ECB Conference Panel | |

| 07/06/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 07/06/2023 | - | *** |  | CN | Trade |

| 07/06/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/06/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 07/06/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 07/06/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 07/06/2023 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.