-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - BoE Goes 'Live'

MNI US MARKETS ANALYSIS - BoE Goes 'Live'

HIGHLIGHTS:

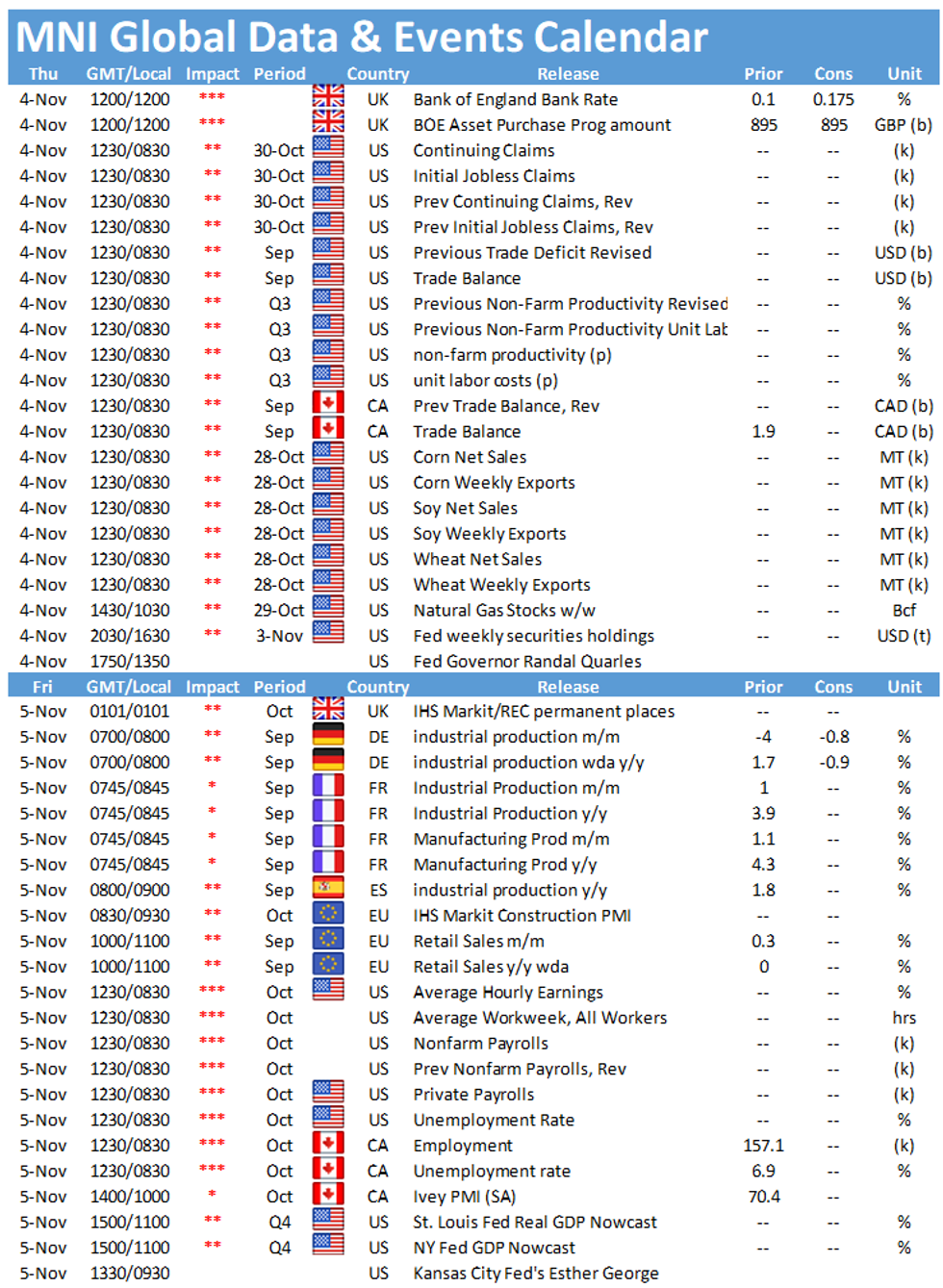

- Focus is on the Bank of England today with expectations running high following the recent hawkish commentary

- Sovereign FI has broadly rallied this morning with equities pushing higher

- US jobless claims data will follow the BoE

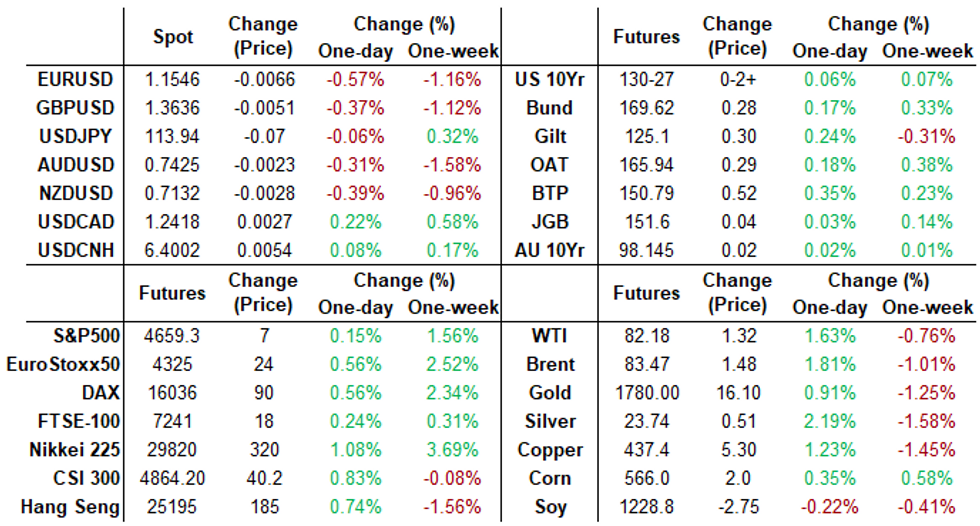

US TSYS: Reversing Some Post-FOMC Steepening

The Treasury curve is bull flattening, reversing some of Thursday's FOMC-related bear steepening.

- Immediate attention is on the Bank of England decision (0800ET), while payrolls Friday is the next key US focal point.

- The 2-Yr yield is down 0.4bps at 0.462%, 5-Yr is down 2.4bps at 1.1638%, 10-Yr is down 3.2bps at 1.5718%, and 30-Yr is down 2.7bps at 1.9937%.

- Dec 10-Yr futures (TY) up 2/32 at 130-26.5 (L: 130-18 / H: 130-28.5).

- Equity futures pointing to fresh all-time highs, while the dollar is stronger.

- A few more labor market clues ahead of Friday's nonfarm payrolls: 0730ET is Challenger Job Cuts, with jobless claims and unit labor costs at 0830ET (as well as trade balance data).

- House of Reps could vote today on infra and social spending bills, though unclear.

- In supply: $35B in 4-/8-week bills at 1130ET. Prior to that, a pair of NY Fed purchase operations: $6.025B of 4.5-7Y Tsys at 1030ET, and $1.425B of 10-22.5Y Tsys at 1120ET.

EGB/Gilt: Expectations Running High Ahead of BoE Meeting

EGBs have firmed and curves have bull steepened alongside gains for equities.

- The focus today is on the BoE meeting. Given that policymakers, led by Andrew Bailey, have ramped up the hawkish rhetoric recently, expectations are running high for the meeting and the bar for disappointment is low. Tightening policy would confirm the hawkish shift, while standing pat and dialing back the rhetoric risks triggering a sharp correction.

- Gilts have been bid this morning with cash yields 1-3bp lower.

- Bunds have rallied and the curve has steepened with the 2s30s spread widening by 4bp.

- OATs have slightly outperformed bunds at the short end where yields are down 4-5bp.

- BTPs have broadly mirrored the move in core EGBs.

- Supply this morning came from France (OATs/Green OAT, EUR9.493), Spain (Obli/OblieEi, EUR5.021bn). In addition, Italy bought back EUR4bn of BTPs/CCTeu.

EUROPEAN ISSUANCE UPDATE

SPAIN AUCTION RESULTS 7/10/25-year Oblis / 9-year ObliEi

| Coupon | 0% | 0.50% | 2.90% | 1.00% |

| Maturity | Jan-28 | Oct-31 | Oct-46 | Nov-30 |

| Instrument | Obli | Obli | Obli | Obli-Ei |

| ISIN | ES0000012I08 | ES0000012I32 | ES00000128C6 | ES00000127C8 |

| Amount | E1.991bln | E1.324bln | E1.006bln | E700mln |

| Previous | E1.585bln | E1.692bln | E420mln | |

| Avg yield | 0.04% | 0.48% | 1.12% | -1.34% |

| Previous | -0.03% | 0.45% | -1.33% | |

| Bid-to-cover | 1.39x | 1.32x | 1.41x | 1.54x |

| Previous | 1.99x | 1.43x | 1.62x | |

| Price | 99.722 | 100.160 | 138.472 | 122.657 |

| Previous | 100.161 | 100.527 | 123.306 | |

| Pre-auction mid | 99.674 | 100.074 | 138.229 | 122.566 |

| Previous | 100.102 | 100.404 | 119.164 | |

| Previous date | 07-Oct-21 | 07-Oct-21 | 05-Aug-21 |

FRANCE AUCTION RESULTS: LT OATs / Green OAT

| 0% Nov-31 OAT | 1.75% Jun-39 Green OAT | 0.75% May-53 OAT | |

| ISIN | FR0014002WK3 | FR0013234333 | FR0014004J31 |

| Amount | E6.25bln | E1.584bln | E1.659bln |

| Previous | E4.93bln | E1.499bln | E2.035bln |

| Avg yield | 0.16% | 0.44% | 0.83% |

| Previous | 0.15% | 0.14% | 0.96% |

| Bid-to-cover | 1.86x | 2.76x | 2.56x |

| Previous | 2.12x | 2.54x | 2.14x |

| Price | 98.45 | 122.24 | 97.73 |

| Previous | 98.51 | 129.29 | 94.19 |

| Pre-auction mid | 98.351 | 121.988 | 97.463 |

| Previous | 98.422 | 129.067 | 93.931 |

| Previous date | 07-Oct-21 | 04-Feb-21 | 07-Oct-21 |

ITALY BUYBACK RESULTS Full E5bln bought back

- E0.961bln of the 5.50% Nov-22 BTP ( ISIN: IT0004848831 ) at 105.857

- E0.525bln of the Jul-23 CCTeu ( ISIN: IT0005185456 ) at 101.150

- E1.875bln of the 0% Jan-24 BTP ( ISIN: IT0005424251 ) at 100.417

- E0.526bln of the 1.85% May-24 BTP ( ISIN: IT0005246340 ) at 105.055

- E0.928bln of the 1.75% Jul-24 BTP ( ISIN: IT0005367492 ) at 104.983

- E0.185bln of the 2.50% Nov-25 BTP ( ISIN: IT0005345183) at 109.678

FOREX: ALL EYES on the BoE

- USD is mainly better bid during our morning European session.

- EURUSD touches session low, USD remains fairly bid in G10s, DXY edges towards best levels.

- USD leads against the EUR up 0.47%.Recall, noted yesterday decent option expiry at 1.1550 (1.1bn), which may act as a magnet.

- Technically support is seen at 1.1535, but better is seen at 1.1524.

- Recall that good demand ahead of 1.1500 was seen last Month and this month, in spot as well as expressed via option put sellers.

- The last time we traded below 1.1500 was over a year ago in July 2020.

- The British Pound is so far mixed, down 0.41% versus the USD and up a small 0.12% versus the NOK.

- ALL EYES are on the BoE, Economists are going for no hike as per Bloomberg survey.

- Banks/Traders majority (64% from our internal survey) are going for a hike of 15bps and above.

- And from all the UK Banks, only Lloyds is going for a hike.

- Today, also sees OPEC+ meeting which will be watch given inflation risks from energy prices

FX OPTION EXPIRY

FX OPTION EXPIRY (updated, closest ones)

Of note:

EURUSD: 2.18bn at 1.1525/1.1550

USDJPY: 3.95bn at 114/114.30

USDCNY: 1.28bn at 6.40- EURUSD: 1.1500 (541mln), 1.1515 (295mln), 1.1525 (1.08bn), 1.1550 (1.1bn), 1.1575 (422mln), 1.1600 (462mln)1.1625 (474mln).

- USDJPY: 114 (2.14bn), 114.30 (1.81bn), 114.50 (733mln).

- EURGBP: 0.8520 (420mln), 0.8525 (402mln)

- USDCAD: 1.2420 (790mln), 1.2435 (200mln),

- AUDUSD; 0.7430 (280mln)

- USDCNY; 6.40 (1.28bn}

Price Signal Summary - EURUSD Is Bearish Within Its Channel

- In the equity space, S&P E-minis continue to defy gravity and have registered another all-time high. The focus is on 4687.32 next, 1.382 projection of Jul 19 - Aug 16 - Aug 19 price swing. EUROSTOXX 50 futures maintain a bullish tone. Attention is on 4371.00, 1.236 projection of Jul 19-Sep 6-Oct 6 2020 swing (cont)

- In FX, EURUSD remains below recent highs and the outlook is bearish. The move lower on Oct 29 - a bearish engulfing candle - highlights a failure to clear the 50-day EMA and means the bear channel top at 1.1686 today, remains intact. The channel is drawn off the Jun 1 high. The focus is on 1.1524, Oct 12 low and bear trigger. GBPUSD is softer. A deeper pullback would open 1.3544, the Oct 6 low and highlight a potential resumption of the downtrend. USDJPY remains below recent highs but above support at 113.42-00, the 20-day EMA and Oct 12 low respectively. A break would signal scope for a deeper pullback. The trend for now remains up.On the commodity front, Gold traded lower yesterday and breached $1772.0, the Oct 29 low. The break lower highlights a developing bearish risk and exposes support at $1760.4, Oct 18 low that was also probed. A clear break of this level would signal scope for a pullback towards $1721.7, Sep 29 low. Yesterday's sell-off in WTI resulted in a breach of $80.58, Oct 28 low and the contract cleared the 20-day EMA. This has opened the 50-day EMA at $77.10. Key resistance has been defined at $85.41, the Oct 25 high.

- In the FI space, short-term gains in Bund futures are considered corrective, however watch resistance at 169.83, Oct 27 high. A break would alter the picture and suggest scope for a stronger recovery. The focus in Gilts is on the potential double bottom reversal following last week's breach of 125.27, Oct 14 high. If correct, the pattern signals scope for a climb towards 126.39, 50.0% retracement of the Aug - Oct downleg. Support is at 124.25, Nov 1 low. Key support has been defined at 123.43, Oct 21 low.

EQUITIES: Asian/European equities higher, US equities close to flat

- Japan's NIKKEI up 273.47 pts or +0.93% at 29794.37 and the TOPIX up 23.89 pts or +1.18% at 2055.56

- China's SHANGHAI closed up 28.329 pts or +0.81% at 3526.866 and the HANG SENG ended 200.44 pts higher or +0.8% at 25225.19

- German Dax up 79.06 pts or +0.5% at 16039.55, FTSE 100 up 12.5 pts or +0.17% at 7261.22, CAC 40 up 29.69 pts or +0.43% at 6980.65 and Euro Stoxx 50 up 22.25 pts or +0.52% at 4332.12.

- Dow Jones mini down 17 pts or -0.05% at 36019, S&P 500 mini up 5.25 pts or +0.11% at 4657.75, NASDAQ mini up 68.25 pts or +0.42% at 16199.

COMMODITIES: Higher despite a stronger USD

- WTI Crude up $1.2 or +1.48% at $82.05

- Natural Gas up $0.06 or +0.97% at $5.733

- Gold spot up $9.36 or +0.53% at $1778.87

- Copper up $6.25 or +1.45% at $438.6

- Silver up $0.18 or +0.76% at $23.6912

- Platinum up $14.46 or +1.4% at $1046.76

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.