-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Bonds Trade Under Pressure

HIGHLIGHTS:

- Yields lurch higher across the curve in extension of last week's move

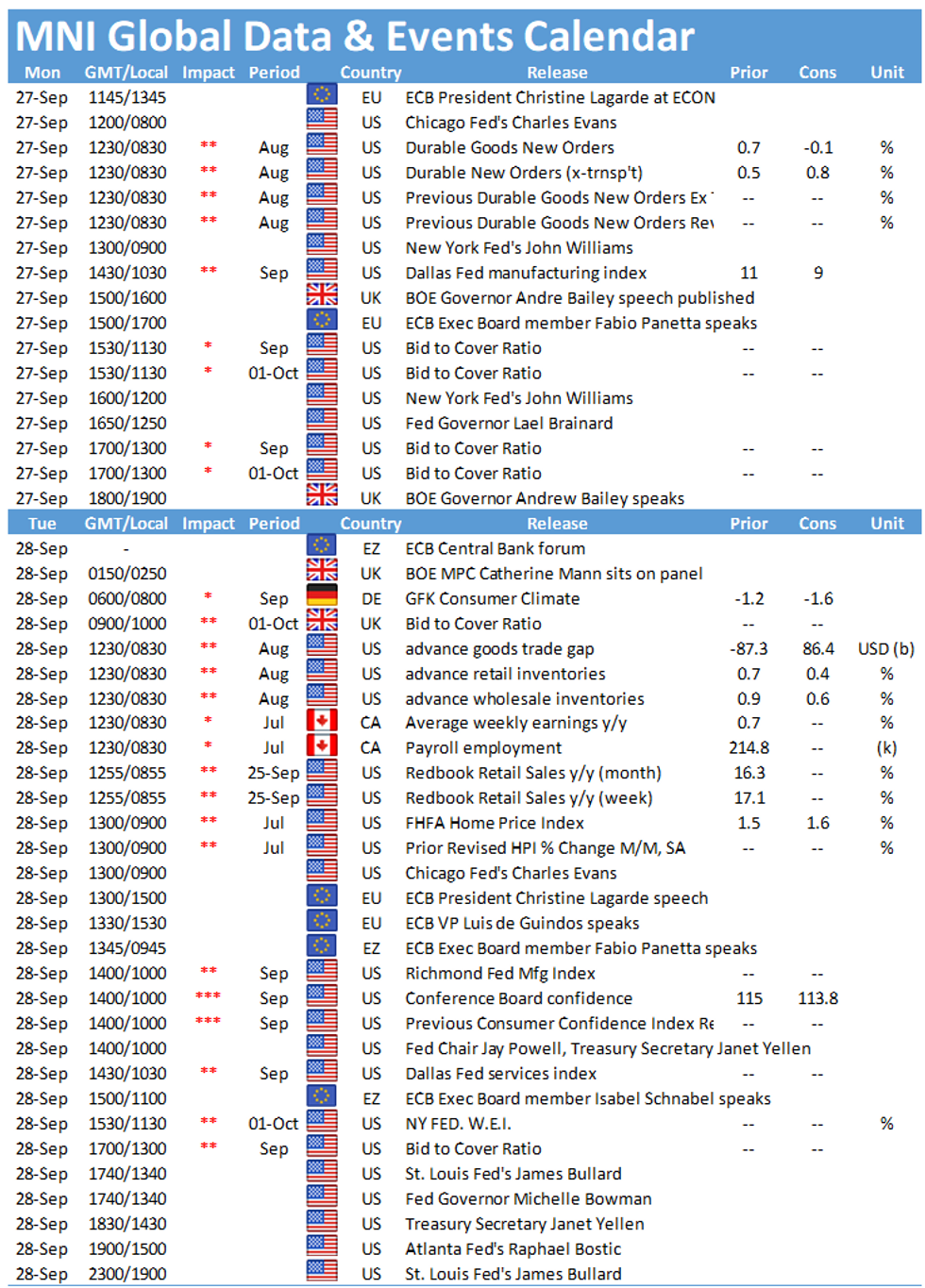

- Central bank speak in focus, with a number of Fed, ECB, BoE speakers

- Commodities on the front foot as oil clears a new 2021 high

US TSYS SUMMARY: US 2yr Yield Touches New Post-Pandemic High

- The US Treasury curve trades bear steeper early Monday, with the run-up in yields extending off the FOMC decision last Wednesday. The upside in the front-end puts the 2-yr yield at a new post-pandemic high of 0.2881%.

- Prelim durable goods orders is the data focus for the Monday session, with markets expecting an uptick in the headline to +0.6% from -0.1% previously. Fedspeak will also be carefully eyed as Fed's Evans, Williams, and Brainard are all due to speak.

- US Treasury auctions 2- and 5-yr bonds Monday, followed by 7-yr on Tuesday. Analysts note that the 2-yr issuance may be smoothly digested while the 5-yr line could require some concession.

- The Dec 21 T-Note future is down 7/32 at 131-25+, having traded in a range of 131-23 to 132-05+. The 2-Yr yield is up 1.3bps at 0.282%, 5-Yr yield is up 3.5bps at 0.9814%, 10-Yr yield is up 3.5bps at 1.4854% while the 30-Yr yield is up 2.4bps at 2.0069%.

EGB/Gilt: Digesting The German Election & Intensifying UK Fuel Crisis

European sovereign bonds have sold off this morning while equities have edged higher.

- The narrowly fought German election and prospect of lengthy coalition negotiations to form the next government, coupled with the intensifying fuel crisis in the UK, is giving markets plenty to digest.

- Gilts have been under pressure this morning with cash yields now 1-4bp higher and the long-end of the curve underperforming.

- The bund curve has similarly bear steepened with the 2s30s spread 1bp wider.

- OATs have underperformed bunds with cash yields up 1-3bp on the day.

- BTPs have marginally underperformed core EGBs with yields pushing up 1-4bp and the belly of the curve leading the way.

- Supply this morning came from Germany (Bubills, EUR3.076bn allotted), the EU (NGEU Bond, EUR2.495bn) and Belgium (EUR3.502bn). Later today France will offer EUR5.7-6.9bn).

- There were no tier one European data releases this morning.

- There is a slew of ECB speakers today (Lagarde, Visco, Panetta and de Cos) as well as BoE Governor Andrew Bailey.

EUROPE ISSUANCE UPDATE: Belgian, EU Issuance

Belgium sells:

E1.482bln 0% Oct-31 OLO, Avg yield 0.10% (Prev. 0.136%), Bid-to-cover 1.62x (Prev 1.05x)

E1.243bln 1.45% Jun-37 OLO, Avg yield 0.44% (Prev. -0.015%), Bid-to-cover 1.40x (Prev 2.63x)

E777mln 1.70% Jun-50 OLO, Avg yield 0.8790% (Prev. 0.937%), Bid-to-cover 1.57x (Prev 1.29x)

EU issue:

E2.495bln 0% Jul-26 EU NGEU, Avg yield -0.487% (-0.335% at syndication), Bid-to-cover 2.33x

EUROPE OPTION FLOW SUMMARY

Eurozone:

OEZ1 135.25/135.50/135.75c fly, bought for 2.5 in 1k

2RH2 100.37/100.62cs, bought for 2.75 in 12,375 (ref 100.245)

UK:

SFIH2 99.65/99.55ps, bought for 2.75 in 5k (ref 99.69)

US:

TYX1 131.5/131/130.5p ladder bought for -2 in 2,835

FOREX: EUR Inching Lower in Wake of German Election Results

- EUR trades on the back foot, with EUR/USD edging back below the 1.17 mark as EGB yields creep higher in tandem. The moves follow the outcome of the German election, which showed a very marginal victory for the Social Democrats, setting up weeks of negotiations and discussions in an attempt to form a governing coalition.

- GBP trades well, with the currency higher against all others in G10 as the UK curve continues to steepen after last week's BoE decision. Progress through last week's 1.3751 opens the 50-dma at 1.3789.

- SEK, CHF and EUR are among the poorest performers, while GBP, AUD trade most favourably.

- Monday's data slate focuses on August US durable goods orders, with Dallas Fed Manufacturing Activity also on the docket. The central bank speaker slate could be of more interest - with Lagarde, Visco & de Cos of the ECB, Evans, Williams & Brainard of the Fed and lastly BoE's Bailey.

FX OPTIONS: Expiries for Sep27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1750-65(E1.3bln), $1.1800(E685mln)

- USD/JPY: Y109.85-00($1.1bln)

- GBP/USD: $1.3740-50(Gbp564mln)

- AUD/USD: $0.7330-40(A$630mln)

- USD/CAD: C$1.2875($750mln)

Price Signal Summary - Bonds Under Pressure Again

- In the equity space, S&P E-minis continue to extend the rally from 4293.75, Sep 20 low. The contract last week cleared a key short-term resistance at 4418.00, Sep 20 high and importantly, remains above the 50-day EMA. The next hurdle is 4478.50, Sep 16 high. A break would open 4539.50, Sep 3 high and the bull trigger. EUROSTOXX 50 maintains a bullish tone following last week's rebound from 3974.00, Sep 20 low. Further gains would open the bull trigger at 4223.00, Sep 6 high.

- In FX, EURUSD outlook remains bearish. The focus is on key support at 1.1664, Aug 20 low. GBPUSD remains above key support at 1.3602, Aug 20 low. Triangle support at 1.3636 remains intact too and a breach of the 1.3636/02 zone is required to trigger a deeper sell-off. A resumption of gains would open 1.3792 the 50-day EMA. USDJPY has traded through 110.80 this morning, Aug 11 high. The break strengthens a bull case and opens 111.66, Jul 2 high and the bull trigger. The USD Index (DXY) key resistance resides at 93.73, Aug 20 high and the bull trigger. A break would confirm a resumption of the uptrend that started May 25.

- On the commodity front, the Gold trend needle still points south and the focus is on $1742.5, 76.4% of the Aug 9 - Sep 3 rally. WTI futures continue to defy gravity and the contract is approaching $80.00, a psychological resistance point.

- In FI, Bund futures remain in a downtrend and are trading lower this morning confirming a resumption of the current downtrend. This opens 169.90 next, 1.236 projections of the Sep 9 - 17 - 21 price swing. Gilt futures remain heavy and are trading lower. The focus is on 125.48, 1.00 projection of the Aug 31 - Sep 17 - 21 price swing. Treasuries are trading lower too and are below 132.00. This opens 131-14 next, Jun 17 low (cont).

EQUITIES: Moving Higher in US and Europe)

- Japan's NIKKEI down 8.75 pts or -0.03% at 30240.06 and the TOPIX down 3.01 pts or -0.14% at 2087.74

- China's SHANGHAI closed down 30.236 pts or -0.84% at 3582.831 and the HANG SENG ended 16.62 pts higher or +0.07% at 24208.78

- German Dax up 148.24 pts or +0.95% at 15679.86, FTSE 100 up 26 pts or +0.37% at 7077.57, CAC 40 up 45.98 pts or +0.69% at 6684.44 and Euro Stoxx 50 up 30.59 pts or +0.74% at 4189.1.

- Dow Jones mini up 162 pts or +0.47% at 34835, S&P 500 mini up 15 pts or +0.34% at 4460.75, NASDAQ mini up 15 pts or +0.1% at 15334.

COMMODITIES: Natgas jumps another 4%

- WTI Crude up $1.02 or +1.38% at $75.01

- Natural Gas up $0.21 or +4.09% at $5.343

- Gold spot up $1.46 or +0.08% at $1752.2

- Copper down $0.35 or -0.08% at $428.35

- Silver up $0.14 or +0.61% at $22.5631

- Platinum up $3.79 or +0.38% at $989.32

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.