-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Brainard, Williams to Add to Recent Policy Comms

Highlights:

- EUR buoyed as Knot warns markets may be underestimating ECB policy path

- NOK unwavered as Norges Bank signal rates could be nearing peak

- Fed's Williams (voter), Brainard (voter) and Collins (non-voter) to add to policy commentary today

US TSYS: Minor Paring Of Recent Large Gains, Fedspeak & More Data Ahead

- Cash Tsys reverse a further bid through the Asia session that came on technical flows following yesterday’s weak data, cheapening through European hours with some impetus from ECB’s Knot calling for multiple 50bp hikes.

- Comments also late yesterday from Dallas Fed’s Logan (’23 voter) calling for a slower pace of 25bp hikes but to a higher level should financial conditions ease, with mixed implications for front Treasuries.

- 2YY -0.2bps at 4.080%, 5YY +1.2bps at 3.450%, 10YY +1.4bps at 3.384%, 30YY +1.1bps at 3.549%

- TYH3 trades 5 ticks lower at 115-24, off overnight highs of 116-08 in a clear breach of prior key resistance at 115-11+ (Dec 13 high). In doing so it cleared the 200-dma and opens 116-21+ (2.0% 10-dma env).

- Fedspeak: Three appearances with text today from non-voter Collins (0900ET) plus permanent voters VC Brainard (1315ET) and then late on Williams (1835ET). We last heard from Brainard Nov 28.

- Data: Housing starts/building permits for Dec at 0830ET after recent timely indicators suggest a potential bottoming in hosing in January. It hits along with Philly Fed for Jan and usual weekly jobless claims, Philly Fed of note after the surprisingly weak Empire mfg survey earlier this week.

- Bond issuance: US Tsy $17B 10Y TIPS (91282CGK1) 1300ET

- Bill issuance: $70B 4W, $60B 8W bill auctions (1130ET), $60B 44D CMB bill sales (1300ET).

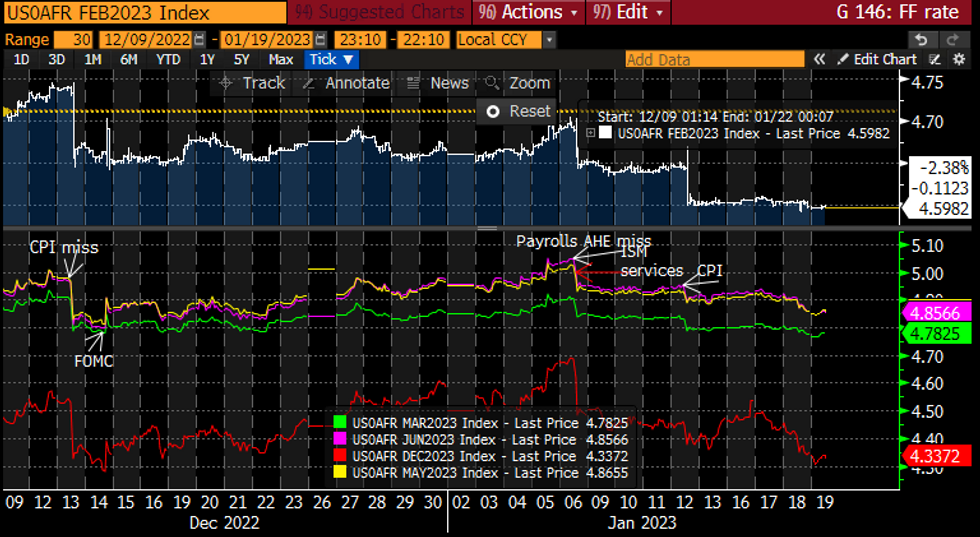

STIR FUTURES: Fed Terminal Pulled Forward Into May

- The Fed Funds implied terminal has nudged higher in European hours after continuing yesterday’s post-data decline into the Asia session, helped by ECB’s Knot saying it plans to hike by 50bps multiple times.

- The terminal remains relatively depressed by recent standards though, close to pre-Dec FOMC brief lows.

- 27bp for Feb 1 (unch), cumulative 45bp for Mar (+0.5bp), 54bp to a terminal 4.87% now seen in May not June (+0.5bp) and then 53bp of cuts to 4.34% in Dec (-1bp).

- Fedspeak: Three appearances with text from non-voter Collins plus permanent voters VC Brainard and then late on Williams. Last heard from Brainard Nov 28.

Source: Bloomberg

Source: Bloomberg

NORGES BANK: Rates Kept Unchanged, Alongside Majority of Expectations

Norges Bank keep rates unchanged at 2.75%, alongside expectations, and name check March as the next likely rate hike.

Statement highlights: https://www.norges-bank.no/en/topics/Monetary-poli...

- “The future policy rate path will depend on economic developments. The policy rate will most likely be raised in March”, says Governor Ida Wolden Bache.

- the policy rate will need to be increased somewhat further to bring inflation down towards the target

- Labour market appears to have been a little tighter than projected

- There are prospects that energy prices will be lower than expected earlier, and global inflationary pressures appear to be easing

- monetary policy has started to have a tightening effect on the economy. This may suggest a more gradual approach to policy rate setting

Language on rates has softened somewhat - possibly suggesting a March hike could be the last of the cycle:

- January: "the policy rate will need to be increased somewhat further"

- December: "a higher policy rate may be needed than currently envisaged."

EUR/NOK has edged higher in response, but price action relatively contained below the earlier intraday high at 10.7617.

FOREX: EUR Buoyed as Knot Warns Markets Underestimating ECB Rate Path

- After trading sideways for the bulk of the Asia-Pac session, EUR/USD picked up alongside comments from ECB's Knot, who stated he sees "multiple" 50bps rate hikes from the bank, adding that markets may be underestimating the bank's policy path. EUR/USD recovered well back above the 1.08 handle, although has stopped short of any test on the Wednesday high at 1.0887.

- JPY is extending the recovery off the BoJ-inspired low this week, and is among the strongest currencies in G10. This confirms price action on Wednesday as corrective, keeping yesterday's 127.57 a focus for USD/JPY bears.

- AUD, NZD are among the poorest performers in G10. Markets moves follow a weaker than expected jobs report out of Australia as well as the unexpected resignation of the NZ PM Jacinda Ardern. AUD/USD eyes support at the 0.6821 200-dma for direction.

- Norway's Norges Bank kept policy unchanged, alongside consensus expectations, but against a minority who saw further tightening today. In name-checking March as the next most likely hike., the bank have confirmed a return to gradualism for Norwegian monetary policy, and softer language on rates may signal 3.00% is the peak of the cycle for now.

- Focus turns to the weekly US jobless claims releases as well as December housing starts and building permits. Fed and ECB speakers will also be carefully watched, with Fed's Collins, Brainard & Williams due as well as ECB's Knot.

FX OPTIONS: Expiries for Jan19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0550(E548mln), $1.0635-55(E1.7bln), $1.0800-20(E1.3bln), $1.0980(E519mln)

- USD/JPY: Y127.95-14($3.0bln), Y128.50($1.4bln), Y130.00($1.3bln), Y131.00-10($1.1bln), Y132.00($2.6bln)

- EUR/JPY: Y140.00(E1.6bln)

- GBP/USD: $1.2100-20(Gbp741mln)

- USD/CNY: Cny6.5900($1.3bln), Cny6.7000($1.5bln), Cny6.7500($931mln)

EQUITIES: Eurostoxx Pullback Considered Corrective After Printing Fresh Cycle High Wed

- EUROSTOXX 50 futures bullish conditions remain intact and the recent shallow pullback is considered corrective. Futures have recently cleared resistance at 4043.00, the Dec 13 high and a bull trigger. The break marks a key short-term positive development and paves the way for gains towards 4215.00 next, a Fibonacci projection. Moving average studies are in a bull-mode condition, reinforcing the bull theme. Initial firm support is 4015.70.

- S&P E-Minis traded lower Wednesday and a key short-term resistance has been defined at 4035.25, the Jan 17 high. Attention is on support at 3931.73, the 50-day EMA. A break of this average would highlight a potential bearish reversal and expose support at 3891.50, the Jan 10 low. On the upside, the contract needs to clear 4035.25 to cancel any developing bearish threat and instead confirm a resumption of recent bullish activity.

COMMODITIES: WTI Future Price Action Reverses Lower From Wed 82.38 One-Month High

- WTI futures traded higher yesterday but price has reversed lower from the $82.38 session high. Attention is on support at $77.47, the 20-day EMA. A break of this average would highlight a stronger bear threat and expose support at $72.46, the Jan 5 low. On the upside, key short-term resistance has been defined at $82.38 where a break would reinstate the recent bullish theme.

- Trend conditions in Gold remain bullish and the yellow metal traded to a fresh cycle high earlier this week. This confirmed an extension on the uptrend and maintains the price sequence of higher highs and higher lows. Note that moving average studies are in a bull mode position - reflecting the uptrend. The focus is on $1934.4 next, the Apr 25, 2022 high. Support to watch lies at $1860.5, the 20-day EMA. Short-term pullbacks are considered corrective.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/01/2023 | 1030/1130 |  | EU | ECB Lagarde Panellist at World Economic Forum | |

| 19/01/2023 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 19/01/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 19/01/2023 | 1330/0830 | *** |  | US | Housing Starts |

| 19/01/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 19/01/2023 | 1400/0900 |  | US | Boston Fed's Susan Collins | |

| 19/01/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 19/01/2023 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 19/01/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 19/01/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 19/01/2023 | 1700/1800 |  | EU | ECB Schnabel in Finanzwende Webinar | |

| 19/01/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 19/01/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 19/01/2023 | 1815/1315 |  | US | Fed Vice Chair Lael Brainard | |

| 19/01/2023 | 2335/1835 |  | US | New York Fed's John Williams | |

| 20/01/2023 | 2350/0850 | *** |  | JP | CPI |

| 20/01/2023 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 20/01/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 20/01/2023 | 0700/0800 | ** |  | DE | PPI |

| 20/01/2023 | 0745/0845 | * |  | FR | Retail Sales |

| 20/01/2023 | 1000/1100 |  | EU | ECB Lagarde Panellist at World Economic Forum | |

| 20/01/2023 | 1330/0830 | ** |  | CA | Retail Trade |

| 20/01/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/01/2023 | 1400/0900 |  | US | Philadelphia Fed's Pat Harker | |

| 20/01/2023 | 1500/1000 | *** |  | US | NAR existing home sales |

| 20/01/2023 | 1530/1630 |  | EU | ECB Elderson Into at European Financial Services Roundtable | |

| 20/01/2023 | 1800/1300 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.