-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - China Rout Unsettles US, Euro Assets

HIGHLIGHTS:

- China stock sell-off accelerates, bleeding into Europe and US assets

- USD/CNH rallies to touch best levels since April

- Light data slate, keeping focus on earnings, with Apple, Microsoft, Visa among others to report

US TSYS SUMMARY: China Risk-Off Keeps Lid On Yields As FOMC Gets Underway

In a replay of Monday, the overnight session was dominated by a continued meltdown in China/Hong Kong stocks resulting in a global safe haven bid. Once again Treasury yields appear to have stabilized by mid-morning Europe time and are off lows, but the curve remains flatter.

- The 2-Yr yield is down 0.8bps at 0.2055%, 5-Yr is down 2.4bps at 0.6971%, 10-Yr is down 3.9bps at 1.2511%, and 30-Yr is down 3.9bps at 1.9027%.

- Sep 10-Yr futures (TY) up 5.5/32 at 134-12 (L: 134-03 / H: 134-16) - though nothing special volume-wise (~340k).

- The 2-day FOMC meeting gets underway this morning, with taper talk in focus (though the fall in yields may garner some attention around the table too) - our preview went out yesterday.

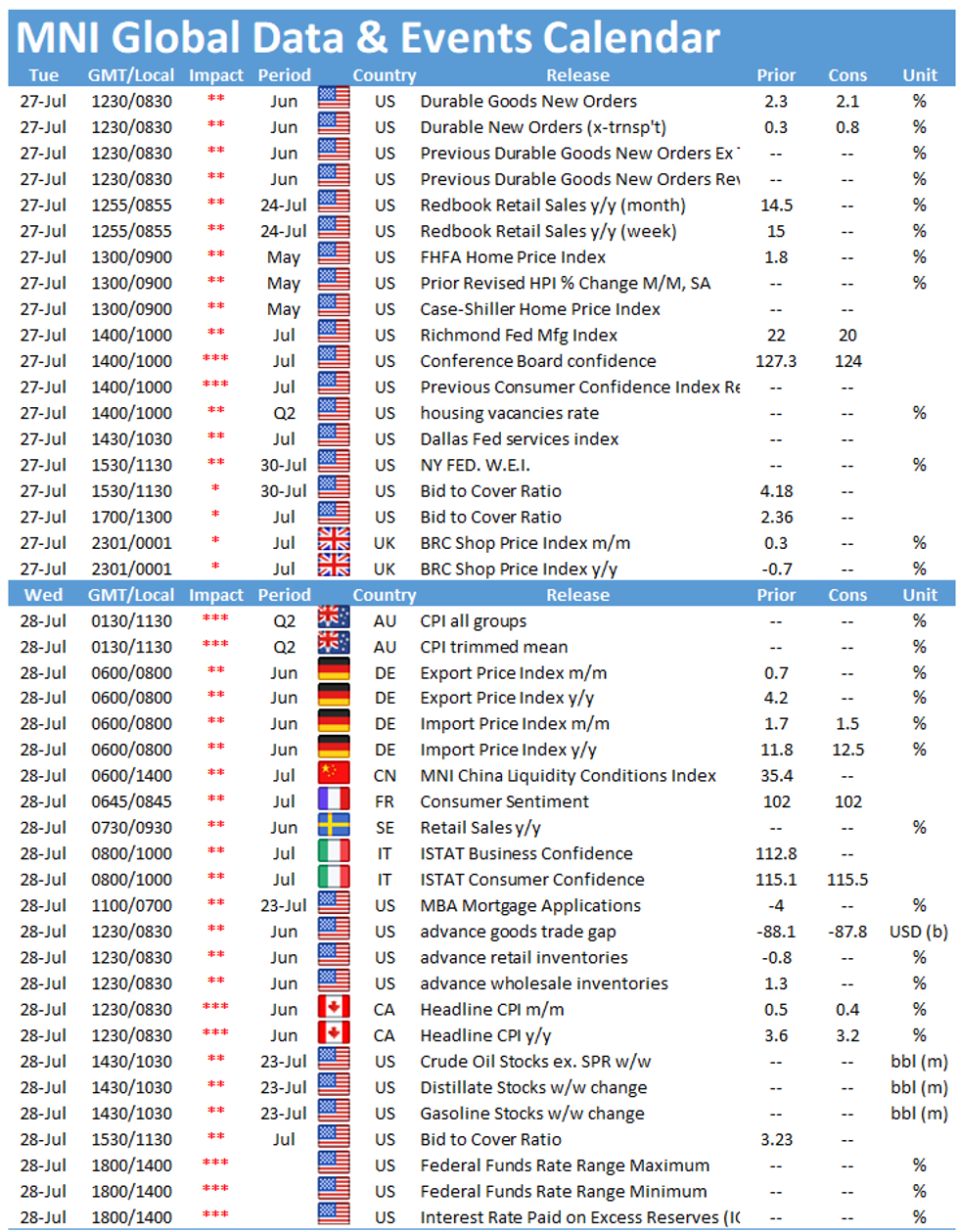

- Durable goods orders (0830ET) is the data highlight, with a couple of house price metrics (FHFA and S&P CoreLogic) to follow at 0900ET. Then at 1000ET we get Conf Board consumer confidence alongside Richmond Fed manufacturing.

- In supply: $20B 42-day bill sells at 1130ET, but focus is on $61B 5Y Note auction at 1300ET. NY Fed buys ~$1.425B of 10-22.5Y Tsys.

EGB/GILT SUMMARY: Equity Jitters Underpin Safe Haven FI Bid

European government bonds have firmed this morning and curves have bull flattened alongside fresh downside for equities. Concerns about a regulatory clampdown in China has underpinned the weakness in Chinese equities and contributed to the risk-off feel to markets this morning.

- Gilts rallied early into the session and continue to hold near the highs of the morning. Cash yields are 1-2bp lower on the day with the curve 1-2bp flatter.

- Bund yields are similarly down 1-2bp with the curve slightly bull flattening.

- OATs trade in line with bunds with the 2s30s spread 1bp narrower.

- Price action in BTPs has been relatively contained so far with yields within 1bp of yesterday's close.

- Supply this morning came from the UK (Gilt, GBP3bn) and Italy (BTP Short Term, EUR3.75bn).

- The ECB's Pablo Hernandez de Cos is due to speak at 1500 GMT, but is unlikely to be market moving (the topic for discussion being: remittance flows and macro/financial stability in Latin America during the pandemic).

EUROPEAN ISSUANCE UPDATE:

Italy sells E3.75bln of new 0.00% Jan-24 BTP Short Term: Avg yld -0.29% (-0.37% prior), bid-cover 1.37x (1.58x prior).

UK DMO sells GBP3bln of 0.375% Oct-26 Gilt, 0.334% yield (0.465% prior), 2.50x cover (2.69x prior)

FOREX: China Rout Accelerates, Bleeding Into European Trade

- Weakness in Chinese/HK assets has persisted, with USD/CNH this morning rallying to touch levels not seen since mid-April while local equities suffer sharply. The Hang Seng Index closed lower by 4.4%, adding to yesterday's acute sell-off.

- This has prompted a broad risk-off theme across G10 currencies, with JPY and USD outperforming at the expense of AUD, NZD and NOK.

- Weakness in AUD/USD puts the pair just above the week's lowest levels at 0.7331 which provides first support ahead of the more major 0.7290 level. The formation of a death cross (50-dma < 200-dma) may continue to exert pressure on the pair.

- Prelim durable goods orders and July consumer confidence data make up the US data slate on Tuesday, but markets will also be watching for any comments from RBA's Debelle and ECB's de Cos. Corporate earnings releases worth watching include 3M, Apple, General Electric , Alphabet, Microsoft and Visa.

FX OPTIONS: Expiries for Jul27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1725(E805mln), $1.1740-50(E1.4bln), $1.1775(E516mln), $1.1825(E813mln), $1.1850-70(E1.4bln)

- USD/JPY: Y109.00($1.1bln), Y109.50($740mln), Y111.00($632mln)

- AUD/USD: $0.7520(A$851mln)

- USD/CAD: C$1.2380-00($1.2bln), C$1.2600($550mln)

- USD/CNY: Cny6.4815($830mln)

Price Signal Summary - USD Trend Direction Remains Up

- In the equity space, the S&P E-minis traded higher again yesterday to another all-time high. The outlook remains bullish despite today's pullback. The focus is on 4420.92, 0.764 projection of the Jun 21 - Jul 14 - 19 price swing. Support is seen at 4330.80, the 20-day EMA. EUROSTOXX 50 futures traded above the important 4101.50 resistance, Jul 1 high last week. An extension would open the 4153.00 key resistance, Jun 17 high. Support to watch is at 4029.50, Jul 22 high.

- In FX, the USD outlook is unchanged and remains bullish. EURUSD is consolidating. The focus is on 1.1704, Mar 31 low and a key support. GBPUSD is holding onto recent gains. The move higher from 1.3572, Jul 20 low is considered a correction. The next resistance to watch is 1.3884, the 50-day EMA . USDJPY continues to trade above 109.07, Jul 19 low. This represents a key short-term support and bear trigger. The pair remains below resistance at 110.70, Jul 14 high and is weaker today. A break above 110.70 would be a bullish development.

- On the commodity front, Gold is consolidating and maintains a bullish tone with the focus on the bull trigger at $1834.1, Jul 15 high. Key short-term support is at $1791.7, Jul 12 low and was tested and briefly probed Friday but has provided support. A clear break of this level would be bearish. Brent (U1) has cleared $73.87, 61.8% of the Jul 6 - 20 downleg. The move higher opens $75.39, the 76.4% level. WTI (U1) is holding onto the bulk of its recent gains. An extension would open $73.46, 76% of the Jul 6 - 20 downleg.

- Within FI, Bund futures remain firm and traded higher yesterday. Sights are on 176.64, the Feb 11 high (cont). Gilts maintain a bullish tone. The break of 129.92, Jul 8 high opens 130.72, 2.236 projection of the May 13 - 26 - Jun 3 price swing. We are still monitoring a bearish candle pattern, an evening star reversal from the Jul 21 close. A deeper pullback would expose 128.54, low Jul 14.

EQUITIES: China Rout Accelerates, Bleeding Into European Trade

- Weakness in Chinese/HK assets has persisted, with USD/CNH this morning rallying to touch levels not seen since mid-April while local equities suffer sharply. The Hang Seng Index closed lower by 4.4%, adding to yesterday's acute sell-off.

- This has prompted a broad risk-off theme across G10 currencies, with JPY and USD outperforming at the expense of AUD, NZD and NOK.

- Weakness in AUD/USD puts the pair just above the week's lowest levels at 0.7331 which provides first support ahead of the more major 0.7290 level. The formation of a death cross (50-dma < 200-dma) may continue to exert pressure on the pair.

- Prelim durable goods orders and July consumer confidence data make up the US data slate on Tuesday, but markets will also be watching for any comments from RBA's Debelle and ECB's de Cos. Corporate earnings releases worth watching include 3M, Apple, General Electric , Alphabet, Microsoft and Visa.

COMMODITIES: Copper Drops, Oil And Gold Hang On

- WTI Crude down $0.07 or -0.1% at $71.62

- Natural Gas up $0.01 or +0.2% at $4.087

- Gold spot down $0.2 or -0.01% at $1799.31

- Copper down $4.95 or -1.08% at $453.45

- Silver down $0.06 or -0.24% at $25.1791

- Platinum down $12.73 or -1.19% at $1056.66

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.