-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - CNH Offered as Regional Equity Weakness Persists

Highlights:

- CNH offered as regional Chinese equities extend recent weakness

- Earnings cycle in focus, with Alphabet, McDonald's, Microsoft, Visa due today among others

- Treasury rally extends as First Republic results expose fragility

US TSYS: Rally Extends With More Earnings, 2Y Supply and Second Tier Data Ahead

- Cash Tsys have extended a rally that saw a further boost late in yesterday’s session with First Republic’s earnings showing a larger than expected drop in deposits in Q1, with the long end today catching up with an initially sharper move in front end yields late yesterday.

- Today has seen and will continue to see a heavy corporate earnings schedule, with McDonalds and Verizon still to report pre-market and the heavily weighted Alphabet, Microsoft and Visa after the close. We have seen mixed results with GE and GM beating adjusted EPS estimates, but 3M missing EPS and Spotify slightly missing revenue estimates.

- 2YY -2.3bp at 4.065%, 5YY -5.2bp at 3.518%, 10YY -4.9bp at 3.441% and 30YY -4.2bp at 3.667%

- TYM3 trades 17 ticks higher at 115-13 off an earlier high of 115-15 on heavier but still not large volumes of 290k. The continued bounce undermines the prior bearish theme, with resistance seen at 115-23 (Apr 14 high) and more focus at 116-08 (Apr 12 high).

- Data: Philly Fed non-mfg Apr (0830ET), FHFA House prices Feb (0900ET), S&P CoreLogic home prices Feb (0900ET), New home sales Mar (1000ET), Conf Board consumer confidence Apr (1000ET), Richmond Fed mfg index Apr (1000ET), Dallas Fed services activity Apr (1030ET)

- Note/bond issuance: US Tsy $42B 2Y Note auction (91282CGX3) – 1130ET

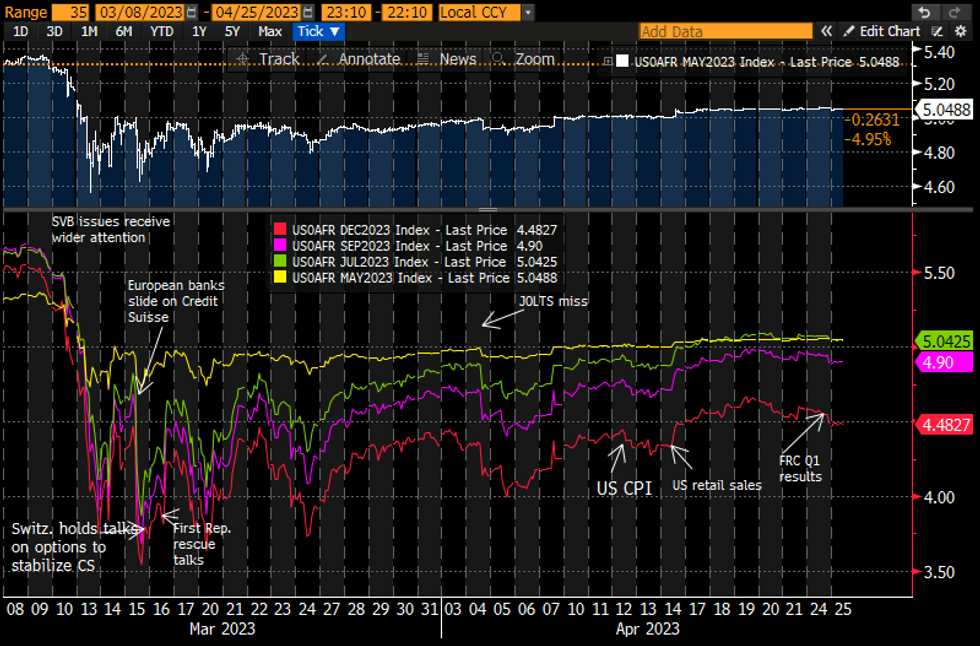

STIR FUTURES: First Republic Results Still Weighing On Fed Rate Path

- Fed Funds implied hikes are off overnight lows but generally hold the step lower after First Republic’s earnings showed a larger than expected drop in deposits late yesterday.

- 22bp hike for next week’s FOMC (-0.5bp) and a cumulative 27bp hike for Jun (unch, -1bp from Fri), with 13.5bp of cuts from current levels for Nov (unch, -7bp from Fri) and 35bp of cuts to 4.48% in Dec (unch, -9bp from Fri).

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

EUROPE ISSUANCE UPDATE:

German auction result:

- E6bln (E4.902bln allotted) of the 2.80% Jun-25 Schatz. Avg yield 2.88% (bid-to-cover 1.2x).

German syndication update:

- New 10-year 2.30% Feb-33 Green Bund. Spread set at conventional twin 2.30% Feb-33 Bund -0.5bp. Size set at E5.25bln (inc E250mln retained). Book in excess of E14.8bln.

- New 15-year Oct-38 EU-bond. Spread set at MS+32bp. Size set at E7bln WNG. Book in excess of E55bln.

FOREX: USD/CNH Touches Multi-Month Highs on Regional Equity Weakness

- Currency markets across Europe and the US are generally treading water ahead of Tuesday NY hours, with markets on pause ahead of the BoJ decision and key Eurozone data later this week. NOK has been more active, and remains toward the lowest levels of the year. The April high in EURNOK is at 11.6929, which was also the highest print since 22nd April. A clear break through the 11.7000 psychological level, would see next resistance at 11.8123.

- Following another negative regional close in China and Hong Kong, weakness across CNH and CNY persists into NY hours, tipping USD/CNH to the highest level since mid-March. Pair has now printed seven consecutive sessions of higher lows, and is narrowing the gap with 6.9506, the 200-dma.

- Progress through here would open 6.9971 over the medium-term, ahead of 7.0362 - the 50% retracement for the Oct - Jan downleg. Worsening trade tensions with the US remain a key driver - particularly following weekend reports that the US requested South Korean firms do not backfill chip orders to China should US-listed firms be barred access to China.

- Focus Tuesday turns to new home sales and consumer confidence data from the US, as well as further regional Fed releases: the Richmond Fed manufacturing index and Dallas Fed services activity. The speaker slate is light, with the Fed remaining inside the pre-FOMC media blackout period.

FX OPTIONS: Expiries for Apr25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0923-25(E602mln), $1.0937-50(E947mln), $1.1000(E1.2bln), $1.1020-25(E539mln), $1.1050(E1.4bln), $1.1080(E568mln), $1.1100(E2.2bln)

- USD/JPY: Y133.35($724mln)

- GBP/USD: $1.2300(Gbp628mln)

- AUD/USD: $0.6665(A$510mln), $0.6720-35(A$774mln), $0.6750-65(A$519mln), $0.6800(A$616mln)

- NZD/USD: $0.6150(N$817mln)

- USD/CNY: Cny7.00($1.8bln)

EQUITIES: Equity Futures Trade Within Recent Ranges; Tech Earnings Reports Take Focus

MNI US EARNINGS SCHEDULE - The quarterly earnings cycle hits a crescendo this week, with 45% of the S&P500’s total market cap set to report. Reports are persistent across the week, but today is likely the most notable session for the index, as Alphabet, McDonald’s, Microsoft, PepsiCo and Visa are all due. Earnings season so far has been relatively solid, with the average firm tending to beat on EPS and revenues – although EPS metrics have held up well relative to sales.

- The Eurostoxx 50 futures uptrend remains intact and the contract is trading at its recent highs. The recent extension reinforced the bullish significance of the break of 4268.00, Mar 6 high and a former key resistance. The move confirmed a resumption of the uptrend and maintains the price sequence of higher highs and higher lows. Sights are on 4381.50, Jan 5 2022 high (cont). Initial firm support lies at 4274.00, the 20-day EMA.

- The trend outlook in S&P E-minis remains bullish and the latest move lower, from the Apr 18 high, is considered corrective. Support to watch lies at 4128.95, the 20-day EMA where a break is required to suggest scope for a deeper pullback - this would expose 4086.73, the 50-day EMA. Attention is on the 4200.00 handle, clearance of this level would resume the uptrend and open 4205.50, Feb 16 high ahead of 4244.00, Feb 2 high and key resistance.

COMMODITIES: WTI Futures Technically Bearish Despite Monday's Slight Uptick

- WTI futures traded lower last week and the outlook remains bearish despite yesterday’s gains. Last week’s move lower resulted in a break of $79.04, the Apr 3 low and the gap high on the daily chart. The continuation lower has seen price breach the 20- and 50-day EMAs, exposing $75.83, the Mar 31 high and a gap low on the daily chart. Key short-term resistance has been defined at $83.38, the Apr 12 high. A break would resume the recent uptrend.

- Broader trend conditions in Gold remain bullish, however, the yellow metal has entered a short-term corrective cycle and is trading below recent highs. Price has traded below support at $1987.1, the 20-day EMA, highlighting potential for a deeper retracement. This has opened $1949.7, Apr 3 low. Key short-term resistance has been defined at $2048.7, the Apr 5 high. A break of this level would confirm a resumption of the uptrend.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/04/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 25/04/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/04/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/04/2023 | 0800/1000 |  | EU | ECB Supervisory Board Chair Andrea Enria and MNI event | |

| 25/04/2023 | 0900/1000 |  | UK | BOE Broadbent Speech at NIESR | |

| 25/04/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/04/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/04/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/04/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/04/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 25/04/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/04/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 25/04/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 25/04/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/04/2023 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 26/04/2023 | 0130/1130 | *** |  | AU | CPI inflation |

| 26/04/2023 | 0130/1130 | *** |  | AU | CPI Inflation Monthly |

| 26/04/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 26/04/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 26/04/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 26/04/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/04/2023 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 26/04/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/04/2023 | 1200/1400 |  | EU | ECB de Guindos Panels Delphi Economic Forum | |

| 26/04/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/04/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 26/04/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/04/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 26/04/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.